Liability-driven investment (LDI) programs often face a tradeoff between hedging liabilities and enhancing diversification, among other competing goals. In our latest investment team insights, we discuss how investment grade private fixed income can help solve the conundrum.

Rebalancing and re-risking in turbulent Canadian markets

For many plan sponsors March proved to be a perfect storm of negative conditions, as equity markets fell dramatically and interest rates hit record lows. While widening credit spreads provide some relief in terms of higher discount rates, many liability hedging portfolios, holding the broad spectrum of bonds, may have underperformed liabilities valued under the annuity proxy.

Pension plan sponsors are now facing difficult decisions around rebalancing and if or when they should consider re-risking their portfolios given their lower funded status. We believe in staying focused on the long-term goals of the plan, remembering the role that each part of the portfolio is intended to play, while also retaining flexibility to take advantage of market dislocations as they occur.

Here, we discuss some of the challenges we’ve been working through with our clients and some considerations and options available to plan sponsors as they try and navigate turbulent waters.

The liability hedging portfolio hopefully performed its role. Despite the unprecedented conditions in financial markets, many plan sponsors are thankfully in a better place to cope than they would have been in years past.

Over the last few years, spurred on by a buoyant stock market and increased contributions from plan sponsors, many Canadian plan sponsors saw significant improvements in funded status (from 91% at the end of 2014 to 102% at the end of 2019)1. With the trend to either indirectly or directly (through a glidepath) link funded status to de-risking, we saw increased interest in hedging interest rates (54% of private sector plans in 2019 compared to 44% of private sector plans in 2017)2. In the current market, plan sponsors would have seen these hedging assets help offset some of the negative news in the risk-seeking part of their portfolio.

Rebalancing: Pension plans looking to return their asset mix to target by redeploying funds from fixed income to growth oriented assets should engage their fixed income managers early to determine how best to execute in today’s environment.

It is important in this context to distinguish rebalancing from re-risking. Most plan sponsors will have seen their fixed income assets significantly outperform their growth oriented assets, such as equities. Now, they are grappling with the challenge of if and when they should start to trim those fixed income gains and redeploy elsewhere.

Rebalancing between hedging and growth assets has historically been shown to add value in turbulent markets because of the mean reverting nature of these asset classes. In the current environment, the challenges around rebalancing come from both a lack of liquidity and an extremely volatile market that is changing by the hour. In these situations, we believe in taking a disciplined approach with the goal of steady and measured rebalancing, while also engaging managers to understand the liquidity constraints they are experiencing in their portfolios.

One potentially unanticipated result we are seeing from rebalancing activity is the impact on liquidity within fixed income portfolios. As managers look to raise cash to meet rebalancing needs, they are forced into selling the most liquid instruments at their disposal, typically any federal allocations, resulting in a potentially less liquid remaining portfolio. With credit markets behaving erratically, this can limit a manager’s ability to take advantage of dislocations in the market as they occur. We believe it is important for sponsors to work with their fixed income managers to understand these evolving dynamics and manage both the broad rebalancing activity and the impact on individual portfolios.

Re-risking: The question of whether to adjust strategic asset allocation targets should reflect changes in the plan sponsor’s risk appetite, not changing views on asset class prices.

Our view is that plan sponsors should stick to their longer-term goals of de-risking their plans. This is even more appropriate in the current environment, where many plan sponsors are facing increased pressure elsewhere in their business, which makes additional volatility in the pension plan less desirable. It is important to remember that most plans are still underhedged with respect to interest rates and credit spreads. This means that plan sponsors are already positioned for a rising rate environment without taking further actions.

While sponsors with well-hedged plans may not participate as much in the upside if markets take a positive turn, the liability hedging portfolio has hopefully performed its role over the last few weeks, putting them in a better position today. This dampened funded status volatility was the original goal for most of our clients in employing Liability Driven Investing (LDI) strategies.

However, for plan sponsors intent on adding risk back into their portfolios, we believe there are multiple levers available in the current volatile market that offer the opportunity to add risk without reducing the effectiveness of the liability hedging bucket.

