Explore institutional insights

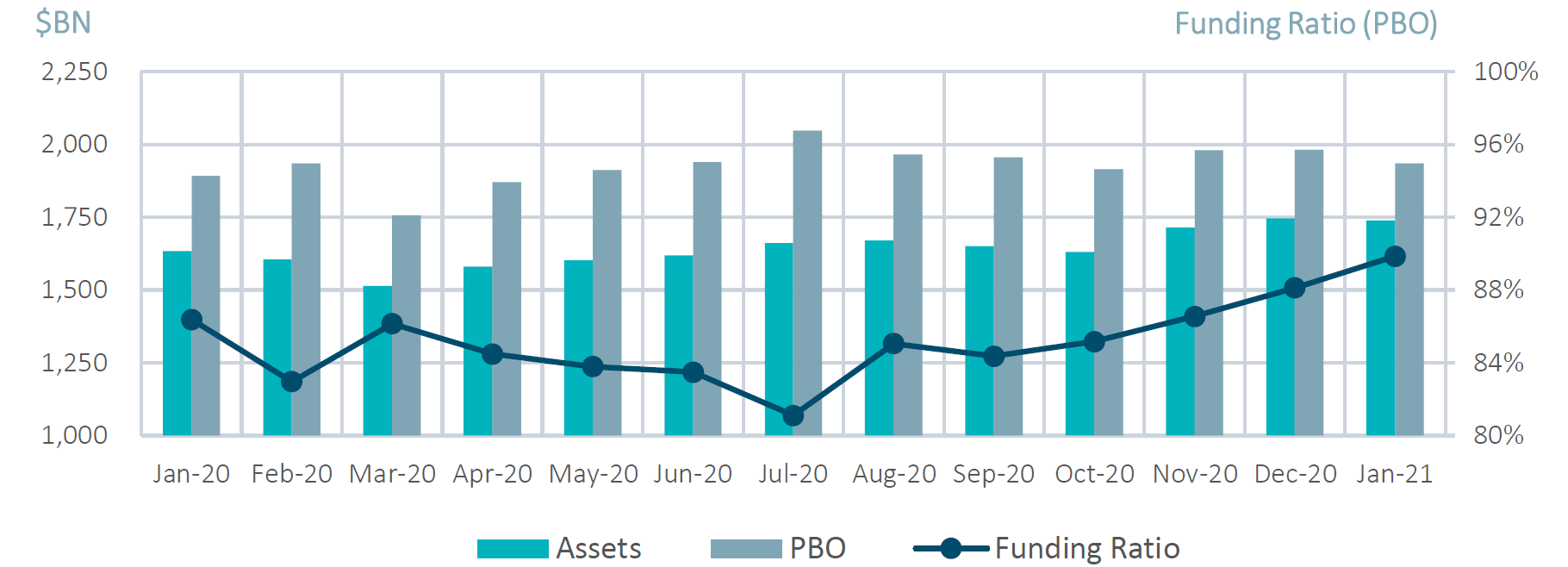

Rise in discount rates increased funded status by nearly 2%

January Market Summary

- Average funded status was up by 1.7% over the month: Assets returned

- 0.2% while an increase in discount rates decreased liabilities by 2.1%. 2020 up 16.3%.

- S&P 500: The S&P 500 had its first negative month since October, declining 1.1% in January.

| Market Watch | Dec 2018 | Dec 2019 | Dec 2020 | Jan 2021 |

|---|---|---|---|---|

| Funded status | 87% | 90% | 8% | 90% |

| CITI discount rate1 | 4.05% | 3.01% | 2.23% | 2.43% |

| Long Credit yield1 | 4.89% | 3.63% | 2.78% | 2.98% |

| U.S. 30Y TSY yield | 3.01% | 2.39% | 1.64% | 1.83% |

| S&P 500 | 2,507 | 3,231 | 3,756 | 3,714 |

- The yield on the Bloomberg Barclays Long Credit Index increased 20 basis points (bps): Credit spreads remained roughly unchanged month over month while long end rates increased 21 bps².

- Steepening yield curve environment: The 2 year Treasury yield dropped 1 bps while the 10 and 30 year yield increased 15 and 18 bps, respectively.

- Investment Grade (IG) Corporate Issuance After a record setting year in 2020, IG issuance posted $110B in January, an increase from the typically quiet month of December, but a 23% decrease compared to January 2020.

