In a year already marked by tariff uncertainty, market volatility and macro-level changes, what’s next for the rest of 2025? In our newest podcast series, Checking In, Looking Ahead, our investment team provides insights and outlook on what’s to come.

Ten years past the global financial crisis: Lessons learned in fixed income

With the approaching anniversary of the global financial crisis, an important metric is being reset: the 10-year performance track record. Asset managers will, starting very soon, no longer have 2008 on their 10-year historical performance charts. With its disappearance, an elementary but key gauge of risk management will vanish as well.

Originally published in the U.S. publication P&I, August 20, 2018

The danger for plan sponsors is obvious: Latent risks may be unknowingly assumed into their portfolios. This is particularly acute for core fixed-income portfolios that are supposed to work as volatility dampeners and inverse-performance drivers during times of retrenchment in global equity markets.

Luckily, there is a simple measure — the information ratio ― that can provide clues to the assumption of these hidden risks and help identify core fixed-income managers who have historically delivered superior performance (both absolute and risk-adjusted) without over-allocating to credit risk, or who at least made the right relative-risk credit bets.

The information ratio is a manager’s excess return above a benchmark index divided by the tracking error (variation from the benchmark return). An information ratio above one is considered excellent over a full market cycle. The metric is used to measure and compare the risk-adjusted returns of active managers.

“It really shows a manager’s risk-adjusted value-add over the benchmark, and investors use that as an apples-to-apples comparison vs. other active managers,” said Chris Adair, Head of U.S. Business Development and Client Relationships, at SLC Management.

BETA DRIFT

During credit bull markets, excess returns are too often generated by fixed-income managers “swinging for the fences.” When this occurs, the reasons for having a primary fixed-income allocation ― stable income, decreased volatility, diversification and liquidity ― are jeopardized.

The concern is that through excess risk-taking, managers start to lose the objective of what the asset class is trying to accomplish, especially as the economy enters the late stages of an expansion.

“There is nothing wrong with managers taking active bets; at SLC Management we are proud of how we have achieved excess returns for 16 calendar years consecutively*,” Adair said. “What is important is that investors understand the risk/return relationship to achieve those excess returns. Our approach focuses on the relative value and relative volatility of the security, similar to a long/short pairs trade with the difference being the benchmark holds the short.”

With the purpose of a fixed-income allocation being primarily diversification, it is important that excess returns generated by a fixed-income portfolio do not introduce “beta drift” into the original asset allocation objective.

“We believe and have proved that investors can have top-tier excess returns without compromising the defensive tenets of the asset allocation,” Adair said. Unfortunately, many investors experienced beta drift during the 2008 financial crisis.

During the global financial crisis, which started with Lehman Brothers’ bankruptcy in September 2008, while many core fixed-income managers were able to keep their portfolios above water and in line with the Bloomberg Barclays U.S. Aggregate Bond index, others failed in this primary objective.

NOT ALL ALPHA IS CREATED EQUAL

Having a high information ratio does not mean avoiding risk. What it does mean is taking the right kinds of risk.

“We take specific risk-adjusted return opportunities in corporate and structured credit,” Adair said. “While these sometimes have higher risk at the security or even subsector level, we believe the risk is mispriced, and we size the trades appropriately so we’re not compromising total portfolio risk. It’s opportunistic risk-taking that targets fundamental or technical relative-value opportunities.”

While the primary function of a fixed-income benchmark is diversification, the primary function of a fixed-income portfolio manager is to have excellent risk-adjusted returns that are higher than the benchmark over longer terms (three-, five- and 10-year periods). Balance is critical - and only the top managers achieve it.

