Market

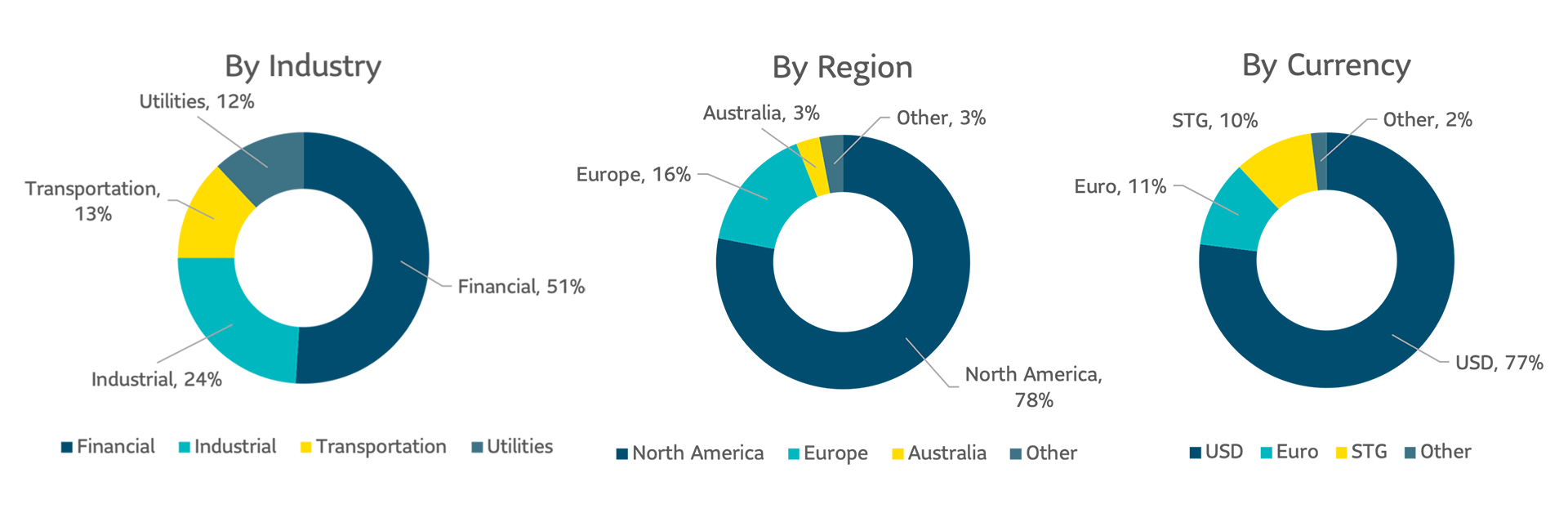

Investment grade private credit (IGPC) issuance was strong in Q2 with volume of $23.5 billion, surpassing Q1 2021 volume of $22.2 billion. The headline for the first half of 2022 has been strong issuance from the financial sector (investment firms, asset managers, REITs and real estate), issuance that has more than doubled as a percentage of total market issuance since 2019. Financials were 66% of market issuance for Q2 and represented 51% of total issuance for H1 2022. Strong REIT deal flow may put upward pressure on spreads and create attractive opportunities in the second half of this year. The balance of H1 2022 volume is comprised of industrials, largely service and energy companies (24%), transportation (13%) and utilities (12%). Transportation issuance jumped from 2% the prior year lead by a combination of aviation, shipping, ports and transportation-infrastructure (toll roads and logistics) deals.

IGPC volume has steadily increased over the past five years and the number of deals has increased, but the average deal size has trended downward. This year, there have been four $1 billion-plus deals compared to eight from last year. We believe this is largely due to the increase in rates and to issuers taking only “what they need” as opposed to taking as much as the market is willing to provide.

For H1 2022, we noted year-over-year increases in both issuance in tenors under ten years and cross-border volume. Issuance has been stronger as global bond market issuers have looked to the IGPC market when other markets were closed due to volatility, particularly in Europe. However, cross-border issuance is still below pre-pandemic levels.

Private spreads in Q2 were up and down, reflecting volatility in the public bond market, although movements were not in lockstep as IGPC spreads typically lag the public market. This dynamic made pricing challenging at times; we lost deals when public spreads widened but other IGPC investors, either hungry for volume or not watching public markets as closely, did not widen their bids correspondingly.

