Building more resilient portfolios with alternative fixed income

Welcome to our Canadian Insurance Newsletter, where we deliver insights on industry trends, regulatory updates and investment strategies relevant for insurance professionals.

- We have seen insurers increasingly incorporating alternative fixed income investments into their portfolios to potentially boost investment income and stabilize returns.

- Alternative fixed income investments, particularly private debt, can offer insurers the potential to generate higher capital-adjusted returns with possible diversification benefits.

- Careful evaluation of risks and complexities associated with these alternative asset classes is crucial as insurers navigate this evolving landscape.

We have seen insurers at the forefront of incorporating alternative fixed income investments into their portfolios, as they seek to boost investment income and stabilize returns. More recently, the democratization of alternative investments and the greater availability of capital-efficient vehicles have further increased insurers’ interest in this market segment. A recent global insurance survey indicates that 51% of insurance companies view diversifying their portfolios away from traditional asset classes as the top investment opportunity over the next 12 months.1 This suggests the trend is likely to persist.

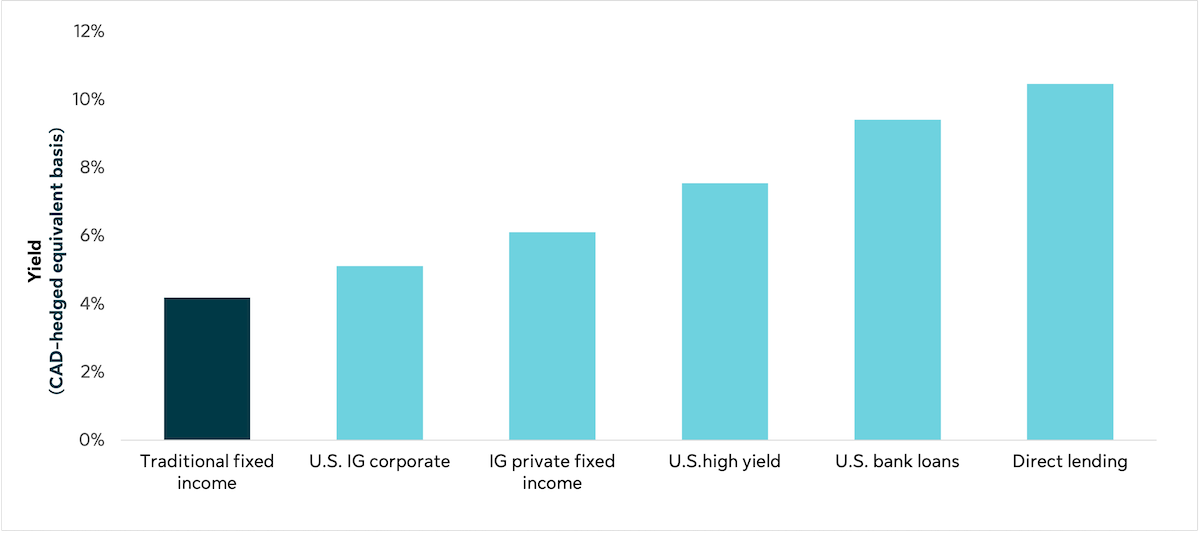

The term “alternative fixed income” is ambiguously defined in the investment community and could lead to some confusion. For the purposes of this discussion, we define this category as fixed income investments that fall outside the traditional bond market (government bonds, investment grade [IG] corporate bonds and other publicly traded debt instruments). Figure 1 provides an overview of the opportunities available within the wide and diverse alternative fixed income segment.

Figure 1: Tapping into an expanded opportunity set with alternative fixed income

Note: As at June 30, 2024. The following representative indices/funds and assumptions were used for each asset class: FTSE Canada Universe Bond Index (traditional fixed income, yield = yield to maturity), Bloomberg U.S. Corporate Investment Grade Index (U.S. IG corporate, yield = yield to worst), SLC Management Short Term Private Fixed Income Plus Fund2 (IG private fixed Income, yield = yield to maturity), Bloomberg US High Yield Bond Index (U.S. high yield, yield = yield to worst) and LSTA US Leveraged Loan Index (U.S. bank loans, yield = yield to maturity), SOFR + 550 bps (direct lending, yield = SOFR + 550 bps). Past performance is not indicative of future results. Yields are presented on a CAD-hedged equivalent basis for asset class denominated in USD, assuming the long-term average hedging cost from December 2016 to June 2024 using rolling 3-month foreign exchange (FX) forward contracts. It is not possible to invest in an index directly.

