July 2023: Inflation watch

In this issue, we discuss the unexpected increase in headline CPI in July and the significant decrease in RRB trading volume.

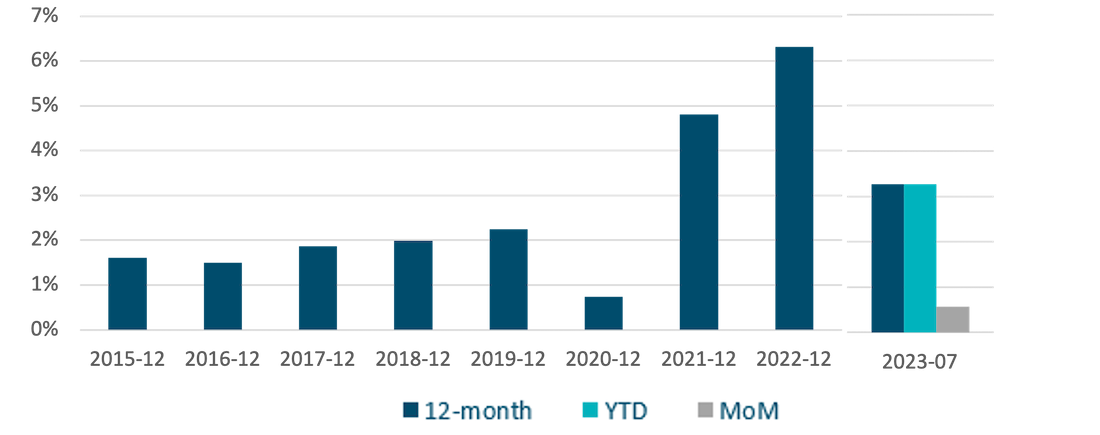

Steve’s take: “As of July, Canadian headline CPI increased 0.6% month-over-month, exceeding market consensus by 0.3% and bringing the year-over-year increase up to 3.3% (figure 1).”

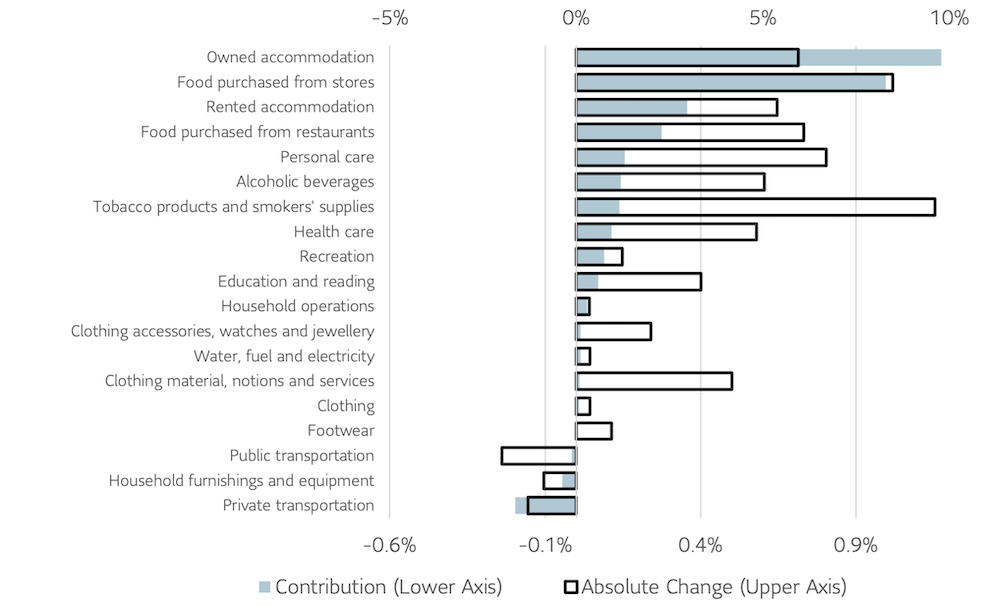

While a pickup in year-over-year headline inflation was expected based on unfavourable base year effects, the increase was well above consensus with a large contribution from shelter (figure 2). Additionally, the recent rise in gasoline prices was not fully reflected in the July CPI report due to the timing of the sampling, which is expected to put upward pressure on the August CPI print.

Higher interest rates continue to flow through to mortgage interest costs, which increased another 2.0% month-over-month and 30.5% year-over-year.

While grocery prices remain elevated, year-over-year price growth has decelerated (8.5% in July vs. 9.1% in June) mainly due to prices for fresh fruit.

