The National Association of Insurance Commissioners (NAIC) is currently reviewing proposed changes to its Risk-Based Capital (RBC) charges related to real estate for life insurance companies. The RBC system is periodically updated to meet the changing regulatory environment.

This review is expected to be completed by the end of June and if approved, changes should be effective for year-end 20211 . This could have a significant impact on the attractiveness of real estate holdings held in fund vehicles. Given the appeal of the asset class – especially in the current low interest rate environment – we expect any change that improves the capital treatment and accessibility of the asset class to have a meaningful positive impact on life company allocations.

What is changing?

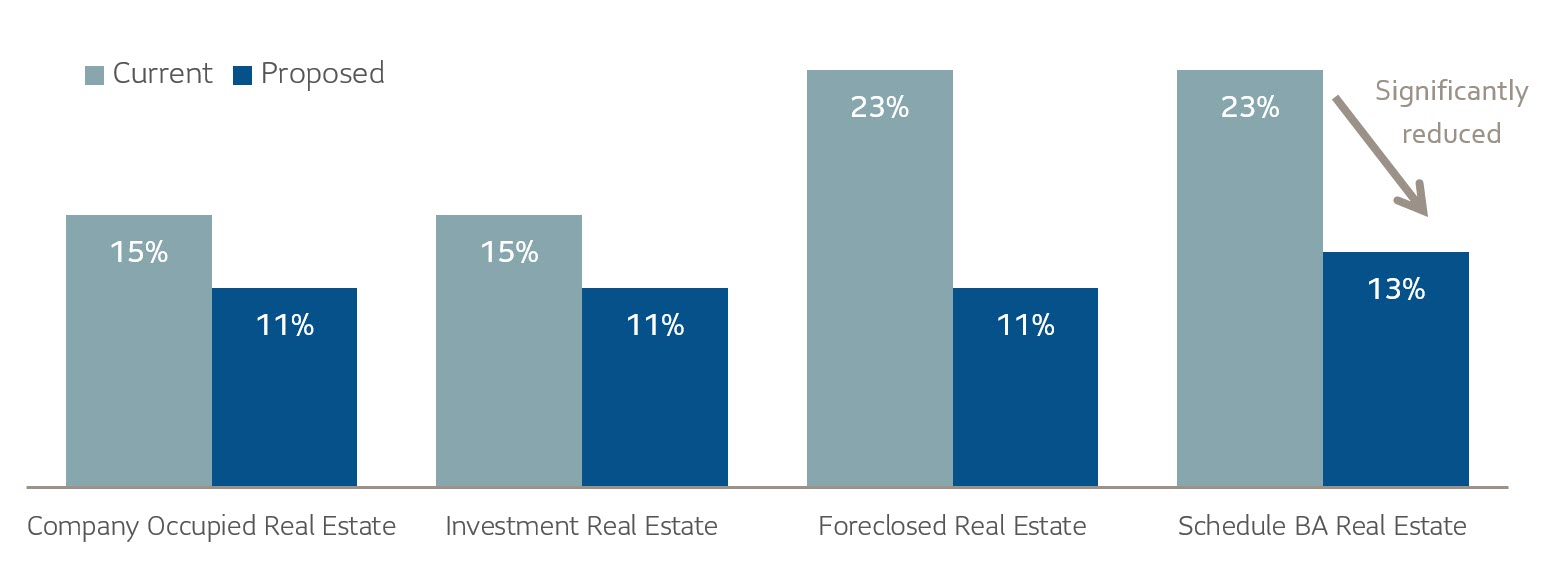

1. Schedule A risk charges for Real Estate under the proposal will be reduced from 15% to 11% (23% to 11% for foreclosures), including:

- Company owned buildings

- Company owned buildings for income purposes

- Foreclosed real estate (properties acquired in satisfaction of debt)

2. Schedule BA risk charges for Equity Real Estate under the proposal will be reduced from 23% to 13%, including:

- Joint Ventures, Partnerships and Limited Liability Companies’ investments in real estate

3. A structural change for the treatment of mortgages in the RBC calculation is also being considered. This could be significant for companies that have mortgages within their real estate investments2.

Illustration 1: Proposed changes to RBC Real Estate Risk Charges, by investment type

Why make changes?

The current risk charge for real estate investments reported on Schedule A is 15%, which was derived based on the suggested relationship between common stock and real estate volatility in 2000. At that time, there was little data available on the performance of real estate assets. Equity real estate reported on Schedule BA was given a risk charge of 23% under a presumption that it was more highly levered than company-owned real estate.

The proposed risk charge of 11% was developed based on real estate performance from the NCREIF Property Index (NPI) over the period of 1978 – 2012. The result of NPI analysis suggested a much lower risk charge for real estate – even as low as 9.5% – would be more than adequate to cushion against potential losses.

What does this mean for investment strategy?

The proposed changes will reduce the real estate equity risk charge significantly. Historically, investments in mortgages represented 13% of life company investment portfolio vs. only 1.2% allocation for real estate equity.

If the lower capital charges are fully adopted, we expect the reduced risk charge for real estate equity vehicles to fuel increased demand, as the ratio of return to required capital will be significantly more favorable than the current model.

