In a year already marked by tariff uncertainty, market volatility and macro-level changes, what’s next for the rest of 2025? In our newest podcast series, Checking In, Looking Ahead, our investment team provides insights and outlook on what’s to come.

Attractive capital efficient yields have made investment grade private credit (IGPC) a staple of insurance balance sheets. Recently, with interest rates hitting near all-time lows, this trend has accelerated. Insurers continue to seek ways to mitigate portfolio yield erosion with a limited capital budget, as they are unable to take significant investment risk without facing regulatory and rating scrutiny. IGPC has been a major investment theme for U.S. insurers of all types, as it offers additional yield, diversification and – in most capital models – risk charges similar to that of a public corporate bond.

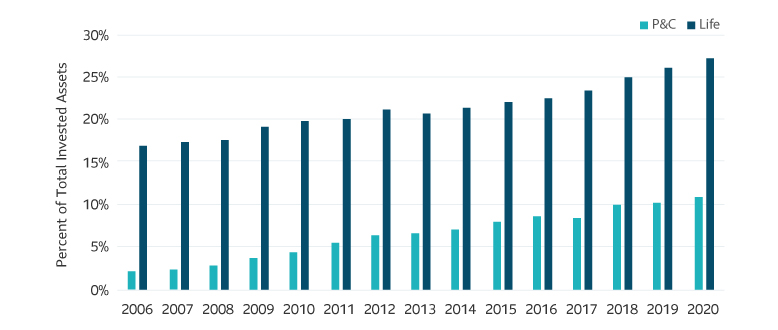

Private Fixed as (%) of Invested Assets

Sources: NAIC Stat filings as of 12/31/2020; S&P Global Intelligence as of 12/31/2020

Why investment grade private credit?

Investment grade private credit refers to loans and debt securities issued by companies or entities outside of the public capital markets. Investors are primarily institutions such as insurance companies and pension funds that invest in the asset class for several reasons:

High quality: IGPC instruments are similar to investment grade public debt in quality and have a more favorable structure. They typically have durations that range from five to 30 years, often include collateral and financial covenants and are available across the rating spectrum. Typically, both default and recovery experience is more favorable with IGPC compared to the equivalent rated public bond. This is due to the additional covenants and collateral associated with the assets.

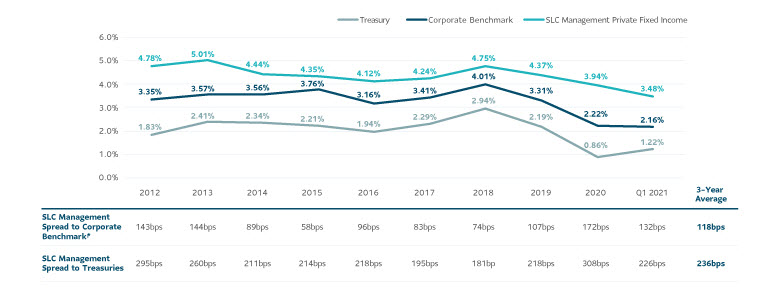

Enhanced yields: Investors are paid a spread premium over comparable public bonds because these transactions are more customized and less liquid. A typical spread premium for a broadly syndicated private transaction would be in the 15-30bps range. At SLC Management, we focus on maintaining a spread premium above 70bps through a highly selective approach to portfolio construction.

Historical Coupon Value

Please see important disclosures at the end of this page.

Diversification: IGPC provides access to high-quality issuers that are not always available in public markets. Annual issuance in the investment grade private credit market is $70 to $100 billion per year and growing, with the U.S. representing about 60% of annual volume1. The issuer base includes public and private corporate issuers and spans major sectors (e.g. industrials, utilities and financials).

Capital efficiency: Given the widespread use of IGPC, insurance regulators and rating agencies are familiar with the asset class and view many of its characteristics as comparable to public bonds. This can provide an efficient way for insurers to access attractive spreads without taking on additional credit risk or less favorable capital charges.

How do insurers access investment grade private credit?

