Liability-driven investment (LDI) programs often face a tradeoff between hedging liabilities and enhancing diversification, among other competing goals. In our latest investment team insights, we discuss how investment grade private fixed income can help solve the conundrum.

Pension plans in Canada: the state of the ESG nation

We surveyed decision-makers from 50 Canadian institutional pension plans about sustainable investing. While ESG issues remain a hot topic for discussion, not all plans are putting ESG talk into action.

The buzz about environmental, social and governance (ESG) issues can be heard everywhere. It is headlining the news and boardroom agendas. Despite all the talk, there appears to be little agreement on what ESG really means. Consider its many names and contexts: corporate responsibility, corporate sustainability, socially responsible investing, sustainable investing, ethical investing.

As an asset manager, we are focused on ESG in an investing context. We believe that it is an integral part of achieving the common goal of asset managers and the institutions we serve: generating higher long-term returns. However, we also know that every institutional investor has a different mission – and can have different principles related to ESG. We wanted to understand those differences and find out how Canadian pension plans are incorporating – or not incorporating – ESG into their investment practices.

In September 2018, we surveyed decision-makers at 50 institutional investment funds about their views and practices on ESG. Respondents included both public and private pension funds, along with foundations and endowment funds. Half of respondents reported their plan assets were between $1 billion and $5 billion, one-third were smaller than $1 billion and the balance greater than $5 billion.

How we defined ESG for the survey

In our pension plan survey, we defined ESG as a set of standards that socially conscious investors use to screen potential investments. Environmental criteria look at how a company performs as a steward of the natural environment. Social criteria examine how a company manages relationships with its employees, suppliers, customers and the communities where it operates. Governance deals with a company’s leadership, executive pay, audits, internal controls and shareholder rights.

Here is what we discovered

Policies and process

We asked plans whether they had a formal policy or process to evaluate ESG factors. While 48% had a formal ESG policy or process, a slight majority had neither.

Only 12% of organizations were a signatory to the United Nations-supported Principles for Responsible Investment (PRI).

ESG and enhanced investment performance

When asked whether incorporating ESG into their organization’s investment decision-making would enhance investment performance in the long run, a majority of plans said that incorporating ESG would definitely or somewhat likely enhance long-term investment performance.

Believe ESG enhances long-term performance:

However, only 24% of plans had dedicated resources to assessing and incorporating ESG factors.

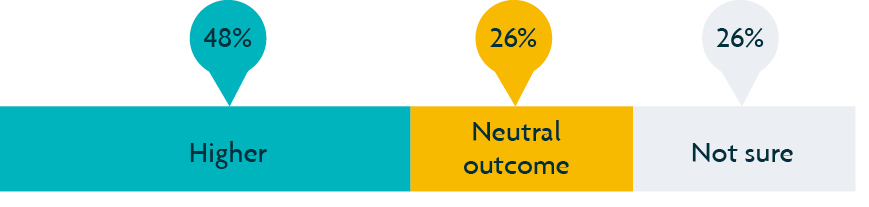

There was less certainty about performance when comparing individual securities. When asked whether an investment with high ESG factors compared to a similar investment with lower ESG factors could generate different risk-adjusted returns, about half of plans thought that securities with high ESG factors could lead to higher returns, with 26% saying that the returns would be neutral between the two.

Risk adjusted returns:

ESG mandates

More than half of plans had no assets invested in specific ESG mandates. For those plans that were invested in ESG mandates, the percentage of plan assets invested in these mandates ranged from 5% to 82%, with a median percentage of 26%.

When we asked whether their plan sets an annual target to increase the portion invested in these mandates, only 4% said yes.

Disclosure

We asked whether fund managers provided institutional investors with enough or too much disclosure about ESG policies and processes. More than one-half said there was not enough disclosure, and less than one-quarter said they had all the information they needed.

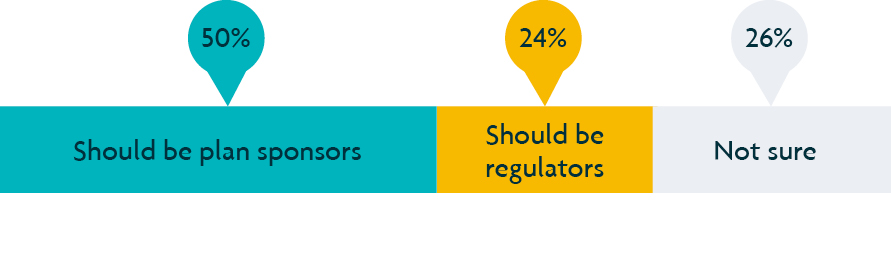

Responsibility for change

In terms of who should take the lead in ‘moving the needle’ forward on regulations related to ESG investments, just one-quarter of respondents identified regulators, while one-half said that plan sponsors themselves should be taking the initiative.

