Explore institutional insights

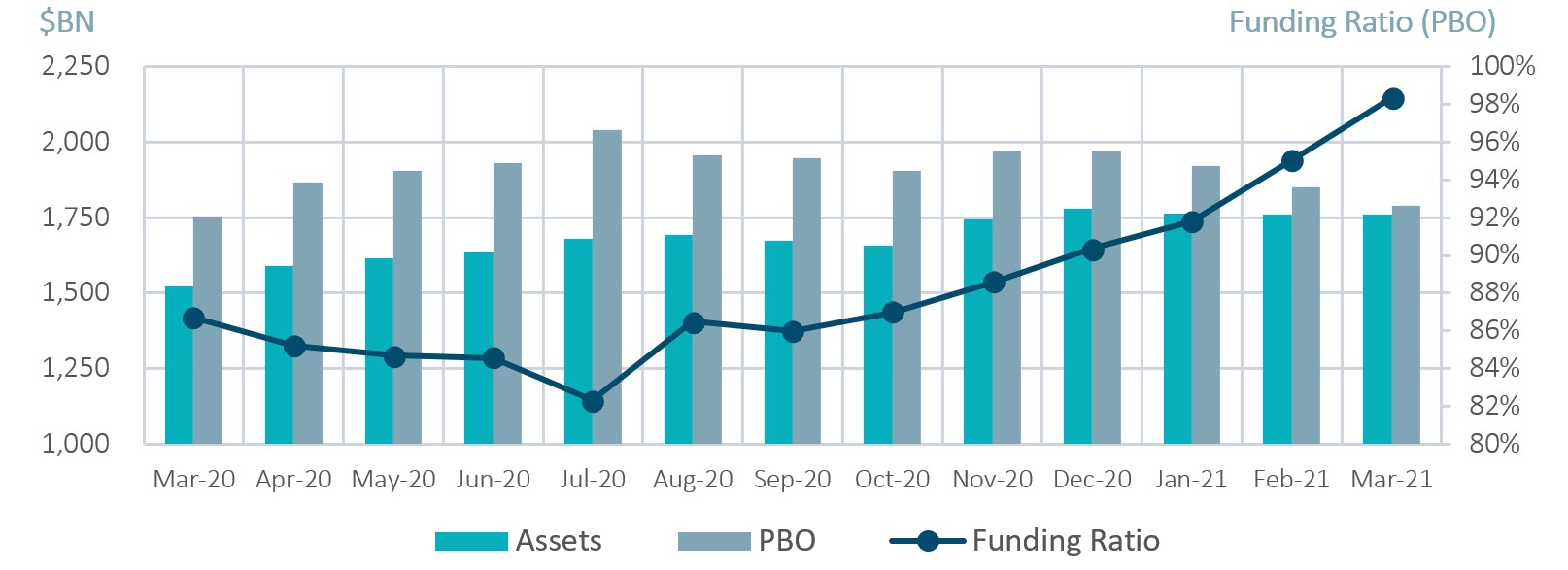

Rise in discount rates increased funded status by 3%

March Market Summary

- Average funded status was up by 3% in March: Assets returned 0.4% while an increase in discount rates reduced liabilities by 3%.

