Explore institutional insights

Discount rates fall, funded status remains unchanged

Positive asset returns offset by further decline in discount rates

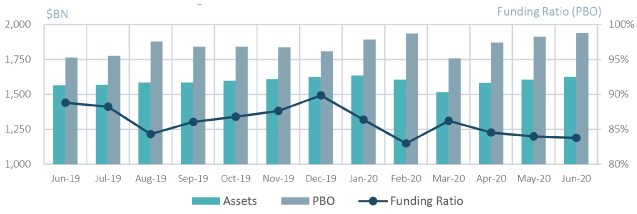

- Average funded status was down by 0.1% over the month — Assets returned 1.66%, offset by a 1.73% increase in liabilities.

- Equities continued to rebound from March lows — The S&P 500 rose another 1.8% while the MSCI ACWI ex-U.S. increased 4.3%.

| Market Watch | Dec 2018 | Dec 2019 | May 2020 | June 2020 |

|---|---|---|---|---|

| Funded Status1 | 87% | 90% | 84% | 84% |

| CITI Discount Rate2 | 4.05% | 3.01% | 2.46% | 2.38% |

| Long Credit Yield2 | 4.89% | 3.63% | 3.31% | 3.16% |

| U.S. 30Y TSY Yield | 3.02% | 2.38% | 1.41% | 1.41% |

| S&P 500 | 2,507 | 3,231 | 3,044 | 3,100 |

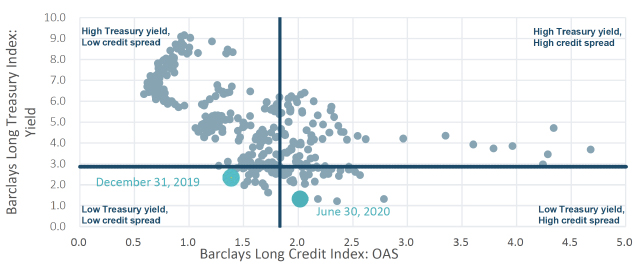

- The yield on the Bloomberg Barclays Long Credit Index declined by 15 basis points (bps) – a 16 bps tightening of long credit spreads drove the yield down while the 30Y Treasury yield remained unchanged at 1.41%.

- Within IG credit, spreads continued to narrow — IG credit markets continue to tighten from the March wides, finishing June at 142 bps, a 22 bps decline month-over-month.

- Continued demand for U.S. corporate debt – U.S. high yield corporate bond issuance set a new monthly record of $52BN in June, greatly exceeding the previous record of $41BN.

Long credit spreads vs. long Treasury yields

Spotlight: Corporate bond purchase by the Federal Reserve

- In March, the Fed announced support for the corporate bond market via a variety of programs, including lending directly to investment grade companies, purchasing investment grade corporate bonds in the secondary market, and purchasing investment grade ETFs.

- The market reacted positively to the announcement, despite the Fed’s minimal participation in the corporate bond markets at that stage.

- In May, the Fed began broad market based purchases via investment grade bond ETFs, which provided more flexibility by bypassing the certification process in the CARES Act. This was followed in June with the purchase of individual bonds on the secondary market, though this accounted for less than 1% of the daily trading volume.

- The purchase program has been largely focused on shorter duration bonds and is based on a custom index with a maximum maturity of 5 years. While direct purchases of long dated corporate bonds have been limited, the Fed’s support for corporate credit has been positive for long credit overall as it boosted both investor confidence and market liquidity.

- For LDI investors in particular, the program has provided a boost. Improved investor sentiment provided support for BBB-rated issues that outperformed higher quality long AA-rated benchmarks over the month by 1.5%2.

Milliman Pension Funding Index

¹The CITI discount rate corresponds to the FTSE short pension liability index. The Long Credit yield corresponds to the Bloomberg Barclays Long Credit Index.

²Source: Barclays Live. Long AA U.S. Corporate Index vs. Long BBB Corporate Index.