Credit markets reported considerable year-over-year deal activity, with investor demand a principal driver. Meanwhile, continued development, expansion and innovation in the asset-backed finance (ABF) space requires a renewed perspective into the possible benefits and risks of these investments.

Would a Biden presidency cause stock markets to stall? That’s what some investors expect as equities soared under the Republican president. However, through Biden’s infrastructure stimulus, healthcare expansion plans and new economic tilt, it could allow markets to power on, particularly as monetary policy remains accommodative.

Infrastructure And Healthcare In Focus

Biden’s $2 trillion infrastructure program is centered on applying clean energy technology to power generation, the building sector and transportation over four years.

His goal is to make U.S. infrastructure more durable by cutting dependence on fossil fuels. He emphasizes the jobs such changes would create, citing the potential to become a green technology leader.

Biden would also exhort the auto industry to step up its commitment to electric vehicles and help by funding research and development in areas such as electric transportation and 5G networks.

As compared to the Green New Deal espoused by Rep. Alexandria Ocasio-Cortez (D-NY), Biden’s infrastructure plan strikes a balance between moderate and progressive solutions. His ideas to expand healthcare in the U.S. similarly call for compromises between the two factions of the Democratic Party.

Biden champions a public option that allows anyone seeking coverage to buy a government plan. While he rejects the costly Medicare for All solution sought by his progressive peers, he supports expanding Medicare by lowering the eligibility age to 60.

Paying For It All

Despite leaning to the political center, Biden’s plans still come with hefty price tags. To foot the bill, he expects to raise corporate taxes, bump up personal taxes on high-end earners and increase borrowing.

Corporate leaders might already worry that a President Biden tax hike would significantly drag down earnings. But some offsets are expected.

Biden’s spending programs are intended to drive innovation and jobs in emerging technologies. His preference for international cooperation should stabilize trade relationships and give companies more visibility on planning and commitments.

For instance, if corporate taxes were increased from 21% to 28%, Goldman Sachs estimates earnings could drop by 12%. A less draconian increase to 25% would reduce earnings by 6%. However, trade tension and tariffs have been a key headwind for earnings. JPMorgan estimates that it could have clipped 7 to 8% off earnings last year.

One of the catalysts for President Trump’s corporate tax cuts was to encourage patience from U.S. companies as the administration amplified trade tension with friends and foes. But after years of increasing tariffs, the economic drag continues and little has improved in some key relationships.

A longtime coalition builder, Biden will opt for a multilateral approach with allies. Cooperation between the U.S. and Europe should make it harder for China to resist pressure to reset the trade relationship. While President Trump deserves credit for drawing attention to trade inequities, sustained progress is unlikely without the multilateral framework Biden is likely to bring.

Winners And Losers

While Biden’s economic policies could benefit a wide slate of sectors embracing greener practices and global partnerships, his party ideologies will take their toll on some industries that have benefited under the current administration.

The Democrat’s commitment to clean energy will create opportunities for the auto sector and transportation in general, as incentives encourage more electric vehicle output. The supporting technology will be boon to semiconductor manufacturers, electrical component suppliers, artificial intelligence applications and software developers.

As the U.S. gears up to reduce emissions, the oil and gas industry will feel the pinch. However, Biden has said he would not outlaw nuclear energy or fracking. He would instead explore technology to capture carbon output from fossil fuel plants while polluters pay a carbon tax.

Renewable energy should see a resurgence. Increase in wind and solar projects should create jobs and demand for machinery, construction and for engineering companies to build out the platforms.

Deescalation of trade tension would benefit exporters that depend heavily on overseas revenue and domestic importers that have significant offshore production. Auto companies, heavy machinery and healthcare equipment manufacturers are obvious beneficiaries.

The healthcare sector would expand as more Americans gain insurance. This trend would also benefit pharmaceuticals companies, although price scrutiny will increase.

The defense industry would lose out under Biden. While companies in the sector grew under President Trump, it’s much more likely to see leaner budgets under Democratic leadership.

