Credit markets reported considerable year-over-year deal activity, with investor demand a principal driver. Meanwhile, continued development, expansion and innovation in the asset-backed finance (ABF) space requires a renewed perspective into the possible benefits and risks of these investments.

The Coronavirus Threat To Supply Chains Is A Big Risk

Superbugs that resist treatment and spread rapidly like Coronavirus always catch the headlines. The market impact of most viruses tends to be intense, but it soon fades. However, this round is different, and investors could be underestimating the longer-term impact of this latest health emergency on global supply chains.

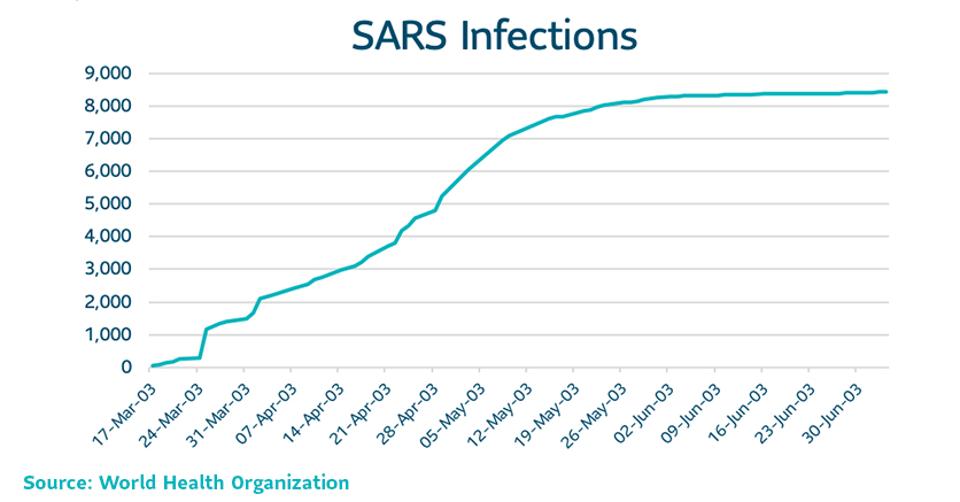

When SARS hit in November 2002, it wasn’t until the WHO issued an alert the following March that it garnered global attention. At that point, markets started to react: between March and June 2003, U.S. Treasury rates dropped 100 basis points and oil was down $10 on growth concerns.

10 Year Treasury rates during the 2003 SARS virus SLC MANAGEMENT

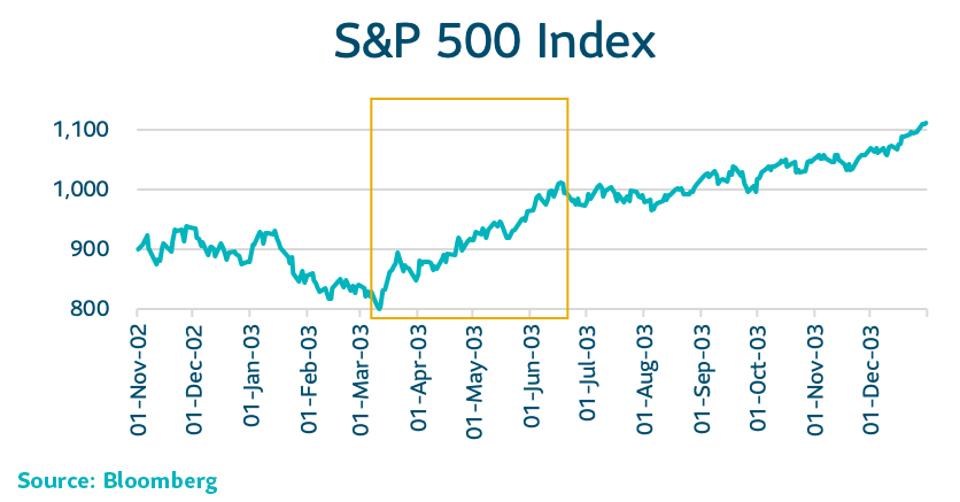

S&P 500 Index during the SARS virus in 2003 SLC MANAGEMENT

However, China was not as big of a market as it is today, and supply chains were rudimentary. That allowed investors to focus on solid U.S. fundamentals, and after a slight dip, equities moved higher. Eventually, as SARS cases peaked in June, U.S. Treasury rates started to rise.

