Timeline of the project

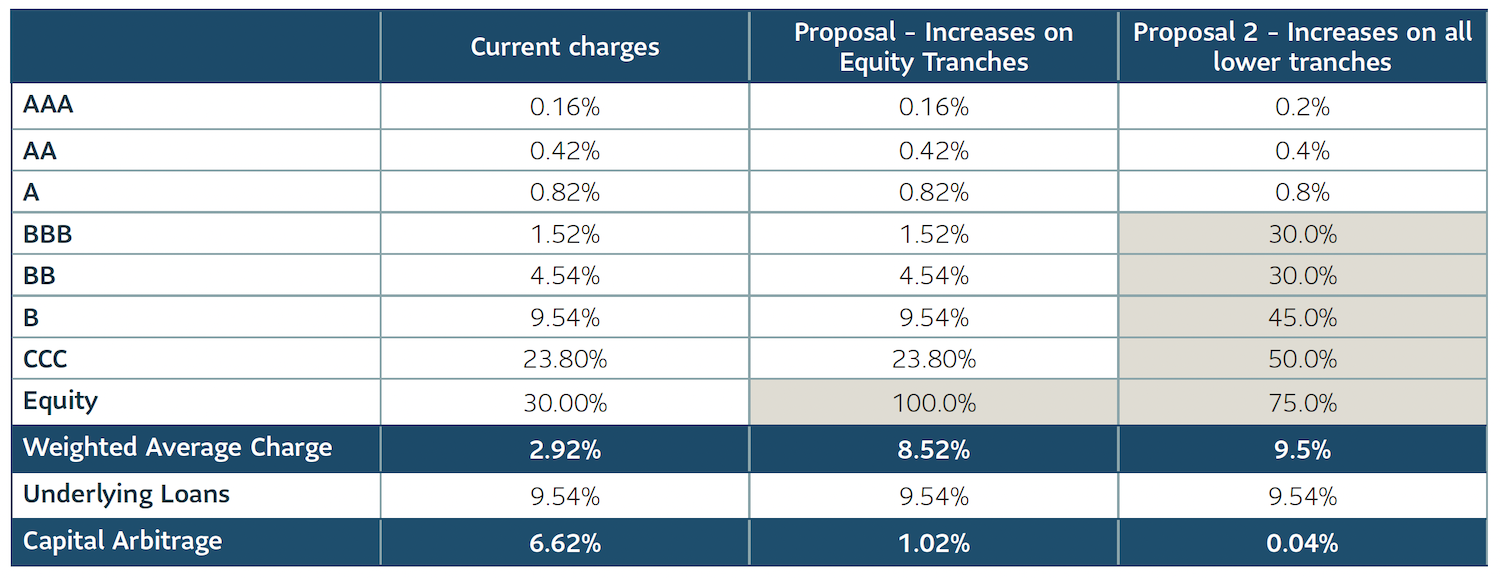

NAIC staff is moving quickly with the timeline. Based on the commentary from 2022 Summer National Meeting, the proposed NAIC Designations and associated RBC charges will come out in 2023 with implementation date setting on 12/31/2023 at earliest or 12/31/2024 more realistically. Either way, the CLO changes are imminent in next 2 years.

What does this mean for investment strategy?