The challenges associated with investing solely in Canadian bonds have also driven increased use of alternative fixed income by Canadian insurers. With their portfolios heavily weighted toward traditional fixed income, Canadian insurers have faced issues such as lack of diversification (both from an issuer and sector perspective), supply and demand imbalances and limited active management opportunities.

The current market environment is one in which interest rates are higher and the equity risk premium is relatively low. This can make the appeal of fixed income investments undeniable for insurers. Specifically, many alternative fixed income asset classes have the potential to generate returns comparable to equities, particularly after accounting for capital charges, while exhibiting lower volatility.

Optimizing insurance investment portfolios: balancing risk, return and regulatory capital

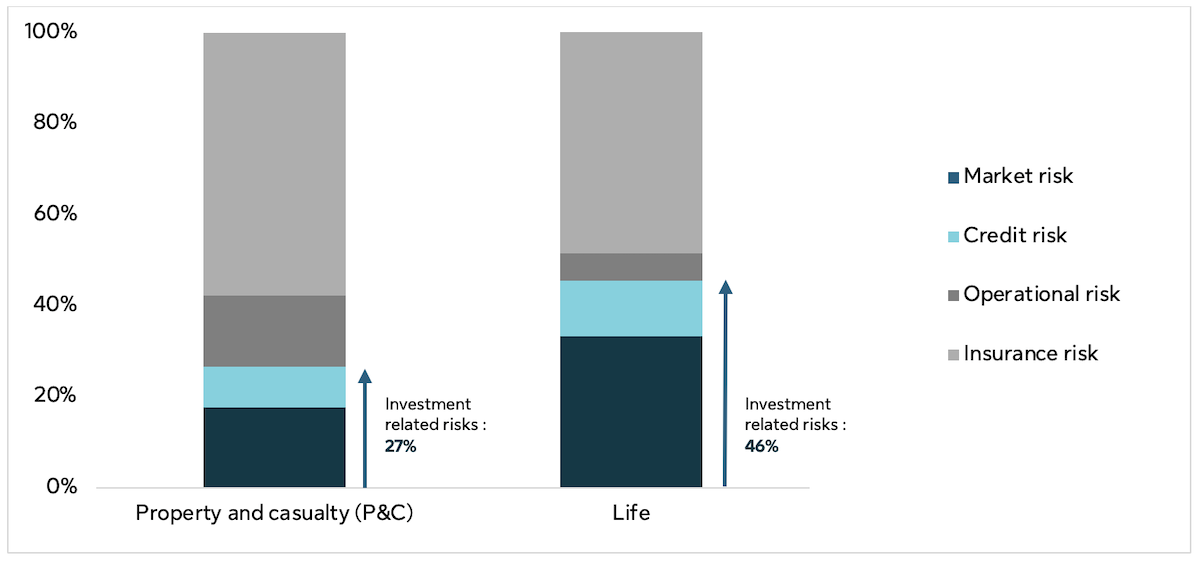

The portfolio optimization problem for insurance companies involves incorporating a crucial third component alongside traditional risk and return metrics: required capital. The calculation of required capital is a formulaic process. It involves multiplying the balance sheet value of each type of risk by a prescribed risk factor. Figure 2 provides an overview of the capital requirements by risk type.

Figure 2: Composition of capital requirements (by risk type)

Source: 2023 Annual Report on Financial Institutions and Credit Assessment Agents. For life insurance companies, segregated fund guarantees risk was included with market risk.

Insurance companies face significant investment-related risks, accounting for 27% of the required capital for P&C insurers and 46% for life insurers. Given the importance of these investment decisions, insurers spend considerable time optimizing investment strategies to extract the maximum value from required capital.

In our view, this is where alternative fixed income investments become particularly compelling. They can offer insurers an expanded toolkit to optimize their risk–return profile while being mindful of capital charges.

Optimizing investment-related risk charges with private debt

One asset class from the alternative fixed income universe that has garnered significant interest from insurance companies is private debt. Private debt is a widely used term encompassing different types of investments and can essentially be viewed as an extension of traditional fixed income. For the purpose of this discussion, we can break private debt down into two main segments: IG and non-IG private debt.