Figure 1: CPI Change

Figure 2: Canada headline CPI contribution year-over-year

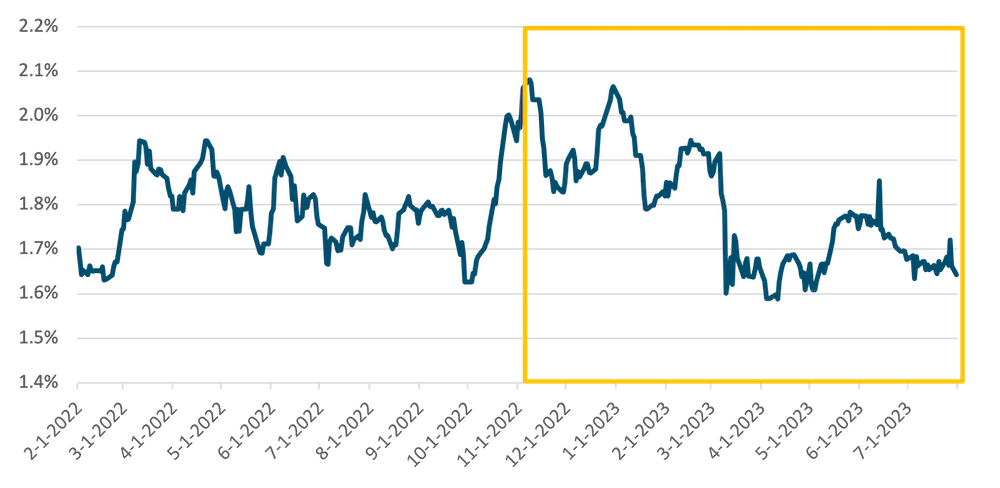

Steve’s take: “Breakeven inflation rates have settled at lower levels despite expectations of higher demand for real return bonds (RRBs), suggesting that investors may be demanding a higher illiquidity discount.”

Following the Government of Canada’s announcement in November 2022 of their decision to cease RRB issuance, breakeven inflation rates experienced an initial spike before stabilizing at slightly lower levels compared to pre-announcement (figure 3). Some market participants may have expected a persistent increase in breakeven inflation rates as a proxy for RRB demand. However, breakeven inflation rates are primarily driven by the combined net effect of two fundamental factors: market expectations for future inflation and liquidity of RRBs. In the event of significant decreases in RRB liquidity, breakeven inflation rates may become a less effective indicator of RRB demand and future inflation expectations.

Comparing the 9-month periods before and after the November 2022 announcement, trading volume of RRBs has decreased by approximately 66% (figure 4). This suggests that demand for RRBs and future inflation expectations may be higher than implied by breakeven inflation rates due to a higher illiquidity discount.

Figure 3: Long-term breakeven inflation rates

Figure 4: Weekly trading volume of on-the-run Canada RRBs (as demonstrated by CA135087M433)

The content of this presentation is intended for institutional investors only. It is not for retail use or distribution to individual investors. All investments involve risk including the possible loss of capital. This presentation is for informational and educational purposes only. Past performance is not a guarantee of future results.

Unless otherwise stated, all figures and estimates provided have been sourced from the Bank of Canada. Unless otherwise noted, all references to “$” are in CAD. Any reference to a specific asset does not constitute a recommendation to buy, sell or hold or directly invest in it. It should not be assumed that the recommendations made in the future will be profitable or will equal the results of the assets discussed in this document.

The information contained in this presentation is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this presentation.

The information may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate.

Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and, in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association. In the U.S., securities are offered by Sun Life Institutional Distributors (U.S.) LLC, an SEC registered broker-dealer and a member of the Financial Industry Regulatory Authority (“FINRA”).

© 2023, SLC Management.

CPI change (figure 1)

12-month, YTD, and MoM change in the Statistics Canada Consumer Price Index, monthly, not seasonally adjusted (Table 18-10-0004-01)

Canada headline CPI contribution year-over-year (figure 2)

Bank of Canada Consumer Price Index Portal

Long-term breakeven inflation rates (figure 3)

Calculated as ((1 + Government of Canada benchmark bond yields, long term [CANSIM V39056])/(1 + Real return benchmark bond yield, long term [CANSIM V39057])) – 1.

Weekly trading volume of on-the-run Canada RRBs (CA135087M433) (figure 4)

Bloomberg

“FTSE®” is a trade mark of FTSE® International Limited and is used under license.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

© SLC Management, 2023

SLC-20230830-3087142