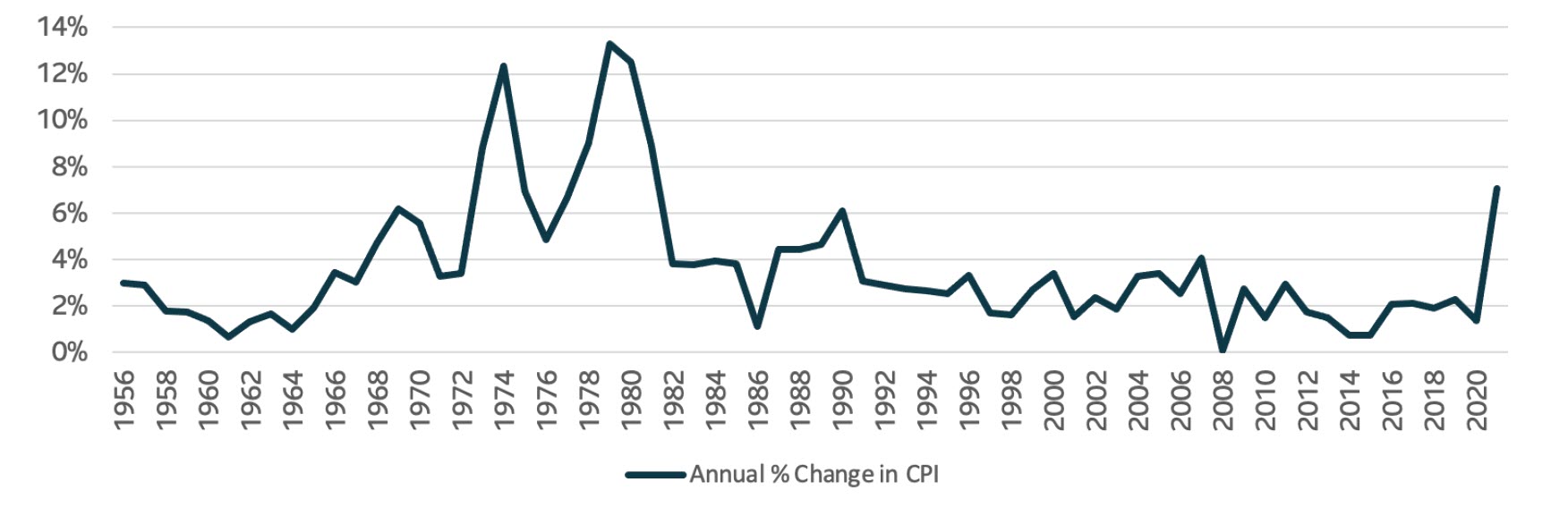

U.S inflation heating up

Source: Bureau of Labor Statistics. As of 12/31/2021

How does inflation impact insurance companies, and what can they do about it?

It’s been a while since we’ve seen it, but historically, persistently high inflation has been a negative for insurance companies. If we look at property & casualty (P&C) insurers, on the liability side of their balance sheets, higher than expected inflation means higher claim costs than what was priced into their policies. That’s because policies are priced today but claims against those policies can emerge well into the future when costs are higher than what was anticipated at the time of policy writing. On the asset side, P&C investment portfolios are mostly comprised of bonds. As interest rates rise due to inflation, bond prices will fall, and so would the market value of the insurer’s investment portfolio. If we think about the last time inflation spiked in the 1980’s, it led to a full-blown liability crisis which was disastrous for this industry. On the other hand, the P&C industry has historically performed well during periods of moderate inflation as price increases can better keep up with loss trends and portfolios are less impacted by mark to market adjustments. We’d note that life insurers tend to be less impacted by inflation on the liability side since many of their products have fixed policy payout amounts.

To hedge against the negative impacts of inflation, there are several actions insurers can take within their investment portfolios. Within their core fixed income portfolios, outside of making duration bets, insurers can rotate into corporate subsectors that fare better during inflationary periods. Some examples include energy and real estate investment trusts (REITS) as well as more defensive sectors such as utilities, consumer staples, and healthcare.

