Q1 2024: Investment Grade Private Credit update

Market statistics for the private placement market sourced from Private Placement Monitor, a standard proxy for the IG private credit market.

Robust volumes, greater demand from a growing investor base and tightening spreads characterized private credit during the first quarter. New investors coming into the market has also led to increased market capacity and larger deal sizes. Meanwhile, fund finance has emerged as a growing, evolving sector for institutional investors looking for potential diversification, investment premiums and risk managed performance.

Market

Strong issuance in Q4 2023 carried into Q1 2024, with IG private credit volume off to a good start to the current year. Q1 2024 volume was reported at US$22.8 billion, ahead of US$20.9 billion the prior year, but lower than Q1 2022 volume of US$24.6 billion when issuers rushed to market in advance of rate increases. Q1 2024 was also the second highest volume of the past five prior Q1 periods. Strong utility and industrial issuance contributed to the market’s longer average duration as its weighted average life increased quarter-over-quarter from 10 to 12 years as of Q1 2024. We also saw a few real estate investment trusts return to the market, albeit in more conservative asset classes (industrial and core funds) as the sector volume is still muted by historical standards. Transportation issuance continues to be weak, in our view. Underpinning that is lackluster aviation volume due to airlines having significant liquidity to pay for equipment, combined with supply side issues causing uncertain delivery.

Notably, price tightening and oversubscriptions returned in the first quarter, in particular for the broadly syndicated market. Following the lead of the public markets, IG private credit spreads tightened and returned to more historical premiums over public market comparables. More demand from longtime insurance company players, as well as new investors, has driven the price tightening and tougher allocations. We have seen the investor base expand to include asset managers that started teams over the past few years and have ramped up, plus established investors who have entered the market, attracted to the relative value and covenant protection opportunities in investment grade private credit.

Outlook

While new investors have increased competition, they have also expanded market capacity and driven larger deals. Q1 2024 tallied four US$1 billion plus deals, including one deal over US$2 billion. While the hunt for relative value intensified, we believe attractive opportunities can still be found in financials and specialist sectors.

As we enter Q2, traditionally a period of robust issuance ahead of the summer, we are hearing from a number of deal sources that volume could be more front-ended this year in response to potential U.S. election volatility. We have also seen a pickup in delayed draws as issuers see the current market as constructive and would like to take any market volatility off the table. With prospects dimming for immediate rate decreases, issuers considering coming to market may also be motivated to do so sooner rather than later. These dynamics are important considerations for IG private credit investors who are tasked with balancing optimal allocations to the current pipeline alongside keeping some powder dry for bespoke opportunities and others that may emerge later in the year.

In focus: Perspectives on fund finance

Fund finance has become a fast growing tool employed by asset managers seeking financing for their investment goals. As IG private credit investors may find themselves exposed to such financing strategies, developing a stronger understanding of the potential benefits and risks of these complex, illiquid and dynamic investment structures is becoming increasingly important.

We can start the discussion with a working definition of fund finance: such investments can be broadly described as a form of financing that is supported by some combination of an investment fund’s assets, cash flows and ability to call capital from its limited partners (LPs). As borrowers, asset managers might seek this type of financing in order to optimize cash management and capital deployment processes for a fund and its LPs, enhance returns through leverage and/or generate liquidity for additional investments in the portfolio or for distributions to LPs.

On the side of the lender, fund finance strategies have further evolved to incorporate investment features and structures that may be more attractive for institutional investors, and several market and macroeconomic factors are creating conditions for potentially increased use of fund finance.

