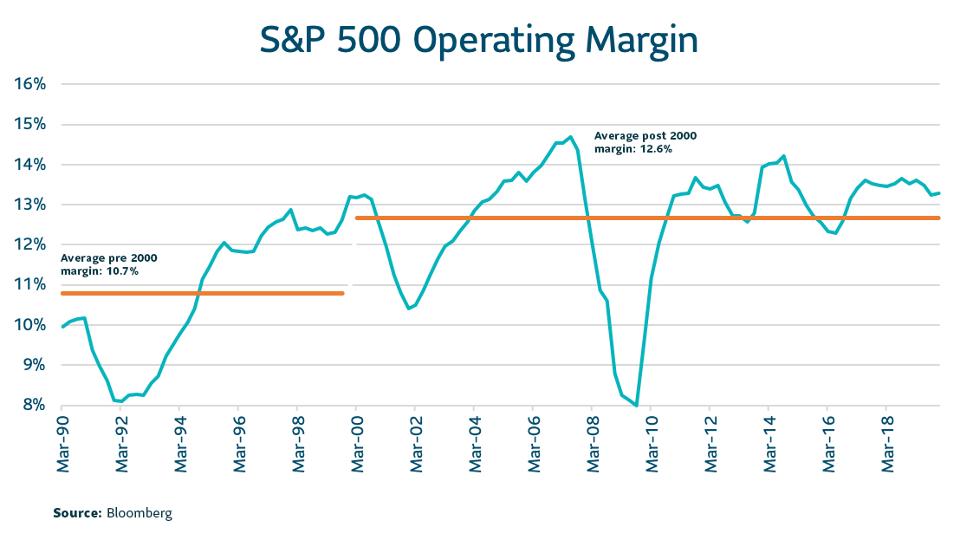

Over the past 20 years, larger companies across different sectors have built a moat around their businesses. That fortified position could protect profit margins for some time to come.

S&P500 Operating Margin SLC MANAGEMENT; SOURCE BLOOMBERG

Bigger Companies, Fewer Competitors

In the last two decades there has been widespread consolidation within industries. In their assessment of public markets, Jonathan Tepper and Denise Hearn’s book, The Myth of Capitalism, reports the extent of industry concentration. Industries such as banking, telecommunications, pharmaceuticals, airlines and social media, to name a few, are dominated by a handful of major brands.

Meanwhile, over this same period, regulations have increased. That builds a barrier to entry to smaller players in many industries, as the complexity requires significant resources to navigate and optimize the competitive landscape.

Similar research from Gustavo Grullon, Yelena Larkin and Roni Michaely confirmed that significant concentration occurred for more than three-quarters of U.S. industries. In fact, in many industries there are just four dominant players.

Unsurprisingly, they found that companies within highly concentrated industries realized higher profits and a greater return on assets. Expanding profit margins was the key driver, as asset utilization and productivity didn’t change that much. Their research also shows that mergers and acquisitions in the same industry, tended to increase profits.

In explaining this shift to more rampant concentration, the authors highlight that since the early 2000s, the number of antitrust enforcements declined, creating a supportive environment for industry consolidation.

They also suggest that technology innovation is likely creating barriers to entry. Over the last several decades, the investment in tangible assets relative to output has remained flat while non-tangible asset investment has doubled.

In line with that, Grullon, Larkin and Michaely found that patents are concentrated among the larger companies. And this patent concentration is highly correlated with the resulting share of sales. Therefore, sophisticated technology seems to be driving value and scale, which new entrants struggle to match.

