As 2020 came to a close, our team looked back and discussed how fixed income managers might have weathered a turbulent period in the bond markets. As we look forward to an uncertain route out of the pandemic, we are focused on managing long duration credit portfolios with a goal to continue to add consistent alpha across market cycles.

Below we discuss some of the key tenets of our strategy and how they have helped us deliver for our clients across a variety of market environments.

First, managing long duration assets can be a little different to other spots on the yield curve.

When it comes to managing corporate bond portfolios, shorter and longer duration portfolios have a lot in common – Fundamental credit research is key to both, active management can exploit market inefficiencies and the ability to execute and implement trades can make the difference between a good idea and monetizing real returns. However, when it comes to consistently adding alpha, there is one key difference.

Long duration portfolio management is dominated by price return, not income return – In shorter duration portfolios, many managers look to out-yield the benchmark. They take on additional credit exposure by selecting issuers and securities where they believe the yield compensation outweighs the additional risk or liquidity profile that they are being compensated for. Over time, managers can expect to earn this additional yield premium and outperform the benchmark.

In long duration portfolios the benefits of additional yield in lower quality issues can easily be wiped out by small spread movements – The duration of the long credit benchmark (~14.5 years) means that even a moderate widening in spreads can cause a fall in price that erases multiple years of income returns. Therefore, moving down in quality, or liquidity, to chase extra yield or spread in the long end of the curve is not always a winning strategy. Instead, we believe exploiting pricing relationships between individual names, capitalizing on spread tightening and actively capturing those returns provides a more consistent approach to outperforming long duration benchmarks.

