Explore institutional insights

Falling discount rates spoil April equity rally

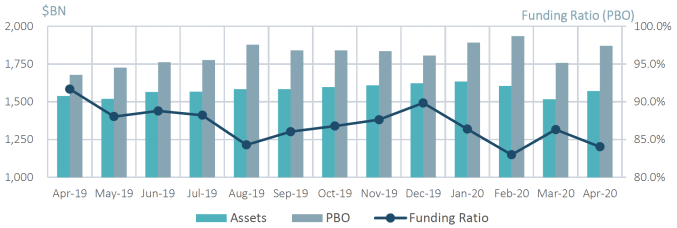

Despite a snapback in equity markets, lower discount rates decreased funding ratios in April

- Average funded status was down by 2.3% over the month - assets returned 3.9%, offset by a 6.7% increase in liabilities.

- Equities rebounded from March selloff - the S&P 500 surged 12.8% while the MSCI AW ex-U.S. increased 7.4%.

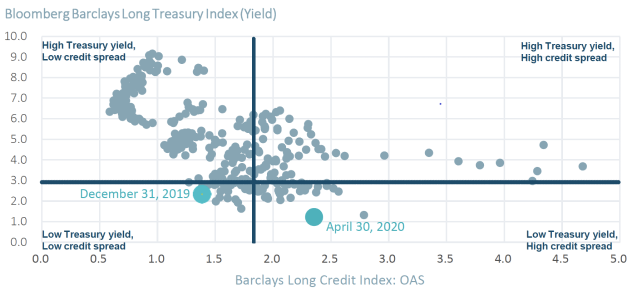

- The yield on the Bloomberg Barclays Long Credit Index declined by 50 basis points - driven by a 43 basis points (bps) tightening of long investment grade credit spreads and declining treasury yields. The U.S. 10-year Treasury yield dropped 8 bps over the month.

- Within IG credit, spreads narrowed from March wides - as credit markets normalized, IG spreads fell below 200 bps, finishing April at 196 bps, a 63 bps decline month over month.

- Influx of US IG corporate debt - $262B of issuance in April as companies take advantage of the Fed backstop.

| Market Watch | Dec 2018 | Dec 2019 | Mar 2020 | April 2020 |

|---|---|---|---|---|

| Funded Status | 87% | 90% | 86% | 84% |

| CITI Discount Rate | 4.22% | 3.22% | 3.12% | 2.80% |

| Long Credit Yield1 | 4.89% | 3.63% | 3.91% | 3.41% |

| US 30Y TSY Yield | 3.02% | 2.38% | 1.35% | 1.27% |

| S&P500 | 2,507 | 3,231 | 2,585 | 2,912 |

Spread tightening coupled with declining treasury rates drove yields down

Spotlight: Evolving the LDI portfolio – the role of private assets

- Most plan sponsors are comfortable with the role private assets play in the growth-oriented portion of the portfolio, but we have historically seen less innovation within the liability hedging portion of their asset allocation.

- Hedging assets are typically focused on public corporate and treasury bonds, however we have seen increasing demand from plan sponsors who are looking to add diversification and additional yield to their portfolios without taking on excess credit risk.

- Investment grade private fixed income can complement traditional fixed income mandates in a well-rounded LDI program. These deals are typically highly negotiated secured transactions that provide investors with diversification, the potential for excess returns and downside protection through the covenants and collateral backing the deals.

- Insurers have historically accessed this asset class to back long-term liabilities. As long-term investors, we believe a similar opportunity exists for plan sponsors to take advantage of their investment horizon and earn extra yield via the attractive spreads on offer in private fixed income, while still maintaining a strong correlation to their plan liabilities.

Milliman Pension Funding Index

1 Bloomberg Barclays Long Credit Index

2 Investment-grade credit ratings of our private placements portfolio are based on a proprietary, internal credit rating methodology that was developed using both externally-purchased and internally developed models. This methodology is reviewed regularly. More details can be shared upon request. There is no guarantee that the same rating(s) would be assigned to portfolio asset(s) if they were independently rated by a major credit ratings organization