Currency forwards and cross-currency swaps can be used to manage the currency risk of foreign investments

- Cross-currency swaps are commonly used for fixed income investments where the cash flows are known with a high degree of certainty. Hedging currency risk with a cross-currency swap effectively creates a synthetic local currency denominated bond by converting the bond’s foreign currency denominated cash flows into a stream of local currency payments.

- Currency forwards are typically used for investments that have a high degree of uncertainty in the timing and amount of future cash flows such as public equity or high yield debt. Given the cash flow uncertainty, this approach is based on the market value of the investment instead of the individual cash flows. Forward contracts with short dated maturities have liquidity and low transaction costs necessary for efficient dynamic rebalancing to match fluctuations in foreign asset values. This note is focused on using currency forwards for equity-like investments.

Selling forwards on the foreign currency that is equal to the foreign investment’s market value acts to offset the volatility of the foreign currency exposure over the life of the forward contract. And if the asset’s value remains constant, the currency risk will be perfectly offset over the life of the contract. When the value of the asset increases (decreases), the size of the forwards position will have to increase (decrease) in tandem to maintain an exact offset. In practice, a dynamic rebalancing strategy should minimize the foreign currency exposure while also minimizing the rebalancing costs. The hedge position will be rolled forward into a new contract as the currency forward nears its expiry date.

Currency forwards are bilateral agreements to exchange a pair of currencies at a predetermined exchange rate on a specific date in the future, typically one year or less from the initiation of the contract. The price of the forward is determined by the spot exchange rate and differences in interest rates between the two countries. Currencies with relatively high interest rates tend to trade at a forward discount (negative return from selling forwards) compared to the spot rate. Currencies with relatively low interest rates tend to trade at a premium (positive return from selling forwards). Currency forwards are liquid, over the counter (OTC) instruments that are customizable in terms of size and maturity. They may require daily collateral transfers for price fluctuations.

Currency futures are similar to forwards in that their price is determined by the spot exchange rate and interest rate differentials. The difference is that currency futures are standardized exchange traded instruments with fixed notional amounts and maturities which makes them less flexible than currency forwards. Currency futures also tend to be less liquid than forwards for most currency pairs. For those reasons, currency forwards are generally preferred over currency futures.

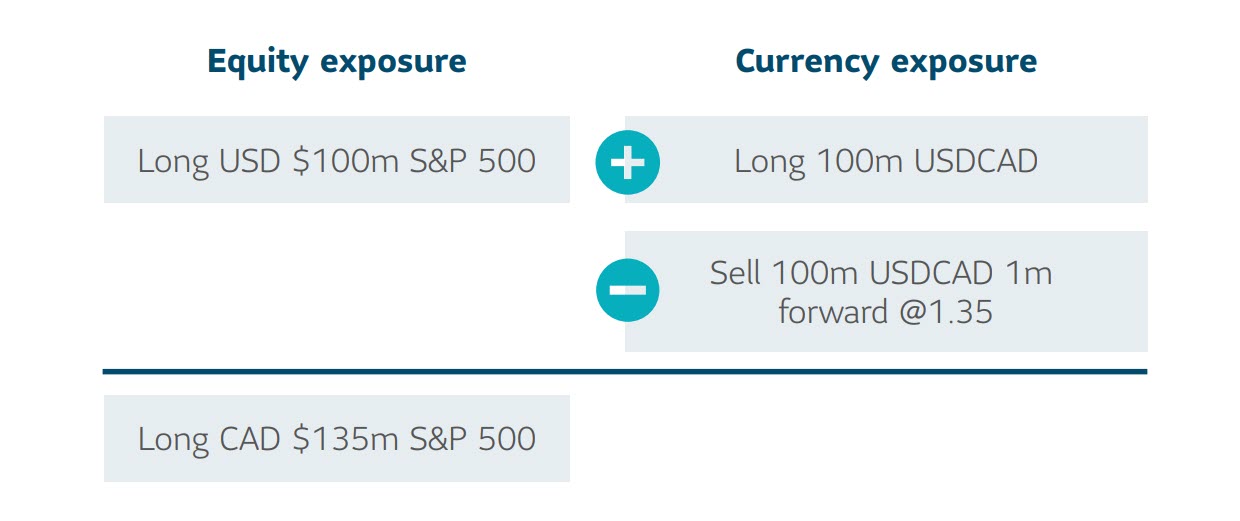

Example 1: Offsetting currency risk for a Canadian investor owning the S&P 500

When a Canadian investor purchases USD $100m in S&P 500 exposure, they will have USD $100m in equity exposure and also USD $100m in currency exposure. To isolate the equity exposure and offset the currency risk, they can sell a one month currency forward of 100m on USDCAD. If the one month forward contract trades at 1.35, the result of the transaction will be CAD $135m notional in equity exposure.