Growth drivers setting the stage for expanded activity

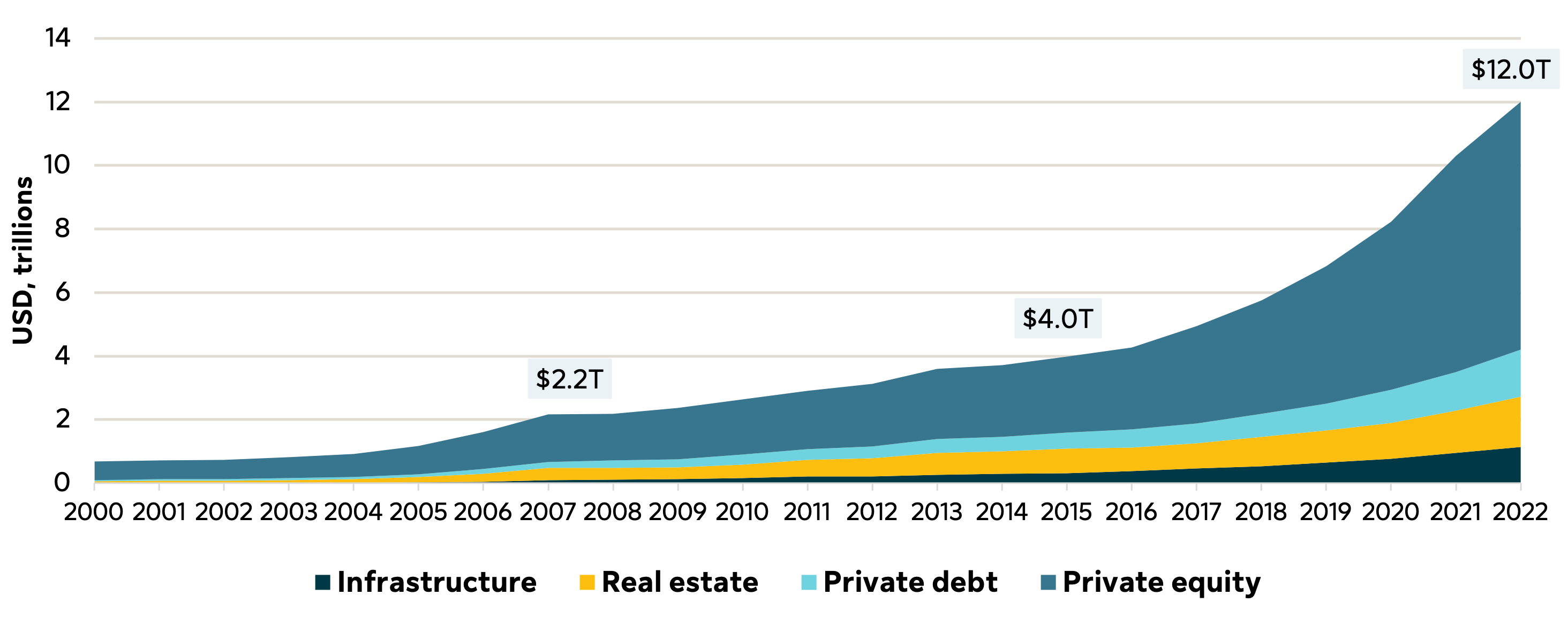

One major growth driver is the increase in privately managed capital among asset managers, as indicated in the following graph. As asset managers raise more vehicles to manage private equity or private debt strategies, the need for tools to better manage capital deployment, enhance returns and utilize accretive financing solutions to fund incremental portfolio investments and distributions to LPs has also increased.

Source: Preqin, as of June 2023. To avoid double counting, fund of funds and secondaries are excluded.

While some potential growth drivers in fund finance are specific to current market conditions that may change, many secular factors – such as demand for more efficient capital deployment, return enhancement and/or accretive financing for incremental investments – could continue to fuel interest broadly in this investment universe for the foreseeable future.

The potential benefits of fund finance investing

Fund finance incorporates several characteristics of both corporate credit and securitized asset backed products, and can be viewed as occupying a middle ground between these two investment universes. The asset class can offer numerous potential benefits that make them attractive to IG private credit investors:

- Credit support – Many fund finance facilities can manage risk exposure through credit support via multiple layers, such as the underlying assets’ cash flows, the collateral value of the assets and possibly guarantees by the asset manager. Lenders could benefit from other sources of overcollateralization as well, such as potential losses being absorbed by junior capital first or cash flows from the underlying asset diverted to lenders in the event of covenant breach or default.

- Diversification – Collateral typically in fund finance facilities is comprised of many individual assets combined to create a diversified source of cash flows. Transactions typically incorporate mechanisms that seek to ensure that a desired level of diversification is maintained, such that no one individual asset can disproportionally impact the outcome of an investment.

- Covenants and cash flow waterfalls – Lenders can have priority over cash flows through covenants based on loan-to-value (LTV) and cash flow sweeps, helping ensure that lenders’ target LTV levels, which often decrease throughout the life of the loan, are maintained. Other measures such as concentration limits, minimum number of assets, interest coverage and leverage levels of underlying assets can help monitor and maintain the quality of the collateral.

- Lower refinancing/tail risk – Fund finance transactions generally attempt to match the cash flow profile of the assets with the maturity of the credit facility. They also incorporate mechanisms to avoid scenarios in which difficult to monetize assets are the only source of repayment available to lenders near the end of a facility’s term. As a result, most transactions are designed to fully amortize upon maturity and thereby eliminate refinancing risk.

- Complexity premium and relative value – Investing in the fund finance market requires expertise across multiple layers. Investors must have expertise in not only assessing individual assets, but also portfolio-level credit risk, drawdown fund structures/mechanics and the structured credit markets in general to manage and price risk appropriately. This complexity limits the universe of potential investors, allowing those that do possess the requisite expertise to earn attractive returns.

