Q2 2024: Investment Grade Private Credit update

With investors increasingly looking into the potential benefits of NAV lending, SLC Management takes a closer look at this asset class.

Market statistics for the private placement market sourced from Private Placement Monitor, a standard proxy for the investment grade (IG) private credit market.

Big deals were in vogue in the second quarter as billion-dollar transactions helped the IG private credit market achieve record quarterly volumes. While 2024 as a whole is poised to be a robust year, the momentum of the first half might not continue over the next six months, however. Meanwhile, IG private credit investors are increasingly looking at net asset value (NAV) lending as a potential source of risk-managed, diversified portfolio returns.

Market

The second quarter of 2024 set a new record for private placement deal volume, driven by several substantial transactions completed in June. Second quarter 2024 volume was reported at US$47 billion, a record high for a standalone quarter. This quarter featured eight deals over US$1 billion in size, including a landmark US$10 billion issuance in the industrial/chip-manufacturing sector. Overall, volume in the first half of 2024 was at US$70.2 billion, which significantly outpaced the US$47.6 billion in the first half of the previous year, reflecting robust market activity. Large deals from the industrial sector were a primary contributor to second quarter volume, in addition to growing utility issuances during the first half of the year. We expect this momentum to continue into the third quarter of 2024, albeit at a more modest pace, and 2024 appears poised to be another record-setting year for deal volume, the last being 2022.

Common themes of oversubscription and price tightening in the first quarter persisted into the second as investor demand remained strong from both longtime insurance company players and new market entrants. Transactions were frequently more than three times oversubscribed, with price tightening by 5–10 basis points from initial guidance. We have seen the private market balance this strong appetite with continued credit discipline, as evidenced by improved deal terms post-launch that are based on investor feedback. While investment grade private credit spreads have narrowed year-to-date toward historic premiums to public markets, overall spread levels remained relatively stable over the quarter.

Outlook

Looking ahead to the second half of 2024, we anticipate continued opportunities in the third quarter with a slowdown expected in the last quarter of 2024. Market participants evidently want to avoid potential volatility surrounding the upcoming U.S. elections. We maintain a disciplined approach with our bidding strategies and remain focused on strong relative value opportunities.

In focus: The growth of NAV lending within fund finance

In last quarter’s IG private credit update, we discussed fund finance, which is increasingly used by asset managers as a financing tool, as well as by IG private credit investors seeking portfolio diversification, enhanced returns and management of certain risks. However, there is a particular subset of fund finance that merits a closer look: net asset value (NAV) lending. As investors may encounter NAV lending more frequently in the private credit space, it might be useful to examine the potential benefits, common structures and risks of these investments.

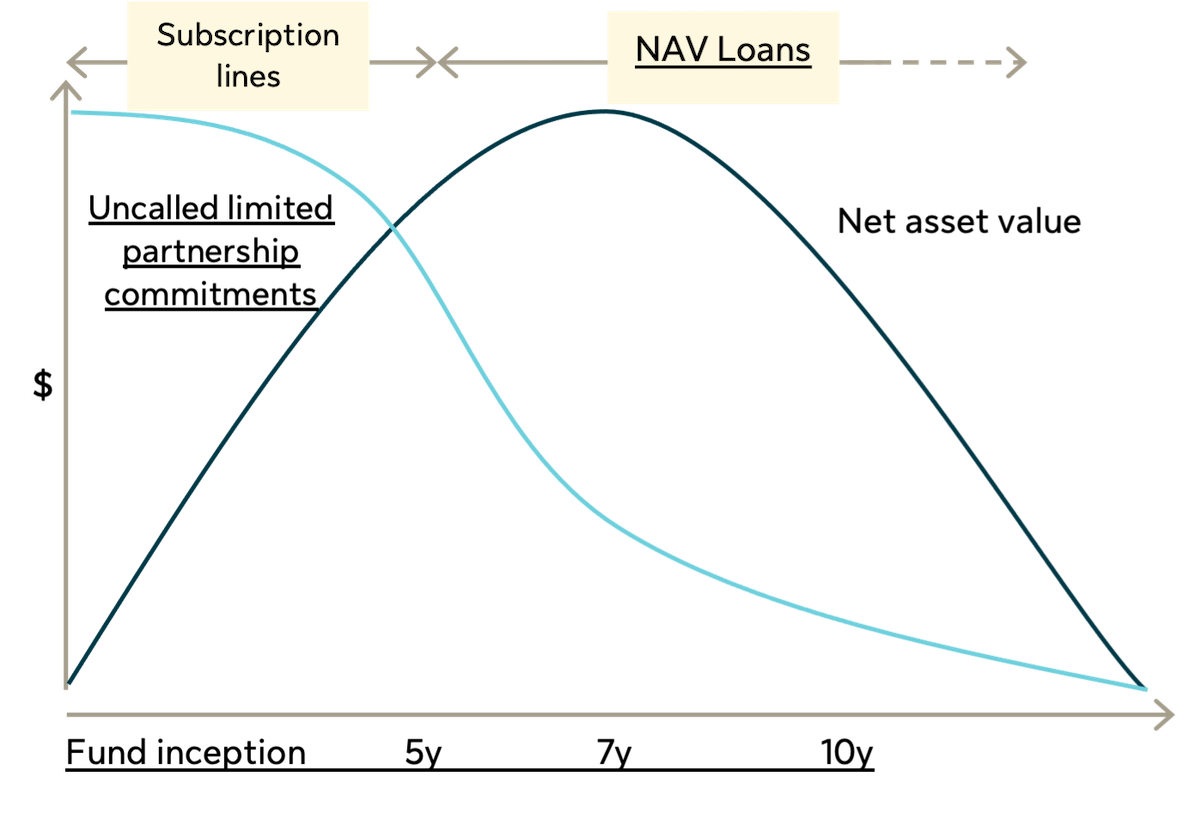

NAV loans are primarily used by private asset managers seeking to optimize liquidity and returns; the facilities are typically secured by the cash flows and value of the underlying assets in a fund. As such, NAV loans are generally utilized by funds at a later stage of their life when sufficient NAV has accumulated in the fund to pledge to lenders, as illustrated in the following diagram.

