Explore institutional insights

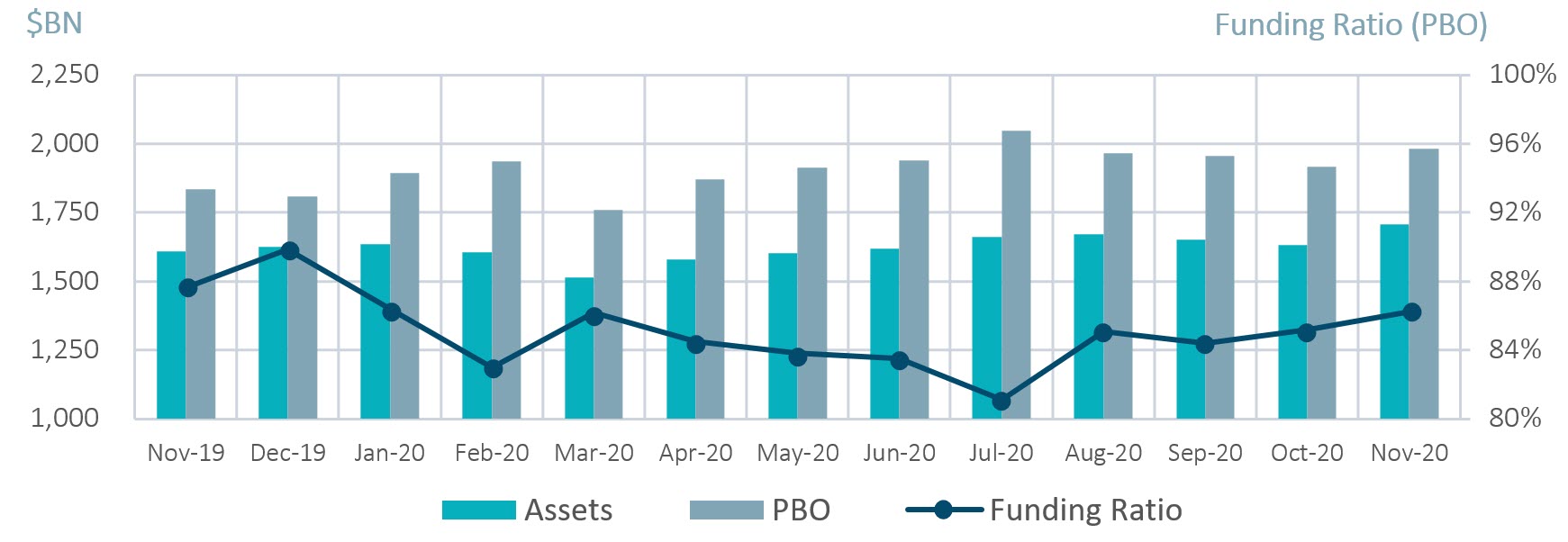

Funded status increases 1% on robust investment gains

November market summary

- Average funded status was up by 1% over the month: Assets returned 5%, while liabilities increased by 3.7%.

- S&P 500: The S&P 500 soared 10.8% in the month of November and is now up 12.1% year-to-date.

