Core fixed income positioning amid a shifting policy backdrop

Today’s environment of rising interest rates has injected considerable uncertainty into fixed income allocations for institutional portfolios. This may lead to suboptimal portfolio positionings, such as effectively remaining on the sidelines with significant allocations to cash and/or low-yielding securities, or otherwise not investing effectively against the backdrop of rising rates.

Notwithstanding special circumstances, such as upcoming client cash needs, SLC Fixed Income believes that a fully invested fixed income allocation is the optimal positioning amid current market conditions. Doing otherwise could mean missing out on important income generating opportunities, especially considering the strong possibility that the U.S. Federal Reserve will be forced to cut rates sometime over the next two years. As fixed income investors ourselves, we seek to strike a balance of Treasury yields and spreads. While we expect both to continue moving higher in the near term, we also expect them to begin to move in opposite directions eventually as recessionary risks increase – with spreads widening but Treasury yields falling.

The following discussion will focus on the state of core fixed income in today’s rising rate environment, covering these and other important topics:

- Markets are already pricing in further increases to the federal funds rate; historical evidence illustrates that market yields tend to lead interest rate changes.

- Suboptimal fixed income allocations could mean foregoing stronger yields from various positions along the curve.

- Fixed income valuations are exhibiting attractive levels in today’s investment environment.

- Various fixed income strategies can position a portfolio well for expected rate hikes and help investors take advantage of higher yields.

Persistent inflation drives rate expectations

The rate-hiking cycle is far from over, based on inflation indicators that are coming in hotter than expected and higher than what’s in the comfort zone of the U.S. Federal Reserve and other major central banks. September’s 8.2% year-on-year increase in the Consumer Price Index was the highest since the early 1980s. This persistently elevated inflation has changed market expectations over the past year, a far cry from pricing in just one rate hike for 2022 at September 30, 2021. So far in 2022, the Fed has enacted 15 rate hikes (as measured by 25 basis-point increments, of 375 bps in total). Markets are currently pricing a terminal rate of 5.098% in June 2023, which suggests five additional hikes before the cycle is finished. This means the market is pricing a 50-bp hike in December 2022, possibly 50 bps in February and an additional 25 bps at one of the next three Federal Open Market Committee (FOMC) meetings through to June 2023.

These changes in rate expectations underscore a fundamental point: markets are constantly assessing and reassessing data as they become available, and pricing rates accordingly. However, there are limitations on their ability to accurately forecast outcomes in the best or most certain of times, to say nothing of the numerous challenges and uncertainties currently facing markets today.