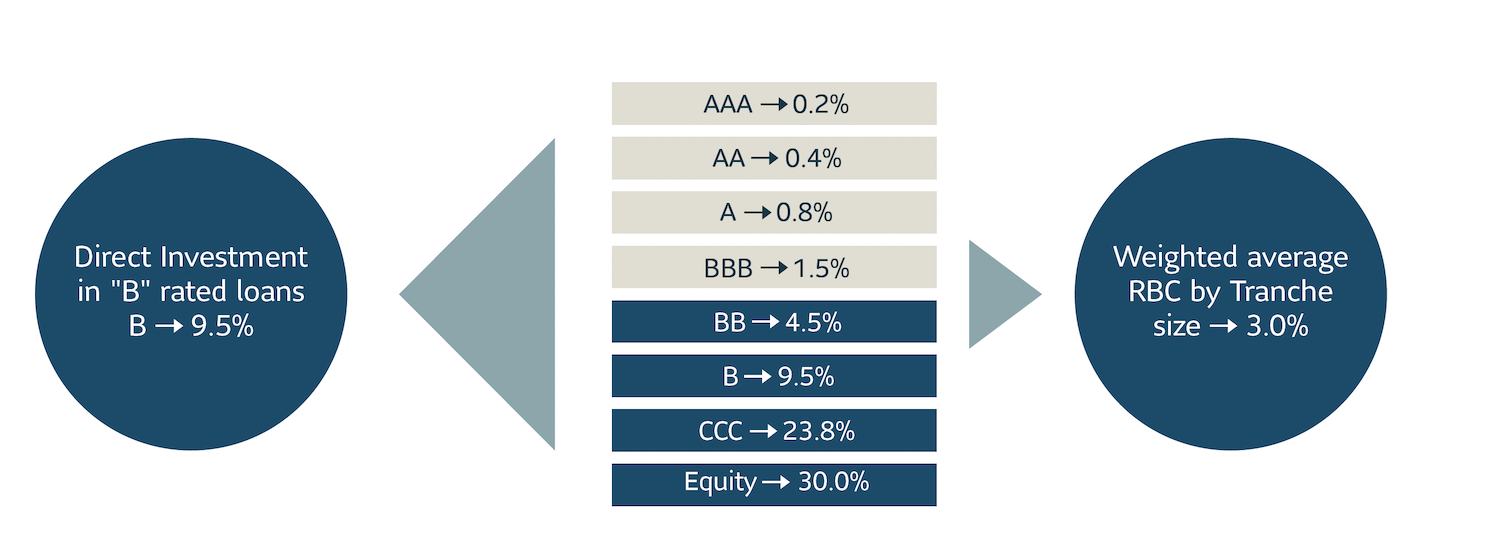

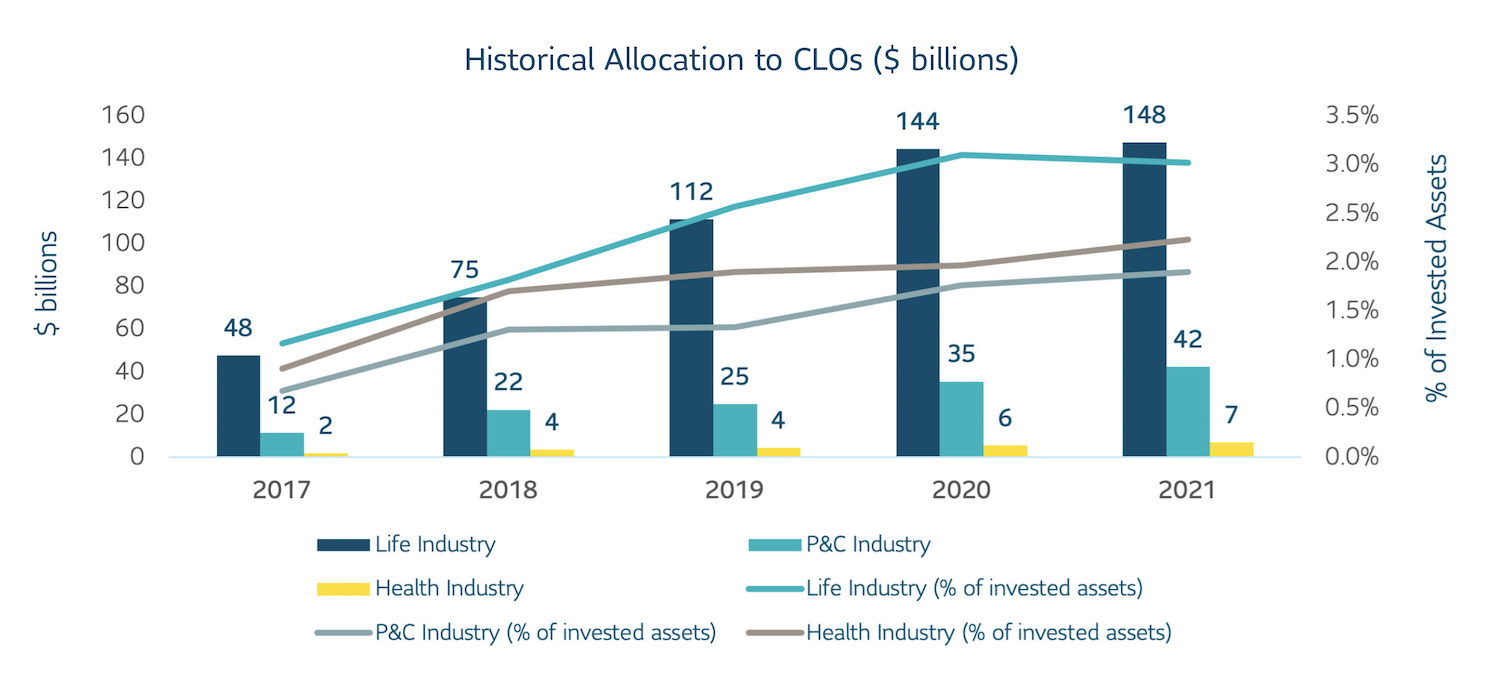

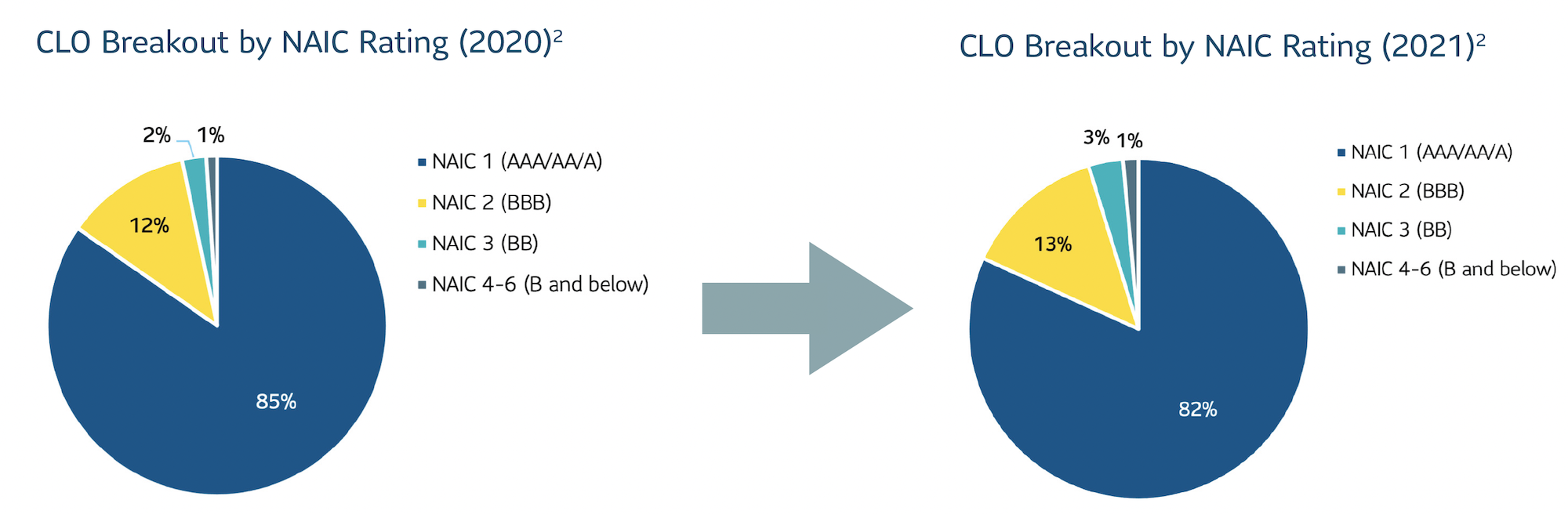

The increases in RBC factors will reduce the attractiveness of lower rated CLO investments for insurance companies. SLC believes that the proposed approach will have minor impact for the vast majority of insurers, who largely focus on the AAA and AA tranches. However, insurers who have added lower rated tranches may see increased capital requirements. If these insurers are capital constrained, it may lead to changes in investment strategy.

While we are a few years away from the new CLO capital framework, insurers and their asset managers should use this time to vet current and future holdings, ensuring there are no surprise capital implications.

SLC-20221012-2471773

Disclosure

This content is intended for institutional investors only. This information is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and, in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association. In the U.S., securities are offered by Sun Life Institutional Distributors (U.S.) LLC, an SEC registered broker-dealer and a member of the Financial Industry Regulatory Authority (“FINRA”).

The information presented may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility.

Efforts have been made to ensure that the information contained in this report is obtained from sources believed to be reliable and accurate at the time of publication; however, Sun Life Capital Management (Canada) Inc. and/or its affiliates (collectively “SLC Management”) do not guarantee its accuracy or completeness. Information is subject to change and SLC Management accepts no responsibility for any losses arising from any use of or reliance on the information provided SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate

© 2022, SLC Management