| Market Watch | Dec 2018 | Dec 2019 | Oct 2020 | Nov 2020 |

|---|---|---|---|---|

| Funded status | 87% | 90% | 85% | 86% |

| CITI discount rate1 | 4.05% | 3.01% | 2.44% | 2.21% |

| Long Credit yield1 | 4.89% | 3.63% | 3.12% | 2.80% |

| U.S. 30Y TSY yield | 3.01% | 2.39% | 1.66% | 1.57% |

| S&P 500 | 2,507 | 3,231 | 3,270 | 3,622 |

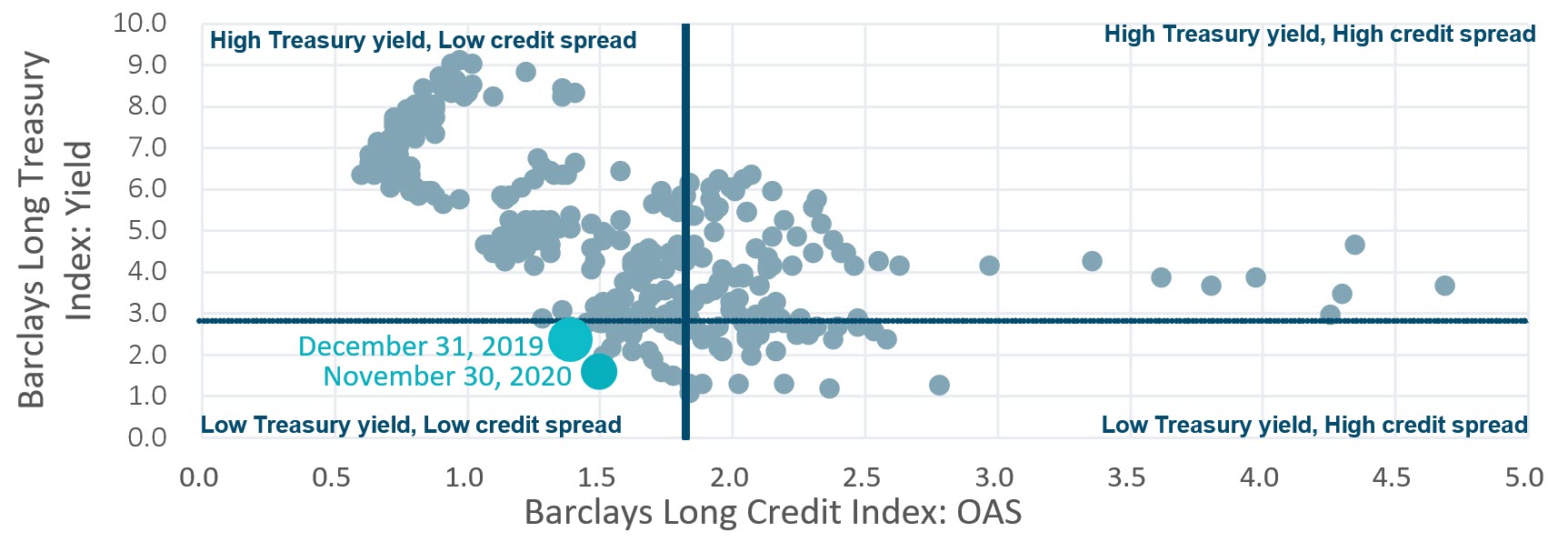

- The yield on the Bloomberg Barclays Long Credit Index fell by 32 basis points (bps): Driven by a 27 bps collapse in credit spreads (OAS) and 6 bps decline in long end rates.

- Credit Spreads narrowed within broad Investment Grade (IG) credit: IG credit spreads finishing the month at 100 bps, a 19 bps tightening month over month².

- IG Corporate Issuance: U.S. IG corporate issuance posted another modest month at $92B, but year-to-date issuance now exceeds $1.8T.

Long credit spreads vs. long Treasury yields

Spotlight: Derivative hedging instruments in an LDI framework

- In the current environment, we have seen an increasing number of plan sponsors looking to use derivatives within their LDI programs. Derivatives allows plans to separately hedge against interest rate risk, independent of the allocation decision between growth assets and hedging assets.

- Plan sponsors can maintain their allocations to the “rewarded” risks of growth assets while simultaneously deleveraging their plans from the “unrewarded” risks of being under-hedged to interest rate risk.

- Many plan sponsors are familiar with the use of interest rate derivatives to extend duration. However, equity derivatives can also be used to help improve the hedge ratio.

- Plan sponsors looking to reduce their interest rate exposure can transfer physical assets into the liability hedging portfolio and achieve the growth asset exposure through derivative products that synthetically replicate equity returns.

- This approach achieves a similar liability hedging outcome but results in a potentially more efficient solution with the plan sponsor owning a physical hedging portfolio and a synthetic growth portfolio.

- It allows for a higher allocation to corporate bonds, which provide additional yield and spread exposure. This is especially important when the credit spread component makes up over 50% of the long credit yield.

- Greater opportunity for upside from active management in less efficient fixed income markets that sponsors may miss out on by capturing fixed income exposure synthetically.

- From a collateral perspective this approach can be more efficient as movements in equity derivatives are likely to offset the moves in the underlying collateral (typically a bond portfolio) required to meet payments on the derivatives.

Milliman Pension Funding Index

¹The CITI discount rate corresponds to the FTSE short pension liability index. The Long Credit yield corresponds to the Bloomberg Barclays Long Credit Index.

²Data from reference Bloomberg Barclays Indices.