IG private credit investors as lenders are repaid from proceeds from the sale and/or realization of the underlying investments in the fund. As a type of fund finance, NAV lending offers IG private credit investors the same types of potential benefits as the broader asset class, which include the following:

- Credit support – Management of certain risk exposures through multiple layers of collateralization.

- Diversification – Exposure to different sources of cash flows through private equity fund collateral.

- Covenant protections – Lenders can have priority over cash flows through covenants based on loan-to-value (LTV) and cash flow sweeps.

- Complexity premium – NAV loan investing requires specialized expertise, limiting the investment universe and generating enhanced potential returns accordingly.

The structure of NAV lending itself can also lead to additional distinctive features:

- Increased downside protection – From conservative loan-to-value ratios and cash sweep mechanisms that can provide credit enhancement and accelerated paydown.

- Increased diversification – Concentration limitations and eligibility criteria that help ensure underlying assets that are diversified and of high quality.

Specific growth drivers of NAV lending

Last quarter we discussed how fund finance has grown in parallel with the growth of privately managed capital. As part of the fund finance universe, NAV lending benefits from this growth driver as well, but there are other factors specific to this asset class that also act as catalysts.

In particular, three factors present in today’s markets are creating a significant need for liquidity that NAV facilities, with their ability to be tailored to the needs of specific general and limited partners, are positioned to fulfill:

- The higher cost of operating company loans incentivizing a search for other sources of financing.

- A challenging merger-and-acquisition environment – leading to general partners holding on to assets for longer.

- Limited partners seeking distributions and recalibrating portfolios to achieve asset allocation policy targets between private and public holdings.

Although some growth drivers for NAV lending are unique to current market conditions and may fade, in our view secular motivations (e.g., more efficient capital deployment, return enhancement, accretive financing for incremental investments) for utilizing NAV loans and other fund finance facilities should continue to propel these strategies.

Risks, challenges and other considerations

It is important to note that as NAV lending is a subset of fund finance, investors can encounter the same risks and challenges, on top of the potential benefits, that are typically present in the asset class. As detailed in our discussion last quarter, such notable risks include:

- Breadth – The wide variance in deal characteristics and nascent nature of NAV lending and other strategies can complicate the calibration of relative risk and return.

- Required expertise – The benefits of complexity premiums bring with them the need for a deep understanding of IG and below IG credit markets, as well as legal and financial structuring considerations.

- Transparency and governance – While overcollateralization is a critical component to fund finance, the characteristic illiquidity of underlying assets can make valuations more difficult.

Furthermore, some caution should be exercised with respect to the ratings of NAV loans in particular. While the prevalence of these deals has resulted in them being increasingly rated, the asset class itself has a short default history from which future default rates can be inferred. Therefore, investors should be aware of the risk of that a rated NAV lending facility could be downgraded just as any other debt investment could be.

As one of the fastest growing segments of the fund finance universe, NAV loans offer IG private credit investors considerable opportunities for enhanced returns, risk management and diversification. With investors likely to encounter NAV lending, and fund finance in general, more frequently in the institutional market, it will become increasingly critical to know the opportunities and challenges inherent to the asset class, and the importance of manager expertise in deploying these strategies in an investment portfolio.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association.

Unless otherwise stated, all figures and estimates provided have been sourced internally and are as of June 30, 2024. Unless otherwise noted, all references to “$” are in U.S. dollars. Past performance is not indicative of future results.

Nothing herein constitutes an offer to sell or the solicitation of an offer to buy securities. The information in these materials is provided solely as reference material with respect to the Firm, its people and advisory services business, as an asset management company.

Market data and information included herein is based on various published and unpublished sources considered to be reliable but has not been independently verified and there is no guarantee of its accuracy or completeness.

This content may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility. Unless otherwise stated, all figures and estimates provided have been sourced internally and are current as at the date of the paper unless separately stated. All data is subject to change.

This information is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this paper. An investor may not invest directly in an index.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

This material is intended for institutional investors only. It is not for retail use or distribution to individual investors. Nothing in this presentation should (i) be construed to cause any of the operations under SLC Management to be an investment advice fiduciary under the U.S. Employee Retirement Income Security Act of 1974, as amended, the U.S. Internal Revenue Code of 1986, as amended, or similar law, (ii) be considered individualized investment advice to plan assets based on the particular needs of a plan or (iii) serve as a primary basis for investment decisions with respect to plan assets.

Sun Life Capital Management (U.S.) LLC. also referred to as "SLC Fixed Income,” offers pooled funds, separately managed accounts and other investment advisory services with the support of the investment operations of SLC Management.

Data presented in this article have been calculated internally based on external market data sourced from Private Placement Monitor.

Investment-grade credit ratings of our private placements portfolio assets are based on a proprietary, internal credit rating methodology that was developed using both externally purchased and internally developed models. This methodology is reviewed regularly. More details can be shared upon request. There is no guarantee that the same rating(s) would be assigned to portfolio asset(s) if they were independently rated by a major credit ratings organization.

Investments involve risk, including loss of principal. Diversification does not guarantee against loss or ensure a profit. Nothing herein constitutes an offer to sell or the solicitation of an offer to buy securities. The information in these materials is provided solely as reference material with respect to the Firm, its people and advisory services business, as an asset management company.

© 2024, SLC Management

SLC-20240802-3761739