Explore institutional insights

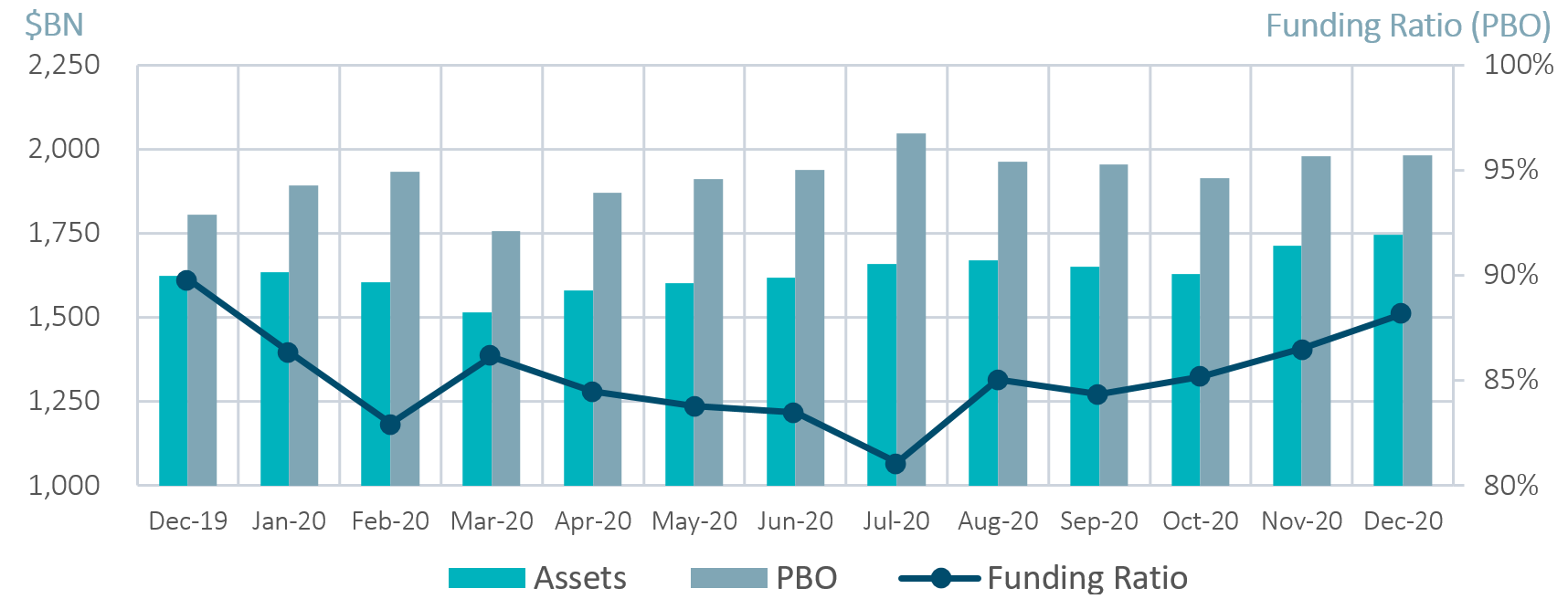

Funded status increases nearly 2% on positive investment gains

December market summary

- Average funded status was up by 1.7% over the month: Assets returned 2.3%, while liabilities increased by 0.4%.

- S&P 500: The S&P 500 gained 3.7% in the month of December and finished 2020 up 16.3%.

