Summary:

The Special Financial Assistance (SFA) program aims to top-up underfunded multi-employer plans1 and nudge them towards a liability driven investment approach. However, the relief could be less robust than originally anticipated due to the discount rate assumptions used and the benefits could be short-lived due to restrictions on how the assets can be invested. Given the significant impact of these funds, as well as the restrictions attached, plan sponsors may want to revisit asset allocation decisions at a total plan level to ensure an efficient approach.

What is it?

Under the American Rescue Plan Act of 2021 (ARPA), plan sponsors would receive a lump sum to help cover expected benefit payments (liabilities) through 2051, essentially making each plan “fully funded.” This provision does not cover liabilities going beyond thirty years, though they make-up a very small portion of the liability present value. Under ARPA, The Pension Benefit Guaranty Corporation (PBGC) issued an “interim final rule without notice period,” with the rule taking immediate effect. The PBGC did invite comments through August 11th and may update the rules in the future.

Investment options are constrained and heavily favor investment grade (IG) corporates:

To ensure that plan sponsors lock-in the newly improved funded status, the SFA funds come with some restrictions on permissible investments. Most notably, the funds are limited to investments in public investment grade fixed income, with a small sleeve (5%) reserved for downgrades post investment. The public market requirement also means that private credit is not permitted, even if it is investment grade. There is currently no specific wording for or against securitized assets.

The guidance explicitly notes that “this condition would effectively require plans to pursue a liability-driven investment strategy under which fixed income assets are matched to expected benefit payments to immunize the portfolio from risk."

Derivative use is restricted to maintaining a similar duration exposure that a cash bond portfolio could achieve. This restriction may limit the ability of plans to implement some hedging strategies. For example, plan sponsors cannot use futures or swaps to extend the duration of the portfolio beyond that of the liabilities, freeing-up the remaining assets for return seeking purposes.

Plan sponsors are provided the flexibility to invest through a variety of vehicles, including separately managed accounts or collective vehicles like private funds and ETFs. Sponsors are also still free to invest the non-SFA assets as they desire.

Funds come with restrictions on benefit improvements:

The PBGC’s stance on benefit improvements can be summarized as: “The funds can help you get out of this hole, but you can’t make the hole bigger.” Plans that accept SFA funds are prohibited from moves that increase the liabilities, which include but are not limited to increasing future benefit accrual rates, retroactive benefit improvements, or a reduction in employer contributions