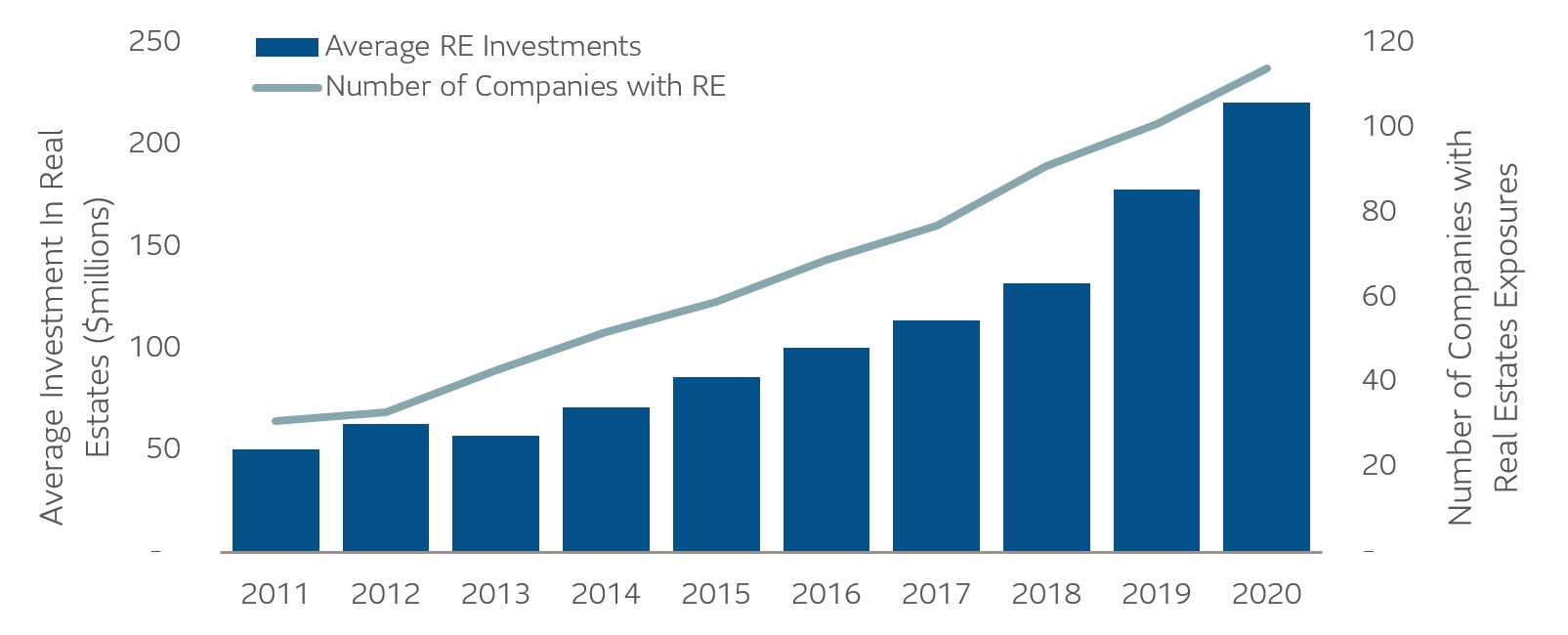

Low interest rates and diversification benefits have already contributed to an increased allocation to real estate over the years (see illustration 3 below). With the reduction in the RBC risk charges, we will likely see this trend accelerate.

Illustration 2: Current RBC charge comparison between real estate and commercial mortgages

| Current Risk Charges | Proposed Risk Charges | ||

|---|---|---|---|

| Commercial Mortgage - CM 1 | 0.9% | 0.9% | |

| Commercial Mortgage - CM 2 | 1.8% | 1.8% | |

| Commercial Mortgage - CM 3 | 3.0% | 3.0% | |

| Schedule A Real Estate, excluding foreclosures | 15.0% | 11.0% | |

| Schedule A Real Estate foreclosures | 23.0% | 11.0% | |

| Schedule BA Real Estate (i.e. Real Estate Equity) | 23.0% | 13.0% |

Illustration 3: Life Insurance Companies have increased investment in Real Estate Assets3 over the years

Reclassifying existing assets

Currently, the minor difference between risk charges for real estate (23%) and other investments (30%) on schedule BA means fund managers are not incentivized to reclassify an investment. However, the proposed changes create a strong motivation for managers to reassess whether an investment could be considered to have characteristics of underlying real estate. Movements between subcategories on Schedule BA do not require re-evaluation of prices, and thus would not trigger gain/loss or repricing. This would allow insurers to quickly adopt these changes and lower their required capital.

Inflation fears could add fuel to the fire

As the market begins to examine the possibility of future inflation, SLC Management anticipates an increased interest in real estate, as it is often seen as a hedge to inflation. Compared to other assets, real estate offers higher diversification benefits to insurance company portfolios, resulting in higher expected returns and lower overall risk.

A reduced risk charge, along with an increased desire for yield and inflation protection, means that investment into real estate equity could potentially be a significant addition to life insurers’ portfolios in 2021 – 2022.

We offer real estate equity and debt investments through BentallGreenOak, an SLC Management company. BentallGreenOak is a leading, global real estate investment management advisor, serving the interests of more than 750 institutional clients with expertise in the asset management of office, retail, industrial and multi-residential property across the globe.

1 This proposal is developed for the Life and Fraternal Risk Based Capital formulas and does not directly address risk charges for Health Risk Based Capital or for Property & Casualty Risk Based Capital.

2 Details on the proposed changes for investments with mortgages are illustrated in Appendix A

3 Data from SNL as of 12/31/2020

The information in this paper is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this paper.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association.

This document may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility. Unless otherwise stated, all figures and estimates provided have been sourced internally and are current as at the date of the paper unless separately stated. All data is subject to change.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

© 2021, SLC Management

SLC-20221101-2462413