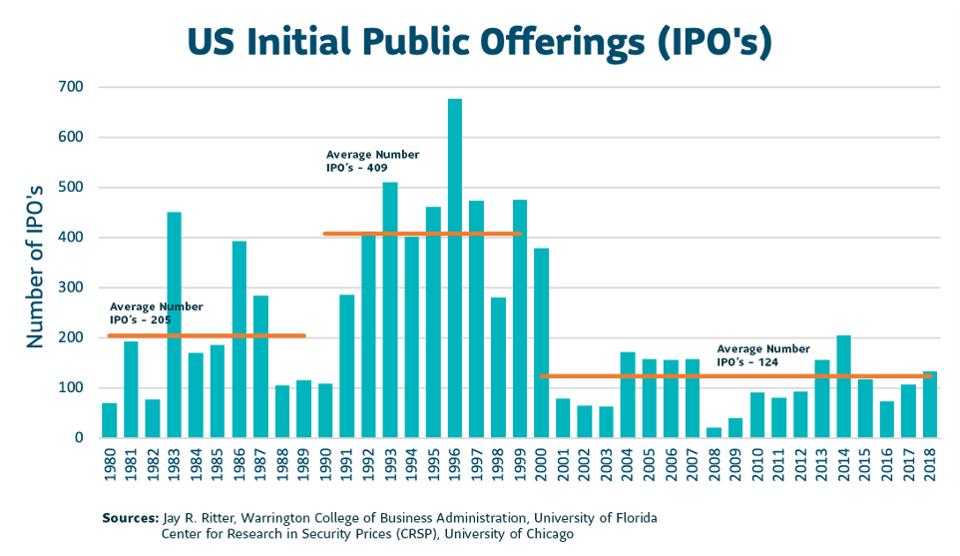

IPO’s Have Dropped

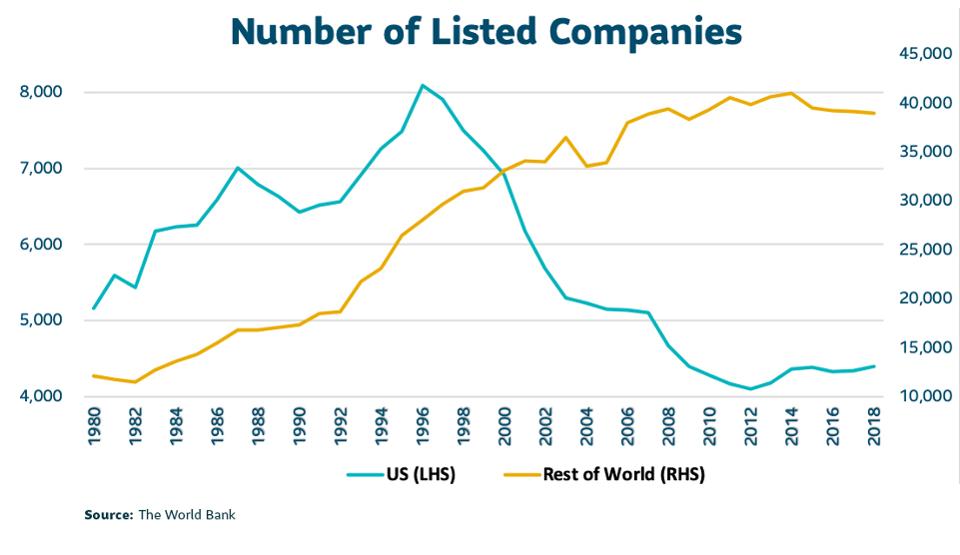

At the same time, over the last 20 years, the number of public companies have been cut in half.

Number of Listed Companies SLC MANAGEMENT

This is a U.S. phenomenon, as the rest of the world has seen a 40% increase. Mergers and acquisitions account for some of the dip in the U.S., but the biggest culprit is that fewer companies are racing to go public.

Post-crisis, the number of IPOs has averaged around 125 per year. That’s modest compared to the exuberance of previous decades. The 1990s saw an average of more than 400 companies a year go public. And even during the tame 1980s, IPOs averaged over 200 a year.

IPOs Have Dropped SLC MANAGEMENT

Why Are Companies Staying Private For Longer?

Reporting demands and increased regulation over the last few decades are some of the reasons companies decide to stay private for longer.

However, another insight is highlighted in the research paper “Eclipse of the Public Corporation or Eclipse of the Public Markets” by Doidge, Kahle, Karolyi and Stulz. It suggests that private companies avoid public markets for longer because more of their assets are intangible.

If a private company’s value is built on R&D insights, having to prematurely reveal sensitive details as part of an IPO could erode their competitive advantage. Better to delay and seek private capital. And this is how the market is evolving. Prior to the crisis the median age of a company launching an IPO was 8 years, now it’s 11 and a half.

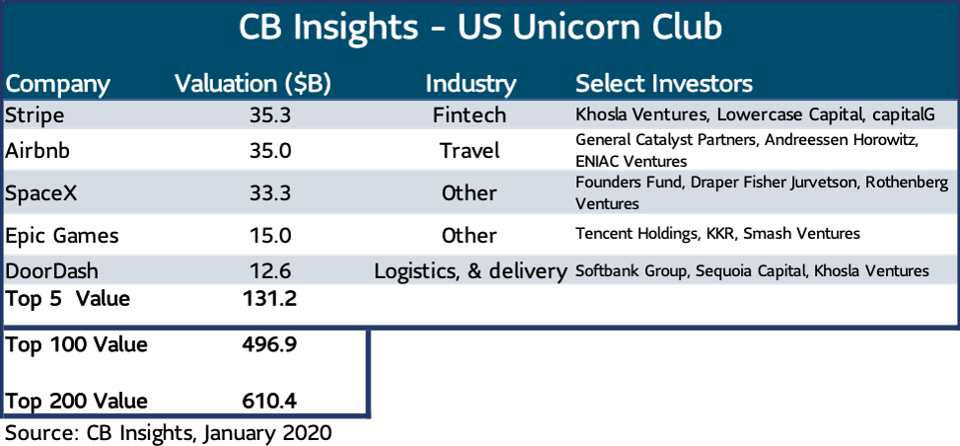

Meanwhile, private companies have easy access to capital as there is an abundance of private equity investors. This has resulted in over 200 U.S. private companies that have a valuation of $1 billion or more (the “Unicorns”). The top five alone - Stripe, Airbnb, SpaceX, Epic Games and DoorDash - have a combined value of $131 billion.

US Unicorn Club SLC MANAGEMENT, CB INSIGHTS

As the economy grows more digital, intangible assets are becoming the norm for many companies. This can lead to greater concentration and a “Winner Takes All” outcome for early leaders.

The impact from network effects is also increasing. Across electronic platforms, once users hit critical mass the benefits of remaining “a member of the community” are compelling. Facebook (FB), Google (GOOGL) and Amazon (AMZN) are all examples. As early movers, these platform companies have enjoyed a dominant advantage.

The composition of the public market is changing. Mastering regulation and aggressively adopting technology are becoming major competitive advantages. Concentration is increasing, generating higher profit margins for the winners.

Meanwhile, private companies are staying private longer. With ample access to capital they can continue to scale and guard intellectual property. They can also avoid hostile takeovers.

Investors need to recognize these seismic shifts and realize that enterprise value is driven more and more by intangible assets.

This article first appeared in Forbes. This material contains opinions of the author, but not necessarily those of Sun Life or its subsidiaries and/or affiliates.