Explore institutional insights

Funded status falls due to decline in discount rates

June Market Summary

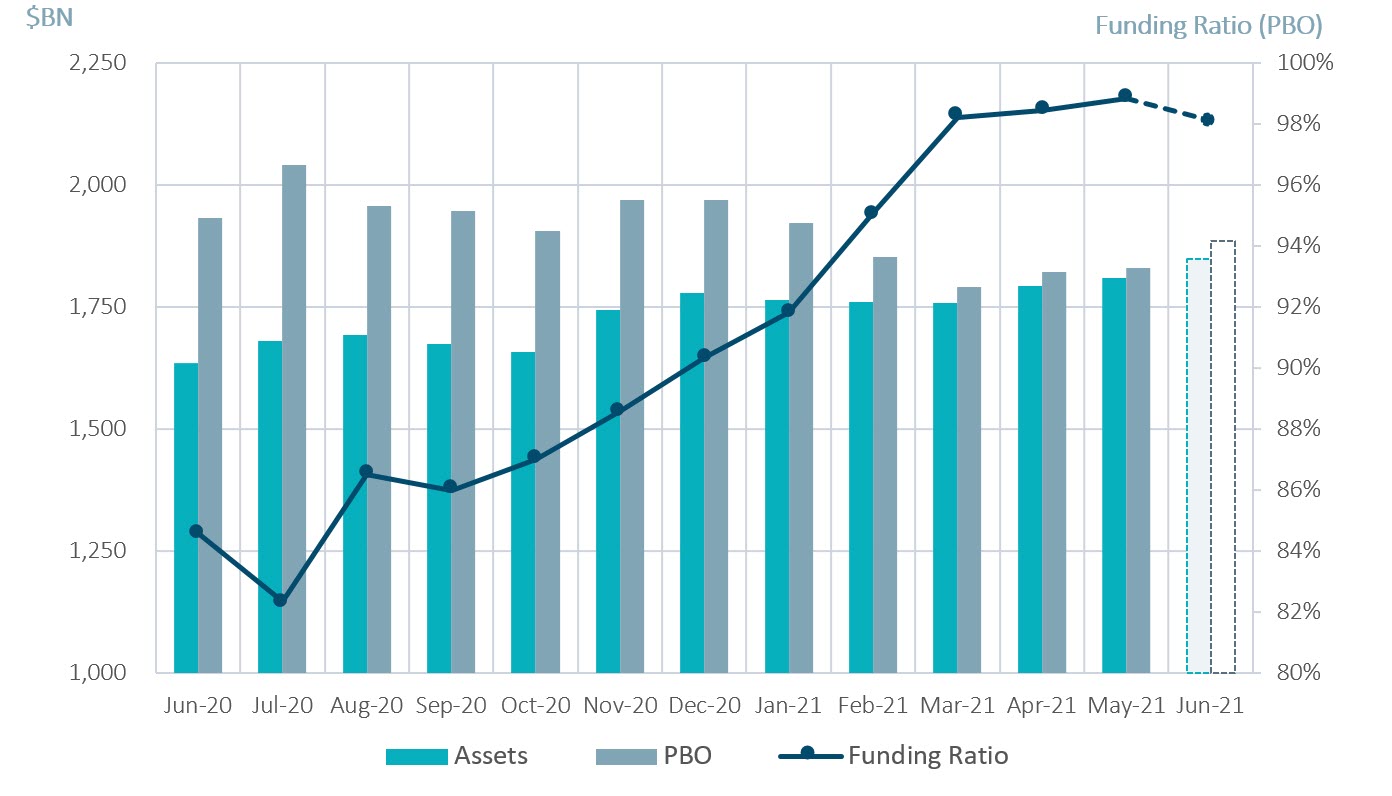

- Average funded status decreased by 0.7% to 98.1% in June: Assets returned 2.2% while a decrease in discount rates increased liabilities by 3.0%.¹

- U.S. equity markets posted their fifth consecutive positive month: The S&P 500 soared another 2.2% in June and is now up 14.4% since the start of the calendar year.

| Market Watch | Dec 2019 | Dec 2020 | May 2021 | June 2021 |

|---|---|---|---|---|

| Funded status | 90% | 90% | 99% | 98% |

| CITI discount rate2 | 3.01% | 2.23% | 2.79% | 2.59% |

| Long Credit yield2 | 3.63% | 2.78% | 3.30% | 3.08% |

| U.S. 30Y TSY yield | 2.39% | 1.64% | 2.28% | 2.09% |

| S&P 500 | 3,231 | 3,756 | 4,204 | 4,298 |

- The yield on the Bloomberg Barclays Long Credit Index fell 22 basis points (bps): Long credit spreads tightened 4 bps while long treasury yields dropped 18 bps.¹

- New issue concessions have been close to flat: New Investment Grade corporate bond issuance has been met with robust demand, a sign of strong appetite for corporate debt in the current low rate and tight credit spread environment.

Spotlight: Fed meeting sparks a hint of uncertainty in the markets

- While the Federal Reserve held steady at the June FOMC meeting as expected, its guidance for potential future rate hikes was interpreted as more hawkish than some had expected.

- A majority of the 11 Federal Reserve officials expressed the intention for at least two interest rate hikes in 2023.

- St. Louis Federal Reserve President Bullard even went as far as publicly stating, “I would put us starting in late 2022”.

- This more hawkish stance caught the market by surprise as Federal Reserve Chairman Jerome Powell has repeatedly stated they felt that higher inflation is merely transitory.

- The markets reacted swiftly to the uncertainty, with the 30-year rate falling by as much as 27 bps to a low of 2.01%, before retracing back up to 2.06%.

- Notably, the 5s/30s curve flattened by 28 bps, its largest single monthly change since 2014.

- Recent volatility highlights how fleeting funded status gains can be. Average funded status, which was near full funding in May, is now back down to 98.1%.

- Amidst the volatility, the correlation between CCC and BBB spreads has fallen from 0.8 to 0.3, and the breakdown of the relationship is often seen prior to periods of credit market uncertainty.

- We believe this environment emphasizes the importance of working with active asset managers whose style allows them to outperform in potential down markets.

Milliman Pension Funding Index (June Estimate)

¹Funded Status for the month of June is estimated and subject to change as final numbers are released. Data from reference Bloomberg Barclays Indices.

²The CITI discount rate corresponds to the FTSE short pension liability index. June 2021 is estimated based on the yield change on the BBgBarc Long AA Corporate Index. The Long Credit yield corresponds to the BBgBarc Long Credit Index.