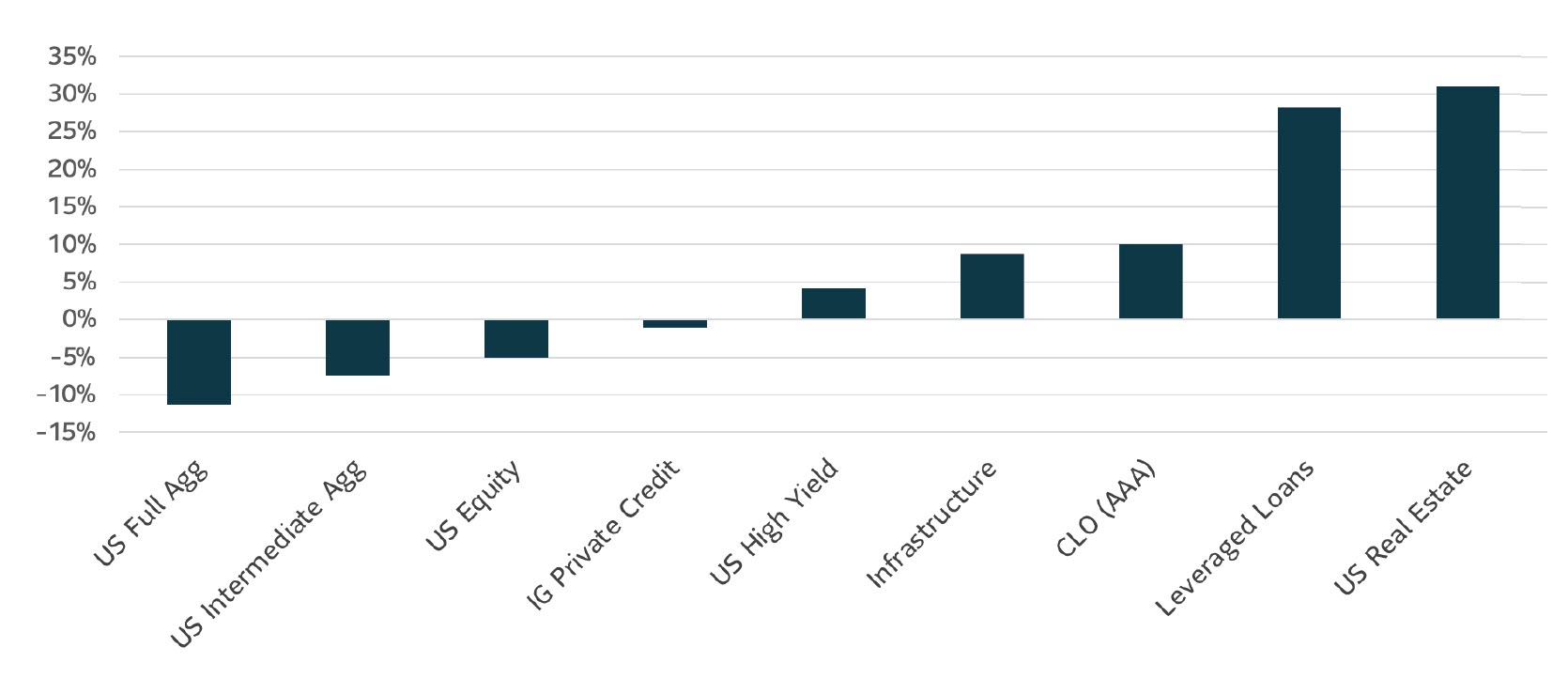

There are also a number of non-core asset classes both within and outside of fixed income for which historical returns have been positively correlated with changes in inflation. Within fixed income, collateralized loan obligations (CLOs) and leveraged loans are two that come to mind; both asset classes have floating rates that move in alignment with rising interest rates. Outside of fixed income, real estate and infrastructure offer good inflation hedges given their exposure to real assets and ability to upwardly adjust leases and essential services, respectively.

Correlation to CPI

Source: SLC Management analysis. Data as of 12/31/2021. Correlation based on historical returns by asset class and changes in the US CPI index. Sources of asset class return data: Real Estate = NCREIF Index data; Infrastructure = InfraRed Capital Partners pooled investment vehicle data; Leveraged Loans = Credit Suisse Leveraged Loan Index data; All other asset classes based on Bloomberg Index data.

The trend towards alternatives

Alternative asset classes have been gaining increased interest from insurers who have traditionally focused exclusively on investment grade public bonds and equities. What’s driving this trend? On the market side, we’re still seeing relatively low yields on core fixed income as well as equity valuations which many believe are stretched. To combat these low yields, the first thing investors and managers are doing is assessing the levers which can be pulled within their core fixed income portfolios – duration, credit quality, and liquidity – and how much the market is compensating investors to take on those different types of risk. Core fixed income is and will continue to be the largest part of insurance company investment portfolios due to regulatory and rating agency restrictions on assets backing reserves but there has been a growing trend of insurers taking advantage of the higher yields offered by alternative asset classes and we expect that trend to continue. On the insurance side, considering P&C insurance companies again, the industry is very well capitalized following years of strong underwriting profits. As a result, many companies have the capacity and the appetite to take on additional forms of investment risk in order to increase returns.

