Explore institutional insights

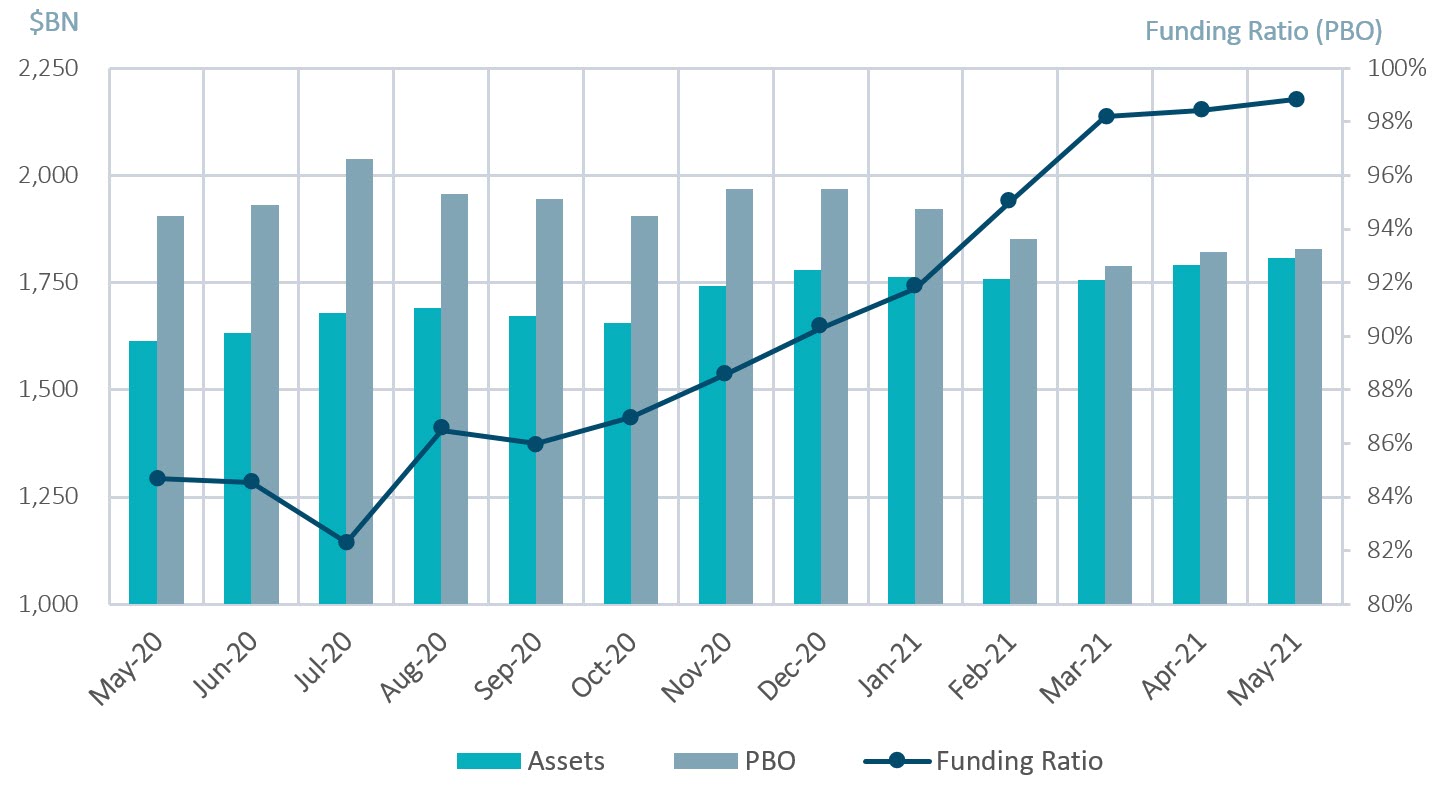

Funded status inches higher on positive investment gains

May Market Summary

- Average funded status increased by 0.4% to 99% in May: Assets returned 1.2% while a decrease in discount rates increased liabilities by 0.8%.

- U.S. equity markets posted its fourth consecutive positive month: The S&P 500 ticked 0.5% higher in May and is now up 11.9% since the start of the calendar year.

| Market Watch | Dec 2019 | Dec 2020 | Apr 2021 | May 2021 |

|---|---|---|---|---|

| Funded status | 90% | 90% | 98% | 99% |

| CITI discount rate1 | 3.01% | 2.23% | 2.81% | 2.79% |

| Long Credit yield1 | 3.63% | 2.78% | 3.35% | 3.30% |

| U.S. 30Y TSY yield | 2.39% | 1.64% | 2.30% | 2.28% |

| S&P 500 | 3,231 | 3,756 | 4,181 | 4,204 |

- The yield on the Bloomberg Barclays Long Credit Index dropped 5 basis points (bps): Long credit spreads tightened 5 bps while long treasury yields remained mostly unchanged month over month.¹

- New Investment grade (IG) corporate supply totaled $123B: Highlighted by Amazon’s $18.5B deal of which $7B was on the long end. Year-to-date issuance is now $698B, which is down 34% relative to 2020 but up 35% compared to 2019.

Spotlight: Consideration for sponsors as plans reach full funding

- For most pension plans, funded status has continued to improve over the last few months with the average plan now close to fully funded – a level not seen since before the financial crisis. In addition to strong equity returns, plan sponsors have received a boost from rising Treasury yields.

- We believe plan sponsors should have a plan in place to move quickly and capitalize on these gains, which can be fleeting. Yields are already lower than their recent highs –reached in early April – and equity gains can quickly disappear in a volatile market.

- Plan sponsors may want to consider utilizing a completion manager with derivative capabilities to help implement asset allocation changes efficiently.

- Completion managers can easily adjust duration, credit and equity beta exposures to lock in funded status improvements. Plan sponsors can then reposition the underlying physical assets over a more reasonable time period.

- As plan sponsors de-risk further, moving from growth-oriented assets like equities to liability-hedging portfolios, they may want to reassess the composition of their fixed income strategies.

- As more of the overall duration risk inherent in plan liabilities is hedged, credit spread volatility can become an increasingly important driver of overall funded status volatility.

- Many assets exhibit a credit spread sensitivity to a greater or lesser extent. We utilize a measure called the “beta-adjusted credit spread hedge ratio” to help us understand the relative sensitivities of the total liability hedging portfolio to the liability.

- For example, on a relative basis AA- rated corporate bond spreads (the basis for most liability discount curves) only have a beta of about 0.8 while BBB-rated spreads have a beta closer to 1.5. Therefore, as plan sponsors allocate more to broad market fixed income strategies, they need to be careful not to over hedge the less sensitive liabilities.

- At SLC Management we help sponsors understand the drivers of funded status volatility across factors such as duration, spread and curve and build liability hedging portfolios to meet the changing needs of plan sponsors as they progress along their glidepaths.

Milliman Pension Funding Index

¹The CITI discount rate corresponds to the FTSE short pension liability index. The Long Credit yield corresponds to the Bloomberg Barclays Long Credit Index.

²Data from reference Bloomberg Barclays Indices. Issuance data sourced from SIFMA and Bloomberg.