In a year already marked by tariff uncertainty, market volatility and macro-level changes, what’s next for the rest of 2025? In our newest podcast series, Checking In, Looking Ahead, our investment team provides insights and outlook on what’s to come.

Recent proposals from the Securities Valuation Office (SVO) aim to bring additional scrutiny to the ratings of private credit securities. The private credit market encompasses a diverse range of structures and issuers, and the current early-stage proposals lack some of the nuance to differentiate between them. While implementation of any new regulation is still someway off, we don’t believe the proposals will end up impacting traditional private placements. However, insurers should be aware of the signaled change in approach from the SVO and any potential impact to their investment strategies.

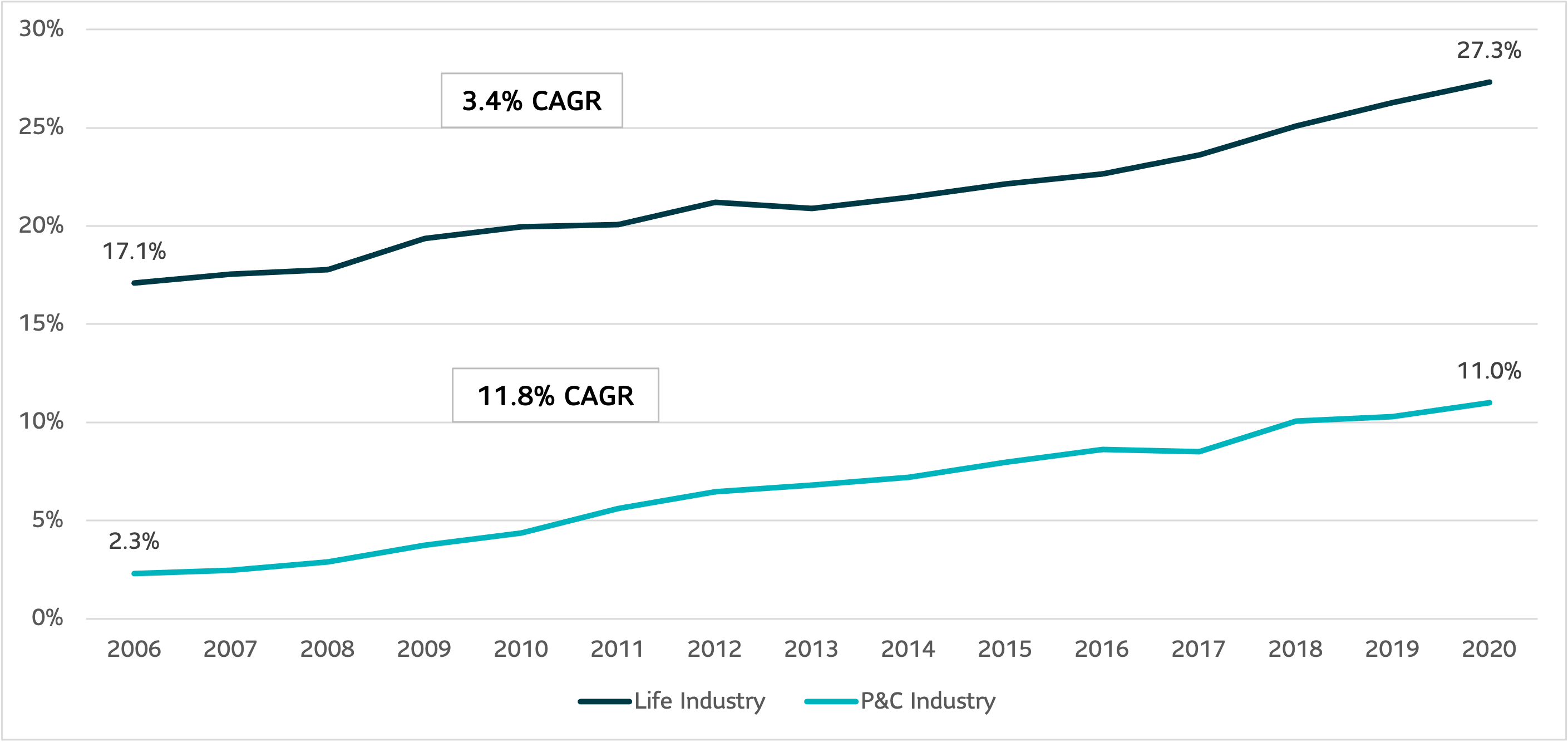

Private credit has increased in popularity among insurers – A period of unprecedented fiscal and monetary policy has increasingly forced insurance portfolios away from the norm of public investment grade fixed income. Insurers have taken advantage of strong balance sheets and are harvesting the illiquidity premium by allocating to various forms of private credit. These investments range from traditional investment grade private placement debt – the bonds of private, creditworthy, large to mid-sized corporations – to more complex rated notes.

Growth of Private Bonds in Insurance Company Portfolios

Source: S&P Market Intelligence

Private credit, specifically investment grade private placements, are not new to the insurance market – Life insurers have been investing in this asset class for decades because it is high-quality and provides favorable covenants. In addition, private placements have historically experienced a low default rate and have generated excess spread over comparable public bonds.1

Over the past decade, there have been an increasing number of different structures and investment types that fall under the label of private credit – Many of these structures are getting more scrutiny from regulators. This dynamic has resulted in traditional private placements getting lumped into the same broad bucket as much more complex and risky strategies, which we believe could lead to unintended consequences for the private credit market.

“Capital arbitrage” investment strategies through rated notes have become more common in insurance portfolios – The general premise of this practice is structuring fixed income securities so that they achieve an investment grade rating with a nationally recognized statistical rating organization (NRSRO), even though the underlying collateral may be below investment grade. This essentially creates a mismatch between the bondholder’s true investment risk and its regulatory capital position.