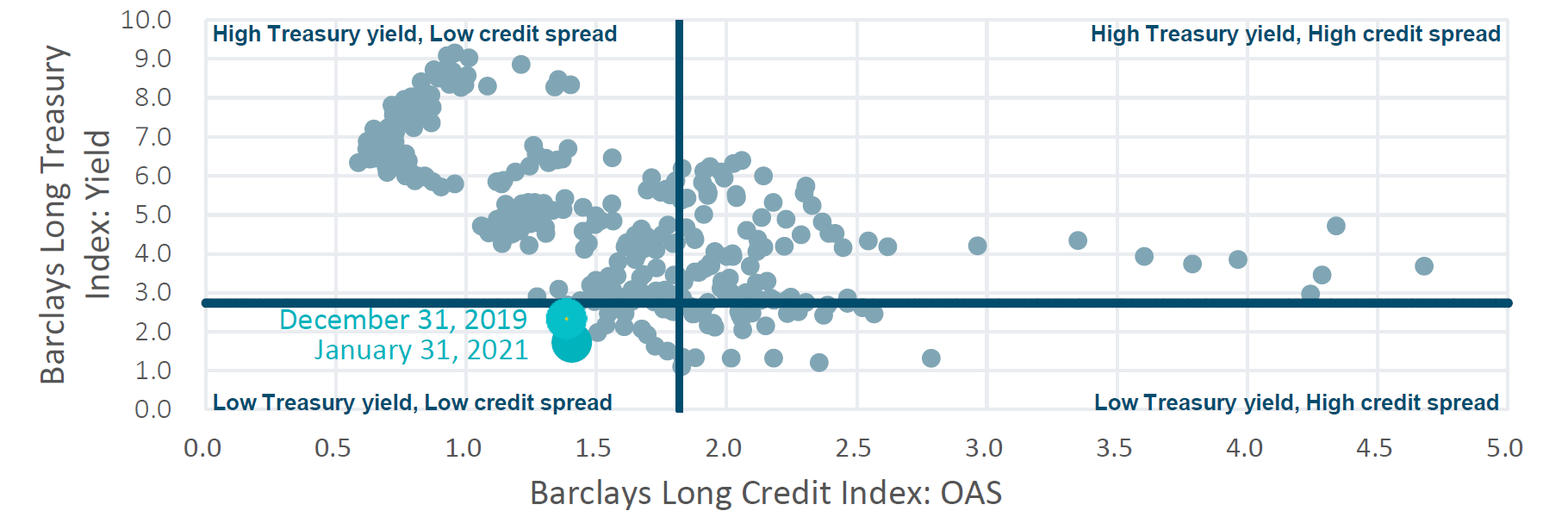

Long credit spreads vs. long Treasury yields

Spotlight: Tight spreads in credit markets

- The flood of liquidity from the Fed has continued to push up risk asset prices. M2, the measure of money supply, has ballooned by 27% from $15.4TN to $19.6TN over the last 12 months.

- At the end of January, long credit OAS stood at 137bps, which is inside the level of 150bps from a year ago, prior to the Covid-19 market sell off.

- Similarly , in equity markets, the P-E ratio of the S&P 500 index has increased from 24 a year ago to 38 today.

- The Treasury curve has also steepened significantly based on inflation concerns, and the 2s-10s spread now stands at 0.96%, its steepest level in about 3.5 years.

- While there is some sentiment that spreads are due for a move wider, there is no obvious catalyst. Therefore, despite concerns, many investors might not be willing to dial down credit exposure for fear of missing out on returns as spreads continue to grind tighter. However, one option is to consider moving up in quality, to maintain credit exposure while buffering against a sell-off.

- In long credit portfolios it is important to balance the diversification benefits of holding BBB-rated corporates against the larger potential price impact they face during a market sell-off. When spreads are tight like they are now, the risk reward of being down in quality becomes more asymmetric in a negative manner.

- As a result, at SLC Management we have looked to reduce our exposure to BBBs in our long credit portfolios. This also means moving away from industrials and adding to utilities and financials.

- In contrast to public markets, private market spreads have not fully retrenched to their previous tights post the Covid sell-off. A strategic allocation to private credit not only could provide additional yield, but also a diversified source of credit exposure that could buffer against a market sell-off.

Milliman Pension Funding Index

¹ The CITI discount rate corresponds to the FTSE short pension liability index. The Long Credit yield corresponds to the Bloomberg Barclays Long Credit Index.

² Data from reference Bloomberg Barclays Indices. Issuance data sourced from SIFMA.