Rising rates and the short end of the yield curve

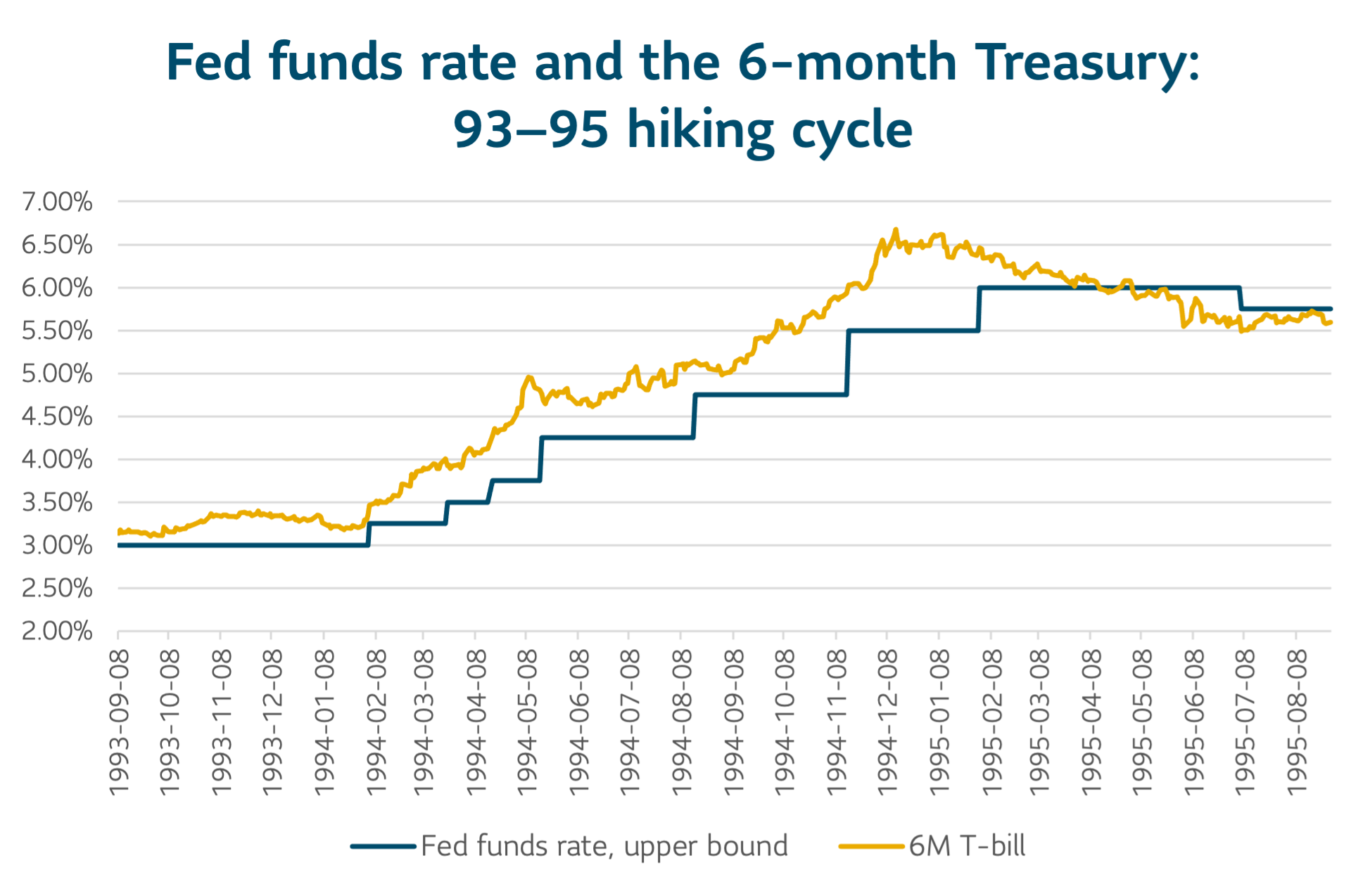

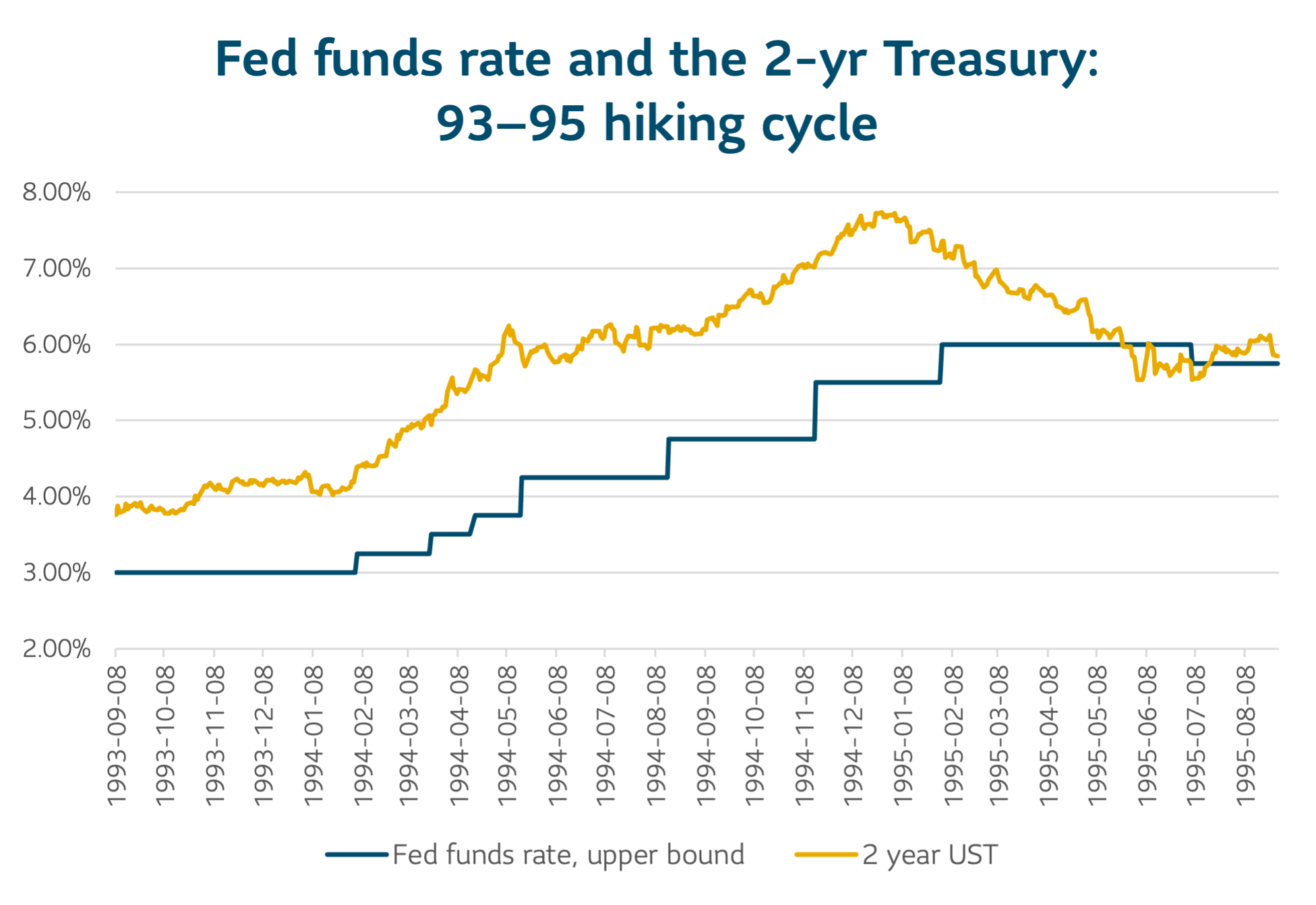

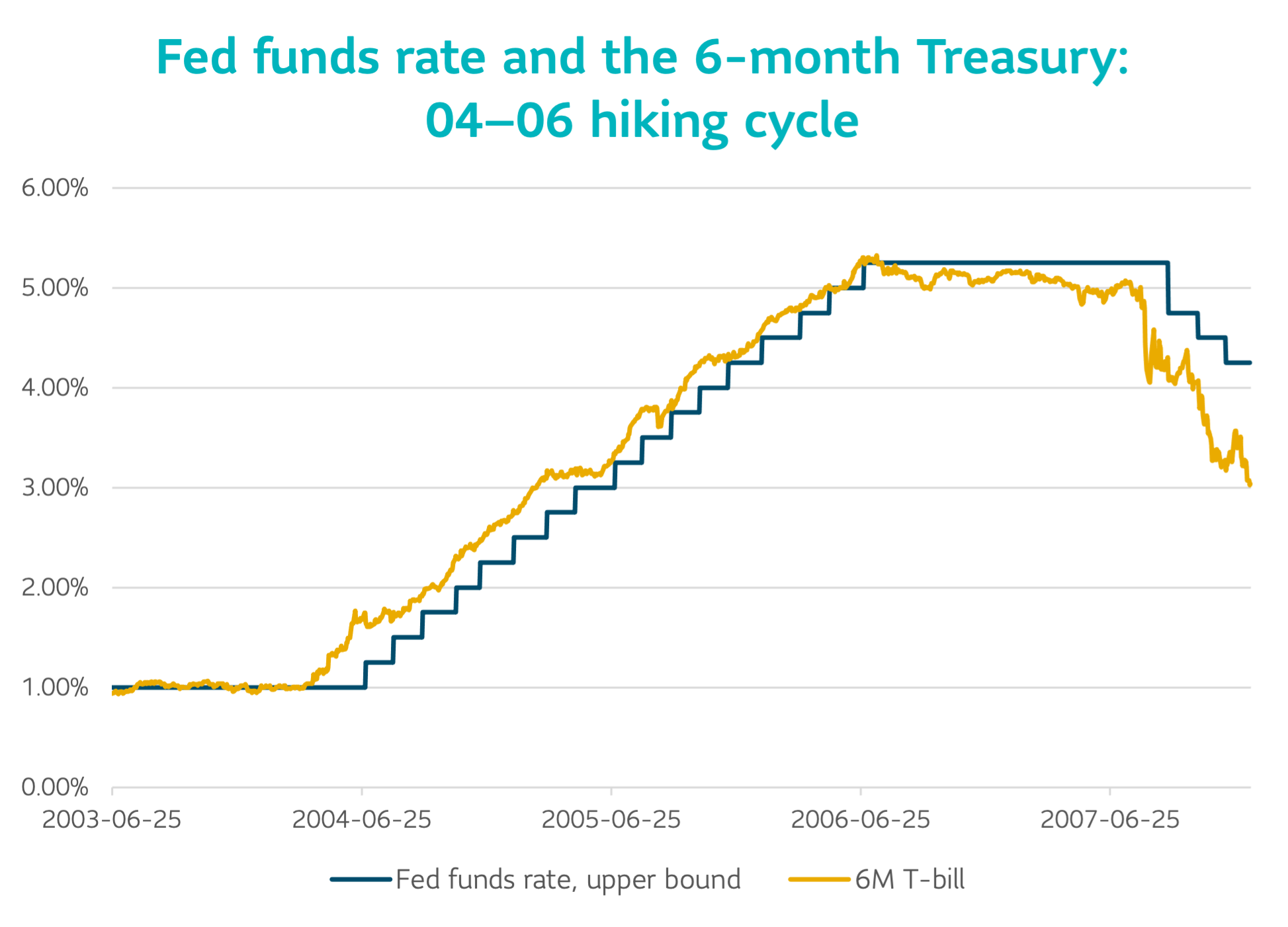

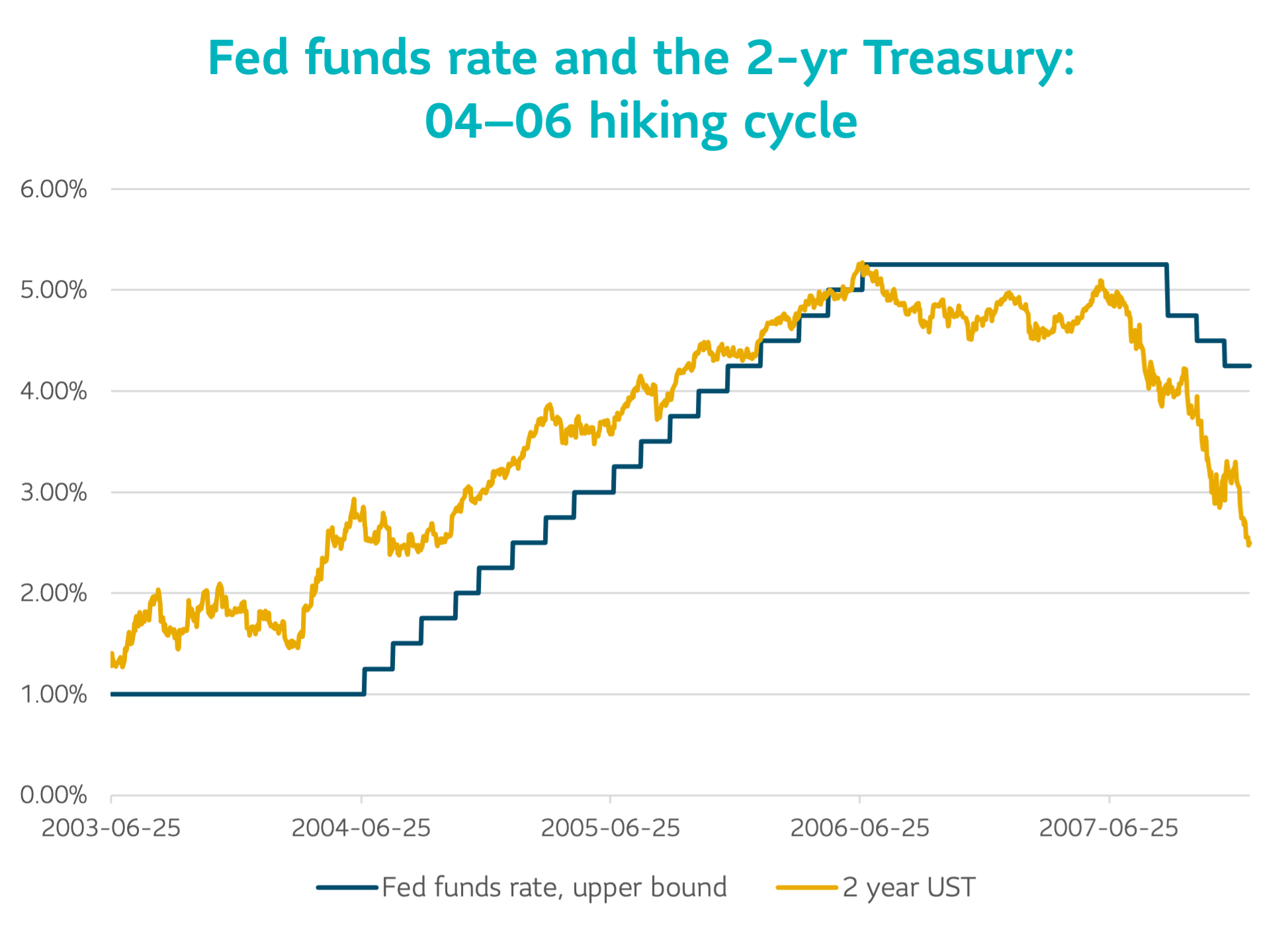

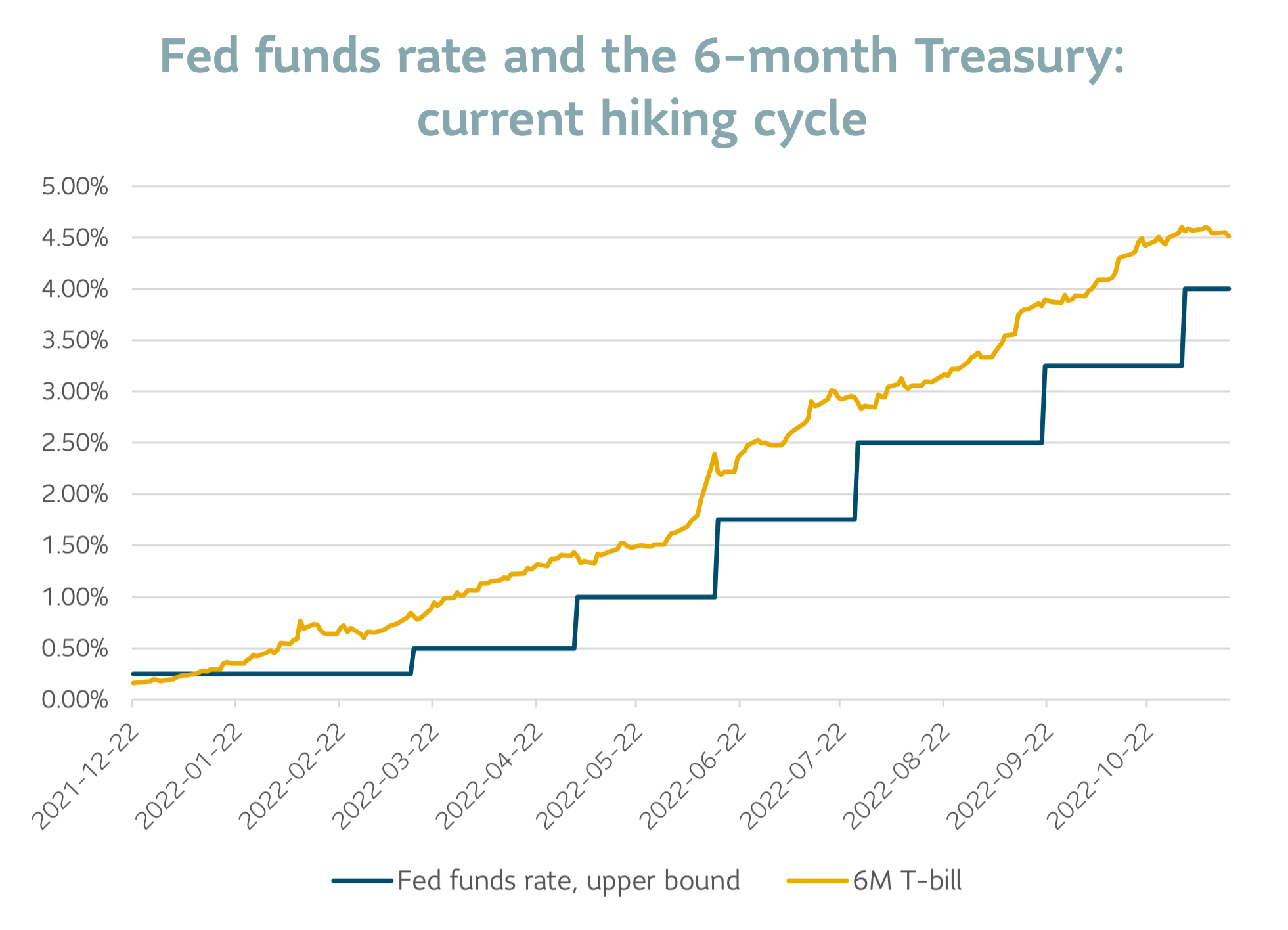

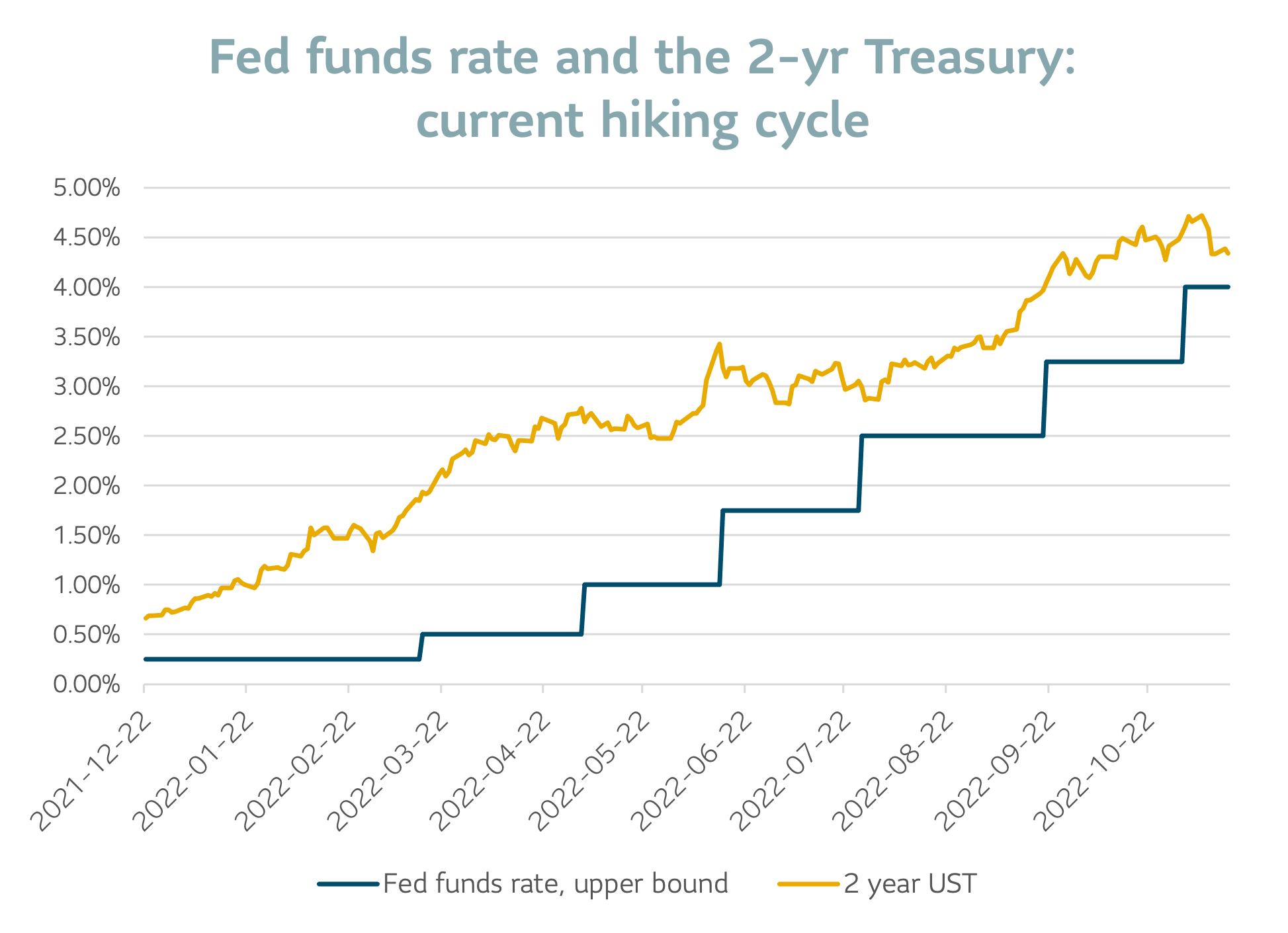

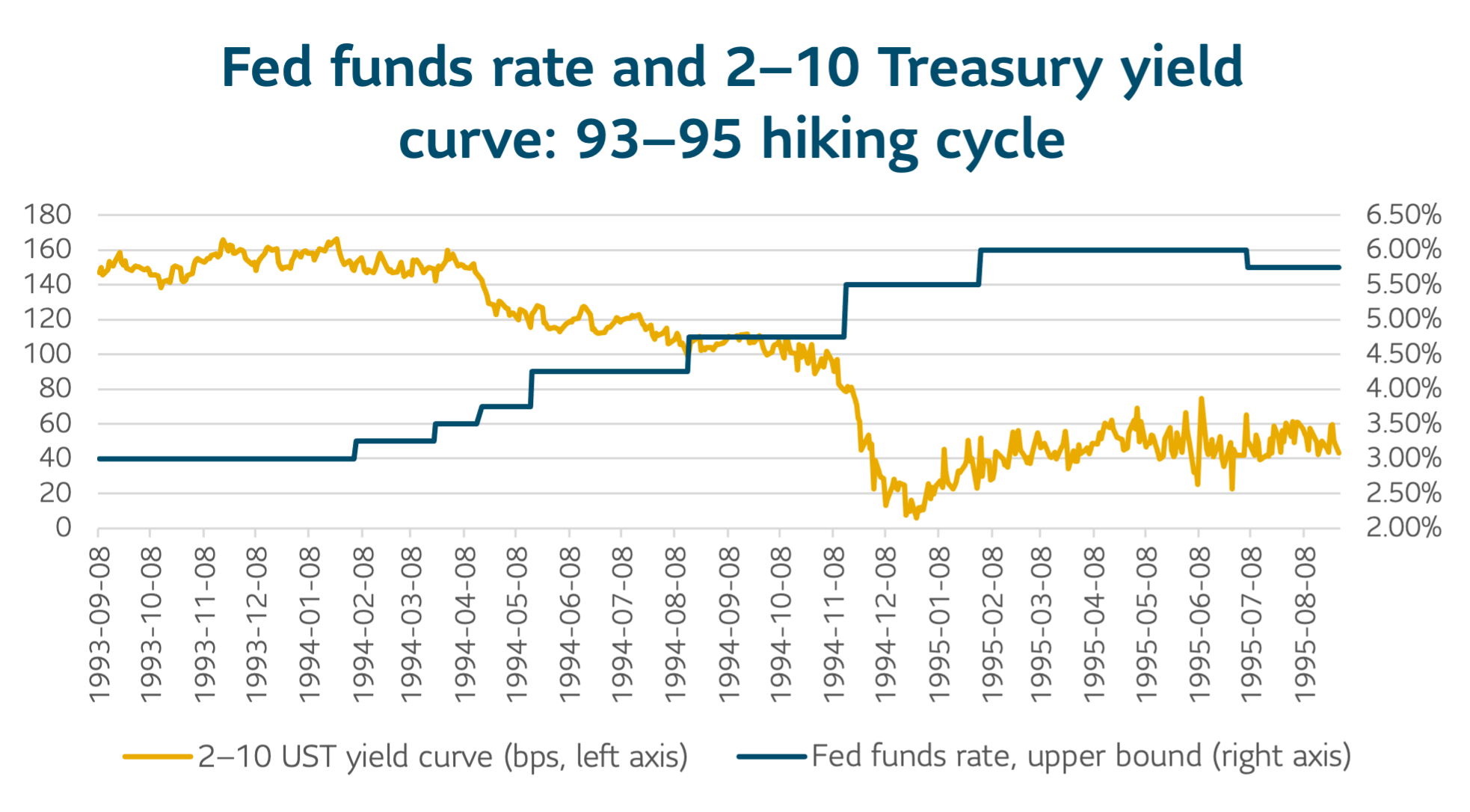

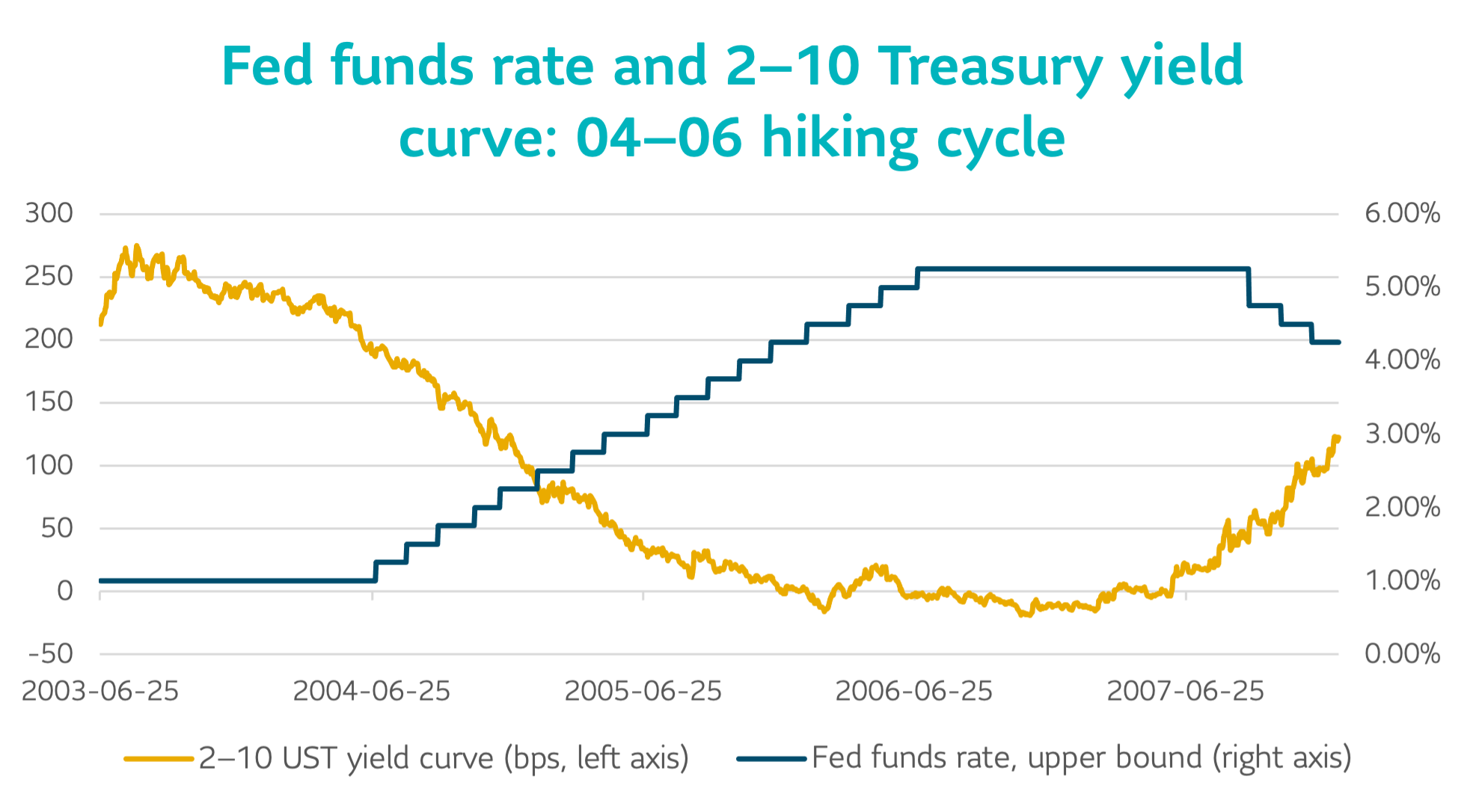

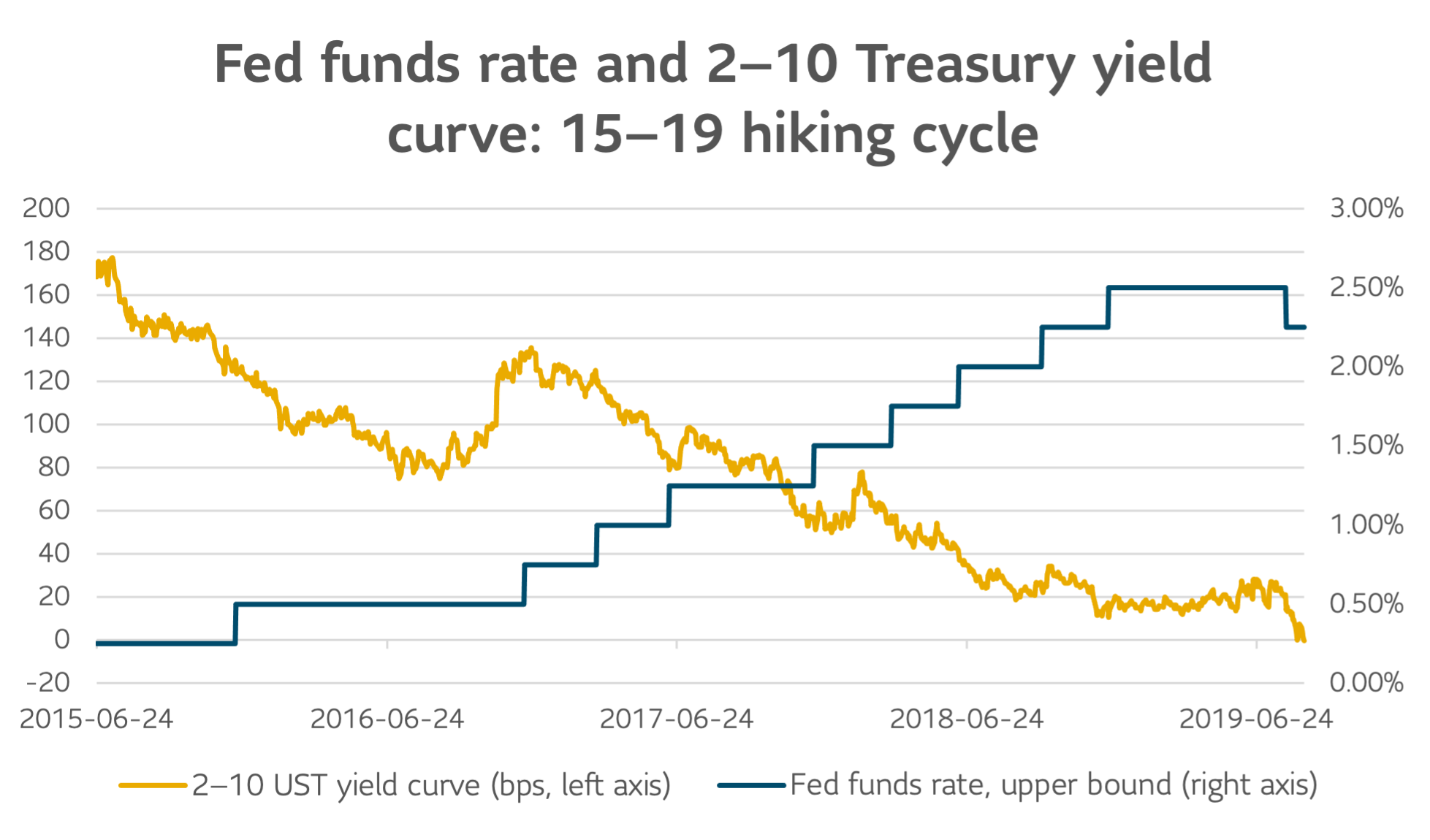

