Explore institutional insights

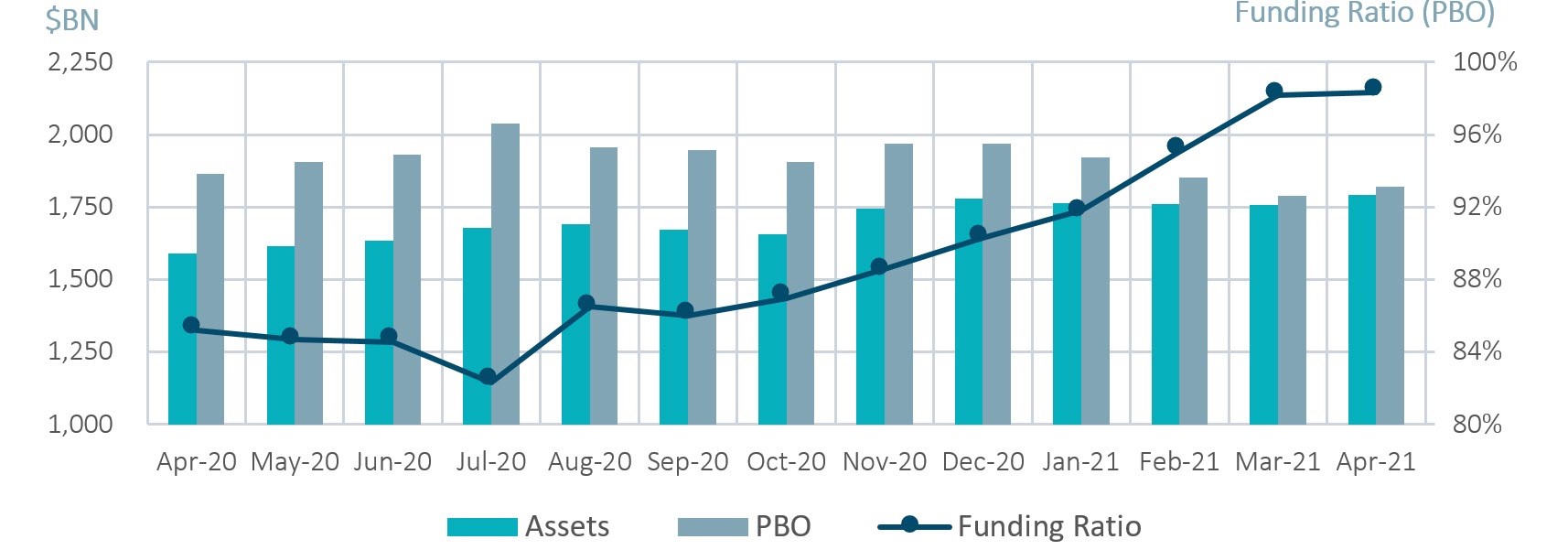

Funded status holds steady as investment gains were muted by lower discount rates

