September 2023: Inflation watch

In this issue, we discuss the continued increase in headline CPI, a burst in RRB trading volume in Q3, and why implementing a U.S. based inflationary strategy could be expensive for Canadian investors.

In this issue, we discuss the continued increase in headline CPI, a burst in RRB trading volume in Q3, and why implementing a U.S. based inflationary strategy could be expensive for Canadian investors.

PM spotlight

Steve Morris, CFA, Senior Managing Director & Portfolio Manager

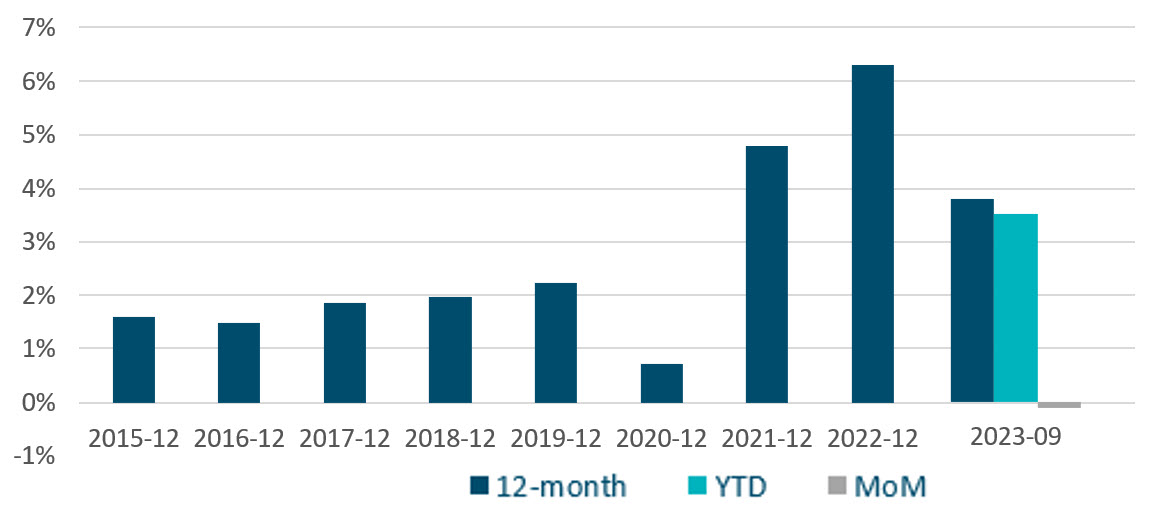

Steve’s take: “The disinflationary process remains underway, but has been slow and bumpy. As of September, headline CPI increased 3.8% year-over-year (figure 1), above the control range of 1%-3%. The increase in year-over-year inflation in Q3 was expected due to base effects from last year and can largely be explained by energy. Core measures have remained sticky around 3.5%-4% on a year-over-year and quarter-over-quarter annualized basis.”

