Explore institutional insights

Rising discount rates increase funded status by 4%

Positive asset gains coupled with a decrease in liabilities drives funded status higher

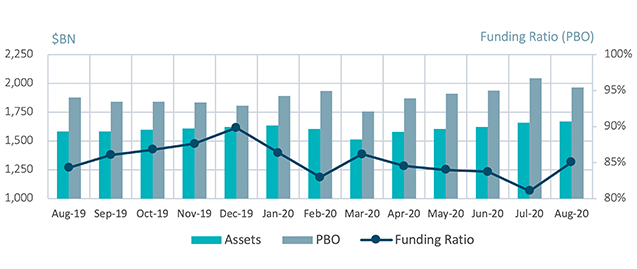

- Average funded status was up by 4% over the month: Assets returned 0.9%, while liabilities dropped by 3.8%.

- S&P 500: The S&P 500 soared another 7% in August, posting it’s highest monthly return since January 2019, and is now up 8.3% for the year.

| Market Watch | Dec 2018 | Dec 2019 | July 2020 | August 2020 |

|---|---|---|---|---|

| Funded status | 87% | 90% | 81% | 85% |

| CITI discount rate1 | 4.05% | 3.01% | 2.02% | 2.32% |

| Long Credit yield1 | 4.89% | 3.63% | 2.78% | 3.01% |

| U.S. 30Y TSY yield | 3.02% | 2.38% | 1.20% | 1.49% |

| S&P 500 | 2,507 | 3,231 | 3,271 | 3,500 |

- The yield on the Bloomberg Barclays Long Credit Index rose by 23 basis points (bps): Driven by a 29 bps increase in the 30Y Treasury. Long credit spreads remained flat for the month.

- Within broader Investment Grade (IG) credit, spreads inched tighter: IG credit markets had modest spread tightening, finishing the month at 122 bps, a 4 bps decline month-over-month.2

- Corporate issuance picks back up: U.S. IG corporates issuance was $144BN in August, rebounding from $69B in July. Year-to-date IG corporate issuance is now over $1.4T.

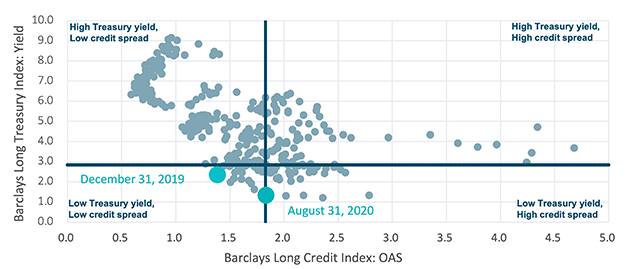

Long credit spreads vs. long Treasury yields

Spotlight: Alternative options for duration and yield

- The current environment of depressed Treasury rates, relatively low spreads, and high equity valuations has created a dilemma for many DB plans. The sub-3% yields on corporate bonds have made some sponsors reluctant to de-risk while high equity valuations also make them hesitant to re-risk.

- As the chart above shows, this month both rates and spreads are below their historical averages. With treasury rates so low, and credit spreads accounting for a greater proportion of all in yields, managing credit exposure becomes increasingly important within LDI mandates whether they choose to de-risk or re-risk.

- Despite tighter than average spreads, as of August 31, credit spread accounted for 61% of the Long Credit index yield compared to only 25% in August 2000.

- In this environment, plan sponsors can complement their traditional LDI allocations with non-traditional asset classes as additional sources of both duration and yield.

- Investment grade private credit is one way sponsors could potentially earn additional yield in the less efficient private markets, taking advantage of attractive opportunities while continuing to reduce surplus volatility and maintain high quality credit exposure.3

- Similarly, although less correlated to liabilities, infrastructure investments are both long-dated in nature and often provide diversifying credit exposure to public credit markets.

Milliman Pension Funding Index

1The CITI discount rate corresponds to the FTSE short pension liability index. The Long Credit yield corresponds to the Bloomberg Barclays Long Credit Index.

2Data from reference Bloomberg Barclays Indices.

3Investment grade credit ratings of our private placements portfolio are based on a proprietary, internal credit rating methodology that was developed using both externally-purchased and internally developed models. This methodology is reviewed regularly. More details can be shared upon request. Although most U.S. dollar private placement investments have an external rating, for unrated deals, there is no guarantee that the same rating(s) would be assigned to portfolio asset(s) if they were independently rated by a major credit rating organization.