Explore institutional insights

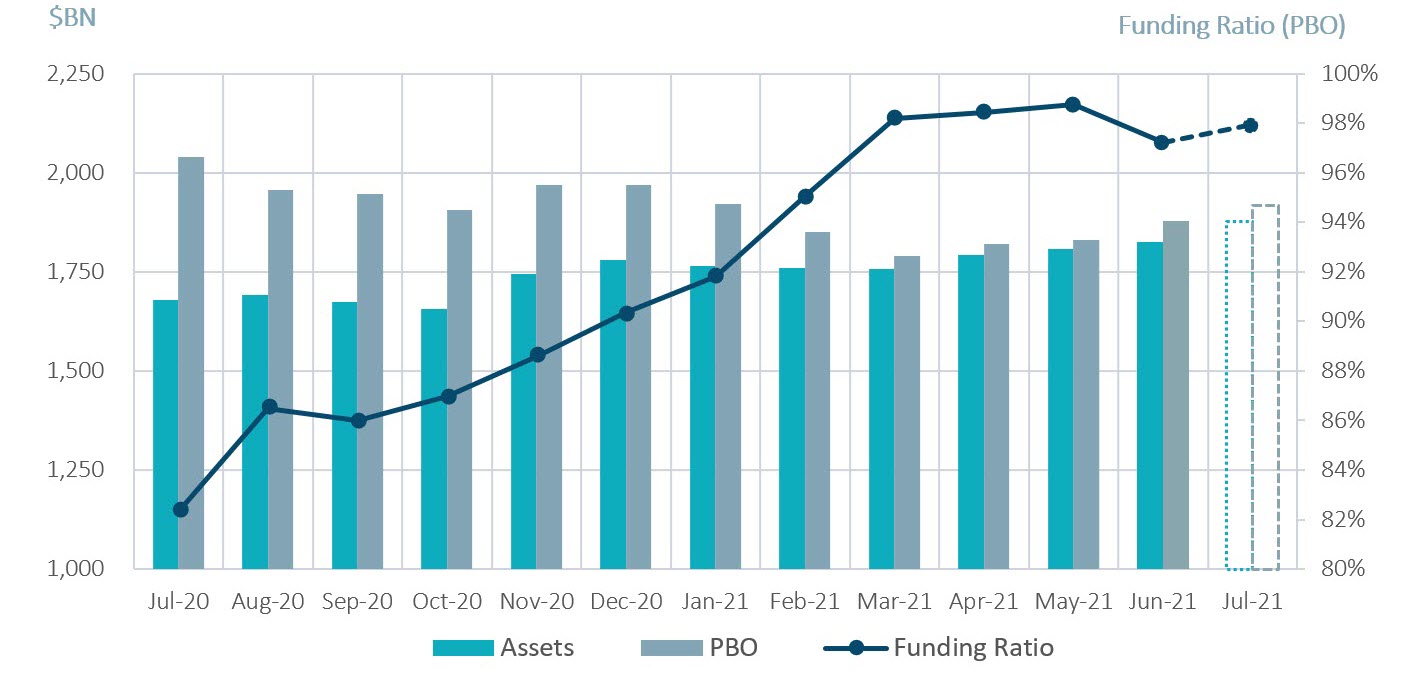

Funded status inches higher on strong investment gains

July Market Summary

- Average funded status increased by 0.8% to 98.0%: Assets returned 2.8% while a decrease in discount rates increased liabilities by 2.0%¹.

- U.S. equity markets posted their sixth consecutive positive month: The S&P 500 rallied another 2.3% in July and is now up 17.0% since the start of the calendar year.

- The yield on the Bloomberg Barclays Long Credit Index fell 15 basis points (bps): Long credit spreads widened 6 bps while long treasury yields dropped 19 bps¹.

| Market Watch | Dec 2019 | Dec 2020 | June 2021 | July 2021 |

|---|---|---|---|---|

| Funded status | 90% | 90% | 97% | 98% |

| CITI discount rate2 | 3.01% | 2.23% | 2.58% | 2.45% |

| Long Credit yield2 | 3.63% | 2.78% | 3.08% | 2.94% |

| U.S. 30Y TSY yield | 2.39% | 1.64% | 2.09% | 1.89% |

| S&P 500 | 3,231 | 3,756 | 4,298 | 4,395 |

Spotlight: Happiness can be fleeting

- Earlier in the year, on the back of rising interest rates and rallying stock markets, average funded status increased from 90% as of 12/31/2020 to 99% at 05/31/2021. During the period, the FTSE AA discount rate increased by 56 bps from 2.23% to 2.79%, while the S&P 500 returned 11.9%.

- Since then, equity markets have continued to push higher despite fears of inflation, Fed tightening and Chinese market weakness, rising another 4.5% in the past two months.

- However, interest rates have collapsed, with the 30yr Treasury rate falling from a peak of 2.45% on March 18th to 1.82% by July 19th, and AA corporate yields declining by 64 bps over the same period. As a result, the average funded status deteriorated to 97% at the end of June, down approximately 2% from the May high.

- Despite a slight rebound in July, the fleeting funded status improvements highlight the importance of having a de-risking plan in place.

- Plan sponsors who utilized a glidepath - with de-risking targets based on funded status and specific duration and spread hedging goals at each step - were likely able to capture and lock-in those elusive funded status gains before they disappeared. The speed of market changes highlights the importance of partnering with consultants and managers who understand liabilities and can help create tailored hedging plans that fit the sponsors risk appetite and constraints.

- However, a de-risking plan is only as effective as the implementation strategy allows. Implementing a governance structure to help facilitate de-risking and to increase the speed of decision making in these situations is key to capturing market gains before they evaporate. Many plan sponsors achieve this through having pre-agreed de-risking steps approved by the pension committee in advance. This allows the manager to move the allocation quickly within the pre-agreed bounds without the need to reconvene committees.

- At SLC Management we work with plan sponsors and their consultants to design de-risking solutions and implement them in practical ways that meet our client’s needs.

Milliman Pension Funding Index (July Estimate)

¹Funded Status for the month of July is estimated and subject to change as final numbers are released. Data from reference Bloomberg Barclays Indices.

²The CITI discount rate corresponds to the FTSE short pension liability index. July 2021 is estimated based on the yield change on the BBgBarc Long AA Corporate Index. The Long Credit yield corresponds to the BBgBarc Long Credit Index.