The markets’ anticipation of interest rate increases can have different effects on different parts of the yield curve, shaping the types of strategies that could work better in a rising-rate environment. For example, short rates (e.g., for six-month T-Bills and two-year Treasury notes) typically run ahead of the Fed and the fed funds rate during tightening cycles, as well as when rates go down in easing cycles.

Historical market behavior illustrates this principle. Prior to the Fed commencing a tightening cycle, short rates usually move up as the market anticipates what’s to come. Conversely, prior to a shift in Fed policy from hawkish to dovish (easing/lower-rates), short rates tend to invert as investors look to lock in what they perceive to be elevated front-end yields. We can see this phenomenon in the last two major tightening-to-easing cycles (1993–1996 and 2004–2006) and can observe the same behavior in the current tightening phase so far.

Source: Bloomberg.

What this all means is that an aggressive rate-hiking cycle is well underway, with short rates elevated in anticipation of the next set of policy moves from the FOMC.

Performance drivers on the long end of the curve

While short-rate instruments can be directly affected by expectations of monetary policy moves, the long end of the yield curve behaves differently, based on historical data. Factors such as inflation, current economic conditions and the global macroeconomic outlook tend to drive the direction of longer rates. Former Fed Chair Alan Greenspan in fact once stated that he found it a “conundrum” that longer-maturity yields were unresponsive to the central bank’s rate hikes and policy signals.

