Explore institutional insights

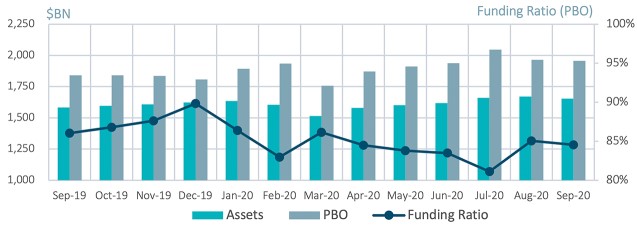

Funded status falls 0.5% as pension assets decline

Despite an increase in liability discount rates, negative asset returns drive funded status lower

- Average funded status was down by 0.5% over the month: Assets returned -0.7%, while liabilities decreased by 0.2%.

- S&P 500: The S&P 500 posted a -3.9% loss in September after a 7.0% gain in August. Year-to-date the index remains positive at +4.1%.

| Market Watch | Dec 2018 | Dec 2019 | Aug 2020 | Sept 2020 |

|---|---|---|---|---|

| Funded status | 87% | 90% | 85% | 85% |

| CITI discount rate1 | 4.05% | 3.01% | 2.32% | 2.32% |

| Long Credit yield1 | 4.89% | 3.63% | 3.01% | 3.05% |

| U.S. 30Y TSY yield | 3.02% | 2.38% | 1.47% | 1.46% |

| S&P 500 | 2,507 | 3,231 | 3,500 | 3,363 |

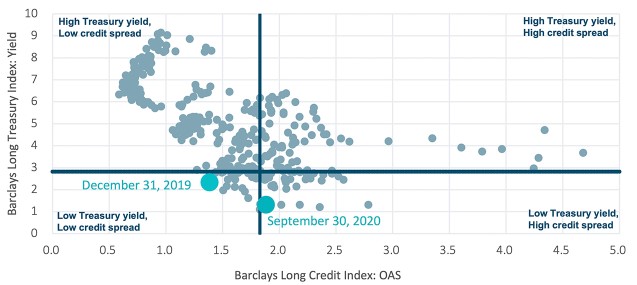

- The yield on the Bloomberg Barclays Long Credit Index rose by 5 basis points (bps): Interest rates held steady for the month while credit spreads (OAS) widened by 5 bps.

- Within broader Investment Grade (IG) credit, spreads inched wider: IG credit spreads finishing the month at 128 bps, a 6 bps widening month over month.²

- Another strong month of IG Corporate Issuance: U.S. IG corporate issuance was $167BN in September, with year-to-date issuance now exceeding $1.6T.

Long credit spreads vs. long Treasury yields

Spotlight: Record corporate bond issuance has had little impact on returns

- In 2020, despite the equity market sell-off earlier in the year, the investment grade new issue market hit record levels with three months still to go.

- Investment grade new issuance was $1.6TN as of 09/30, far surpassing the 2019 annual figure of $1.1TN. Total issuance at the same time last year was only $939BN.

- Similarly, the high yield market saw $325BN of new issuance YTD, far surpassing the Q1-Q3 total of $206BN last year, and is on pace to break the $332BN mark from 2013.

- Banks, autos, energy and healthcare/pharma have seen the greatest relative increase in issuance activity while retail was the only notable sector to retreat from the market.

- The frantic issuance activity reflected corporate borrowers taking advantage of the opportunity to increase liquidity, as they braced for an uncertain economic outlook.

- In addition, direct bond purchases by the Federal Reserve provided additional liquidity for borrowers in the market and acted as a backstop to further spread widening.

- Despite heavy issuance and the additional leverage it brings, performance in corporate bond markets has been strong year-to-date. However, active management has been even more crucial in navigating pockets of the market such as energy and airlines that have lagged in performance, being down 1.8% and 7.3% respectively.

Milliman Pension Funding Index

1The CITI discount rate corresponds to the FTSE short pension liability index. The Long Credit yield corresponds to the Bloomberg Barclays Long Credit Index.

2Data from reference Bloomberg Barclays Indices.