IG private debt, also known as private fixed income, encompasses fixed income securities issued by high-quality, creditworthy borrowers, akin to those found in the traditional public bond market. These securities often feature fixed-rate structures, stronger covenants, higher yields and more flexible repayment terms compared to their public market counterparts. The primary advantage of IG private debt lies in its ability to provide investors access to high-quality fixed income opportunities outside the public markets. This can potentially enhance portfolio diversification and yield. Given the fixed-rate coupons and predictive nature of the cash flows, IG private debt can also serve as an effective liability-hedging tool. Insurance companies have been at the forefront of this segment of the market, recognizing the benefits it can offer to their portfolios.

It is important to note that IG private debt investors remain exposed to various investment risks. Some of these risks are endemic to IG fixed income investing overall. These include credit, issuer and interest rate risk. Other risks are specific to the private debt market. One such principal risk is the lower liquidity profile of private debt, which is compensated for with a premium in yield.

The second segment is non-IG private debt, which represents a larger portion of the private debt market. This asset class has gained traction as a way to fill the void left by banks, which have tightened their lending practices in the aftermath of the 2008 financial crisis. It is typically floating-rate in nature and is often issued by small- and mid-sized companies, offering attractive yield spreads to compensate for the higher credit risk involved.

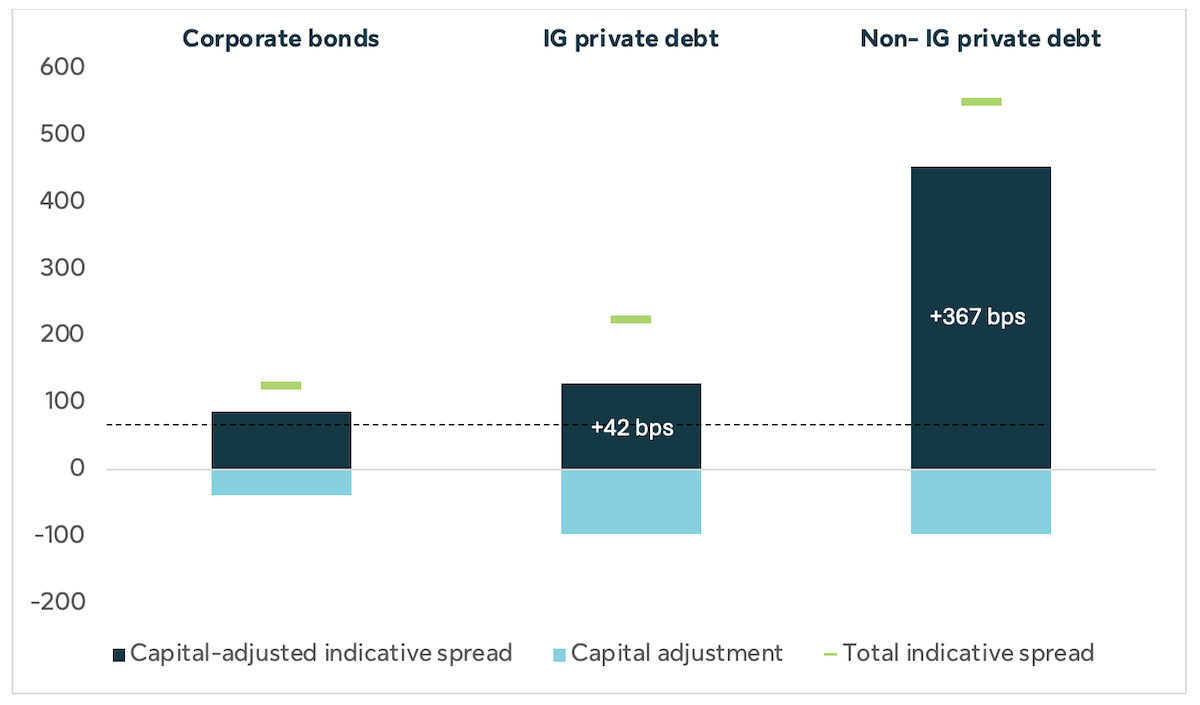

Private debt has become popular among insurance companies because it can offer a compelling opportunity to enhance portfolio resilience (through diversification) and potentially achieve higher yields. It offers insurers access to a diverse range of issuers and sectors outside of public markets. This diversification is critical for insurers looking to reduce concentration risk in traditional bond markets and spread exposure across different industries and geographies. It also has the potential to generate higher capital-adjusted spreads compared to Canadian corporate bonds (see Figure 3) by taking advantage of the illiquidity premium.