We asked institutional investors about their official stance on ESG.

Here is what they told us.

1% require investment managers to be PRI signatories

27% require all investment managers and investments to consider ESG factors

37% believe in ESG factors, but meeting plan return and investment objectives should always take priority

17% expect their investment managers to provide detailed ESG reporting

17% do not consider ESG factors in any of their investment decisions or choice of investment managers

What other reports tell us

Industry and academic research also shows evidence of a positive impact on investment returns when ESG factors are considered. Here are a few examples:

In September 2016, Quotient Investors1 published a case study that measured the importance of ESG factors on performance. A performance attribution analysis was conducted on the Russell 1000 Index from January 2010 to June 2015. The results indicated positive excess returns of 1.6%, 2.4% and 2.7% that could be explained by social, environmental and governance factors respectively.

In October 2017, McKinsey2 published an insights article that reviewed the opportunities of integrating ESG factors with the investment process. McKinsey conducted interviews with over 100 investment and ESG leaders about their involvement with ESG investing. Enhancing returns was reported as one of the top three reasons to consider ESG investing. The article also referred to comprehensive research studies that determined investment strategies that incorporate ESG have positive effects on returns and that poor returns are uncorrelated with ESG investing.

In December 2015, The Journal of Sustainable Finance & Investment3 released a paper that studied ESG and financial performance collected from more than 2000 empirical studies on the subject. Only 10.7% of studies found a negative correlation between ESG investing and corporate financial performance.

Offense and defense – the value of ESG analysis

Pension plans have differences of opinion on ESG – and are at different stages of integrating ESG factors into their investment process. However, 60% of plan sponsors believe that incorporating ESG factors into investment decision-making would likely enhance long-term investment performance.

From an asset manager standpoint, that has been our experience. SLC Management’s process – which we call ESG Plus, combines a deep analysis of quantifiable environmental, social and governance concerns with a heightened awareness of less quantifiable and evolving non-financial risks. Non-financial risks are future events and trends that are difficult to quantify, but likely to affect investment returns. These risks can be related to a number of things like technology, public policy, and changing societal norms.

We build an ESG analysis industry-by-industry and share this information across asset classes. We then use this information to be both defensive – in avoiding investments that are less sustainable, like coal and oil sands projects – and offensive in identifying investments that have strong sustainability features, such as clean and renewable energy projects, green bonds, or emerging technologies designed to solve sustainability issues.

While institutional investors may have different needs and situations, most share a common trait – having long-term commitments that require sustainable solutions. For that reason alone, we believe that an ESG framework is critical – a permanent organizational structure that ensures investing strategies and actions are current, coordinated, and aligned for maximum effectiveness.

We have seen first hand how it can preserve and enhance the long-term market value and income generation capacity of the assets we manage – and enhance long-term value for our clients.

1 Source: Quotient Investors, “Attributing performance to ESG factors” case study, September 5, 2016; published on PRI website, https://www.unpri.org/listed-equity/attributing-performance-to-esg-factors/742.article

2 Source: McKinsey & Company, “From why to why not sustainable investing” research, October 2017; published on McKinsey & Company website, https://www.mckinsey.com/industries/private-equity-and-principal-investors/our-insights/from-why-to-why-not-sustainable-investing-as-the-new-normal

3 Source: Journal of Sustainable Finance & Investment, “ESG and financial performance: aggregated evidence from more than 2000 empirical studies” article, December 2015, published on Taylor & Francis Online website, https://www.tandfonline.com/doi/full/10.1080/20430795.2015.1118917

The 2018 Sun Life ESG Research study was conducted by Canadian Institutional Investment Network (CIIN) and TC Media research group, both parts of Transcontinental Media, between August 15 and September 21, 2018. TC Media research group has been collecting B2B decision-maker insights via interviewing and engaging elite audiences, such as those responsible for Canada’s largest pension plans, for the past 15 years, and has developed and honed techniques and best practices for dealing with this level of respondent. The 50 self-selected respondents come from TC Media’s Canadian Institutional Investment Network database and include persons serving in executive or management roles at pension plans, foundations, and endowments (with a minimum of $250.0M in assets under management). Invitations to participate were sent to 119 individuals. Fielding and preliminary analysis were also completed by CIIN and TC Media research group. All sample surveys and polls may be subject to other sources of error, including, but not limited to methodological change, coverage error and measurement error. The information obtained by CIIN and TC Media research group during the survey was taken “as is” and was not validated or confirmed by SLC Management.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Prime Advisors, Inc. (“Prime”), Ryan Labs Asset Management Inc. (“Ryan Labs”), and Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Additionally, the SLC Management brand includes the investment division and General Account of Sun Life.

This document is not for retail use or distribution to individual investors. The information in this document is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this proposal.

All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility.

No part of this material may, without SLC Management s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

©2019 SLC Management