The regulatory environment is still adapting to meet these changes – Recognizing the growth in this area, the Investment Analysis Office (IAO) of the NAIC has proposed further scrutiny to the Filings Exemption methodology, or the current process insurers use to assign NAIC ratings to private securities for capital modeling, such as Risk Based Capital. The proposal centers around an analysis the SVO finalized in 2021 that highlighted disparities between NRSRO and SVO ratings of the same security. This was particularly noticeable in instances where the SVO rated certain securities significantly lower than currently available NRSRO ratings.

As a result of this identified mismatch, the SVO recently released several proposals – It is important to note that these proposals are still early in their adoption period and the outcome and timeframe for potential implementation is uncertain. As they currently stand, there are three main tenets of the IAO proposal relating to private credit ratings for review:

- Require multiple ratings, and accept the lowest of all ratings

- Implement an annual approval process for current NRSROs and accept ratings only from those on the approved list

- Force rating agencies to issue additional rating methodology on a security level basis, such as a credit note, for further scrutiny by the SVO

The SLC Management View

It is still unclear which, if any, of the proposals the NAIC will adopt. With the current language, any new regulation would likely apply to all forms of private credit, lumping rated notes in with traditional private placements. This appears to be an unintended consequence relative to the way the current proposals are written. In any case, with these proposals on the horizon, it is a good reminder for insurers to be aware of how their portfolio is managed. It is important for companies to ensure that their private credit holdings are externally rated by an appropriate agency and that they adhere to the spirit of the SVO rules to avoid any negative implications should any of the above proposals be adopted.

SLC Management has a strong track record of sourcing and managing investment grade private credit for over 40 years, currently overseeing more than $44.6 million in private debt for insurance company clients. By leveraging the expertise of an experienced team with 59 dedicated investment professionals, we have generated 85 basis points of relative value over comparable public bonds over the past 6 years.2 Our investment process emphasizes portfolio monitoring and due diligence, which is reflected in a 0.20% historical default rate and a .05% loss rate, which compares favorably to comparable public bonds of .19%. At SLC, an important aspect of the credit research process is examining external ratings by credit rating providers approved by the SVO. In 2020, SLC underwrote 74 private credits, 75% of which were externally rated.

