Credit markets reported considerable year-over-year deal activity, with investor demand a principal driver. Meanwhile, continued development, expansion and innovation in the asset-backed finance (ABF) space requires a renewed perspective into the possible benefits and risks of these investments.

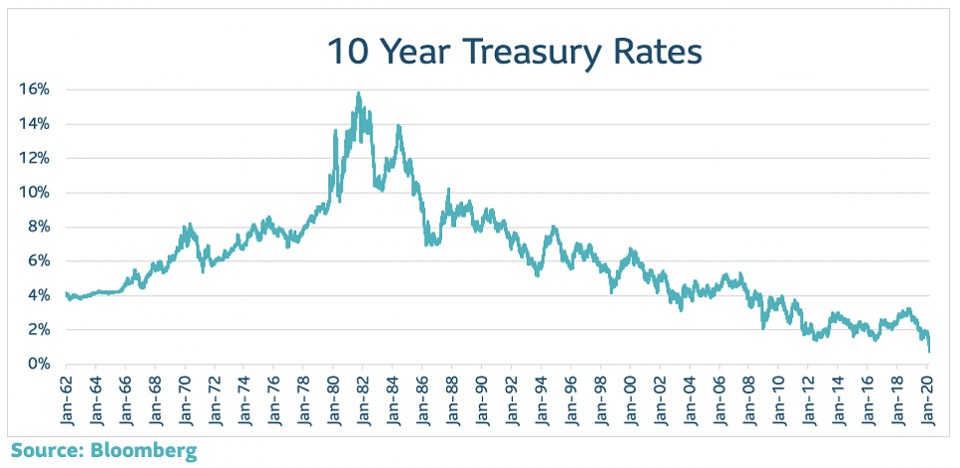

But rather than quell investor fears, in the past week, volatility escalated as stock markets swooned, oil prices tanked, and government bond yields raced to record lows.

10-year Treasury Rates SLC MANAGEMENT

The reality is that this goes further than the Fed’s reach – the exogenous threat of a full-blown pandemic is forcing at least half the world to restrict activity, which in the short term will dent growth. In the U.S., the recent travel ban, cancellation of large venue entertainment and new work from home policies will result in a severe economic hit, and could further spiral into weak consumer demand that will ultimately affect earnings and potentially lead to employee layoffs.

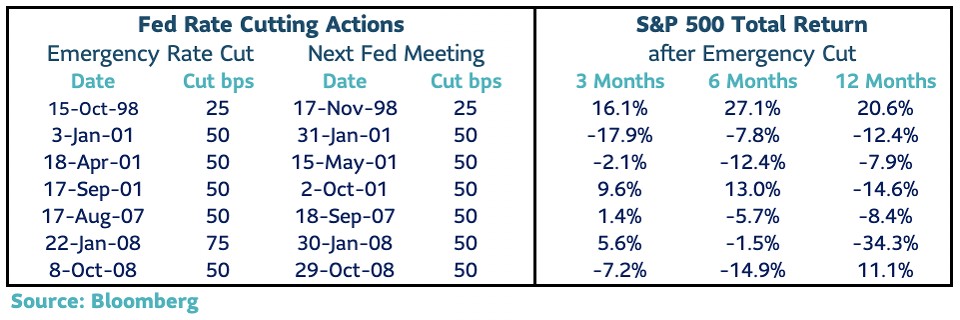

History suggests that emergency rate cuts usually beget more. And a lot is still unknown about the duration and intensity of this disruption. We expect the Fed to cut 50 basis points at its next meeting on Wednesday, March 18. While the Fed cannot conjure up a vaccine, cheaper debt can help buffer some setback and delays – but that action alone won’t be enough to revive market confidence. Fiscal policy is needed to put a floor under the economy.

More Rate Cuts On The Horizon

Markets already failed to revive when the Fed slashed interest rates by 50 basis points in early March. Equities would have normally cheered, but the surprise backfired. Alarmed that the Fed was foreseeing deeper economic cracks, the S&P 500 weakened and interest rates dropped further.

Other central banks are following the Fed’s lead. The Bank of Canada (BOC) and the Bank of England (BOE) both cut rates 50 basis points at their March meetings, echoing the Fed - that the virus shock threatens growth. The Bank of Japan (BOJ) has promised to inject liquidity and the European Central Bank (ECB), already at negative rates, left rates unchanged but ramped up its bond buying program.

If history is any guide, we should expect more cuts. Following the last seven surprise rate cuts, the Fed remained accommodative at its next meeting. Those follow-up cuts tended to be equally as generous. Other than October 1998, when a highly levered hedge fund threatened financial stability, all other emergency moves happened as a recession was percolating. Given recessions are hard to predict, the Fed has shown prescience in getting ahead of dislocations.

S&P 500 after an emergency rate cut SLC MANAGEMENT

Given this, we’re confident the Fed will cut rates again at its meeting next week, and there will be pressure to do more at the April meeting if the virus fallout intensifies. Treasury rates and equities are signaling a slowdown.

But The Fed Can’t Go It Alone

However, by racing towards zero, the Fed is depleting its capacity to fight the next disruption. Since the Fed seems intent on avoiding negative rates, it still has tools to direct the economy. Forward-rate guidance and renewed bond buying can continue to help but eventually it becomes a blunt, if not second order tool.

This is where a fiscal policy with targeted programs needs to take over. Recession risk has risen and will stay elevated until cases in the U.S. and Europe start to level off. If the damage from COVID-19 extends to the third quarter, a technical recession is likely in some developed economies with global growth cut in half for the year.

While most economic models assume a lively bounce back once the virus is contained, a few months of subpar growth could inflict serious damage. Some government support certainly will help take the bite out of reduced paychecks or temporary interruptions in small company cash flows. Fiscal support that puts a floor under an intense shock could prevent business and consumer sentiment from taking a dive and materially derailing growth.

Right now the U.S. government is considering stimulus programs such as sick pay for quarantine related losses, relief for beleaguered industries, loans to small businesses and delaying tax collections. Enthusiasm for payroll tax cuts seems low as Congress feels it is less targeted than other options. There is also latitude under the Federal Emergency Management Agency (FEMA), to advance funds to distressed regions.

Many of these proposals could be turned on immediately once approved and would help keep consumers and small businesses solvent as they manage inevitable cash flows interruptions.

This article first appeared in Forbes. This material contains opinions of the author, but not necessarily those of Sun Life or its subsidiaries and/or affiliates.