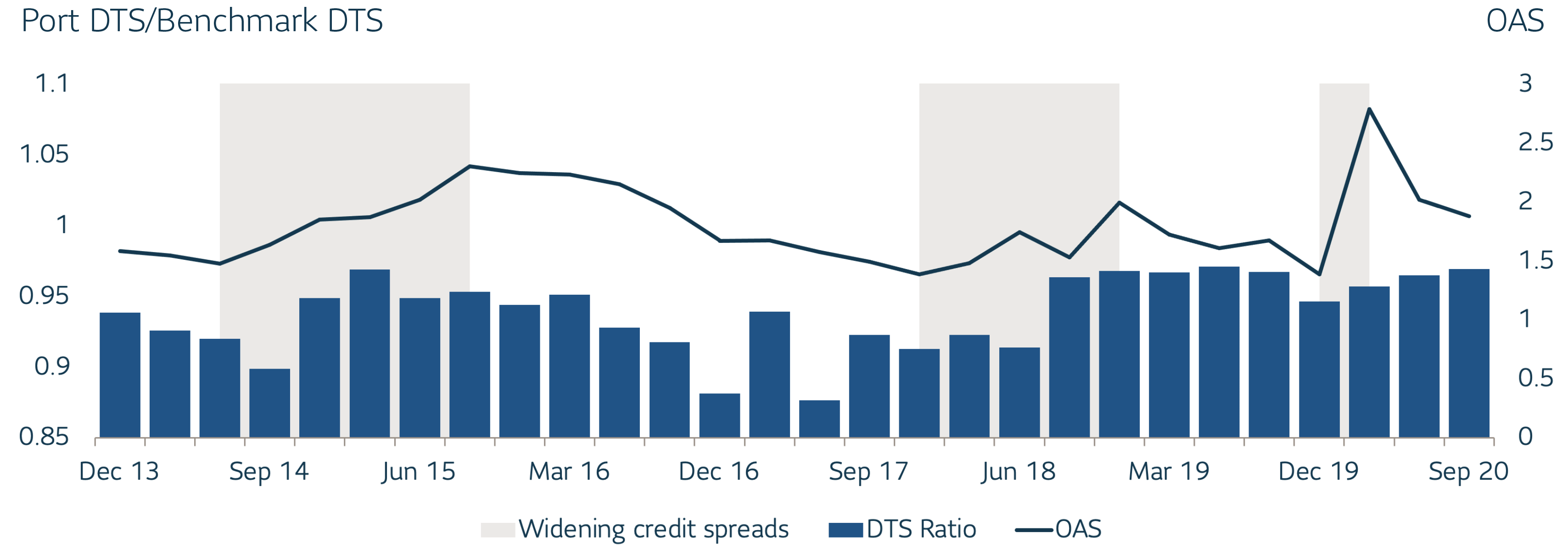

The chart below shows how we have outperformed while still keeping the average Duration Times Spread (DTS) for our long credit strategy below that of the benchmark – DTS is calculated by multiplying the spread-durations and the credit spread of each holding, creating a measure of overall credit exposure in the portfolio. Historically, we rarely look to outperform by simply having more credit risk than the benchmark. This is illustrated below by the ratio of DTS for the portfolio compared to DTS for the benchmark typically being less than one. We prefer to drive performance in a risk-controlled manner through security selection with the goal of higher risk adjusted returns and lower overall portfolio volatility.

Nimble active management without excess DTS

Source: Bloomberg

There is a tendency to try and split fixed income managers into top-down or bottom-up managers. The truth is, like most managers, we fall somewhere in the middle. We look at those longer-term macro themes to try to understand the broader trends and the potential impact on names we invest in. However, we’re not looking to hold excess credit risk over the long run, or take a position on rates in our portfolio. We’re always duration neutral and typically under-yield the benchmarks in our long strategies. We’re trying to beat the benchmark by being more efficient, exploiting short-term pricing inefficiencies and having good sell discipline to monetize those ideas as they play out. Historically this style has provided competitive excess returns with a lower risk profile that protects the downside in risk off environments. This squares well with an LDI framework where the goal of the bond portfolio is to provide interest rate hedging and low equity correlation on the downside. It’s worked well for us in different environments, especially when we’ve seen volatility in the markets.

– Rich Familetti, CIO U.S. Total Return Fixed Income

Second, “Long duration” does not only mean a long time horizon.

As security selectors, we believe strongly in fundamental credit research. Our global research team of 39 analysts conducts deep dive credit research into the names in which we invest. However, there can be a misconception when managing long duration assets that the timeframe for those credit views is also extended. While we might exclude issuers and issues where we have longer-term worries about their ability to meet debt obligations, especially where these aren’t being reflected in pricing, the timeframe we look at for inclusion in a portfolio is often much shorter.

Our average turnover of close to 100% allows us to exploit short term pricing inefficiencies. Turnover of 100% means that on average, a bond has a lifetime in the portfolio of close to one year. While we are focused on the credit worthiness of an issuer over the longer-term, the buy/sell decision is also heavily influenced by shorter-term pricing relationships. This allows us to actively exploit pricing inefficiencies in the market that are often driven by technical relationships rather than by changes in the underlying credit fundamentals.

This approach typically leads to a higher information ratio through a portfolio that expresses many smaller active positions rather than a few large macro bets. Understanding pricing relationships means taking into account factors such as the levels of leverage, liquidity, ratings and where other names in the sector are trading. This style - balancing longer-term credit views with shorter-term price changes - has helped us to outperform in multiple market environments. For clients with an LDI focus, or those that utilize a multimanager arrangement, it can provide a diversified source of alpha against both liabilities and other managers.

