Q1 2024: Inflation Watch

In this issue, we discuss cooling inflation, decreasing liquidity in real return bonds (RRB), and why the cost of implementing a U.S. based inflation strategy has increased.

PM spotlight

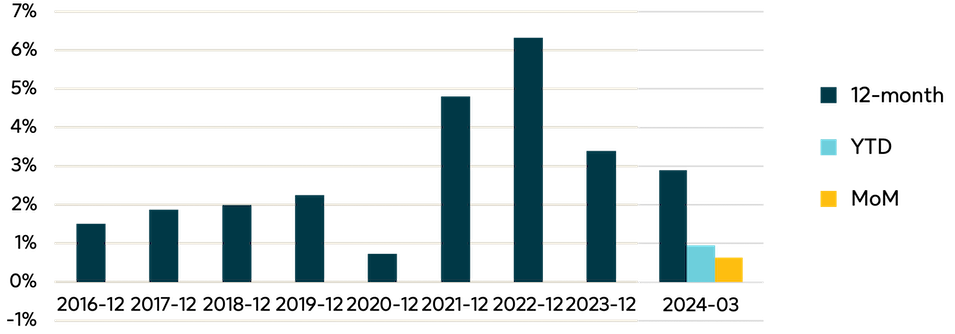

Steve’s take: “Canadian inflation came in soft in Q1 with headline CPI increasing 2.9% year-over-year (figure 1), broadly in line with market consensus and staying within the Bank of Canada’s 1.0%-3.0% target range. Most of the cooling has been coming from core goods, whose prices have been roughly unchanged year-over-year. With evidence of decreasing price pressures, analysts have revived their expectations of the first rate cut of the year occurring in June or July.”

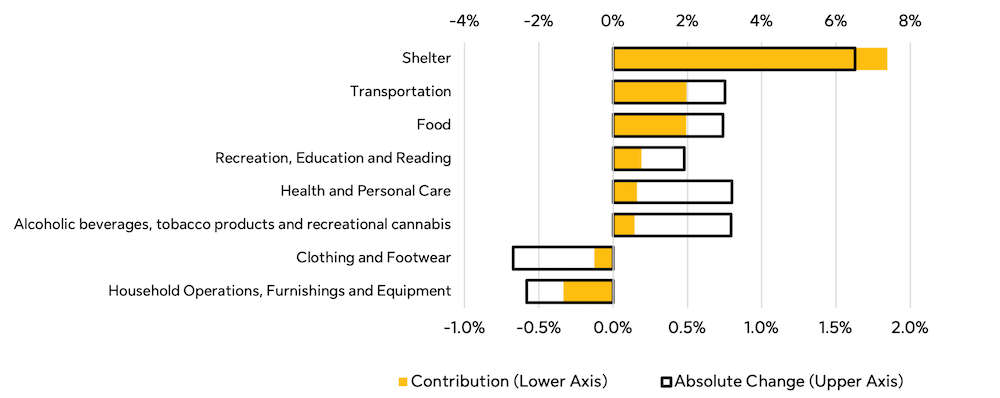

Shelter is currently the main driver of headline inflation with prices increasing 6.5% year-over-year, contributing 1.7% to headline inflation (figure 2). Shelter prices have been a thorn in the side of disinflationary progress.

In addition to core goods, food has been a key contributor to the cooling in headline inflation with only a 3.0% year-over-year increase. This is a significant decrease compared to the 10.4% year-over-year increase seen in January 2023.

Gasoline prices rose 4.5% year-over-year due to crude oil supply concerns amid geopolitical conflict and continued voluntary production cuts.

Figure 1: CPI Change

12-month, YTD, and MoM change in the Statistics Canada Consumer Price Index, monthly, not seasonally adjusted (Table 18-10-0004-01)