Outlook

New issue pipeline across most of our asset classes appears solid over the summer. Although it’s too early to have much visibility into fall activity, Q4 is typically our busiest quarter. Through ongoing volatility, we remain committed to our investment discipline and achieving our relative value targets. There is much uncertainty in the market these days, but as we charge into the second half of July, we are expecting a busy second half of the year.

Q1 2022 |

Weighted average life |

Average rating |

Average Spread1 |

|---|---|---|---|

Private Placement Monitor |

10.2 years |

43%: A 57%: BBB |

137 basis points |

1 All commitments.

In focus: Private credit supply

IGPC has long had a reputation as a dependable source of capital and 2022 has been no exception. H1 2022’s volume of $49.8 billion is well ahead of H2 2021’s volume of $41.2 billion—2021’s total annual volume was a record $124.2 billion. Volume this year has been solid, but a large portion of the volume increase year over year is due to a very strong March, after the start of the Ukraine war and during the initial Federal Reserve rate increase. While volatility was high and other markets closed, the IGPC market continued to execute transactions in the face of a myriad of headwinds. Investors in this market take a long-term view when underwriting deals and rely on strong structures and covenants as an early warning trigger of credit deterioration for when the inevitable downturn occurs. Dissecting this year’s issuance, we are seeing some interesting trends.

Trends in issuance

While 2022 is off to another record start in terms of issuance, it is interesting to see where the growth is coming from. At the 10-year term mark, for the first time we saw issuance with terms below 10 years outpacing those equal to and above 10 years, and by a wide margin no less.

| <10yr | >10yr | |

|---|---|---|

| 2022 | H1 $32,527 | H1 $15,147 |

| 2021 | H1 $21,962 | H1 $28,618 |

| 2020 | H1 $19,526 | H1 $20,532 |

| 2019 | H1 $18,718 | H1 $20,492 |

When looking further into the below 10-year segment of the market, we note that the while the growth was spread across all tenors the biggest growth was seen in the 7–10-year term bucket and <5 years. Driving this growth was the dominance of issuance from investment managers, financials and REITs. The financial sector (investment firms, asset managers, REITs and real estate) represented 66% of market issuance for Q1 and represented 51% of total issuance for H1 2022. REITs have historically been an important issuer in this market, but the wave of investment firms and asset managers that began during the onset of the pandemic has accelerated in 2022.

Though the IGPC market has been historically focused on longer-term investment opportunities, it found itself in the surprising position of having an ample supply of short-term opportunities, perhaps even exceeding demand.

| Term of 10 years or less | <5yr | 5–7 Yr | 7–10yr |

|---|---|---|---|

| 2022 | H1 $8,525 | H1 $5,335 | H1 $18,398 |

| 2021 | H1 $6,177 | H1 $4,313 | H1 $11,473 |

| 2020 | H1 $4,586 | H1 $3,616 | H1 $11,325 |

| 2019 | H1 $3,314 | H1 $3,337 | H1 $12,067 |

What’s next?

We feel that the YTD trends in issuance will continue throughout the remainder of the year with an expectation that a greater proportion of the issuance will be toward terms of greater than 10 years, but not by a margin wide enough to offset the difference from earlier this year. Given that market participants’ appetites have been and continue to be focused on longer terms over shorter terms, and that most investors have already over-allocated to their respective short-term programs, we expect that for issuances to be successful they will need to offer attractive pricing.

We continue to like the fundamentals of investment firms and asset managers and will continue to be selective on credit and relative value. REIT issuance is expected to continue and make up a large portion of the short issuance. We like the REIT sector and believe that the strong deal flow may put upward pressure on spreads and create opportunities in the second half of this year.

Data presented in this article has been calculated internally based on external market data sourced from Private Placement Monitor.

The information in this paper is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this paper.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association. Registration as an investment adviser does not imply any level of skill or training. There is no assurance that the objective of any private placement strategy can be achieved. As with any strategy, the Advisor’s judgments about the relative value of securities selected for the portfolio can prove to be wrong.

Unless otherwise stated, all figures and estimates provided have been sourced internally and are as of June 30, 2022. Unless otherwise noted, all references to “$” are in U.S. dollars.

This document may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility. Unless otherwise stated, all figures and estimates provided have been sourced internally and are current as at the date of the paper unless separately stated. All data is subject to change.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

© 2022, SLC Management

SLC-20221103-2572234