Most insurers are only able to access the asset class via separately managed accounts or fund vehicles. This decision is often dependent on balance sheet size as well as the insurer’s investment objectives. Key considerations for deciding between a separately managed account or fund approach typically include:

- Minimum commitments: Many separate account strategies will require a minimum account size in order to achieve a fully diversified portfolio of private credit names. These account minimums can sometimes be prohibitive to insurers with smaller balance sheets or those looking to take on a smaller exposure to the asset class.

- Liquidity needs: In order to maintain liquidity within an IGPC portfolio, individual holdings may be sized in $3 - $5 million dollar blocks, allowing them to be traded more easily in secondary markets. These large individual security sizes may limit the appeal of separate accounts for certain investors, as large line items may be prohibited in investment policy statement and guidelines. In contrast, fund vehicles provide investors with liquidity via a redemption process.

- Operational requirements: Reporting and pricing complexities for traditional private credit mandates may conflict with NAIC or SVO reporting, particularly if the private credit manager is not familiar with the unique requirements insurers face. Implementation of private credit mandates can often be complex, as cash is called to fund new issuance. Insurers can create a “drag” on performance holding cash or expose themselves to forced liquidation during times of market stress. Additionally, investors are lenders of record in SMAs, which adds additional operational considerations versus a fund.

Benefits of fund vehicles

A fund offers investors access to IGPC without some of the potential challenges associated with separately managed accounts discussed above. A fund approach can also provide a cost efficient way for insurers to access the asset class, especially for smaller allocations, while gaining exposure to a broader diversified pool of underlying credits.

However, a fund vehicle may carry less favorable capital and accounting treatment. To minimize these risks, it is critical for insurers to partner with an asset manager that has experience working with insurers. For example, the investment committee should ensure that the fund has undergone the due diligence to register and file the fund with the Securities Valuation Office (SVO) to be rated, which can help alleviate capital concerns. For insurers subject to rating agencies, investors should ask managers if they can provide “look through” on the fund. This will allow them to potentially reassign risk charges to the underlying credits (lower risk charges) rather than the fund structure (higher risk charges).

IGPC offers many benefits to insurance portfolios, and a fund vehicle can help insurers of all sizes access the asset class. With $57B of private credit assets under management - of which $36B is investment grade - SLC Management offers a broad range of solutions targeting yield-enhancing and capital efficient strategies designed to work for insurance company portfolios.

1 Calculated internally based on external market data sourced from Private Placement Monitor and Bank of America Securities Private Placement Snapshot.

Investment grade credit ratings of our private placements portfolio are based on a proprietary, internal credit rating methodology that was developed using both externally-purchased and internally developed models. This methodology is reviewed regularly. More details can be shared upon request. Although most U.S. dollar private placement investments have an external rating, for unrated deals, there is no guarantee that the same rating(s) would be assigned to portfolio asset(s) if they were independently rated by a major credit ratings organization.

The information in this paper is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this paper.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association.

Registration as an investment adviser does not imply any level of skill or training. There is no assurance that the objective of any private placement strategy can be achieved. As with any strategy, the Advisor’s judgments about the relative value of securities selected for the portfolio can prove to be wrong.

The relative value over public benchmarks estimate is derived by comparing each loan’s spread at funding with a corresponding public corporate bond benchmark based on credit rating. Loans that are internally rated as “AA” are compared to the Bloomberg Barclays U.S. Corporate Aa Index, loans rated “A” are compared to the Bloomberg Barclays U.S. Corporate A Index, while loans rated “BBB” are compared to the Bloomberg Barclays U.S. Corporate Baa Index. For certain power and utility project loans, a best fit approach of a variety of Bloomberg Barclays’ indices was employed prior to September 30, 2016. After this date, these types of loans were compared to Bloomberg Barclays Utilities A Index and Bloomberg Barclays Utilities Baa Index, for “A” and “BBB” internally rated loans, respectively. Relative spread values obtained through the above methodologies were then aggregated and asset-weighted (by year) to obtain the overall spread value indicated in the paper.

Unless otherwise stated, all figures and estimates provided have been sourced internally and are as of December 31, 2020. Unless otherwise noted, all references to “$” are in U.S. dollars.

This document may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility. Unless otherwise stated, all figures and estimates provided have been sourced internally and are current as at the date of the paper unless separately stated. All data is subject to change.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

© 2021, SLC Management

SLC-20221024-2461734