Jim Reid, who heads Global Fundamental Strategy at Deutsche Bank, chunks the last 160 years of the modern economy into five major cycles and concludes we are embarking on a sixth. In our post-pandemic era, we seem ready for a surge that will be accelerated by digitalization.

Reid deems the coming super cycle the ‘Age of Disorder,’ defined by political shifts to younger progressives, massive debt loads and sharper geopolitical clashes. We would add to this the potential for productivity breakthrough that seems to be percolating - that could dominate other factors, resulting in a transformational ‘Age of Digitization’. Since being attentive to these shifts is key to improving investment performance, being in tune with the unfolding cycle and adopting new technology will be critical to success in the coming years.

Historic Economic Cycles

Reid gets his lens out annually to see what’s in store for long run asset returns. In a Covid-19 disrupted world the parameters of the next cycle are far from certain. For insight, he reflects on the last five major cycles, spanning the past 160 years, each with different attributes.

The first cycle from 1860 to 1914, was the first era of globalization. Trade increased as populations grew, leading to well-contained inflation and good performance for both equity and bonds.

World War I was the start of the “great wars and depression cycle.” From 1914 through 1945, international cooperation was stymied, trade stalled and severe recessions hit. Inflation oscillated between high and low, indicating that the era was unequivocally the most turbulent multi-decade period in the last two centuries. Most asset classes struggled with poor returns.

After World War II to 1971, there was global coordination of currency management. The Bretton Woods agreement established a return to the gold standard with the U.S. dollar pegged to it, and other currencies managing to a tight range with the dollar. That stability ignited growth. Using financial repression, countries reduced war-related debt. Inflation was contained and the social safety net expanded as populations grew.

The 1970s hit with rampant inflation, causing the disintegration of the Bretton Woods system as the need for dollars grew more quickly than the gold supply. With the U.S. unwilling to constrain its growth, it abandoned the gold standard. The ensuing economic instability battered the world. The aggressive surge in inflation pummeled equity and bond markets for an entire decade, and the only asset that really held its value was commodities.

Finally, the second era of globalization emerged in 1980 as China reengaged with the West. Outsourcing increased, and when China joined the World Trade Organization (WTO) in the early 2000s, supply chains were already a sophisticated series of global handoffs. The unification of Germany and an expanding European Union added to global growth, doubling the share of GDP of trade from where it was when the U.S. left the gold standard.

This modern globalization cycle has had a twenty year run. Equity and bond returns were strong on the back of solid growth, attentive central banks, modest inflation and low rates that extended the business cycle. However, peak globalization was cresting just as the U.K. pursued its Brexit agenda and the U.S. welcomed Donald Trump as a president with an appetite for trade sanctions. At this point, a return to unfettered global trade seems unlikely.

Where Are We Heading

So, where do we go from here? Reid thinks we are entering the sixth stage, which he calls the ‘Age of Disorder’. China is likely to surpass the U.S. as the largest economy. Debt will push higher as ongoing relief is needed to restore jobs and businesses that were damaged during the pandemic and are at risk of becoming permanently dislocated. Younger cohorts will become a larger voting block and favor more spending on progressive policies and climate change awareness.

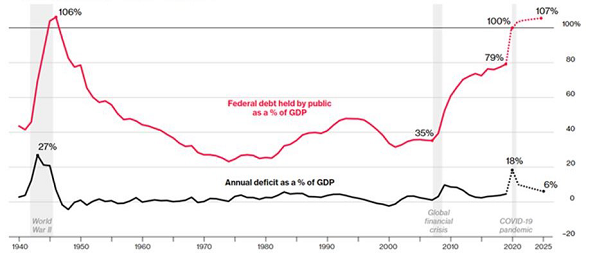

High debt loads will be an issue, as there has been a greater reliance on debt over the last several decades. The pandemic has exacerbated this as countries rushed to save their economies by stemming the stress of lockdowns. Indeed, the International Monetary Fund (IMF) expects debt-to-GDP to revisit the elevated levels last seen at the end of World War II.

Debt Projection Exceeds Economic Output

Source: Committee for a Responsible Federal Budget, Congressional Budget Office, Bloomberg data

Debt Projection Exceeds Economic Output SLC MANAGEMENT

Breakthroughs In The Pipeline

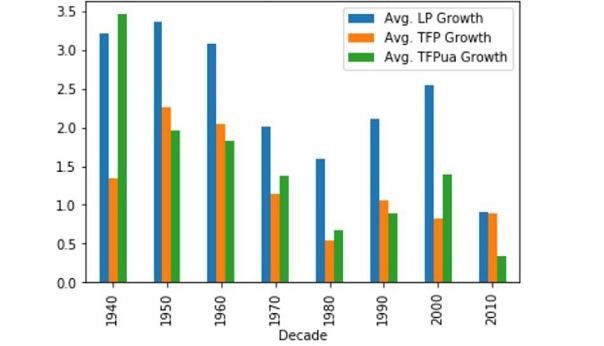

All this may lead to a grim outlook, but there are reasons to cheer. While productivity growth has been disappointing for at least a decade, we appear to be surrounded by blistering breakthroughs in artificial intelligence, robotics and cloud computing. Our fortunes may be about to change.

Recent research suggests that broad technologies like artificial intelligence that have the potential to impact a wide range of industries, takes time to evolve. They call this the “productivity J curve”. The essential nature of this curve is that while companies develop the infrastructure to embrace new technologies, investment goes unmeasured, but once it’s rolled out, productivity surges.

U.S. TFP and Labor Productivity Growth (percent) by Decade

U.S. Productivity Growth (%) by Decade

Source: Brynjolfsson, Rock and Syverson “Artificial Intelligence and the Modern Productivity Paradox”, NBER December 2017

U.S. TFP and Labor Productivity Growth by Decade SLC MANAGEMENT

The recent success of work from home for some sectors was leveraged entirely by technology. Many companies seem likely to continue to fortify this resilience with greater investment and quicker adoption of technology. A global company survey conducted by the World Economic Forum found that 80% of companies intend to accelerate technology adoption.

A critical feature in economist growth models is total factor productivity - it is the ability of some new innovation or process to scale what we already have. In boosting inputs we can grow faster than trend, debt can be contained quicker, and wages can accelerate without stoking inflation.

Indeed the next era could well be an “Age of Digitalization.” The pandemic has amplified this need and we have an arsenal of technologies already in place, ready to be leveraged in what could be a super growth cycle.

This article first appeared in Forbes. This material contains opinions of the author, but not necessarily those of Sun Life or its subsidiaries and/or affiliates.