| Market Watch | Dec 2018 | Dec 2019 | Nov 2020 | Dec 2020 |

|---|---|---|---|---|

| Funded status | 87% | 90% | 87% | 88% |

| CITI discount rate1 | 4.05% | 3.01% | 2.21% | 2.23% |

| Long Credit yield1 | 4.89% | 3.63% | 2.80% | 2.78% |

| U.S. 30Y TSY yield | 3.01% | 2.39% | 1.57% | 1.64% |

| S&P 500 | 2,507 | 3,231 | 3,622 | 3,756 |

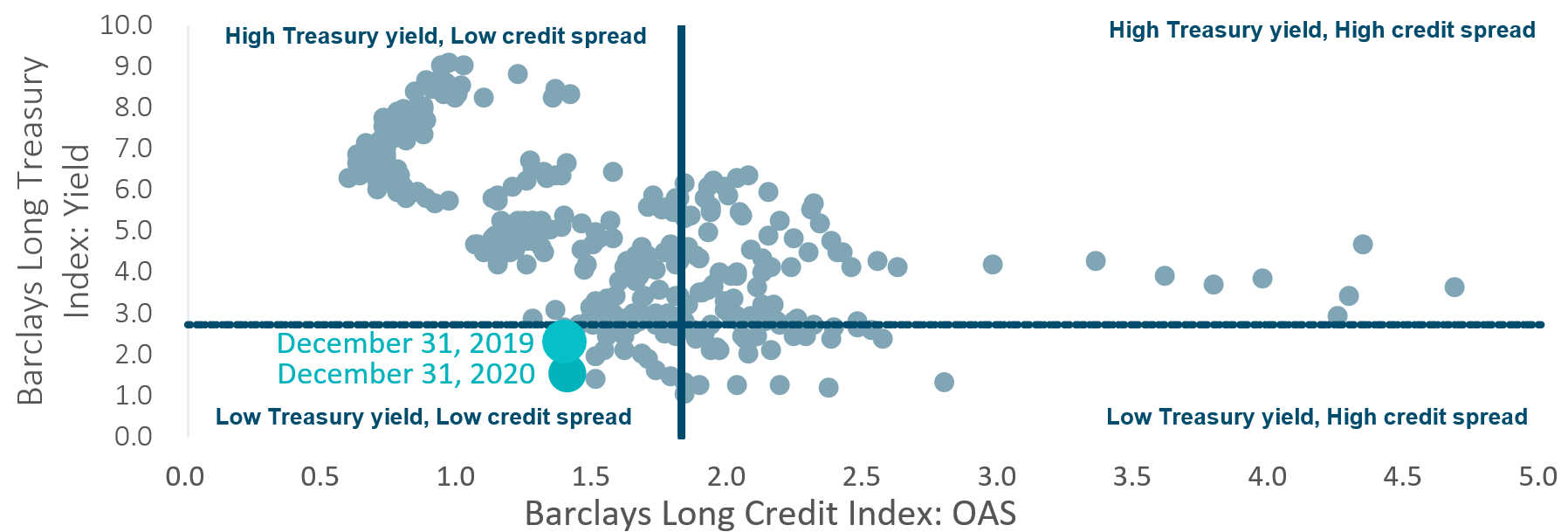

- The yield on the Bloomberg Barclays Long Credit Index fell by 2 basis points (bps): Driven by a 9 bps decrease in credit spreads (OAS) and 7 bps increase in long end rates.

- Credit spreads narrowed within broad Investment Grade (IG) credit: IG credit spreads finished the month at 92 bps, an 8 bps tightening month over month².

- IG Corporate Issuance: As expected, IG corporate issuance slowed in December posting just $36B, but finished 2020 with roughly $1.9T in new issuance which is the single highest calendar year on record².

Long credit spreads vs. long Treasury yields

Spotlight: 2020 LDI year in review and look ahead to 2021

- After a turbulent year, average funded status was down 1.6% in 2020. Plan sponsors that were further along in their de-risking paths would have seen a less volatile funded status.

- As Fed action led to record low rates, discount rates dropped by 0.8% in 2020. This led to a 13.7% increase in liabilities, which were not fully offset by strong equity returns.

- In a volatile market, active management was a significant value add, especially within corporate bond strategies that were able to take advantage of attractive spreads in Q2.

- Wide spreads in investment grade private credit persisted throughout the year, providing an attractive opportunity to diversify and add yield to their LDI portfolios.

- In 2021, the challenge of hedging pension liabilities in a lower for longer rate environment has worsened, as long credit spreads retraced nearly all 2020 widening, hovering at 141 bps, almost identical to December 2019 trading levels.

- In this environment, we believe a focus on security selection within fixed income portfolios is critical, as investors are receiving ever lower compensation for taking on risk.

- Additionally, with low all-in yields, a focus on managing spread exposure becomes even more important as spreads now account for 51% of the total long credit yield.

- With little compensation for risk taking, our expectations for 2021 are that more sponsors will seek to increase the yield within their LDI portfolios without dipping down in quality.

- Alternatives such as infrastructure, real estate and private fixed income may prove popular with sponsors who are willing to look outside the traditional liability hedging assets.

- Similarly, plan sponsors may move to reduce risk by using derivative strategies such as synthetic equity, which could maintain exposure to buoyant equity markets while moving physical assets to the hedging portfolio to lock in gains.

Milliman Pension Funding Index

¹ The CITI discount rate corresponds to the FTSE short pension liability index. The Long Credit yield corresponds to the Bloomberg Barclays Long Credit Index.

² Data from reference Bloomberg Barclays Indices. Issuance data sourced from SIFMA going back to 1996.