Figure 3: Capital-adjusted spreads (in bps) for selected asset classes

Note: for illustrative purposes only. Capital adjustments made based on the Minimum Capital Test (MCT) guideline of the Office of the Superintendent of Financial Institutions (OSFI), which applies to property and casualty (P&C) insurers. However, a similar picture emerges for life insurers, who are subject to OSFI’s Life Insurance Capital Adequacy Test (LICAT) guideline. Assumes a 12% cost of capital.

It's important to note that non-IG private debt carries the same capital charge as IG private debt. This means that, from a regulatory perspective, the two asset classes are treated similarly. Non-IG private debt could then be an appealing option for insurance companies with the appropriate risk appetite.

Likewise as with IG private debt, non-IG private debt brings with it types of investment risk common to broad fixed income and to the private debt space in particular. In addition to the aforementioned risks of IG private debt, the rating of non-IG private debt implies higher risk than an IG bond. As with IG private debt, non-IG private debt offers a yield premium to compensate for this higher risk profile. In the case of both asset classes, investors should also consider the level of expertise, track record and network of resources of a given investment manager they partner with to access these opportunities.

Closing thoughts

The increased adoption of alternative fixed income investments, particularly private debt, by insurance companies highlights the industry's ongoing efforts to optimize their investment portfolios and navigate the challenging market environment.

As insurers continue to grapple with the constraints of traditional fixed income markets, the expanded toolkit offered by alternative fixed income investments allows them to strike a better balance between risk, return and regulatory capital requirements.

However, it is crucial for insurers to carefully evaluate the risks and complexities associated with these alternative asset classes. This can help ensure their investment decisions align with their overall risk appetite and strategic objectives. Ongoing monitoring, robust risk management and a deep understanding of the underlying investments will be essential as insurers navigate this evolving landscape.

Nonetheless, the ability of these alternative asset classes to potentially generate higher capital-adjusted returns while providing diversification benefits can make them a compelling addition to insurers' investment strategies.

1. Source: Mercer and Oliver Wyman 2024 Global Insurance Investment Survey.

2. SLC Management Short Term Private Fixed Income Plus Fund is an institutional strategy managed by SLC Management that invests primarily in a diverse portfolio of short term private and public fixed income and floating rate assets.

© 2024, SLC Management

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association.

Unless otherwise stated, all figures and estimates provided have been sourced internally and are as of December 31, 2023. Unless otherwise noted, all references to “$” are in Canadian dollars or US Dollars (Check and update the correct currency). Past performance is not indicative of future results.

Nothing herein constitutes an offer to sell or the solicitation of an offer to buy securities. The information in these materials is provided solely as reference material with respect to the Firm, its people and advisory services business, as an asset management company.

Market data and information included herein is based on various published and unpublished sources considered to be reliable but has not been independently verified and there is no guarantee of its accuracy or completeness.

This content may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility. Unless otherwise stated, all figures and estimates provided have been sourced internally and are current as at the date of the paper unless separately stated. All data is subject to change.

This information is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this paper. An investor may not invest directly in an index.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

This material is intended for institutional investors only. It is not for retail use or distribution to individual investors. Nothing in this presentation should (i) be construed to cause any of the operations under SLC Management to be an investment advice fiduciary under the U.S. Employee Retirement Income Security Act of 1974, as amended, the U.S. Internal Revenue Code of 1986, as amended, or similar law, (ii) be considered individualized investment advice to plan assets based on the particular needs of a plan or (iii) serve as a primary basis for investment decisions with respect to plan assets.

Cash and Non-Cash Compensation

- SLC Management provides no cash compensation or any other direct economic benefit to Consultants.

- SLC Management may provide non-cash compensation to Consultants in the form of entertainment.

- Consultants are acting solely on behalf of their clients and are not acting as placement agents on behalf of SLC Management or otherwise engaged in the offering or promotion of interests in SLC-managed private funds or accounts to prospective investors.

- SLC Management is not involved in the preparation of any report and/or recommendation provided by Consultants to their clients.

Conflicts of Interest

Non-cash compensation in the form of meals and entertainment by SLC Management to a Consultant may create a conflict of interest for the Consultant who may be induced to recommend that prospective investors invest with SLC Management.

Sun Life Capital Management (U.S.) LLC. also referred to as "SLC Fixed Income,” offers pooled funds, separately managed accounts and other investment advisory services with the support of the investment operations of SLC Management.

SLC-20240930-3875689