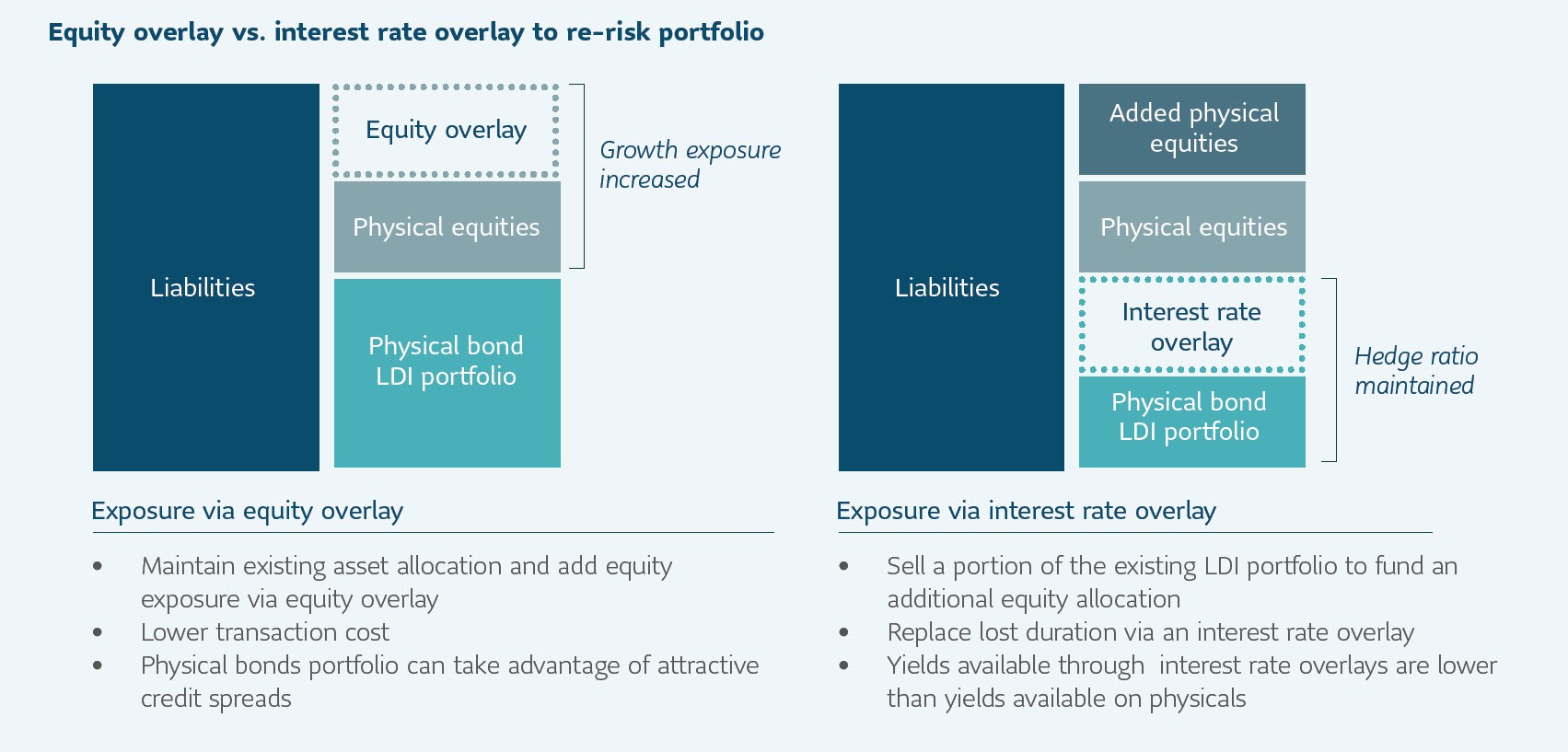

For plan sponsors who are looking to add equity exposure without reducing their hedge ratio, utilizing overlays can be an efficient method to do so.

Most plan sponsors will still have the long-term goal of increasing fixed income allocations to reduce funded status volatility as the plan reaches the later stages of its glidepath. Selling out of fixed income positions to fund equity purchases, with the hope of reversing the trade again if funded status improves in the future, exposes a client to risk if interest rates fall further, and can be a costly round trip, particularly with current liquidity levels. For example, the current round trip cost of selling and then buying a 15-year corporate bond could be as much as 6%, significantly higher than in normal market environments.

