To date, China is leading the effort. It launched its central bank digital coin (CBDC) pilot program last year and has already rung up over $5 Billion in consumer transactions. A broader launch of its digital currency seems likely in February, as China kicks off the winter Olympics. Research from the Bank of International Settlement (BIS) shows that other central banks are paying attention, reporting that over 80% of central banks are exploring CBDCs.

There are clear benefits to CBDCs. If every citizen holds it in a digital wallet, then it reduces the need for a traditional bank deposit. Dealing directly with the central bank eliminates the risk the bank will fail, so deposits are insured regardless of size. Further, if the government wants to send social assistance or stimulus checks, they can immediately deposit it into digital wallets. Presumably bank charges would be minimal or zero, ultimately democratizing banking for those who can’t afford a bank account.

However, CBDCs pose a potential disruption to the banking system. This is further complicated by the hurdle of getting citizens comfortable that their transaction data won’t be used for surveillance and control. Therefore, for CBDCs to advance, clear principles and operating guidelines are critical to ensure banks are not dramatically disintermediated and that citizens feel confident that the currency preserves consumer privacy.

Bank Disintermediation

The biggest challenge with broad adoption of digital currencies is that money would be stored at central banks. Commercial banks would lose their primary funding, raising the question as to who will support bank lending if commercial bank deposits shrink, particularly when 90% of the money supply is deposits.

If central banks were to take on the lending role, the government would be on the hook for building the infrastructure and absorbing loan losses. Commercial banks could still compete by replacing deposits with public market debt.

Another option is that the central bank lends its new deposit base to commercial banks, but that could be tricky. Right now, banks compete to attract deposits which end up being independent decisions by impartial consumers. However, if the government holds all these funds and then lends or allocates to banks, that decision could become politicized and eventually undermine competitiveness.

In a recent study sponsored by the Bank of International Settlement (BIS), a group of major central banks acknowledge that a significant shift from bank deposits to CBDCs could disintermediate banks and drive some financial instability as deposits shift and bank lending and profitability is disrupted.

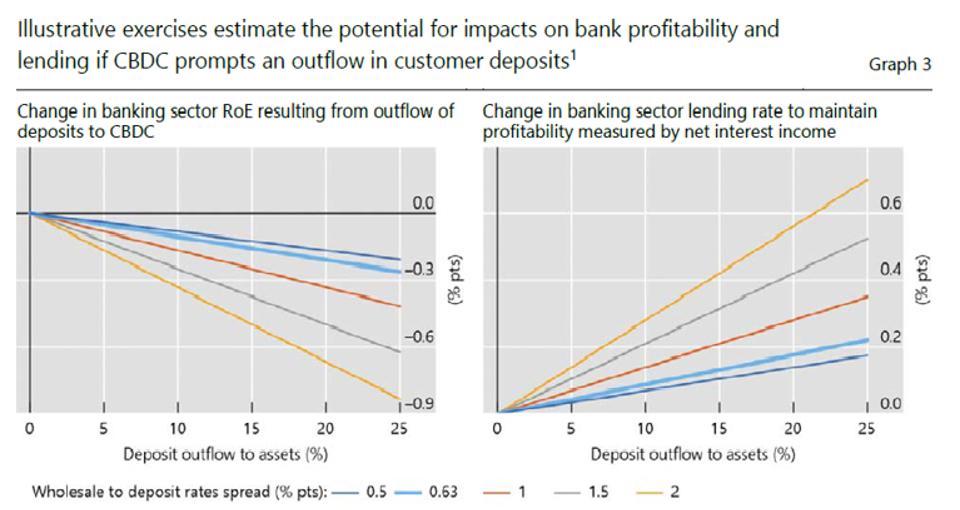

The researchers created a generalized model of the aggregate banking system using balance sheet data. They looked at the impact on banks’ return on equity (ROE) if forced to replace deposits with costlier wholesale (public market) funding.

The chart below estimates some of those sensitivities. The left chart shows a range of deposit outflows from 0 to 25% and the effect on ROE, as lost deposits are replaced by costlier wholesale funding. The five scenarios range from 0.5% to 2.0% for increases in funding costs.

The second scenario (light blue line) has an increased funding cost of 0.63%. This is in line with the average for advanced economies from the last five years. In this scenario if 25% of banking deposits moved to CBDCs, bank ROEs are estimated to drop by 0.3%. However, assuming banks offset this by increasing lending rates - the right chart suggests they would need to add 0.2% to the cost of the average loan to keep profits and ROEs at existing levels.

Source: Country Banking Data Tables from CGFS publication No. 60. BIS bank level asset data and BIS bank level deposit and CDS rates. Data is obtained for a subset of advanced economies.

Illustrative exercises estimate the potential for impacts on bank profitability and lending if CBDC prompts an outflow in customer deposits.

The effects on lending become more severe the bigger the gap between wholesale funding and deposits. At some point lending could contract, forcing more consolidation in banking. Non-bank institutions would likely step in to fill some of the gap, but smaller companies would probably be underserved.

Another risk is an abrupt flight to safety, say during a crisis, where deposits get pulled and parked in a government CBDC. This would require some limits or guidelines because if left unfettered a CBDC could be a catalyst for a central bank sponsored run on the banking system.

Privacy Concerns

Away from financial transactions, the privacy intrusion that CBDCs could allow would likely get significant push back, at least in liberal democracies. For instance, if the government wants to censor activities, they could easily build the surveillance to decline certain transactions.

If CBDCs look likely to become a surveillance tool, then some of the economy will move to independent digital coins or go underground. In an extreme case the U.S. dollar could fade as the reserve currency as the detailed digital footprint makes international holders nervous of abuse.

On another note, centralizing deposits could also raise the vulnerability to cyberattacks. Taking down a single target could be easier than a string of banks. The complexity of these issues for the global financial system is staggering. Expect central banks to wade carefully into this thicket. For now, China is the leading test case and should be closely watched.

This article first appeared in Forbes. This material contains opinions of the author, but not necessarily those of Sun Life or its subsidiaries and/or affiliates.