Across six major market disruptions the researchers found that on average, endowments increased their equity holdings in the three years following the onset of a crisis. And they lightened up on equities in the lead up to the Dotcom bust in 2000 and the Great Financial Crisis in 2008. These moves show a contrarian trend and how endowments took advantage of the correction.

Investing with a long-term focus is commonly accepted wisdom. However, experience shows that it takes a well-rehearsed playbook and fortitude on the day to embrace risk when the outlook darkens. It is also equally as challenging to pare back even when markets appear overdone.

In the wake of this current crisis, what can investors learn from the endowment playbook?

Endowment Asset Allocations over the Long Run

Source: Chambers, Dimson and Kaffe “Seventy five years of investing for future generations”, Financial Analysts Journal 2020

Endowment Asset Allocations over the Long Run SLC MANAGEMENT

What’s Different About Endowments

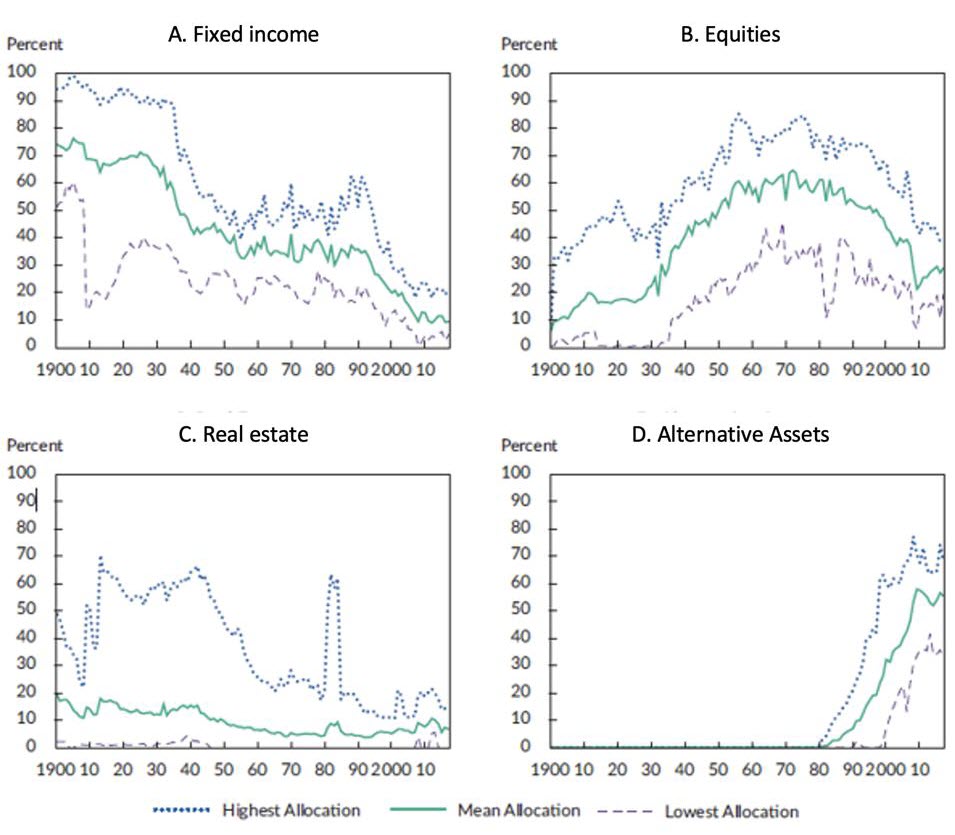

The university endowment mandate is to outlive its benefactors and continue to educate students for centuries. Therefore, it should be an optimal long-term investment entity. Many of the endowment programs were incepted in the early 1900’s, and in the early stage, the asset mix was fairly risk averse with 75% fixed income, 20% real estate and 5% equities.

Endowment officers soon realized that investing for the long term should incorporate more equity-type investments and began embracing growth-linked assets. By the 1950’s approximately 50% of the endowment assets were in equites. And by the early 70’s they had expanded to 60%.

The next major shift occurred in the 1980’s. The larger endowments led a reallocation from equities to alternative assets, mainly hedge funds and private equity. Alternative assets have grown from 0% in 1980, to close to 60% today. As a cohort that held 75% of their assets in fixed income back in 1900, they currently hold only 8%. Following such a dramatic shift, private equity and hedge funds now represent the bulk of the holdings.