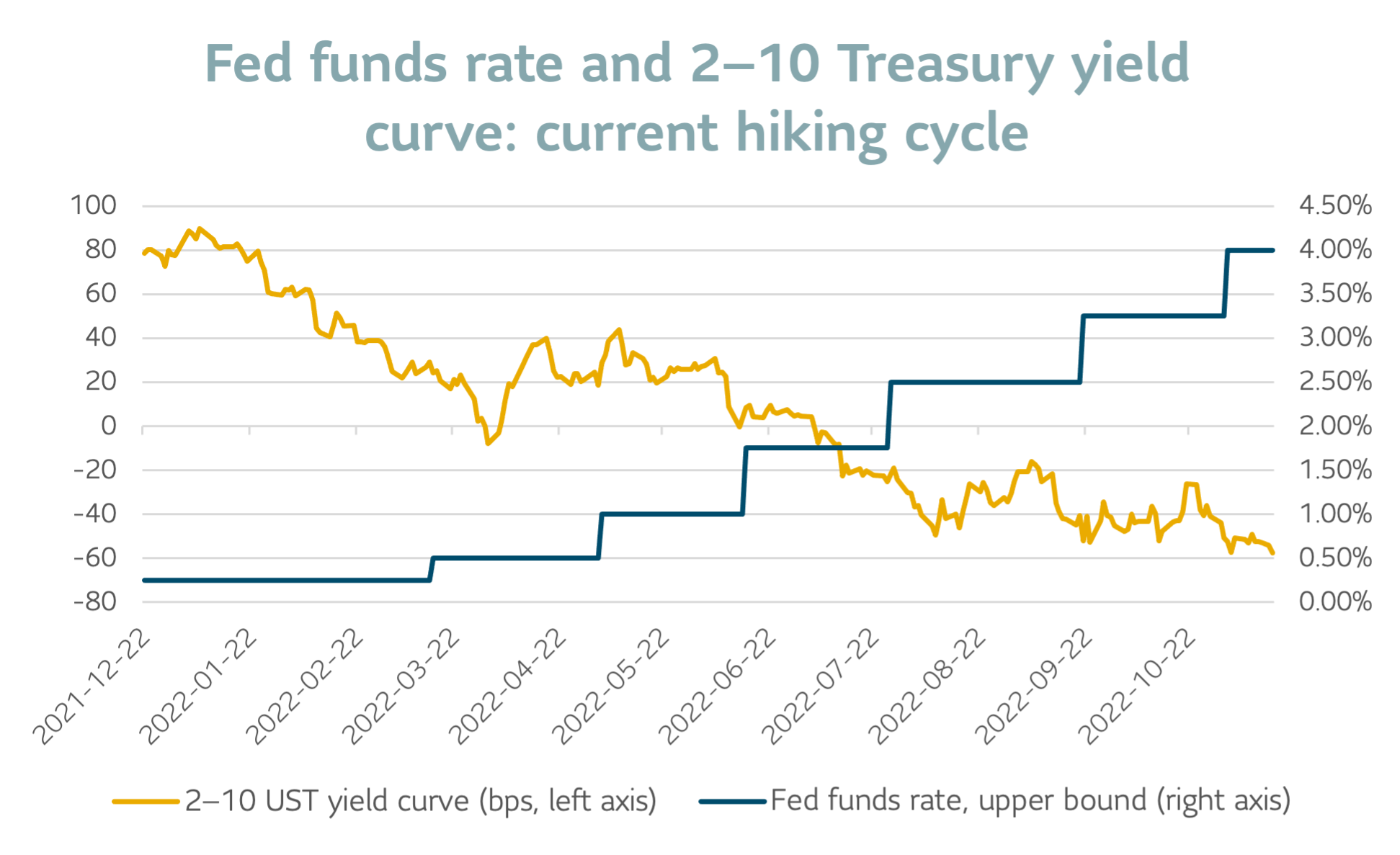

What the longer end of the curve tells us today is the possibility that there may be a near-term recession. As illustrated in the following exhibit, an inversion in the 2–10 Treasury yield curve spread often presages a recession. At the time of writing, the curve has inverted by approximately 50 bps, a sobering signal for market watchers who place importance on the spread as a predictive measure.

Source: Bloomberg.

Searching for value in the bond market

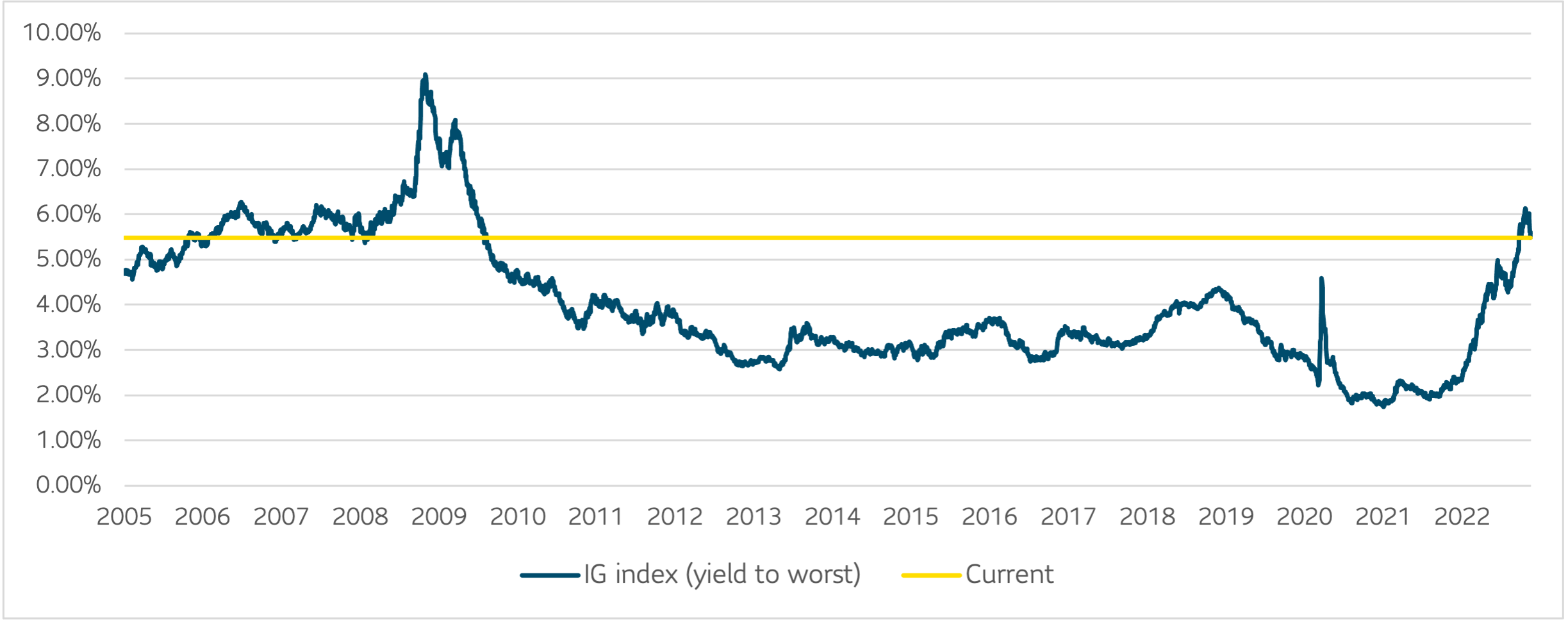

As bond yields rise, they approach a point when they are likely to peak out, and on a total return basis this could mean potentially abundant value in fixed income. For example, while they are often considered unattractive investments in an inflationary environment, high-quality bonds could be positioned to perform reasonably well. The following exhibit illustrates that recent all-in yields for investment-grade fixed income haven’t been this high since the Great Financial Crisis of 2007–9.

All-in IG yields the highest since Great Financial Crisis

Source: Bloomberg.