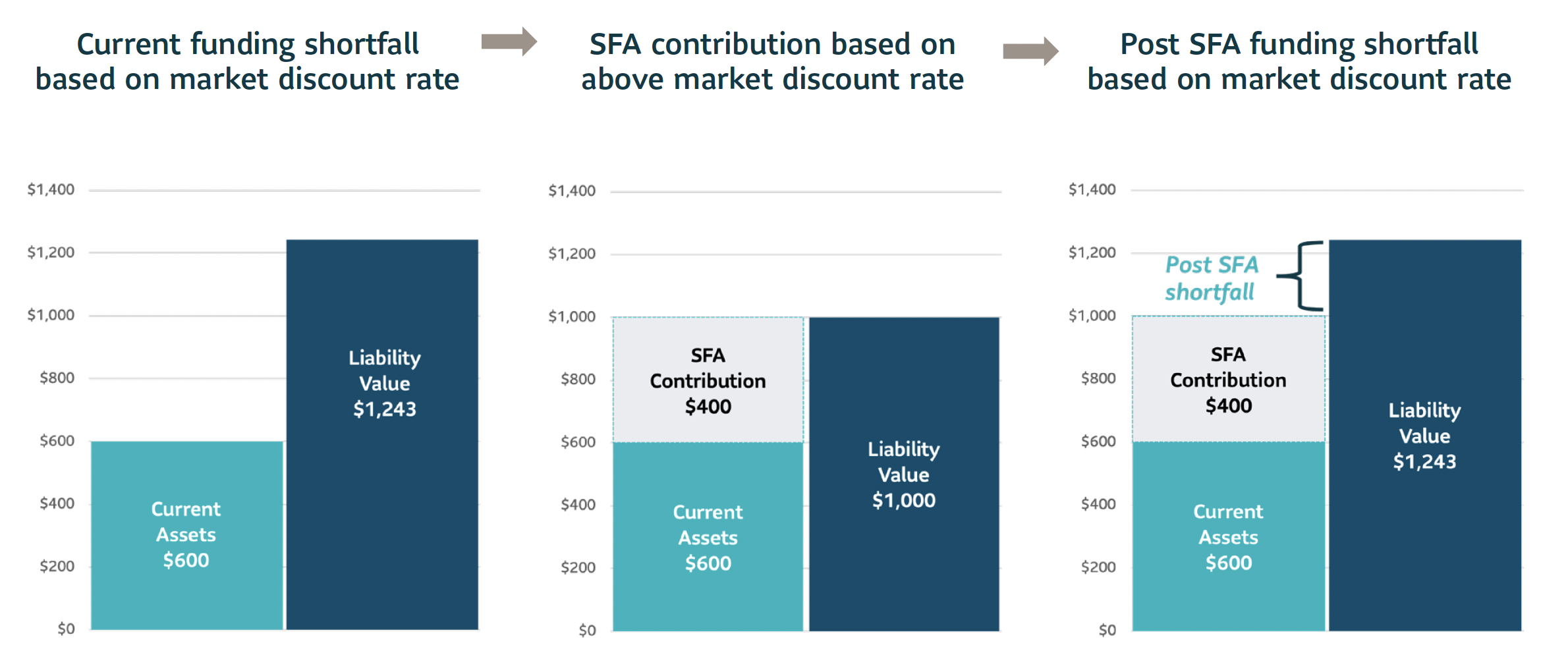

Higher discount rates used to estimate relief will likely result in underfunding again in the future:

The SFA funds will be issued based on a liability discount rate that could be about 2% higher than the rate at which the assets can be invested. The 2% estimate is based on the cap defined by the PBGC, which states that “The interest rate limit … is the rate that is 200 basis points higher than … any permissible rate for a month during the 4-month period ending … in which the plan’s application was filed”

Plan sponsors are therefore topped-up to “full funding” based on a lower liability present value (resulting from the higher discount rate). This means they may receive insufficient assets to be fully funded on a mark-to-market basis.