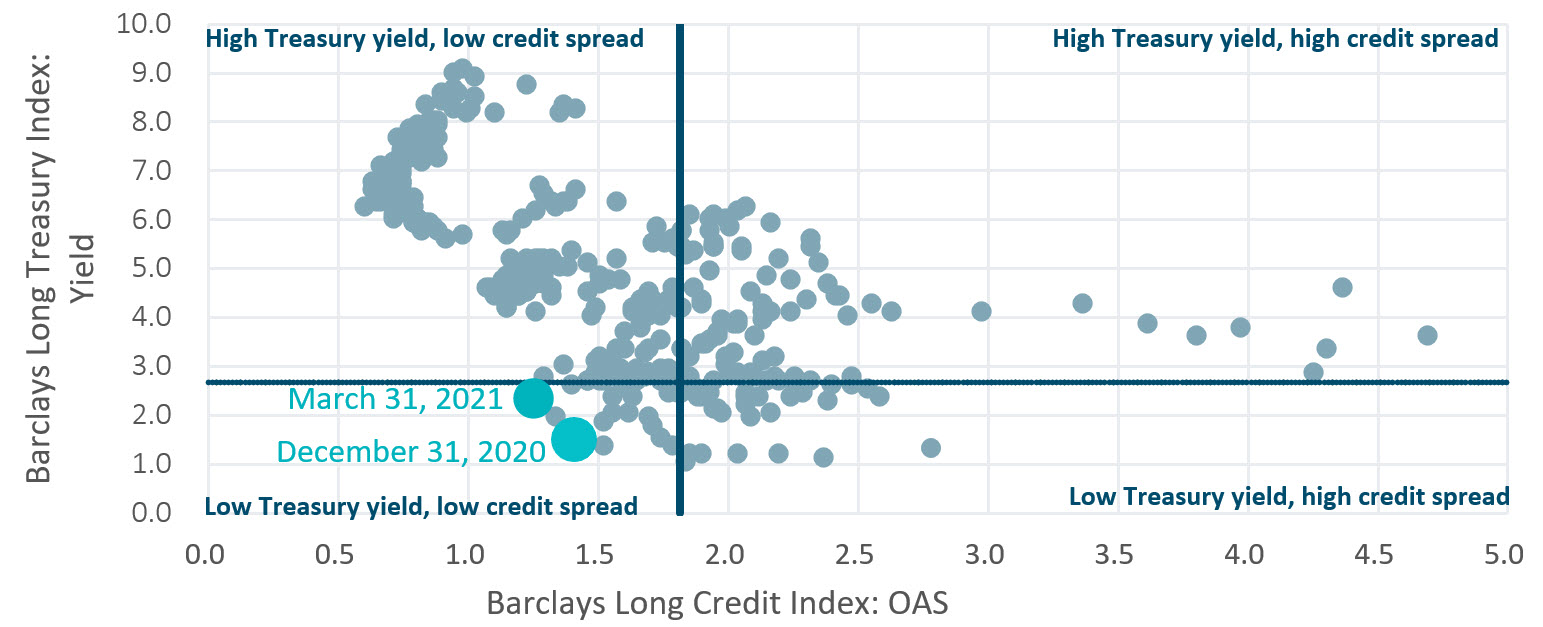

- The yield on the Bloomberg Barclays Long Credit Index increased 22 basis points (bps): Despite credit spreads rallying 7 bps in March, a 29 bps rise in long end Treasury yields pushed the index yield up to 3.45%, its highest trading level in roughly a year¹.

| Market Watch | Dec 2019 | Dec 2020 | Feb 2021 | Mar 2021 |

|---|---|---|---|---|

| Funded status | 90% | 90% | 95% | 98% |

| CITI discount rate2 | 3.01% | 2.23% | 2.70% | 2.94% |

| Long Credit yield2 | 3.63% | 2.78% | 3.23% | 3.45% |

| U.S. 30Y TSY yield | 2.39% | 1.64% | 2.15% | 2.41% |

| S&P 500 | 3,231 | 3,756 | 3,811 | 3,973 |

- The yield curve continues to steepen: The 2 year Treasury yield ticked up a modest 3 bps, while 10 and 30 year yields rose by 34 and 26 bps, respectively. The 2s10s spread now sits at 158 bps, its widest level since July of 2015.

- Investment grade corporate supply posted its strongest month since June of 2020, totaling $158B: Robust corporate issuance may be an indication corporations are rushing to lock in low debt financing as rising rates and higher borrowing costs could be on the horizon.

Long credit spreads vs. long Treasury yields

Spotlight: The great re-opening

- March Non-Farm Payrolls came in at 916K, far exceeding the expected figure of 647K and a significant increase over the 468K figure from February.

- This can be attributed to the continued reopening of the economy, as the vaccine rollout has been faster than expected. Single day dosage administration now exceeds 4MM/day and 7-day average deaths from Covid-19 now sits at fewer than 1K/day, far below the ~3.3K/day figures we saw in January.

- The rebound has resulted in strong equity market performance and supply chain constraints that have pushed commodity prices to multi-year highs.

- Prices of copper, iron and lumber are all at 7-year highs. As travel resumes and the TSA passenger count climbs to its highest in 12 months, WTI rebounded to ~$60.

- Inflation concerns have also been reflected in real yields, as the 10-yearTreasury has increased 83 bps since the start of the year and now sits at 1.6% as of March 31st. Real rates now sit at -0.6% versus -1.1% at the end of 2020.

- As pension funded status is pushed higher by strong equity performance and higher yields driven by inflation, plan sponsors should ensure they have plans in place to rebalance when yield or funded status targets are met, as market conditions could change quickly.

- For sponsors concerned with the continuation of tight long end spreads, alternatives such as private credit could provide additional yield.

- Sponsors should consider working with managers that have derivative capabilities to develop implementation plans to shift exposures/allocations efficiently.

Milliman Pension Funding Index

¹Data from reference Bloomberg Barclays Indices. Issuance data sourced from SIFMA.

²The CITI discount rate corresponds to the FTSE short pension liability index. The Long Credit yield corresponds to the Bloomberg Barclays Long Credit Index.