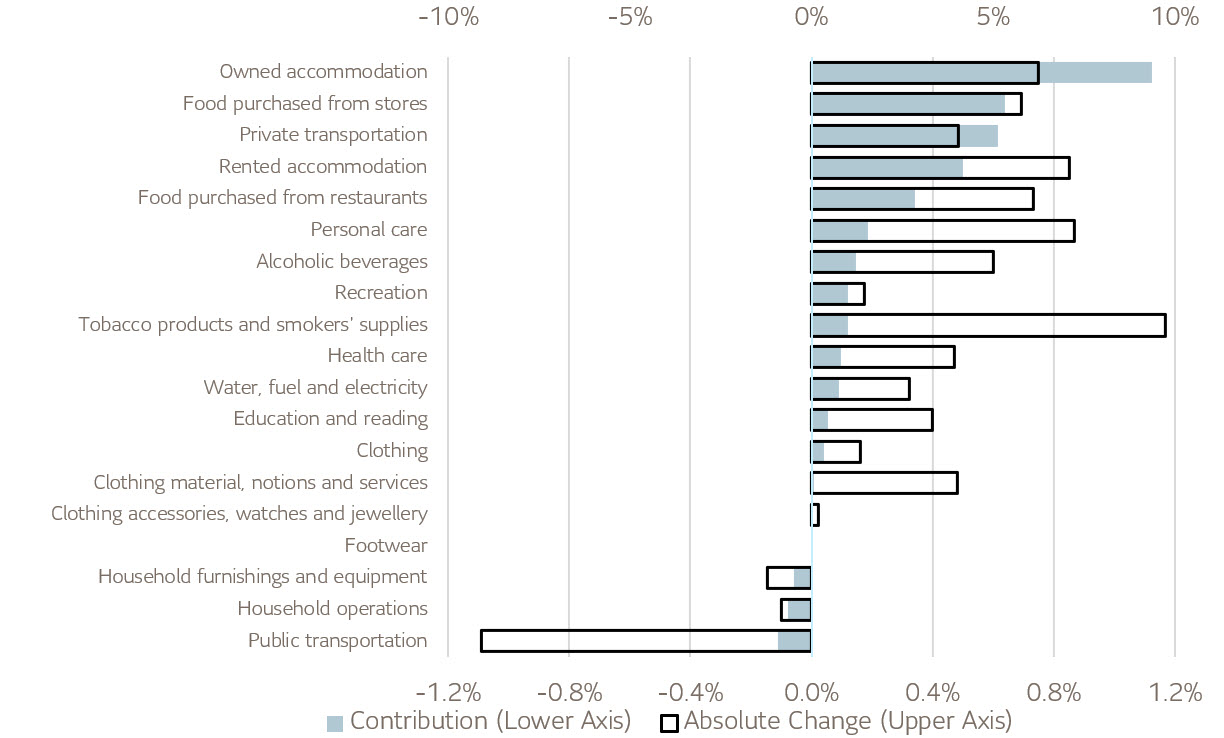

Shelter continues to be a large driver of headline inflation, contributing 1.7% to year-over-year inflation (figure 2). We have seen some recent acceleration in rent of primary residence and owned accommodation in Canada.

Price growth for groceries continued to decelerate in September but remained above headline inflation, rising 5.8% year-over-year vs. 6.9% in August. The deceleration was driven by year-over-year slowdowns in price increases for meat and dairy products, which increased 4.4% and 4.0% respectively.

Gasoline prices rose 7.5% year-over-year largely due to unfavourable base year effects, offsetting the deceleration in CPI.

Figure 1: CPI change

12-month, YTD, and MoM change in the Statistics Canada Consumer Price Index, monthly, not seasonally adjusted (Table 18-10-0004-01)

Figure 2: Canada headline CPI contribution year-over-year

Bank of Canada Consumer Price Index Portal

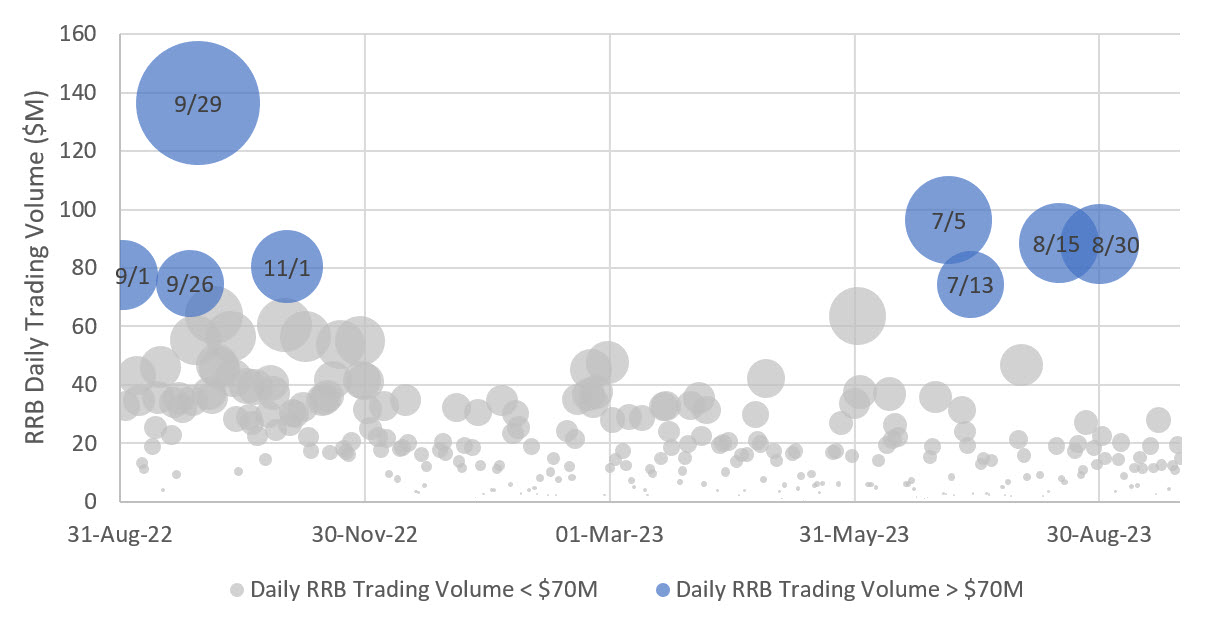

Steve’s take: “With decreasing liquidity in real return bonds (RRBs), strong dealer relationships and market experience is a key factor in being aware of opportunities to obtain significant allocations and implementing new RRB mandates at efficient prices.”