Biden would champion an increase in the federal minimum wage. This idea is popular with two-thirds of Americans and research suggests that minimum wage bumps should increase consumption.

The most vulnerable sectors to a wage floor are retail, restaurants, hospitality and leisure. Some may offset with automation or price improvements, but those that can’t will see margins dip.

How Likely Is A Democratic Sweep?

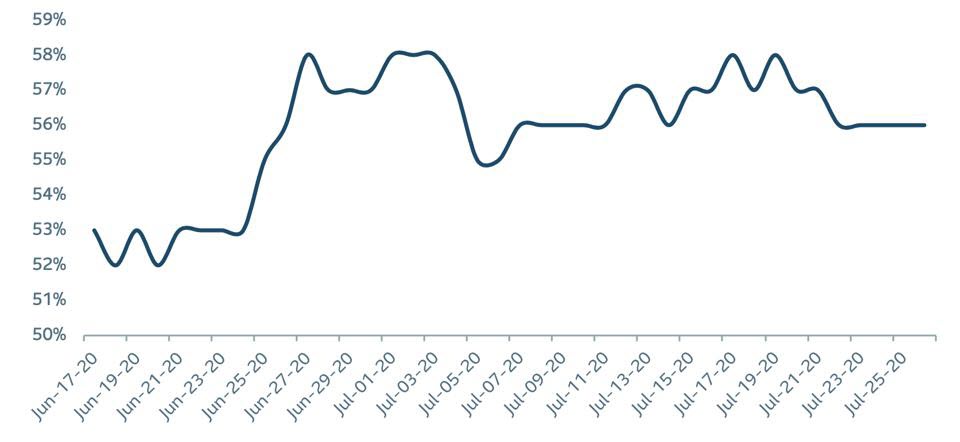

To deliver on all these promises, the Democrats would need to not only win the Presidency and hold the House, but would also need to take control of the Senate. That would require picking up three seats. Over the last month, Predictit, a prominent political betting platform, has assigned a 55-58% probability to a Democratic sweep.

Probability of Democratic Sweep

Source: Predictit, Victoria University of Wellington

Probability of a Democratic sweep SLC MANAGEMENT

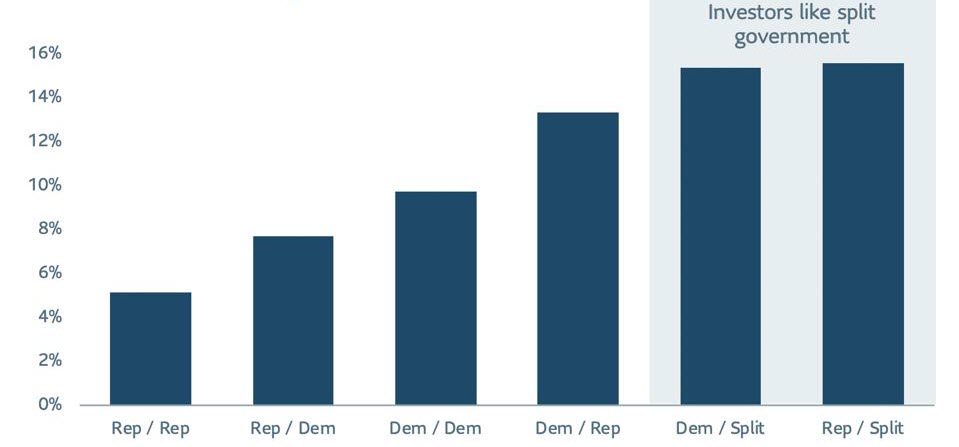

So far, markets seem unfazed by Biden’s popularity. It’s still early stages and a Biden Presidency may do little to disrupt the status quo if the Senate remains Republican. History suggests that markets like split government, primarily because it mutes political overreach.

