Explore institutional insights

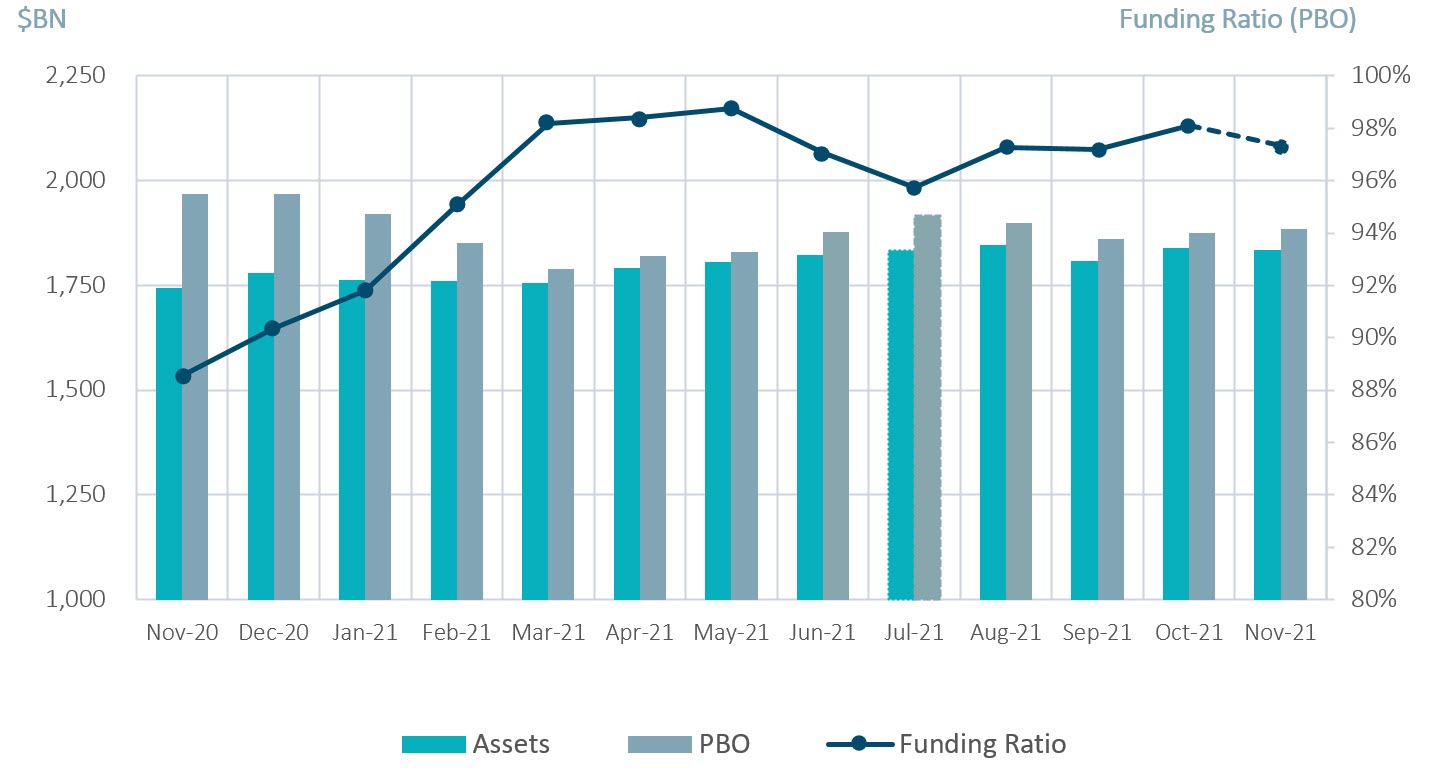

Funded status fell 0.8% in November due to a drop in discount rates and selloff in equities

November Market Summary

- Average funded status decreased by 0.8% to 97.3%: Assets returned -0.2% while a drop in discount rates increased liabilities by 0.6%. ¹

- U.S. equity markets fell in November: After a nearly 7% S&P 500 return in October, U.S. equities fell -0.8% in November. Year-to-date, the index is up 21.6%.

- The yield on the Bloomberg Barclays Long Credit Index decreased 1 basis points (bps): Long credit spreads widened 12 bps while the underlying Treasury basis decreased 13 bps. This was the largest month-over-month credit spread widening since March 2020. ¹

| Market Watch | Dec 2019 | Dec 2020 | Oct 2021 | Nov 2021 |

|---|---|---|---|---|

Funded status |

90% |

90% |

98% |

97% |

CITI discount rate² |

3.01% |

2.23% |

2.58% |

2.52% |

Long Credit yield² |

3.63% |

2.78% |

3.06% |

3.05% |

U.S. 30Y TSY yield |

2.39% |

1.64% |

1.93% |

1.97% |

S&P 500 |

3,231 |

3,756 |

4,605 |

4,567 |

Spotlight: Positioning for uncertainty

- In November, uncertainty over inflation and how the Fed might react caused the curve to flatten significantly. The 5s-30s Treasury curve flattened by 12 bps, ending the month at a spread of just +63 bps. For context, the spread between 5s and 30s reached +163 bps in February of this year.

- On November 30th, Chairman Powell finally acknowledged that inflation might not be transitory and strongly hinted that tapering might be on the menu sooner than people initially expected.

- However, this outlook has been muddled by two factors: a slowing Chinese economy & the Covid-19 Omicron variant.

- Following the fall of China Evergrande, Chinese high yield spreads ballooned from 1250 bps to 1980 bps. As the largest commodities consumer in the world – with approximately 50% of world copper consumption – this led to a drop of over 10% in the S&P GSCI Commodities Index.

- Uncertainty regarding the potential impact of the Covid-19 Omicron variant caused risk assets to sell off, with the S&P falling from a high of 4,704 in November to 4,567 at the end of the month.

- Similarly, we saw a 21% fall in oil prices in November. WTI fell from a high of $84/barrel to $66/barrel by month end, easing inflation concerns.

- This high degree of uncertainty combined with tight spread levels means SLC Management has positioned our portfolios defensively. We are moving up the quality spectrum and maintaining some dry powder to allow for opportunistic purchasing of mispriced assets if we begin to see weakness in the market.

Milliman Pension Funding Index (November Estimate)

¹ Funded Status for the month of November is estimated and subject to change as final numbers are released. Data from reference Bloomberg Indices.

² The Long Credit yield corresponds to the Bloomberg Long Credit Index. The CITI discount rate corresponds to the FTSE short pension liability index.