RRB trading frequency and lot sizes have decreased significantly since the Government of Canada’s November 2022 announcement of their decision to cease RRB issuance (figure 3). While we continue to see low trading frequency and volume on most days, we experienced four days of significant RRB trading activity (daily trade volumes > $70M) in Q3, suggesting investors may still have opportunities to increase their RRB holdings if desired.

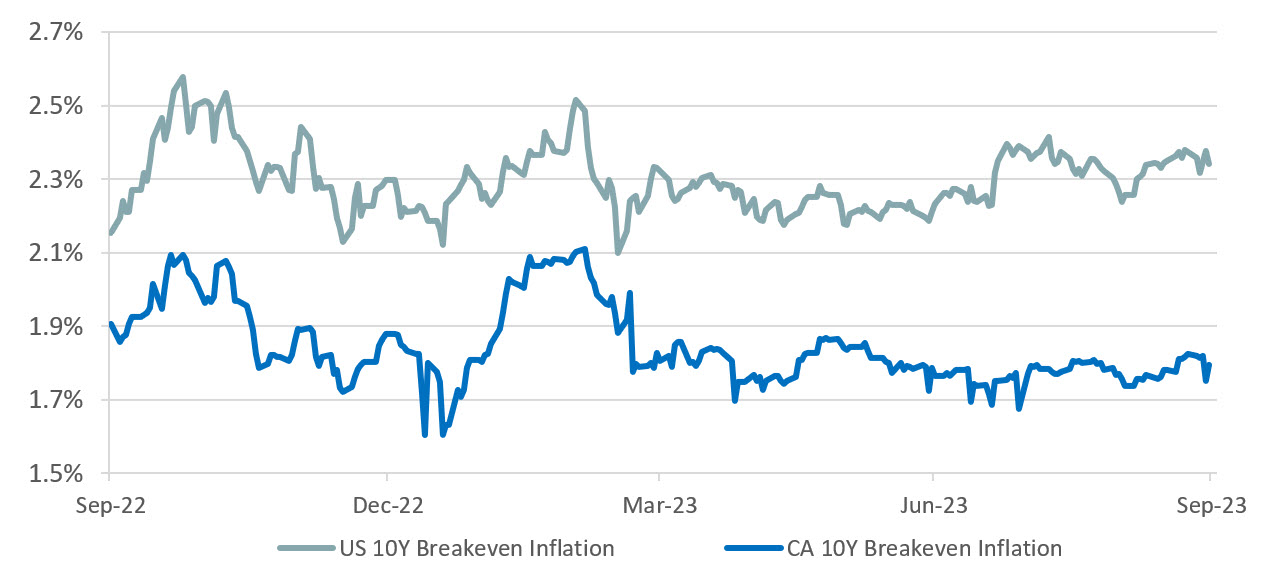

As RRB liquidity becomes further challenged, our clients are considering alternatives to RRBs to hedge Canadian inflation, including U.S. TIPS and inflation swaps. We are closely monitoring entry points for these clients. Over the past year, the gap between breakeven inflation rates in the U.S. and Canada has widened by 20 bps (figure 4), suggesting that implementing a U.S. based inflation strategy is relatively expensive. As market dynamics in this space change rapidly, we will evaluate whether more favourable entry points may emerge going forward.

Figure 3: RRB trading volume

Bloomberg

Figure 4: US vs. Canadian 10-year breakeven inflation rates

Bloomberg

The content of this presentation is intended for institutional investors only. It is not for retail use or distribution to individual investors. All investments involve risk including the possible loss of capital. This presentation is for informational and educational purposes only. Past performance is not a guarantee of future results.

Unless otherwise stated, all figures and estimates provided have been sourced from the Bank of Canada. Unless otherwise noted, all references to “$” are in CAD. Any reference to a specific asset does not constitute a recommendation to buy, sell or hold or directly invest in it. It should not be assumed that the recommendations made in the future will be profitable or will equal the results of the assets discussed in this document.