- Other sources of risk reduction – The underlying assets in fund finance are typically allocated to a special purpose vehicle (SPV), against which lenders have a priority claim. This provides some legal separation from the asset manager seeking financing, which may provide some additional benefits of risk reduction by creating distance from any operational risks or other issues relating to other assets or funds managed by the borrower.

Important considerations in fund finance investment

Fund finance offers investors an opportunity to generate attractive returns relative to traditional corporate loans. However, there are some additional risks, challenges and other considerations to keep in mind in this market.

- Breadth of strategies brings unique risks

Although all fund finance strategies at their core seek to help asset managers manage capital more efficiently and enhance returns, each strategy does so differently. The type of collateral, deal structure, cash flow profile and attachment/detachment points can vary significantly from one strategy to the next. Moreover, given the nascent nature of some fund finance strategies, there is meaningful variation even across deals in the same vertical. It is therefore critical for institutional investors to understand fund finance more broadly and be specifically knowledgeable about the subtle differences that exist across transactions to more accurately calibrate risk and return.

- Deal complexity

Fund finance transactions often use complex structuring and the advantage of diversification to engineer an IG profile from below IG collateral. This requires that investors active in fund finance have a deep understanding of IG and below IG credit markets, as well as legal and financial structuring considerations.

- Valuation transparency and governance

Underwriting to and maintaining an appropriate level of overcollateralization is a critical component of deal structuring in fund finance. This can sometimes be challenging due to the illiquid nature of the underlying assets that can make assessing asset value more difficult. Such challenges can typically be mitigated through negotiating appropriate valuation and governance provision in transactions, using independent valuation sources to estimate asset values and relying on firsthand knowledge and expertise in the assets to sense check GP and third-party valuation estimates.

- Revolving nature of some facilities

Some facilities, particularly in the Lender Finance and Subscription Line segments can be revolving in nature which has both administrative and financial implications for investors.

- Uncertain timing of cash flows and PIK flexibility

Although many fund finance strategies are cash pay, certain subsets of the investment class, such as single-fund net asset value (NAV) lending facilities, often provide the borrower with payment-in-kind (PIK) flexibility. This can allow the asset manager to add interest payments to the principal balance versus paying them in cash; the PIK interest is repaid in full either through cash flow sweeps or at maturity. The appropriate level of flexibility is a function of the cash flow profile of the underlying fund. Investors should therefore be prepared to incorporate PIK optionality into their assessment of investment opportunities.

The fund finance market is changing across multiple axes. The sheer number of transactions is growing while deal terms continue to evolve. Some segments of the market are increasingly being rated, but also have shorter default histories from which future default rates can be inferred. The possibility of a rated fund finance facility being downgraded poses a potential risk to an investor, as a downgrade would for any other debt investment. The dynamic nature of the market therefore is creating opportunities for investors, but at the same time should be approached with a well-informed understanding of the market as it exists today and the trends that are shaping the future of these strategies.

In upcoming Investment Grade Private Credit updates, we will continue to explore different facets of fund finance. To be alerted to our next update, follow SLC Management on LinkedIn and subscribe for alerts for future insights.

Disclosure

Data presented in this article have been calculated internally based on external market data sourced from Private Placement Monitor.

Investment-grade credit ratings of our private placements portfolio assets are based on a proprietary, internal credit rating methodology that was developed using both externally purchased and internally developed models. This methodology is reviewed regularly. More details can be shared upon request. There is no guarantee that the same rating(s) would be assigned to portfolio asset(s) if they were independently rated by a major credit ratings organization.

The information in this paper is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this paper.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association. Registration as an investment adviser does not imply any level of skill or training. There is no assurance that the objective of any private placement strategy can be achieved. As with any strategy, the Advisor’s judgments about the relative value of securities selected for the portfolio can prove to be wrong.

Unless otherwise stated, all figures and estimates provided have been sourced internally and are as of March 31, 2024. Unless otherwise noted, all references to “$” are in U.S dollars. Past performance is not indicative of future results.

Investments involve risk, including loss of principal. Diversification does not guarantee against loss or ensure a profit. Nothing herein constitutes an offer to sell or the solicitation of an offer to buy securities. The information in these materials is provided solely as reference material with respect to the Firm, its people and advisory services business, as an asset management company.

Market data and information included herein is based on various published and unpublished sources considered to be reliable but has not been independently verified and there is no guarantee of its accuracy or completeness.

This content may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility. Unless otherwise stated, all figures and estimates provided have been sourced internally and are current as at the date of the paper unless separately stated. All data is subject to change.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

© 2024, SLC Management

SLC-20240507-3546721