S&P 500 returns since 1928 under different Presidential / Congressional control

Source: Bloomberg, SLC Management

S&P 500 returns since 1928 SLC MANAGEMENT

This material was first published in Forbes. This material contains opinions of the author, but not necessarily those of Sun Life or its subsidiaries and/or affiliates.

Related articles

About SLC Management

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate.

Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association.

BentallGreenOak, InfraRed Capital Partners (InfraRed), Crescent Capital Group (Crescent), and Advisors Asset Management are also part of SLC Management.

BentallGreenOak is a global real estate investment management advisor and a provider of real estate services. In the U.S., real estate mandates are offered by BentallGreenOak (U.S.) Limited Partnership, who is registered with the SEC as an investment adviser, or Sun Life Institutional Distributors (U.S.) LLC, an SEC registered broker-dealer and a member of the Financial Industry Regulatory Authority (“FINRA”) . In Canada, real estate mandates are offered by BentallGreenOak (Canada) Limited Partnership, BGO Capital (Canada) Inc. or Sun Life Capital Management (Canada) Inc. BGO Capital (Canada) Inc. is a Canadian registered portfolio manager and exempt market dealer and is registered as an investment fund manager in British Columbia, Ontario and Quebec.

InfraRed Capital Partners is an international investment manager focused on infrastructure. Operating worldwide, InfraRed manages equity capital in multiple private and listed funds, primarily for institutional investors across the globe. InfraRed Capital Partners Ltd. is authorized and regulated in the UK by the Financial Conduct Authority.

Crescent Capital Group is a global alternative credit investment asset manager registered with the U.S. Securities and Exchange Commission as an investment adviser. Crescent provides private credit financing (including senior, unitranche and junior debt) to middle-market companies in the U.S. and Europe, and invests in high-yield bonds and broadly syndicated loans.

Securities will only be offered and sold in compliance with applicable securities laws.

AAM is an independent U.S. retail distribution firm that provides a range of solutions and products to financial advisors at wirehouses, registered investment advisors and independent broker-dealers.

Website content

The content of this website is intended for institutional investors only. It is not for retail use or distribution to individual investors. All investments involve risk including the possible loss of capital. All asset classes have associated risks. Certain asset classes are speculative, can include a high degree of risk and are suitable only for long-term investment. Further information available upon request. This website is for informational and educational purposes only. Past performance is not a guarantee of future results.

The information contained in this website is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained on this website. The assets under management (AUM) represent the combined AUM of Sun Life Capital Management (Canada) Inc., Sun Life Capital Management (U.S) LLC, BentallGreenOak, Crescent Capital Group, InfraRed Capital Partners, and Advisors Asset Management.

AUM as of March 31, 2025. Total firm AUM includes approximately $8B in cash, other, unfunded commitments, and Advisors Asset Management equity. Total firm AUM excludes $11 billion in assets under administration by AAM.

Currency conversion rate: USD $1.00 CAD $1.4387 as of March 31, 2025.

SLC Management Newsroom: SLC-20221101-2566004

UK Tax Strategy - InfraRed (UK) Holdco 2020 Limited

InfraRed (UK) Holdco 2020 Ltd is the UK holding company of InfraRed Partners LLP and a subsidiary of Sun Life (U.S.) Holdco 2020 Inc, which has its headquarters in the U.S. The company was incorporated to purchase InfraRed Partners LLP and acts solely as a passive holding company. The Tax Strategy for the InfraRed Holdco Group sets out our approach to the management of InfraRed Holdco Group UK tax affairs in supporting business activities in the UK.

This UK tax strategy is published in accordance with the requirements set out in Schedule 19 of Finance Act 2016. The strategy, which has been approved by the Board of Directors of InfraRed (UK) Holdco 2020 Ltd, is effective for the period ending 31 December 2024. It applies to InfraRed (UK) Holdco 2020 Ltd and its dormant subsidiary Sun Life (UK) Designated Member Ltd, referred to as the “InfraRed Holdco Group”. InfraRed Holdco Group.