Credit markets reported considerable year-over-year deal activity, with investor demand a principal driver. Meanwhile, continued development, expansion and innovation in the asset-backed finance (ABF) space requires a renewed perspective into the possible benefits and risks of these investments.

Stimulus Checks Are Not Helping The U.S. Economy, Here’s What Can.

As unemployment spiked this spring, the U.S. government put its faith in the $500 billion of loans to small businesses from the Paycheck Protection Program (PPP). Yet this huge wave of stimulus did little to secure jobs, according to preliminary results from a study by economist Raj Chetty and his team at Harvard.

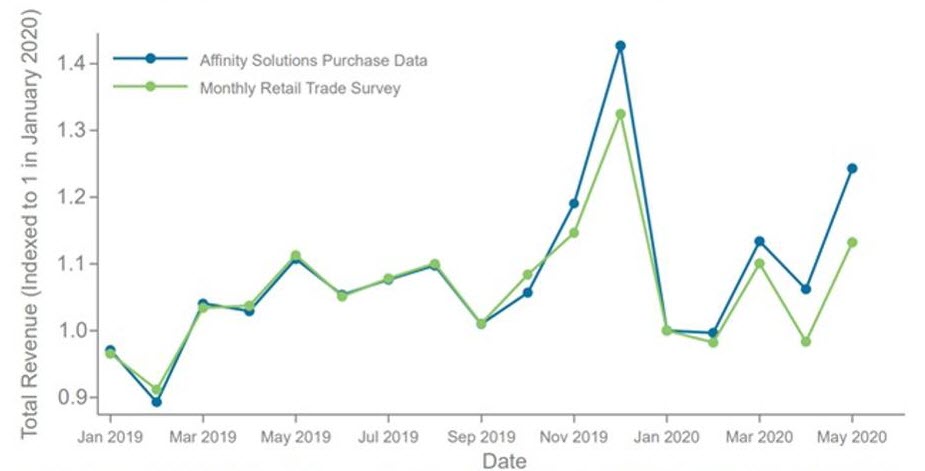

Using anonymized data from private companies, credit cards and payrolls, Chetty analyzes consumer spending, small business revenues, wages and more all the way down to the ZIP code level. This real-time view of the economy is worth paying attention to; in back testing, his real-time credit and debit card activity highly correlated with the Census Bureau’s official Monthly Retail Trade Survey.

Real time monitoring should allow quicker assessment of the efficacy of stimulus programs and that accelerated feedback should improve the odds of a sustainable recovery. ZIP code level data could also allow more customized responses and help minimize regional dislocations.

In a similar tone, the Organization for Economic Co-operation and Development (OECD) recently called on governments to stay adaptable as they balance policies between income security and incentivizing a return to work as economies reopen.

Changes in Consumer Spending: National Accounts vs. Credit/Debit Card Data

Retail Services in Affinity Solutions Purchase Data vs. Monthly Retail Trade Survey

Source: Chetty, Raj, John N Freidman, Nathaniel Henderson and Michael Spencer, 2020 How Did COVID-19 and Stabilization Policies Affect Spending and Employment? A New Real-Time Economic Tracker Based on Private Sector Data.

Changes in Consumer Spending RAJ CHETTY

Health concerns drive spending reductions among top earners

Government data has already confirmed that the pervasive drop in GDP was driven by an implosion in consumer spending.

Chetty’s research provides context and actionable insight to complement these overarching trends. With the use of ZIP code data, he determined that the massive drop in credit expenditure was concentrated in the most affluent ZIP codes. Almost two-thirds of the drop in credit card spending came from consumers in the top 25% of the income distribution. Those at the bottom 25% continue to spend at their pre-pandemic pace.

Survey results indicate that the drastic spending reduction by the rich was not driven by austerity, but rather health concerns. Nearly three-quarters of the drop in spending resulted from a reduction in services that required physical contact. For example, hotels and restaurants suffered because of their reliance on human interaction, but landscaping and poll installations were able to maintain revenue.

Small businesses data further supports Chetty’s conclusions. In affluent ZIP codes, small businesses lost 70% of their revenues from the pandemic’s onset, versus 30% in the lower rent areas. The revenue drop drove a comparable cut in the respective work forces.