April Market Summary

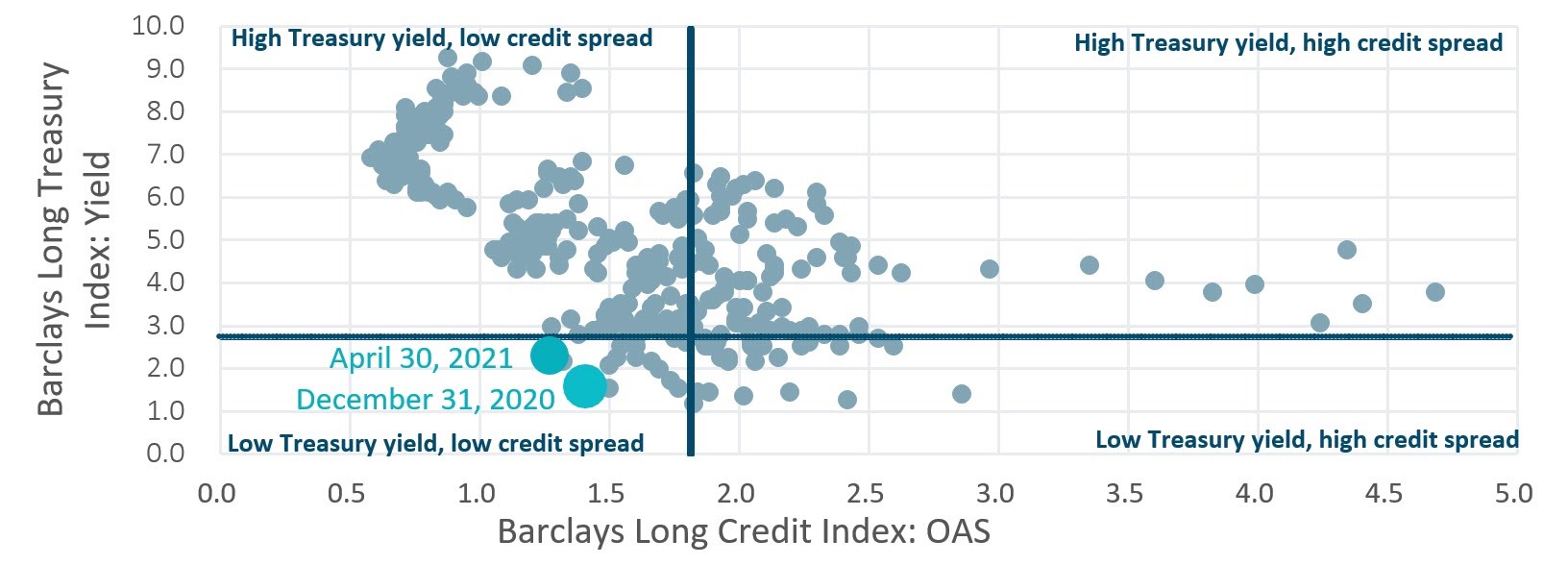

- Average funded status was unchanged in April: Assets returned 2.3% while a decrease in discount rates increased liabilities by 2.2%.

- U.S. equity markets posted another strong month: The S&P 500 increased by 5.2% in April and is now up 11.3% since the start of the calendar year¹.

| Market Watch | Dec 2019 | Dec 2020 | Mar 2021 | Apr 2021 |

|---|---|---|---|---|

| Funded status | 90% | 90% | 98% | 98% |

| CITI discount rate2 | 3.01% | 2.23% | 2.94% | 2.81% |

| Long Credit yield2 | 3.63% | 2.78% | 3.45% | 3.35% |

| U.S. 30Y TSY yield | 2.39% | 1.64% | 2.41% | 2.30% |

| S&P 500 | 3,231 | 3,756 | 3,973 | 4,181 |

- The yield on the Bloomberg Barclays Long Credit Index dropped 10 basis points (bps): Long credit spreads widened 1 bps while long end treasury yields fell by 11 bps.

- Investment grade (IG) corporate supply slows down: After a strong March of over $200B, new supply totaled $98B in April. Year-to-date new issuance is now $548B, a 32% decline relative to this time last year, but 30% higher compared to April 2019.

Long credit spreads vs. long Treasury yields

Spotlight: Three reasons investment grade private credit is more liquid than you might think

- Many plan sponsors are adding alternative sources of credit like investment grade private credit (IGPC) to their hedging portfolios in search of yield and diversification. One of the most common questions we receive is “how liquid is investment grade private credit?”

- Contrary to common belief, there is an active secondary market in private fixed income, where the bid ask is often only a couple bps for more liquid names.

- In a typical year, there is roughly $100BN of new issuance, while about $3BN - $4BN change hands on the secondary market. The lower volume of secondary market activity is a result of a lack of sellers, not buyers, where insurers with a buy-and-hold mentality create a market with relatively few willing sellers.

- The most direct liquidity source is via other lenders that are holders of the original deal, who already own and are familiar with the credit and happy to take an additional allocation.

- Regular issuers, such as Major League Baseball, are especially liquid. The market has already done the due diligence and transactions often complete at a competitive rate on the same day offers are made. Sellers can also reach a broader market through brokers, who also act as third-party pricing agents.

- A fund structure significantly improves liquidity by crossing flows, utilizing a liquidity sleeve and providing greater diversification.

- Capacity constraints in the IGPC market means many funds establish a queue for investors. The most natural source of liquidity is to cross the in/outflows, simply transferring ownership from those looking to exit with those looking to add exposure. IGPC funds often also hold a small sleeve of public fixed income to help manage duration. If needed, this can provide an additional source of liquidity buffer before selling private credit holdings.

Milliman Pension Funding Index

¹Data from reference Bloomberg Barclays Indices. Issuance data sourced from SIFMA.

²The CITI discount rate corresponds to the FTSE short pension liability index. The Long Credit yield corresponds to the Bloomberg Barclays Long Credit Index.