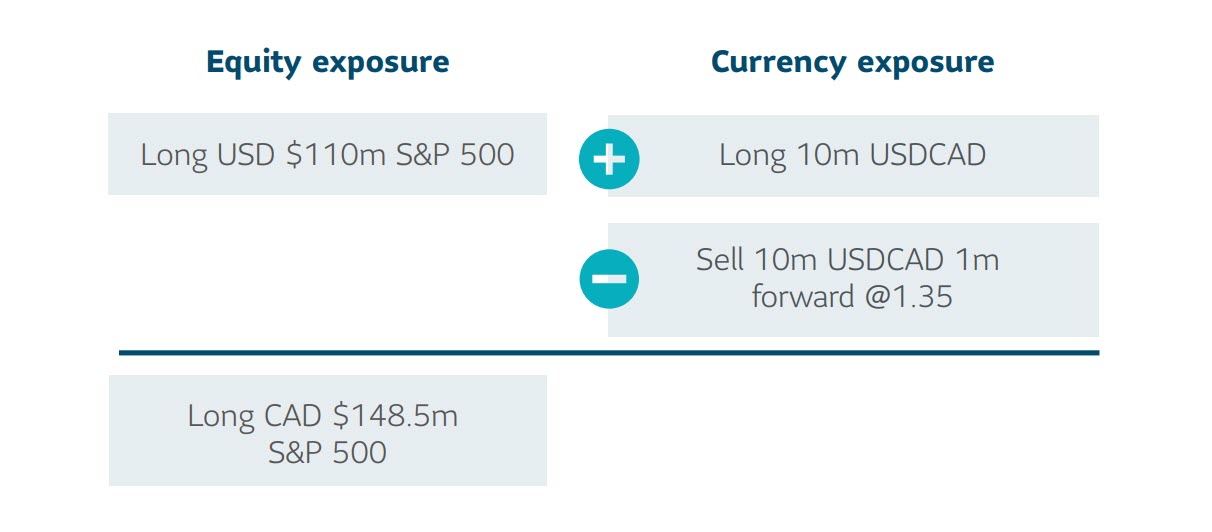

Fluctuations in the value of the equity index will cause a mismatch in the currency offset position. For example, if the value of the equity position increases 10% from USD $100m to USD $110m and the exchange rate is unchanged, the short forward position of 100m USDCAD will no longer exactly offset the currency risk of the position. To make the currency forward offset the risk, an additional $10m USD forward would be sold so the size of the hedge matches the equity exposure.

Example 2: Rebalancing currency position after a move in the equity investment

Considerations

The portfolio manager can add alpha by rebalancing the forwards at advantageous levels, targeting more attractive points on the forward curve and deliberately mismatching the currency offset position to express a view on the currency pair. Opportunities to target points on the forward curve arise when the pricing of the forward curve differs from the actual future path of interest rates.

Determining how frequently to rebalance the currency forward position involves a trade off between tracking error and trading costs. Trading more frequently will reduce tracking error but simultaneously increase trading costs. The client’s preferences and market dynamics must be considered when determining a strategy. If the foreign investment and foreign currency are negatively correlated, this is referred to as “wrong way risk” and the currency position should be rebalanced more frequently. When the foreign investment and foreign currency are positively correlated, this is referred to as “right way risk” and the currency position will have to be rebalanced less frequently. Additionally, more volatile assets will require more frequent rebalancing because mismatches in the forward position occur more rapidly.

Managing currency risk using forwards also incurs rollover risk as the contracts have to be rolled periodically and the price can fluctuate between rebalancing periods. This risk could be mitigated by laddering exposure and avoiding maturity dates that coincide with large currency flows.

Foreign assets can present attractive opportunities to diversify by gaining exposure to different geographies. When investing abroad, investors should work with skilled managers to gain a better understanding of the nuances of currency risk and manage it in a way that aligns with their investment objectives.

This paper is intended for institutional investors only. The information in this paper is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this paper.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association. Registration as an investment adviser does not imply any level of skill or training.

Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives involves leverage and could lose more than the amount invested. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio.

Unless otherwise stated, all figures and estimates provided have been sourced internally and are as of March 31, 2020. Unless otherwise noted, all references to “$” are in U.S. dollars.

Nothing in this paper should (i) be construed to cause any of the operations under SLC Management to be an investment advice fiduciary under the U.S. Employee Retirement Income Security Act of 1974, as amended, the U.S. Internal Revenue Code of 1986, as amended, or similar law, (ii) be considered individualized investment advice to plan assets based on the particular needs of a plan or (iii) serve as a primary basis for investment decisions with respect to plan assets.

This document may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility.

Unless otherwise stated, all figures and estimates provided have been sourced internally and are current as at the date of the paper unless separately stated. All data is subject to change.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

© 2020, SLC Management