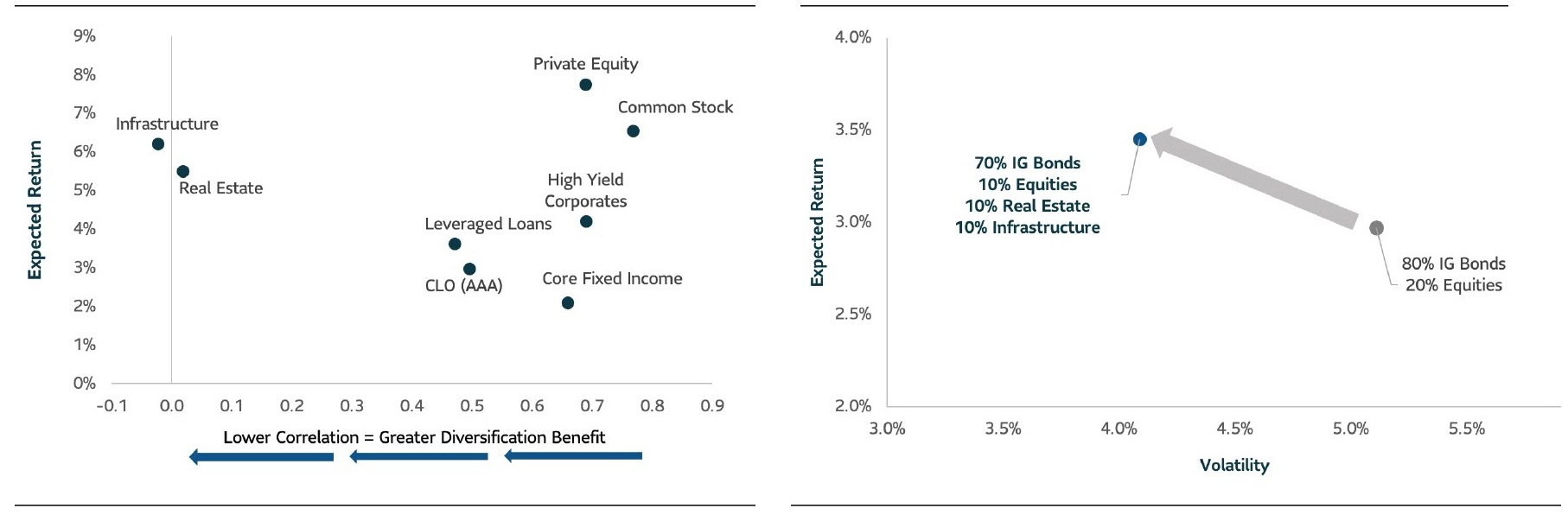

At SLC Management, we’ve completed strategic asset allocation work for many of our insurance company clients over the past year, and one consistent observation across all those analyses is that these alternative asset classes model well. Even though some of them come with higher volatility on a standalone basis, adding them to traditional insurance company portfolios can improve yield and expected return while maintaining or reducing overall portfolio risk. The primary driver of this potential reduction in overall portfolio risk is diversification; historically, the returns of these asset classes have displayed relatively low correlation to the returns of investment grade public bonds.

Adding alternatives to traditional insurance company portfolios can improve diversification...

...often resulting in higher expected returns and lower overall risk

For illustrative purposes only. Risk and return metrics for all asset classes other than Real Estate and Infrastructure are based on historical Bloomberg index returns and Morningstar assumptions. Real Estate volatility is based on historical NCREIF index returns while Infrastructure volatility and expected returns are based on the historical returns of InfraRed Capital Partners’ listed pooled investment vehicles. Correlations are relative to a portfolio consisting of 80% IG bonds and 20% equities.

Considerations in investing in alternatives

As alternative asset classes continue to make their way into insurance company investment portfolios, it’s worth examining the different goals and considerations that different types of companies face. If we look at structure, public and private companies have different goals which may dictate investment strategy. For publicly traded insurers, the primary goals are growing book value per share and maximizing operating return on equity (ROE) whereas private insurers may have less of a heightened focus on profitability. As a result, publicly traded insurers may have more willingness to explore higher returning asset classes not traditionally utilized by the industry. That said, privately held insurance companies are also participating given their excess capital positions. As for considerations, the three most prevalent ones are liquidity, capital, and ESG:

- Liquidity: Alternative asset classes generally come with lower liquidity, meaning they are more difficult to sell. Therefore, ensuring that a company has sufficient cash to support its operations is important to avoid a scenario of having to sell those less liquid investments in order to cover potential cash needs. That said, when we model liquidity for clients, we invariably find they have excess capacity to take on less liquid assets.

- Capital: Insurers are required to hold a certain amount of capital to support the risks inherent in their businesses. The greater amount of risk in their investment portfolios, the greater amount of capital that they must hold. While alternatives generally come with higher capital charges, many companies have plenty of excess capital above and beyond what is required. These companies don’t have to worry so much about what the capital charge with each investment is; for them, the decision to allocate to alternatives is more of an economic exercise of risk vs. return. However, there are other companies which are far more capital constrained and thus more likely to shy away from asset classes which make economic sense but come with punitive capital charges.

- ESG: The impetus to analyze and quantify the prevalence of ESG factors is growing as rating agencies and regulators have begun to require greater disclosure on ESG factors within insurance company investment portfolios. As a result, examining the impact of alternative investments on company sustainability goals has increased in importance.

With our decades of managing investment portfolios for insurance companies, SLC Management is ready to help clients navigate through the inflation-related uncertainty ahead. Doing so requires patience, analysis, and creativity, as well awareness of the various considerations impacting investment decisions.

The information in this paper is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this paper.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association.

This document may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility. Unless otherwise stated, all figures and estimates provided have been sourced internally and are current as at the date of the paper unless separately stated. All data is subject to change.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

© 2022, SLC Management

SLC-20221102-2462392