Explore institutional insights

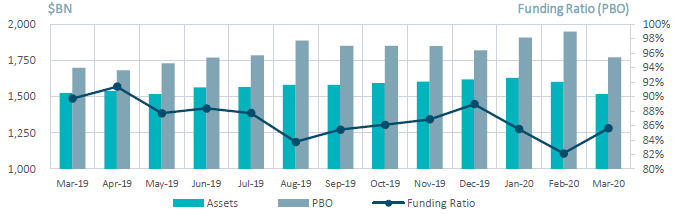

Rising discount rates offset the impact of asset losses

Despite a drop in equities, credit spread widening led to improved funding ratios over the month

- Average funded status was up by 3.5% over the month – assets declined by 5.3%, offset by a 9.1% decrease in liabilities

- Equities plunged over the month of March – the S&P 500 fell by 12.4% while the MSCI AW ex-U.S. declined 14.4%.

| Market Watch | Dec 2018 | Dec 2019 | Feb 2020 | Mar 2020 |

|---|---|---|---|---|

| Funded Status | 87% | 89% | 82% | 86% |

| CITI Discount Rate | 4.22% | 3.12% | 2.76% | 3.22% |

| Long Credit Yield1 | 4.89% | 3.63% | 3.22% | 3.91% |

| U.S. 30Y TSY Yield | 3.02% | 2.38% | 1.67% | 1.35% |

| S&P 500 | 2,507 | 3,231 | 2,954 | 2,585 |

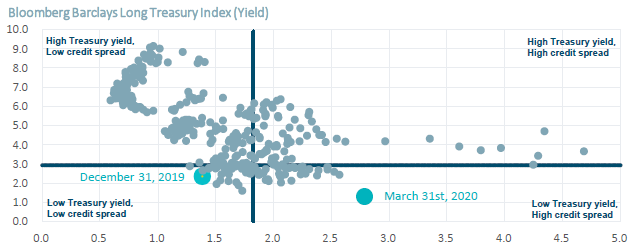

- The yield on the Bloomberg Barclays Long Credit Index surged by 69 basis points – driven by a 106 basis points widening of long IG credit spreads which offset declining treasury yields. The U.S. 10-year Treasury yield was down 42 basis points over the month.

- Within IG credit, spreads reached their widest trading levels since May 2009 – peaking at 341 basis points on March 23. Fed intervention and improved price discovery helped tame the credit markets over the last six trading days with spreads compressing to 255 basis points by the month end.

Significant spread widening offset declining treasury yields

Spotlight: TALF 2020

- On March 23, 2020, in an effort to re-energize the credit markets, the Fed established the Term Asset-Backed Securities Loan Facility (TALF)

- The TALF was previously launched in 2009 during the last financial crisis to help support the flow of credit to consumers and businesses. The program was a success in helping capital markets return to normal

- Investors in the TALF 2009 program experienced strong returns with early participants typically benefiting most as spreads tightened in line with the roll-out of the program

- SLC Management will be participating in TALF 2020 as we did in 2009. We believe that the TALF 2020 program provides a similar opportunity for investors to achieve attractive risk-adjusted investment returns. However, investors may need to move quickly. The window to access this program is short with an expected launch date in May

Milliman Pension Funding Index

1 Bloomberg Barclays Long Credit Index

2 TALF 2009 was offered by Ryan Labs Asset Management which recently merged into Sun Life Capital Management (U.S.) LLC.