An alternative is to use overlays to adjust asset allocations through either equity overlays or provincial bond overlays using repurchase agreements. Care needs to be taken in understanding the limits on these instruments in times of stress, but utilizing overlays can provide a cost efficient way to adjust asset allocations while still maintaining the existing hedge ratio. This can be achieved either by adding growth asset exposure synthetically or by replacing any reduced rate exposure in the liability hedging portfolio.This can be achieved either by adding growth asset exposure synthetically or by replacing any reduced rate exposure in the liability hedging portfolio.

The above data is hypothetical and for illustrative purpose only and does not represent real assets or assets within an actual client portfolio.

Exposure via equity overlay

- Maintain existing asset allocation and add equity exposure via equity overlay

- Lower transaction cost

- Physical bonds portfolio can take advantage of attractive credit spreads

Exposure via interest rate overlay

- Sell a portion of the existing LDI portfolio to fund an additional equity allocation

- Replace lost duration via an interest rate overlay

- Yields available through interest rate overlays are lower than yields available on physicals

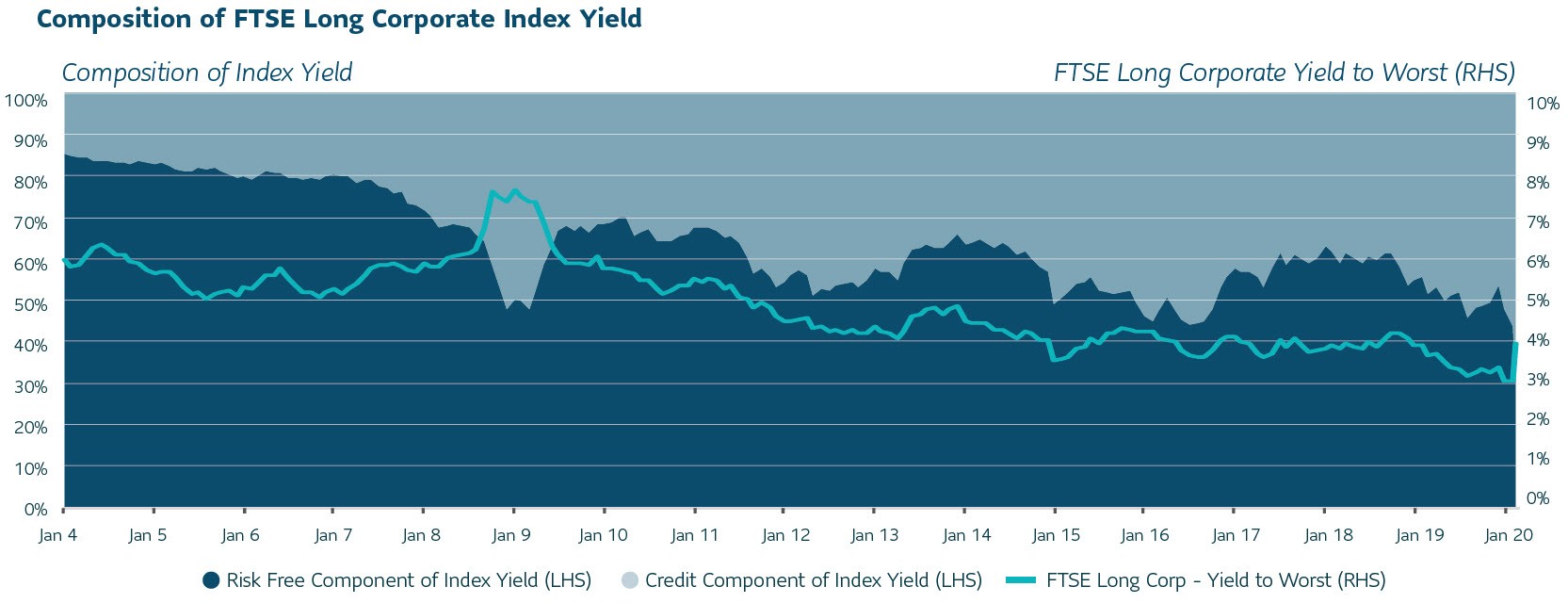

Wide credit spreads provide an opportunity for plan sponsors to lock in cheap credit exposure.

Since the start of the year, rates have been extremely volatile, and have hit record lows. As a result, plan sponsors may be considering shortening the duration of their hedging portfolio to try and take advantage of future rate rises.