The information contained in this presentation is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this presentation.

The information may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate.

Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and, in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association. In the U.S., securities are offered by Sun Life Institutional Distributors (U.S.) LLC, an SEC registered broker-dealer and a member of the Financial Industry Regulatory Authority (“FINRA”).

CPI change (figure 1)

12-month, YTD, and MoM change in the Statistics Canada Consumer Price Index, monthly, not seasonally adjusted (Table 18-10-0004-01)

Canada headline CPI contribution year-over-year (figure 2)

Bank of Canada Consumer Price Index Portal

RRB trading volume (figure 3)

Bloomberg

US vs. Canadian 10-year breakeven inflation rates (figure 4)

Bloomberg

“FTSE®” is a trade mark of FTSE® International Limited and is used under license.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

© SLC Management, 2023

SLC-20231109-3217384

About SLC Management

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate.

Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association.

BentallGreenOak, InfraRed Capital Partners (InfraRed) and Crescent Capital Group (Crescent), and Advisors Asset Management are also part of SLC Management.

BentallGreenOak is a global real estate investment management advisor and a provider of real estate services. In the U.S., real estate mandates are offered by BentallGreenOak (U.S.) Limited Partnership, who is registered with the SEC as an investment adviser, or Sun Life Institutional Distributors (U.S.) LLC, an SEC registered broker-dealer and a member of the Financial Industry Regulatory Authority (“FINRA”) . In Canada, real estate mandates are offered by BentallGreenOak (Canada) Limited Partnership, BGO Capital (Canada) Inc. or Sun Life Capital Management (Canada) Inc. BGO Capital (Canada) Inc. is a Canadian registered portfolio manager and exempt market dealer and is registered as an investment fund manager in British Columbia, Ontario and Quebec.

InfraRed Capital Partners is an international investment manager focused on infrastructure. Operating worldwide, InfraRed manages equity capital in multiple private and listed funds, primarily for institutional investors across the globe. InfraRed Capital Partners Ltd. is authorized and regulated in the UK by the Financial Conduct Authority.

Crescent Capital Group is a global alternative credit investment asset manager registered with the U.S. Securities and Exchange Commission as an investment adviser. Crescent provides private credit financing (including senior, unitranche and junior debt) to middle-market companies in the U.S. and Europe, and invests in high-yield bonds and broadly syndicated loans.

Securities will only be offered and sold in compliance with applicable securities laws.

AAM is an independent U.S. retail distribution firm that provides a range of solutions and products to financial advisors at wirehouses, registered investment advisors and independent broker-dealers.

Website content

The content of this website is intended for institutional investors only. It is not for retail use or distribution to individual investors. All investments involve risk including the possible loss of capital. All asset classes have associated risks. Certain asset classes are speculative, can include a high degree of risk and are suitable only for long-term investment. Further information available upon request. This website is for informational and educational purposes only. Past performance is not a guarantee of future results.

The information contained in this website is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained on this website. The assets under management (AUM) represent the combined AUM of Sun Life Capital Management (Canada) Inc., Sun Life Capital Management (U.S) LLC, BentallGreenOak, Crescent Capital Group, InfraRed Capital Partners, and Advisors Asset Management.

AUM as of March 31, 2025. Total firm AUM includes approximately $11B in cash, other, unfunded commitments, and Advisors Asset Management equity. Total firm AUM excludes $16 billion in assets under administration by AAM.

Currency conversion rate: USD $1.00 CAD $1.4387 as of March 31, 2025.

UK Tax Strategy - InfraRed (UK) Holdco 2020 Limited

InfraRed (UK) Holdco 2020 Ltd is the UK holding company of InfraRed Partners LLP and a subsidiary of Sun Life (U.S.) Holdco 2020 Inc, which has its headquarters in the U.S. The company was incorporated to purchase InfraRed Partners LLP and acts solely as a passive holding company. The Tax Strategy for the InfraRed Holdco Group sets out our approach to the management of InfraRed Holdco Group UK tax affairs in supporting business activities in the UK.

This UK tax strategy is published in accordance with the requirements set out in Schedule 19 of Finance Act 2016. The strategy, which has been approved by the Board of Directors of InfraRed (UK) Holdco 2020 Ltd, is effective for the period ending 31 December 2024. It applies to InfraRed (UK) Holdco 2020 Ltd and its dormant subsidiary Sun Life (UK) Designated Member Ltd, referred to as the “InfraRed Holdco Group”. InfraRed Holdco Group.