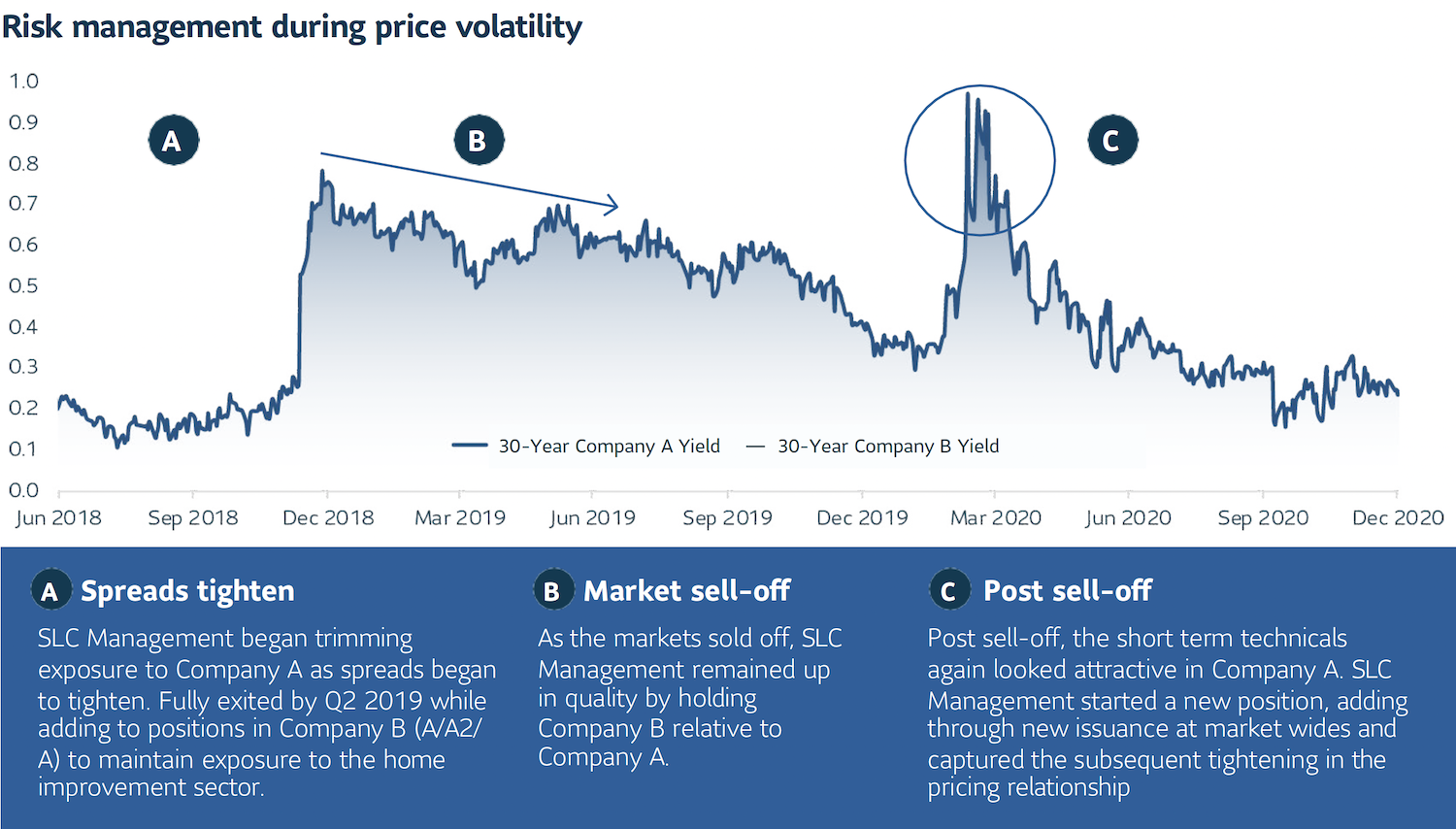

Below is an example of a pricing relationship between two issuers in the retail home improvement industry. We may be comfortable holding both issuers in our portfolio based on longer-term credit fundamentals. The decision over which issuer is included in the portfolio reflects those long term views, but also how the pricing relationship is moving and whether we believe the technical factors driving it will reverse.

In December 2018, a U.S. retailer, rated A-/A3, announced plans to double its pace of share repurchases and increase leverage from ~2x to 2.75x, subsequently generating a downgrade by all rating agencies (Baa1/BBB+) and fundamentally changing the pricing relationship between Company A and Company B.