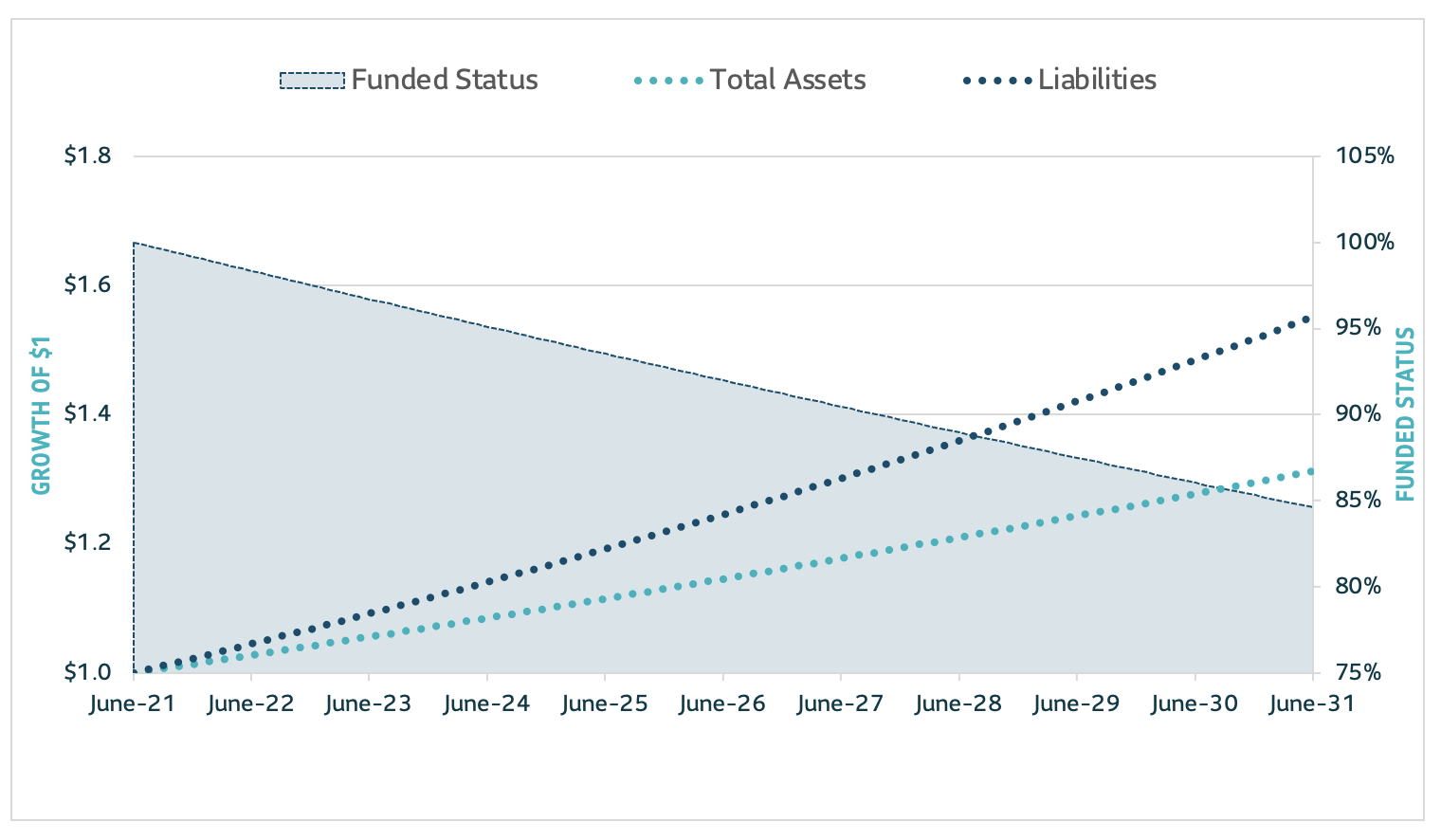

Over time, the difference between the discount rate and the return on the permissible assets will likely lead to plan sponsors seeing a decline in their funded status (measured on the SFA basis). The liability will accrue at its discount rate, all else equal, at a yield that is 2% higher than the assets in which the funds are invested.

Notes & Assumptions:

- Total assets have a 90% allocation to fixed income and 10% allocation to U.S. equities. The fixed income mix is designed to target an 100% liability interest rate hedge ratio.

- The liabilities are assumed to grow at the AA liability discount rate + 2% while the assets are assumed to grow at an EROA based on the current fixed income yield and an 8% equity return.

- We assume the yield curve remains unchanged over time.

Investment implications:

The key for plan sponsors looking to maintain funded status is investing the additional assets within the framework provided, while also balancing the competing needs of liability hedging and closing the 2% yield gap.

In the fixed income portfolio, it may mean an additional focus on corporate bonds, as low yielding Treasuries accentuate the yield differentials. At SLC Management, we believe it should also mean an emphasis on active managers who can consistently add alpha above their benchmarks.

It may also require rethinking your investment strategy within the less restricted “non-SFA” assets, as plan sponsors could potentially reposition these assets to account for the more conservative investment of the SFA assets. In this case, investments in alternative higher yielding assets such as private fixed income, real estate debt or infrastructure debt may prove beneficial.

Funding relief has come at a crucial time for many plan sponsors, despite the limitations and restrictions imposed on the assets. With many plan sponsors seeing significant changes in funded status, we believe it is an important time to revisit the investment strategy and recalibrate for this new dynamic. At SLC Management, we work with plan sponsors across the corporate, public, and multi-employer plan sectors to help them understand the inherent risks in their investment strategies and build traditional and alternative solutions to meet their goals.

1 A multiemployer plan is a pension plan created through an agreement between two or more employers and a union. The employers are usually in the same or related industries, like construction or transportation. Multiemployer plans are run by a board of trustees, with an equal number of employer and union trustees.

The information in this paper is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this paper.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association. Registration as an investment adviser does not imply any level of skill or training. There is no assurance that the objective of any private placement strategy can be achieved. As with any strategy, the Advisor’s judgments about the relative value of securities selected for the portfolio can prove to be wrong.

Unless otherwise stated, all figures and estimates provided have been sourced internally and are as of December 31, 2020. Unless otherwise noted, all references to “$” are in U.S. dollars.

This document may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility. Unless otherwise stated, all figures and estimates provided have been sourced internally and are current as at the date of the paper unless separately stated. All data is subject to change.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

© 2021, SLC Management

SLC-20221102-2462392