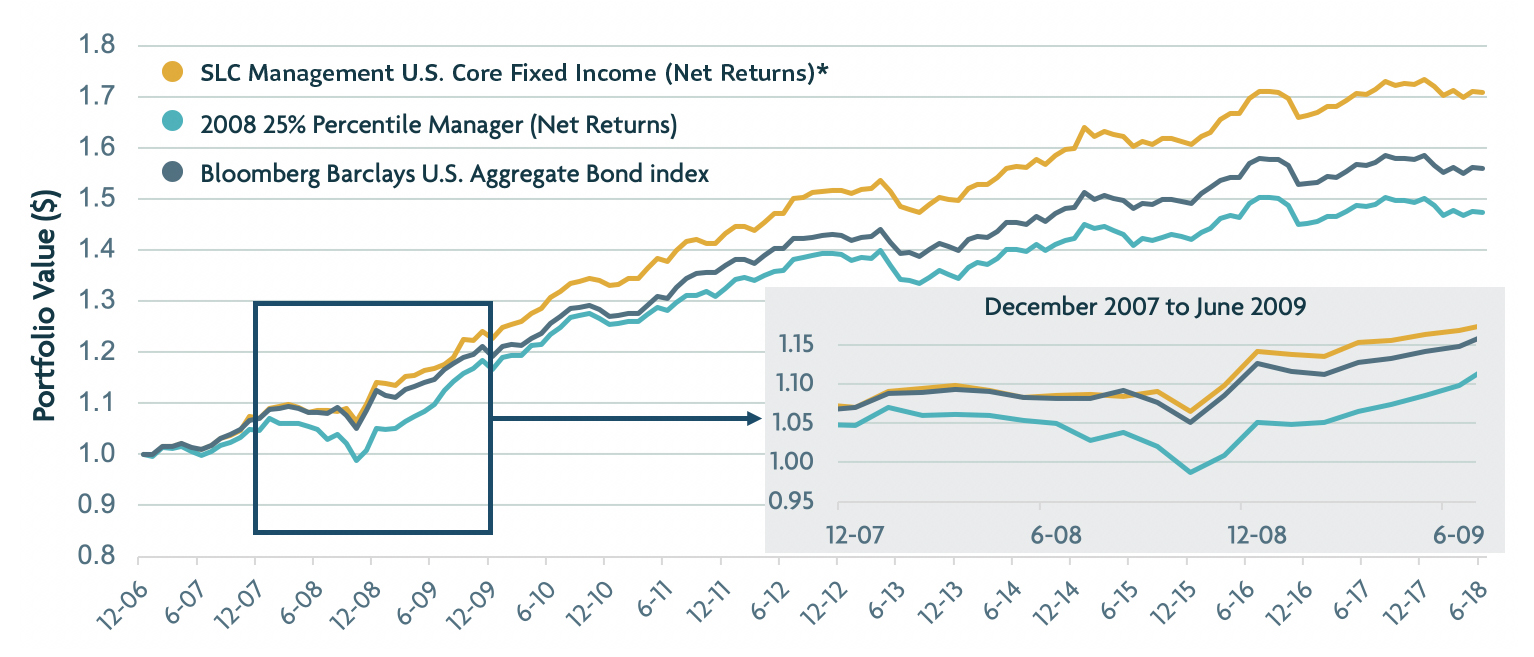

Growth of $1

December 2006 to June 2018

*SLC Management’s Core Fixed Income strategy (formally Ryan Labs Asset Management Inc.’s Core Fixed Income strategy) has achieved returns in excess of its benchmark, the Bloomberg Barclays U.S. Aggregate Bond index, for 16 consecutive years, on an annualized gross-of-fee basis, from Jan. 1, 2002 to Jan. 1 2018.

Source: PSN Enterprise

If a manager compromises risk management, they can end up with disastrous 2008-like results. But investing too conservatively can leave them trailing peers for years. It can also lead to below-benchmark returns because they didn’t spot opportunities from the long side, or they were too afraid of taking credit risk to recognize that a value opportunity was asymmetrically in their favor. High information ratios coinciding with strong excess returns help measure that balance.

BIGGEST LESSON

The key is to let fixed income fulfill its role when it matters most. That’s probably the biggest lesson learned from the global financial crisis, according to Adair.

Few analysts are predicting that the next downturn, when it does come, will be anywhere as severe as the 2008-2009 iteration. But for any plan allocator or asset owner, market corrections, even less traumatic ones, need to be hedged. When markets correct, both equities and higher credit-risk fixed-income values fall. This not only negatively impacts the portfolio’s value, it can reduce liquidity at a time when so many pension plans are facing increased liquidity needs due to the rising number of baby boomers retiring from the workforce.

“2008 was about as extreme an event as you can experience,” Adair said. “But even if ’08 was just an extreme aberration, you still get corrections.” Recent examples include the sovereign debt crisis in Europe or the so-called taper tantrum in 2013, when Treasury yields surged anew after the Fed announced it would begin scaling back its bond-purchase program. Brexit and the U.S. presidential election in 2016 also moved markets.

In each case, the first line of defense is this allocation to fixed income, according to Adair.

“Regardless of the magnitude, it plays a role, and there is a reason that asset allocation models allocate to fixed income in the first place. It is not because you are going to just get 4% to 5% returns during normal times,” he said. It is because during the specific time period when you have drawdowns, “you may get an uncorrelated positive return to the rest of your portfolio. That is the reason the allocation models gravitate to fixed income.”

There is no guarantee that these investment strategies will work under all market conditions. Each investor should evaluate its ability to invest long-term, especially during periods of downturn in the market. This material contains opinions and such opinions are subject to change. Past performance is not a guarantee of future results. Market participation presents the potential for loss as well as profit. Gross performance does not reflect payment of advisory fees and other expenses. The “2008 25% Percentile Manager (Net Returns)” line is a representation of Core Fixed Income managers that were within the 25% percentile of returns during the 2008-09 time period as reported to MercerInsight. The exhibit is for illustrative purposes only.

This sponsored investment insights was originally published by the P&I Content Solutions Group, a division of Pensions & Investments. The content was not written by the editors of the newspaper, Pensions & Investments, and does not represent the views of the publication, or its parent company, Crain Communications.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Prime Advisors, Inc. (“Prime”), Ryan Labs Asset Management Inc. (“Ryan Labs”), and Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Additionally, the SLC Management brand includes the investment division and General Account of Sun Life.

This document is not for retail use or distribution to individual investors. The information in this document is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this proposal.

All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility.

No part of this material may, without SLC Management s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

©2019, SLC Management