Figure 2: Canada headline CPI contribution year-over-year

Bank of Canada Consumer Price Index Portal

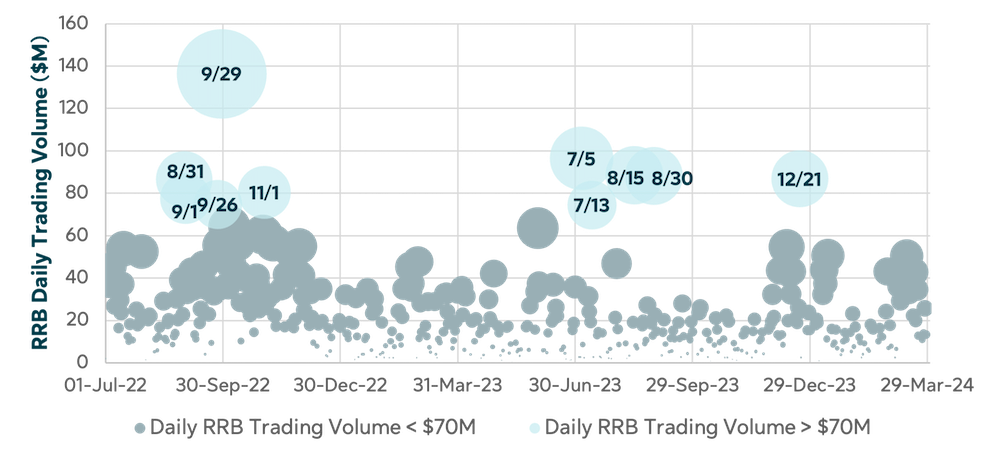

Steve’s take: “With decreasing liquidity in real return bonds (RRBs), strong dealer relationships and market experience is a key factor in being aware of opportunities to obtain significant allocations and implementing new RRB mandates at efficient prices.”

Figure 3: RRB trading volume

Bloomberg

RRB trading activity was light in Q1, consistent with trends seen since the Government of Canada’s cessation of RRB issuance in November 2022 (figure 3). Daily trade volume was light over the quarter, with daily trading volume under $60M for all days. With lower liquidity in RRB markets, it may take up to several months to complete the purchase of larger RRB lot sizes at efficient prices.

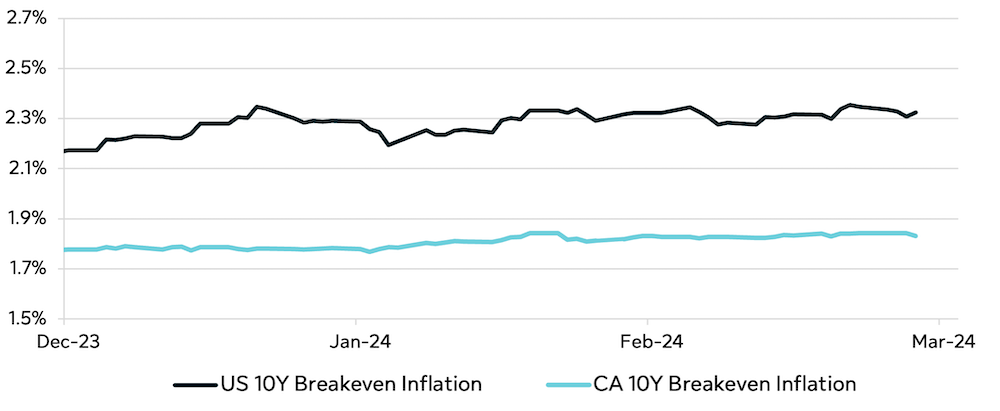

We continue to monitor entry points for clients who are considering using alternatives to RRBs to hedge Canadian inflation, including U.S. TIPS and inflation swaps. Over the past quarter, the gap between 10-year breakeven inflation rates in the U.S. and Canada widened from 40 bps to 49 bps (figure 4). This suggests that the cost of implementing a U.S. based inflation strategy has increased over the quarter.

Figure 4: US vs. Canadian 10-year breakeven inflation rates

Bloomberg

The content of this presentation is intended for institutional investors only. It is not for retail use or distribution to individual investors. All investments involve risk including the possible loss of capital. This presentation is for informational and educational purposes only. Past performance is not a guarantee of future results.

Unless otherwise stated, all figures and estimates provided have been sourced from the Bank of Canada. Unless otherwise noted, all references to “$” are in CAD. Any reference to a specific asset does not constitute a recommendation to buy, sell or hold or directly invest in it. It should not be assumed that the recommendations made in the future will be profitable or will equal the results of the assets discussed in this document.

The information contained in this presentation is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this presentation.

The information may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate.

Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and, in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association. In the U.S., securities are offered by Sun Life Institutional Distributors (U.S.) LLC, an SEC registered broker-dealer and a member of the Financial Industry Regulatory Authority (“FINRA”).

© 2024, SLC Management.

CPI change (figure 1)

12-month, YTD, and MoM change in the Statistics Canada Consumer Price Index, monthly, not seasonally adjusted (Table 18-10-0004-01)

Canada headline CPI contribution year-over-year (figure 2)

Bank of Canada Consumer Price Index Portal

RRB trading volume (figure 3)

Bloomberg

US vs. Canadian 10-year breakeven inflation rates (figure 4)

Bloomberg

“FTSE®” is a trade mark of FTSE® International Limited and is used under license.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

© SLC Management, 2024

SLC-20240510-3571068