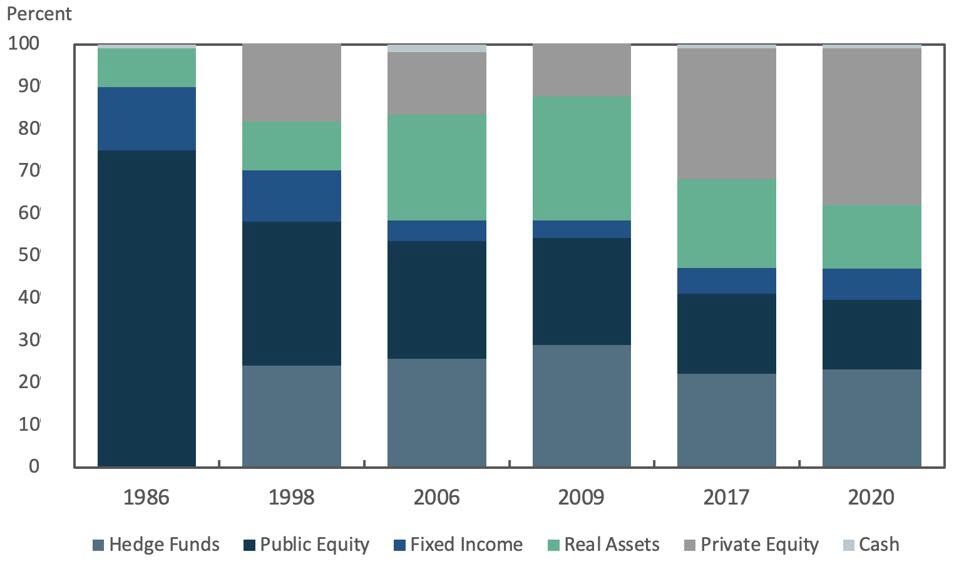

David Swensen at Yale University is one celebrated endowment investor responsible for driving this change. When he started in 1986, he inherited a portfolio that was 75% public equity. Today it is dominated by private equity and hedge funds. Swensen’s “Yale model” has influenced a generation of endowment managers as he aggressively diversified away from public markets over the decades.

Yale Endowment

Yale Endowment SLC MANAGEMENT

Endowment Performance Over 70 Years

The modern era of endowment management started in the 1950’s, and performance since then has been strong.

Endowment performance and risk

From 1950 through 2017 for fiscal years ending June 30

| Geometric Return | Standard Deviation | Sharpe Ratio | |

|---|---|---|---|

| All 12 Endowments | 6.6% | 12.4% | 0.54 |

| Leaders | |||

| Princeton | 7.9% | 12.8% | 0.64% |

| Yale | 7.8% | 13.0% | 0.62 |

| Chicago | 7.3% | 14.0% | 0.54 |

| Laggards | |||

| John Hopkins | 5.6% | 11.3% | 0.50 |

| Brown | 5.7% | 6.4% | 0.47 |

| Cornell | 5.8% | 12.3% | 0.48 |

| Broad Asset Classes | |||

| Equities | 7.6% | 17.3% | 0.48 |

| Gov Bonds | 2.5% | 11.2% | 0.21 |

| Corp Bonds | 2.8% | 10.9% | 0.25 |

| Generic Benchmark | |||

| 60/40 | 5.6% | 14.9% | 0.37 |

Source: Chambers, Dimson and Kaffe “Seventy five years of investing for future generations”, Financial Analysts Journal 2020

Endowment Performance and Risk SLC MANAGEMENT

Over approximately 70 years, endowments achieved a 6.6% return with a favorable Sharpe ratio, excess return per unit of risk, of 0.54. Compared to broad asset classes and a generic institutional portfolio of 60% equities and 40% bonds (60/40 Portfolio), endowments have done well, averaging a 1.00% return advantage with a much higher Sharpe ratio.

While the endowment leaders have done much better, even the laggards have matched or beaten the 60/40 portfolio, with lower risk.

So What Can Investors Learn From Endowments?

The endowment shift to private equity introduces another contrarian tilt to investing. In 2000, endowments shifted more to private equity, a space where mangers tend to be contrarian. Research shows that private equity has generated large investor distributions towards the top of the market cycle as valuations soared, while increasing their capital calls as markets corrected and produced buying opportunities.

The average investor cannot access the world of private investing like an endowment can, but their success is not solely attributed to the asset mix. Investors face the challenge of an impulse to be procyclical and chase frothy markets or aggressively pull back when they correct. Endowments tend to do the opposite.

Institutional investors also employ forecasting to better understand their expected outflows over the long term. That helps inform what asset mix could best support those demands. At a simple level, most investors can forecast a rudimentary version of future cash flow needs. Incorporating this, along with some buffer for uncertainty, can help derive a target asset mix that is better than sticking to short-term investing plans.

Sticking with a target asset mix requires periodic rebalancing. And that by its nature encourages countercyclical investing which is an important lesson from the endowment model. For instance, if equities have a big year and likely end up over their target, selling some to reinvest in bonds to restore the targets is a countercyclical move.

These strategies could help investors make sounder decisions. If investors could put into practice one lesson from endowments, it would be to think about what is best for the long term, rather than being pulled along by current sentiment.

This article first appeared in Forbes. This material contains opinions of the author, but not necessarily those of Sun Life or its subsidiaries and/or affiliates