Source: Bloomberg. Shown for illustrative purposes only. The securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

The ability to balance credit fundamentals against shorter-term price volatility is a key part of how our research team interacts with our desk analysts and portfolio managers. We have a dedicated research group of 39 people that support all our public fixed income desks. They are looking at anything and everything that could affect our view of a credit, both short-term changes to metrics like leverage and reported earnings through to longer-term factors like ESG policies. Our desk analysts and portfolio managers across the firm utilize this research but also overlay it with daily price relationships. Understanding and acting when those price movements aren’t justified by changes in the credit is a key part of how we add alpha for our clients.

– David Hamlin, Senior Managing Director, Public Fixed Income, North American Credit Research

Finally, your investment strategy is only as good as your execution.

In the long duration space we believe in an actively traded portfolio that emphasizes price volatility over excess risk and yield. Successfully executing this strategy requires that a number of factors align in order to turn good trade ideas into successful alpha.

Liquidity plays a primary role – In shorter-duration portfolios, a bias towards less liquid, or off-the-run securities, can be a great way to add yield that can be converted to alpha as the bonds mature. However, the additional price sensitivity in longer-duration portfolios means that excess yield is often secondary to the ability to trade a bond as a pricing relationship changes. This often leads to a greater focus on liquidity in our long credit portfolios. Taking liquidity risk is an active decision for us in long duration strategies. We move to a more liquid portfolio when this risk is at a premium and seek opportunities when the market is starved for liquidity.

The nature of our investment style, means that we are particularly defensive when credit spreads are tight versus historical levels – We favour moving up in credit quality rather than looking to add excess yield. While we cannot predict market turns, it does mean that we are usually positioned defensively when a catalyst appears to initiate a sell-off. This defensive positioning not only cushions against spread widening, but it also means we are ready to execute on ideas at attractive prices when the opportunity presents itself as it did in 2020.

Investment teams should be able to capitalize quickly on pricing moves. The nimble structure of our investment team, with desk analysts sitting side by side with portfolio managers who actively trade, means that decision-making happens on a real-time basis. This allows us to quickly capitalize on short-term opportunities that can be fleeting in an over-the-counter market.

I think 2020 was a great example of how we approach the long duration space. We outperformed over the period, net of fees, in our long credit strategy. I believe it’s illustrative of our style, that the outperformance was evenly split across both the risk-off environment in the first quarter and the risk-on environment that followed the market sell off. We were able to turn the portfolio exposures around quickly as the volatility changed the pricing dynamics in the market. Our ability to work side by side with our desk analysts allowed us to express our views quickly in a way that helped lock in real alpha for our clients. The fact we had positioned defensively coming into the crisis meant we had liquidity available to put our ideas to work.

– Annette Serrao, Senior Director, Portfolio Manager

SLC Management has been managing long duration bond portfolios for pension plans and other long-term investors since 1991. We approach the long duration space by marrying strong credit research with efficient, nimble active management. On average, our investment team has had annual outperformance (net of fees) in long credit strategies over that period, helping our clients to outperform their benchmarks and meet their long-term financial obligations.

Gross-of-fees returns are calculated gross of management and custodial fees, and gross of taxes on dividends and interest, and net of transaction costs. Net returns are net of model fees and are derived by deducting the highest applicable fee rate in effect for the respective time period from the gross returns each month.

This paper is intended for institutional investors only. The information in this paper is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this paper.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association. Registration as an investment adviser does not imply any level of skill or training.

Unless otherwise stated, all figures and estimates provided have been sourced internally and are as of December 31, 2020. Unless otherwise noted, all references to “$” are in U.S. dollars.

Nothing in this paper should (i) be construed to cause any of the operations under SLC Management to be an investment advice fiduciary under the U.S. Employee Retirement Income Security Act of 1974, as amended, the U.S. Internal Revenue Code of 1986, as amended, or similar law, (ii) be considered individualized investment advice to plan assets based on the particular needs of a plan or (iii) serve as a primary basis for investment decisions with respect to plan assets.

This document may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility.

Unless otherwise stated, all figures and estimates provided have been sourced internally and are current as at the date of the paper unless separately stated. All data is subject to change.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

Past results are not necessarily indicative of future results.

© 2021, SLC Management

SLC-20221024-2461750