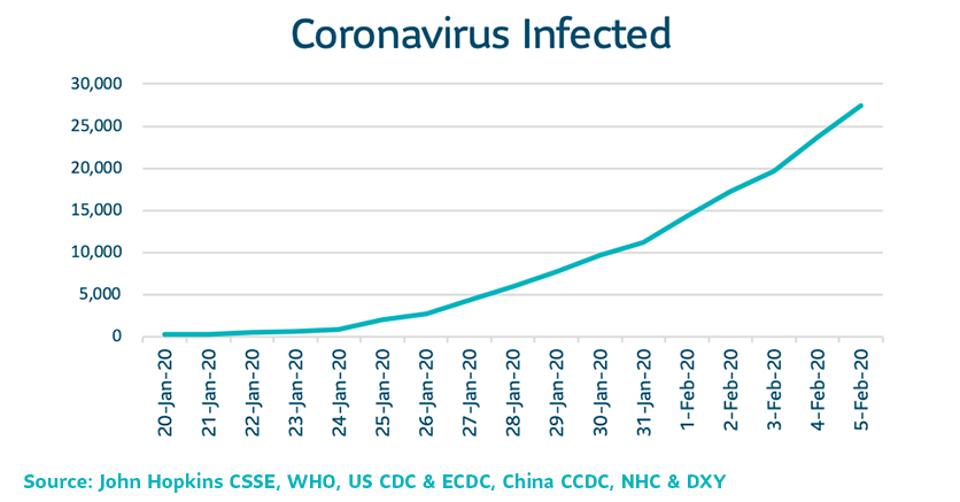

The current Coronavirus is a more contagious version of SARS, but the global response this time is more coordinated. Markets have taken comfort that global awareness and resources will prevent a pandemic, and the rate of transmission outside China has been modest so far.

Number of people infected by SARS over time SLC MANAGEMENT

Based on the playbook for SARS, as infected cases for Coronavirus start to level off over the next three months, we expect bearish global investor sentiment to turn. U.S. Treasury rates were down 35 basis points from the beginning of the year but have bounced back slightly. Equities, on the other hand, had given back their year-to-date gains but have recently hit new highs as earnings season remains strong.

Number of people infected by Coronavirus SLC MANAGEMENT

However, while the stock market may recover quickly, the disruption to supply chains could be more severe this time and last much longer. That will have deeper ramifications for the global economy, just as it was recovering from the U.S.-China trade spat. Currently, this risk is being underestimated by markets.

China’s Economy Will Take a Hit

Most economists expect China to take a 0.3-1.5% hit to its annual GDP from the impact of Coronavirus. Travel restrictions and the need to minimize contact will impact services. Manufacturing plants will see a productivity loss as infected workers, quarantines and transportation delays disrupt output. That means the expected economic rebound from the U.S.-China Phase I trade deal in Q1 2020 will be delayed.

The Chinese Lunar New Year, which is the largest annual migration in the world as families reunite, is typically a retail firestorm. But amid lockdowns, the virus smothered celebrations and consumer spending.

It should be evident in the next few weeks how effective the current preventative steps are in limiting the contagion. If the number of newly infected cases starts to slow, then lost output should be limited to the Hubei province at the virus’ epicenter. If efforts seem ineffective, there will be a material upward revision in both Chinese and global growth risk.

Supply Chains Are Under Stress

Beyond the immediate economic impact, however, it is disruption to global supply chains that poses the greatest threat to markets. The technology, electronics and auto sectors are the most vulnerable to impacts from Coronavirus.

The city of Wuhan in the Hubei province, where patient zero was diagnosed, is a manufacturing hub. Apple relies on Wuhan for some of its iPhone production, and it recently warned that the lockdown could impact its first-quarter earnings.

Meanwhile, global automakers such as Honda and Nissan have a significant slice of their Chinese production in the region. One of the largest auto parts makers in the world, Robert Bosch GmbH, shut two of its plants in the area. Hyundai just stalled its South Korean production as it ran out of Chinese parts. In a world of “just-in-time” inventories, a number of U.S. and European car manufacturers estimate they are three to four weeks away from running out of Chinese supplies.

None of this is a surprise. China is the largest exporter of intermediate products, so its ability to disrupt global output is significant. If Chinese factories stay offline for a couple of weeks, global automakers will be forced to dial back output targets.

Today’s sophisticated supply chains took a decade to optimize. Finding alternatives for high-end manufacturing is not trivial, and the assumptions on finding alternatives are probably optimistic. Even if the capabilities are there, any surge in demand will overwhelm these secondary suppliers.

Supply chain disruption is unequivocally being overlooked in most of the economic scenario analysis, as the knock-on effects are complicated.

China has to demonstrate it can quickly get its supply chains back online. Right now, markets are expecting flawless execution. That seems optimistic. There will undoubtedly be some mishaps and that will flow into earnings disappointments.

The U.S. auto industry, for example, sources 15% of its components from China. Any delays in a single part, shuts down the entire production line. Early alerts of these vulnerabilities are already cropping up. As noted already, Hyundai stalled its South Korean production and Fiat Chrysler just warned they may have to halt production at one of its European plants in the next few weeks if the dislocation continues. Expect this stress to intensify.

This article first appeared in Forbes. This material contains opinions of the author, but not necessarily those of Sun Life or its subsidiaries and/or affiliates.