As a non-sovereign currency, Bitcoin’s value depends on its independence and scarcity. But it is also pitched as an alternative to conventional currencies in case of government mismanagement. Gold has traditionally been viewed as a safe haven against monetary disruptions. Now amidst growing interest, investors wonder if Bitcoin could become a contender.

Enthusiasm Is Expanding

Since its first debut at around $0.06 over a decade ago, Bitcoin now trades above $35,000. While it has been a meteoric rise, it has also been a bumpy ride. Retail investors, for the most part, seem unperturbed by the volatility.

In a 2019 report, Charles Schwab analyzed the top 10 equity holdings across its investor base. Across generations, Millennials had been the most enthusiastic investors. They have close to 2% of their equity holdings in Bitcoin, while Gen X and Baby Boomers seem to ignore it.

Top 10 equity holdings across generations

| MILLENIALS | GEN X | BABY BOOMERS | |||

|---|---|---|---|---|---|

| AMAZON.COM INC | 7.87% | APPLE INC | 10.52% | APPLE INC | 9.19% |

| APPLE INC | 6.18% | AMAZON.COM INC | 7.16% | AMAZON.COM INC | 5.32% |

| TESLA INC | 3.22% | BERKSHIRE HATHAWAY | 2.37% | BERKSHIRE HATHAWAY | 2.75% |

| FACEBOOK INC | 3.03% | FACEBOOK INC | 2.26% | MICROSOFT CORP | 2.69% |

| GRAYSCALE BITCOIN TRUST | 1.84% | MICROSOFT CORP | 2.16% | FACEBOOK INC | 1.43% |

| BERKSHIRE HATHAWAY | 1.73% | TESLA | 1.45% | VISA INC | 1.25% |

| WALT DISNEY CO | 1.68% | ALPHABET INC. | 1.30% | ALPHABET INC. | 1.23% |

| NETFLIX INC | 1.58% | NETFLIX | 1.29% | AT&T INC | 1.17% |

| MICROSOFT CORP | 1.53% | ALIBABA GROUP HOLDING | 1.23% | BOEING | 1.08% |

| ALIBABA GROUP HOLDING | 1.39% | VISA INC | 1.23% | ALIBABA GROUP HOLDING | 0.98% |

Source: Charles Schwab, Self Directed Brokerage Account Indicators, Q3 2019

Of late, a growing number of institutional investors are showing interest. Some see its potential as an alternative to other safe havens like gold, or as a hedge against inflation.

Larry Fink, head of Blackrock, in a recent interview noted that “People are fascinated about it. It could be another store of wealth. But right now, it’s still untested. It has huge volatility.”

These comments encapsulate the broader institutional perspective. Over the last decade, Bitcoin has shown resilience. However it is still in the early stage of price discovery, as there is still no general agreement on what fundamental factors drive its value. That leaves it to momentum trading and sudden shifts in sentiment to dictate price, which has made it look more like a speculative novelty.

Bitcoin As An Institutional Asset Class

Bitcoin has similarities to gold. It was initially conceived as insurance against the risk of any nation recklessly printing money and stoking inflation. Neither asset pays income, leaving appreciation as the only return. Both are scarce and need to be mined, which gets harder and more expensive over time.