The one-time household payments that arrived on April 15 were somewhat successful in that they drove a surge in spending. However, most spending was on durable goods, as consumers avoided in-person contact. This did little for many battered service sectors, and as a result, employment growth has lagged.

In-person service spending remains at half its normal level, and variations in states’ reopening plans had little impact on the difference in economic activity. Implicitly, consumers realize this is a health crisis and have in turn moderated in-person activity.

Paycheck protection did not reverse layoffs

The Federal Government’s solution to mitigating these job losses was its Paycheck Protection Program which gave loans to small businesses that would otherwise need to lay-off employees.

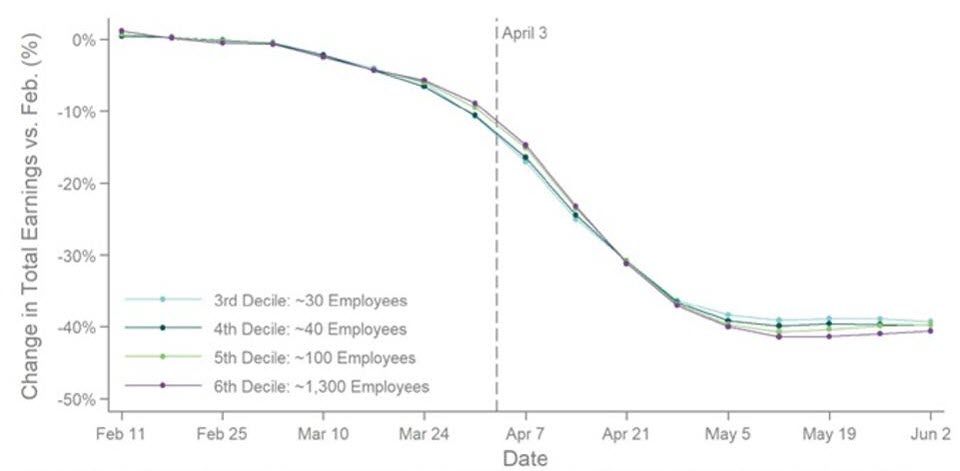

Yet despite the roll out of the Paycheck Protection Program, Chetty found that there was no difference in total earnings between a control group of smaller companies receiving PPP and a group of companies that did not qualify for those loans.

The dataset shows companies with average employee sizes of 10, 40 or 100 employees saw total earnings down about 40% from early February. This was right in line with large companies that on average have 1,300 employees.

Furthermore, states that had higher pre-PPP job losses did not see greater PPP participation. It appears companies that cut employees prior to PPP enactment didn’t reverse course; while companies that enacted minimal layoffs accepted support.

Impact of Paycheck Protection Program Loans on Employment

Source: Chetty, Raj, John N Freidman, Nathaniel Henderson and Michael Spencer, 2020 How Did COVID-19 and Stabilization Policies Affect Spending and Employment? A New Real-Time Economic Tracker Based on Private Sector Data.

Impact of Paycheck Prevention Program RAJ CHETTY

Additional research on sector analysis paints an even more revealing picture of the PPP shortcomings. Accommodation and food services account for almost half of all pre-PPP layoffs, whereas professional and technical services accounted for only 5%. Yet professional and technical received a greater share of the PPP loans.

From all of that, it appears that companies that were not intending to layoff employees took the loans as insurance knowing they could maintain their payroll and convert the loan to a grant. The more stressed sectors that are being derailed by social distancing seemed less confident that a loan could help.

Data-driven strategies for recovery

High-frequency data analysis like Chetty’s provides the opportunity to quickly determine the efficacy of stimulus efforts and develop more informed strategies to move forward.

Based on these preliminary results, policymakers need to de-emphasize blanket stimulus checks and loan programs. Instead, the focus should be on re-configuring unemployment benefits to better target economic losses and drive a more robust and sustainable recovery.

Chetty acknowledges that this recession may eventually turn into a more traditional shock, in which case, standard stimulus can help. This possibility reinforces the need for quality, timely data. In order to develop an adaptable response for the ongoing crisis, policy makers should incorporate more high-frequency data to identify inflection points and trigger shifts in the response.

This material was first published in Forbes. This material contains opinions of the author, but not necessarily those of Sun Life or its subsidiaries and/or affiliates.