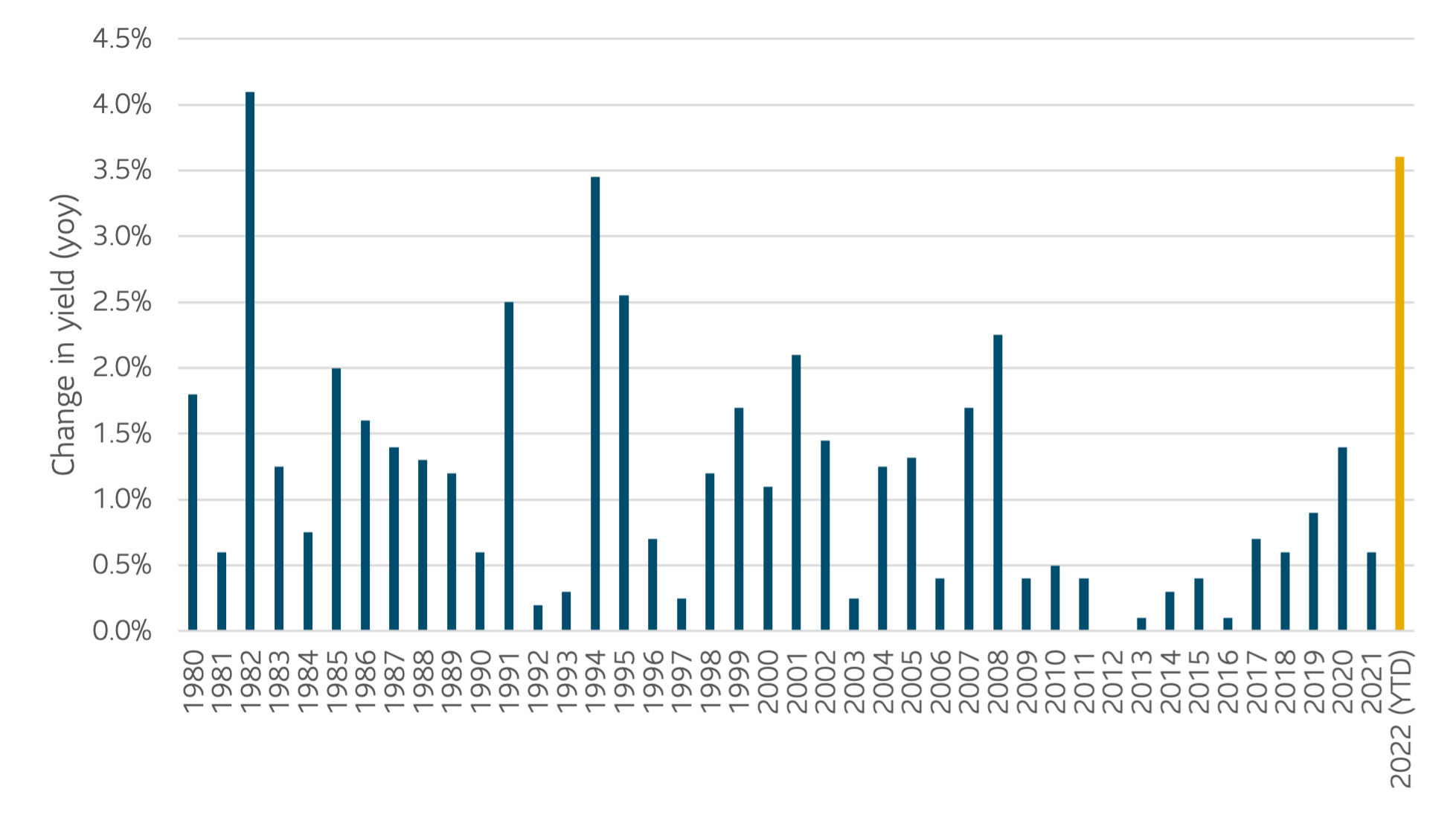

Another possible silver lining in today’s economic turmoil is the 2-year Treasury yield, which is showing similar behavior as year-over-year changes in yields are also reaching potential crises-era peaks. These and other indicators suggest compelling opportunities to purchase short-dated investment-grade paper with yields in the high 4% to low 5% range, attractive levels from a historical perspective.

Annual yield change in 2-year Treasuries at crisis-level highs

Sources: S&P Dow Jones Indices, Federal Reserve Economic Data, as of Nov. 15, 2022.

SLC Management: investing into the rate-hiking cycle

With respect to our own strategies, at SLC Management we’re investing further out the curve. All else being equal, these long yields should not change significantly during the serious rate hikes to come. However, there are other risk factors that could impact our positioning.

We also expect our laddered maturity structure to prove favorable in a rising rates environment, allowing us to take advantage of higher yields over time through reinvesting maturities. In our view, this portfolio approach is preferred over increasing our cash position, considering the risk that rates could be dramatically lower in the future if recessionary fears were to escalate, and ultimately come to fruition. As previously stated, we expect the Fed to be forced to cut rates, likely over the next two years.

Our base case is for a 5.5% federal funds terminal rate, which we view as a signal for peak tightening. We do not attempt to time our investment activity with the peaks, but are positioning for that scenario by gradually legging into more spread risk at the end of 2022 and Q1 2023. We continue to target high-quality spread products in the 7–10-year space, with the goal of reaching a more neutral risk allocation profile by the end of Q1 2023, compared to our lower-risk positioning at the time of writing.

The importance of remaining fully invested

Macroeconomic and policy uncertainty could continue to shape bond investing for some time. However, reacting by allocating to cash or cash proxies could mean missing out on important fixed income opportunities that may arise from shifting markets. For institutional portfolios to weather current conditions, it is critical to be positioned with the right strategy that can take advantage of today’s historically high yields, while positioning for a possible recession and/or post-rate-hiking-cycle scenario.

Key takeaways from this document

- Rate-hiking cycles will have varied effects on different terms along the Treasury curve; staying on the sidelines could mean foregoing stronger yields from both shorter- and longer-duration positions.

- With bond yields possibly exhibiting peak levels, fixed income valuations appear attractive in today’s investment environment.

- Investing out the curve can be beneficial, as market yields shouldn’t change if rate hikes come in as expected. If rates continue to rise, a laddered maturity structure can help take advantage of the higher yields over time through reinvesting maturities.

This content is intended for institutional investors only. It is not for retail use or distribution to individual investors. All investments involve risk including the possible loss of capital. This presentation is for informational and educational purposes only. Past performance is not a guarantee of future results.

Any reference to a specific asset does not constitute a recommendation to buy, sell or hold or directly invest in it. It should not be assumed that the recommendations made in the future will be profitable or will equal the results of the assets discussed in this document.

The information contained in this presentation is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this presentation.

The information may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate.

Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association. In the U.S., securities are offered by Sun Life Institutional Distributors (U.S.) LLC, an SEC registered broker-dealer and a member of the Financial Industry Regulatory Authority (“FINRA”).

© 2022, SLC Management.

SLC-20221110-2581558