While shortening duration will likely help in a rising rate environment, it’s important to remember that in liability hedging terms, there is a cost to doing so. This cost is both from a loss of protection if rates fall further, but also in accepting lower yields lower than the annual liability growth rate.

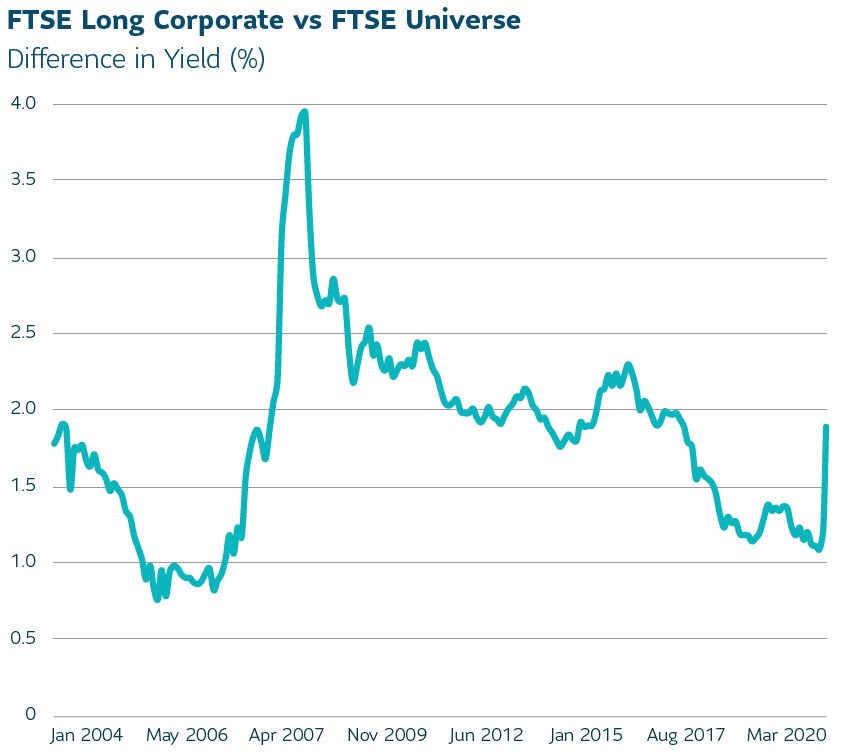

Pension plan liabilities are typically valued by using a discount rate, based either implicity or explicitly, on the yield on corporate bonds. By shortening the duration of the hedging portfolio plan sponsors, and with upward sloping yield and credit curves, plan sponsors that shorten duration are accepting a yield shortfall between their portfolio and the discount rate of the plan’s liabilities. For example, as of March 26, the FTSE Canada Long Corporate Bond Index yielded 3.96%, compared to the FTSE Canada Universe Bond Index yield of 2.10%, resulting in a yield advantage of 1.86%.

Source: FTSE Canada. “FTSE®” is a trade mark of FTSE® International Limited and is used under license.

This yield differential means that views on potential future rate rises should account not just for how far plan sponsors feel rates might rise, but also over what time period it could happen and whether this will offset the cost of that position.

Further, recent widening in credit spreads has left longer dated corporate bonds looking attractive. For plan sponsors intent on shortening duration, one way to balance these competing dynamics is to maintain existing credit allocations while using reverse repurchase agreements, interest rate swaps, or futures to shorten the overall duration. This allows them to maintain exposure to attractive spread levels while expressing their views on potential future rate moves.

Similarly, the current environment provides an interesting entry point for plan sponsors with the long-term goal to add long credit exposure as funded status improves. Allocating to long credit today, and reducing the duration through overlays allows plan sponsors to lock in attractive spread levels without increasing their hedge ratio. The overlay positions can then be unwound, and the hedge ratio increased as rates rise and funded status improves.

Source: FTSE Canada. “FTSE®” is a trade mark of FTSE® International Limited and is used under license.

Asset allocation decisions are complicated even in stable markets. In the current unpredictable environment, we believe in maintaining a long-term focus on the de-risking goals of our clients while also utilizing all the tools at our disposal to help them take advantage of short term dislocations in the market.

1 Aon Median Solvency Ratio survey

2 Aon Global Pension Risk survey (Canadian findings)