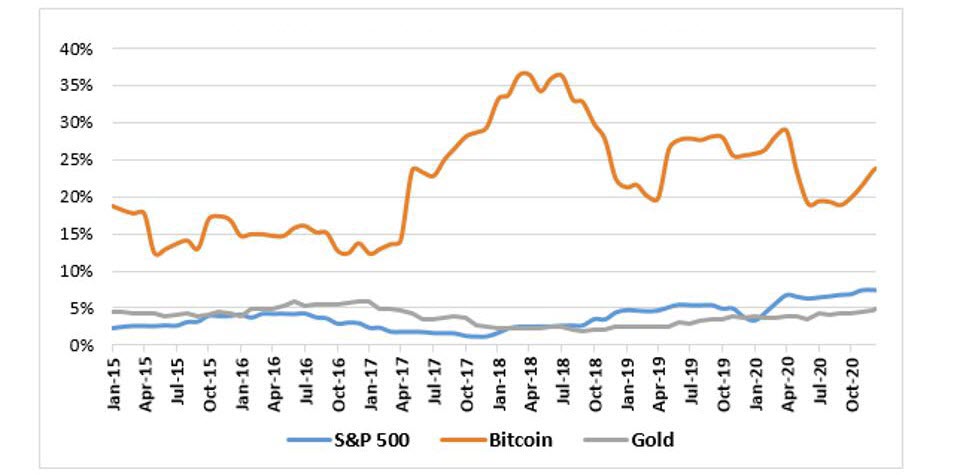

Irrespective of its conceptual similarities to gold, Bitcoin is considerably more volatile. Its rolling monthly volatility over the last five years has dropped from its early years, but it is still a multiple of the risk of either gold or the S&P 500.

Rolling 12 Month Volatility

Source: Bloomberg based on last five years

Over this same period, Bitcoin’s correlation with other asset classes remained close to 0. This suggests a high degree of independence, which can be appealing in a diversified portfolio. But it also implies that the risk factors that drive Bitcoin are fairly idiosyncratic. So far, it hasn’t shown a sustained connection with a safe haven like gold or a risky asset like the S&P 500. It also shows little sensitivity to moves in the dollar or changes in interest rates.

Generally, institutional investors want to understand the core factors that drive asset risk and return. Much of that comes from understanding correlation with other assets. In that context, Bitcoin is still a puzzle, as its trading volatility overwhelms any evidence of its long run economic drivers.

Correction between Asset Classes

Asset |

Bitcoin |

GOLD |

S&P 500 |

U.S. Dollar |

10 Yr Treas |

Corp Bonds |

|---|---|---|---|---|---|---|

Bitcoin |

1.000 |

0.093 |

0.079 |

0.062 |

(0.080) |

0.062 |

GOLD |

0.093 |

1.000 |

(0.002) |

(0.381) |

0.504 |

0.475 |

S&P 500 |

0.079 |

(0.002) |

1.000 |

(0.277) |

(0.391) |

0.427 |

U.S. Dollar |

0.062 |

(0.381) |

(0.277) |

1.000 |

0.087 |

(0.181) |

10 Yr Treas |

(0.080) |

0.504 |

(0.391) |

0.087 |

1.000 |

0.407 |

Corp Bonds |

0.062 |

0.475 |

0.427 |

(0.181) |

0.407 |

1.000 |

Source: Bloomberg, based on monthly date over 5 years

As Larry Fink noted, the challenge for institutional investors is Bitcoin’s volatility. While retail investors may be willing to tolerate erratic swings, large institutions such as pension funds, operate within risk budgets. Given that risk management framework, Bitcoin’s volatility would make it more of an opportunistic investment than a material holding.

Fundamental Value

An essential feature in analyzing most assets is applying a robust methodology to help estimate long term value. The traditional approach is to forecast future cash flows and discount those to determine current value.

For assets that don’t have income, this process is more challenging. Both gold and Bitcoin fit this profile. However, gold’s long history as a respected store of wealth and global central bank reserve asset has helped it converge on a market price that trades with reasonable volatility.

As a rough “what if” estimate, J.P. Morgan suggests that if Bitcoin was to rival gold’s popularity, its 18.5 million coins could trade at $2.7 trillion - the market value of gold held outside central banks. The path to a $146,000 value would require a hearty embrace from long term investors which, in turn, would fortify its credentials as a financial asset and help tame its volatility

Still In Price Discovery

Bitcoin’s vision is to become a reliable store of value and a safe haven if central banks act recklessly. For now, it is getting more attention from institutional investors. With time, the pace of adoption could pick up as price moves normalize and its contribution to portfolio diversification becomes more apparent.

This article first appeared in Forbes. This material contains opinions of the author, but not necessarily those of Sun Life or its subsidiaries and/or affiliates.