If the NAIC adopts any of the proposals listed above, we believe it likely won’t be for another 2-3 years, which should alleviate many of the short-term concerns for insurers. Moreover, we do not expect the additional rating scrutiny to impact traditional investment grade private placement holdings. At SLC Management, we look forward to providing you with additional insights as the review process unfolds.

Agency |

Count |

% |

S&P |

21 |

28.4% |

Fitch |

19 |

25.7% |

DBRS |

17 |

23.0% |

Moody’s |

16 |

21.6% |

Kroll |

15 |

20.3% |

Egan-Jones |

2 |

2.7% |

AM Best |

1 |

1.4% |

Unrated |

19 |

25.7% |

Total unique credits: 74

*Note: doesn’t add to 100% because several deals have multiple ratings

2 Investment grade credit ratings of our private placements portfolio are based on a proprietary, internal credit rating methodology that was developed using both externally-purchased and internally developed models. This methodology is reviewed regularly. More details can be shared upon request. Although most U.S. dollar private placement investments have an external rating, for unrated deals, there is no guarantee that the same rating(s) would be assigned to portfolio asset(s) if they were independently rated by a major credit ratings organization.

The relative value over public benchmarks estimate is derived by comparing each loan’s spread at funding with a corresponding public corporate bond benchmark based on credit rating. Loans that are internally rated as “AA” are compared to the Bloomberg Barclays U.S. Corporate Aa Index, loans rated “A” are compared to the Bloomberg Barclays U.S. Corporate A Index, while loans rated “BBB” are compared to the Bloomberg Barclays U.S. Corporate Baa Index. For certain power and utility project loans, a best fit approach of a variety of Bloomberg Barclays’ indices was employed prior to September 30, 2016. After this date, these types of loans were compared to Bloomberg Barclays Utilities A Index and Bloomberg Barclays Utilities Baa Index, for “A” and “BBB” internally rated loans, respectively. Relative spread values obtained through the above methodologies were then aggregated and asset-weighted (by year) to obtain the overall spread value indicated in the paper.

Disclosure

The information in this paper is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this paper.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association.

Registration as an investment adviser does not imply any level of skill or training. There is no assurance that the objective of any private placement strategy can be achieved. As with any strategy, the Advisor’s judgments about the relative value of securities selected for the portfolio can prove to be wrong.

Investment grade credit ratings of our private placements portfolio are based on a proprietary, internal credit rating methodology that was developed using both externally-purchased and internally developed models. This methodology is reviewed regularly. More details can be shared upon request. Although most U.S. dollar private placement investments have an external rating, for unrated deals, there is no guarantee that the same rating(s) would be assigned to portfolio asset(s) if they were independently rated by a major credit ratings organization.

The relative value over public benchmarks estimate is derived by comparing each loan’s spread at funding with a corresponding public corporate bond benchmark based on credit rating. Loans that are internally rated as “AA” are compared to the Bloomberg Barclays U.S. Corporate Aa Index, loans rated “A” are compared to the Bloomberg Barclays U.S. Corporate A Index, while loans rated “BBB” are compared to the Bloomberg Barclays U.S. Corporate Baa Index. For certain power and utility project loans, a best fit approach of a variety of Bloomberg Barclays’ indices was employed prior to September 30, 2016. After this date, these types of loans were compared to Bloomberg Barclays Utilities A Index and Bloomberg Barclays Utilities Baa Index, for “A” and “BBB” internally rated loans, respectively. Relative spread values obtained through the above methodologies were then aggregated and asset-weighted (by year) to obtain the overall spread value indicated in the paper.

Unless otherwise stated, all figures and estimates provided have been sourced internally and are as of December 31, 2021. Unless otherwise noted, all references to “$” are in U.S. dollars.

Past performance is not indicative of future results.

This document may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility. Unless otherwise stated, all figures and estimates provided have been sourced internally and are current as at the date of the paper unless separately stated. All data is subject to change.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

© 2022, SLC Management

SLC-20221101-2462413