Explore institutional insights

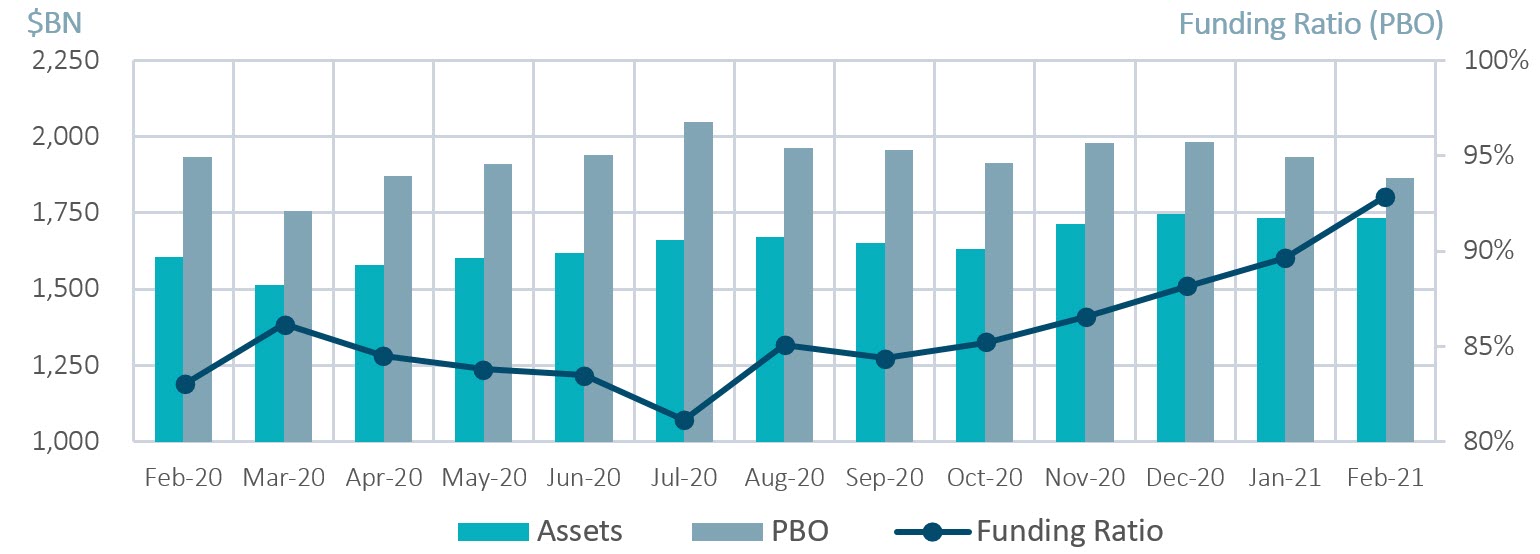

Funded status increased 3% on sharp rise in interest rates

February Market Summary

- Average funded status was up by 3.2% over the month: Assets returned 0.1% while an increase in discount rates decreased liabilities by 3.3%.

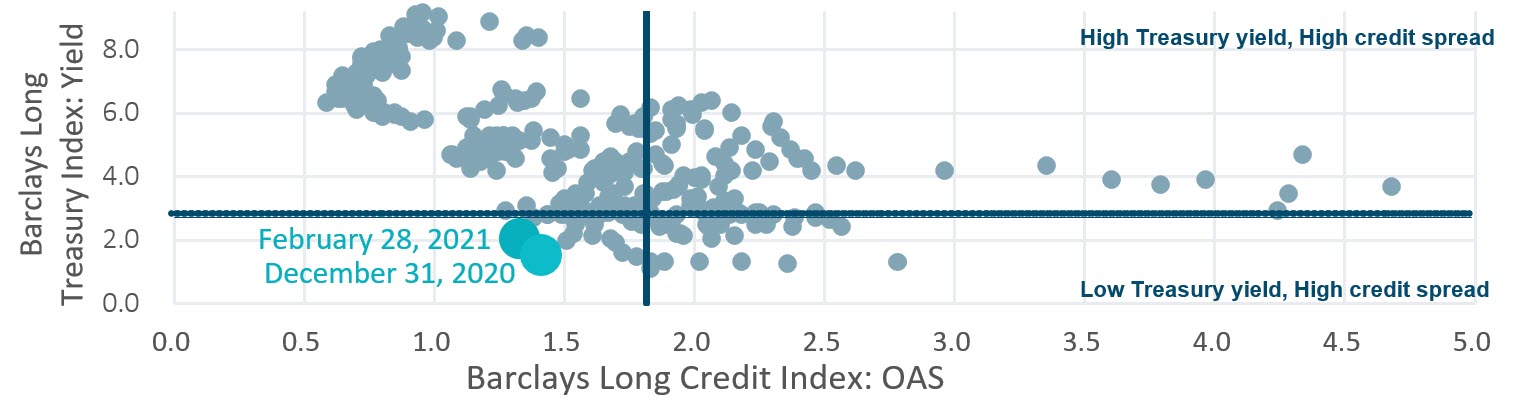

- The yield on the Bloomberg Barclays Long Credit Index increased 25 basis points (bps): Credit spreads tightened 8 bps month over month while long Treasury yields climbed 33 bps¹.

| Market Watch | Dec 2019 | Dec 2020 | Jan 2021 | Feb 2021 |

|---|---|---|---|---|

| Funded status | 90% | 88% | 90% | 93% |

| CITI discount rate2 | 3.01% | 2.23% | 2.43% | 2.70% |

| Long Credit yield2 | 3.63% | 2.78% | 2.98% | 3.23% |

| U.S. 30Y TSY yield | 2.39% | 1.64% | 1.83% | 2.15% |

| S&P 500 | 3,231 | 3,756 | 3,714 | 3,811 |

- Steepening yield curve environment: The 2-year Treasury yield ticked up a modest 2 bps while the 10- and 30-year yield increased 34 and 32 bps, respectively. The 2s10s spread now sits at 128 bps, its widest trading levels since December 2016.

- Investment Grade (IG) Corporate Issuance: New issuance totaled $111B in February with $34B coming from the long duration space, highlighted by Apple’s new deal worth $6.3B.

Long credit spreads vs. long Treasury yields

Spotlight: De-risk and diversify

- At 93%, the average corporate DB plan funded status has climbed to the highest level in over a decade (eclipsing the most recent high achieved back in 2018) so all eyes are back on de-risking.

- As evidence, STRIPS creation is near the highs we saw in 2019.

- While Long Credit yields rose over the month, credit spreads are tighter as plan sponsors look to rebalance back to their liability hedging portfolios.

- Corporate bond supply is down year-over-year on both a gross and net basis. Issuers have been favouring 10 years and shorter maturities, as the credit and rates curves have steepened a bit.

- All of this could continue to keep long corporate spreads at the tighter end of their range. The thought of moving more assets into long duration fixed income now, with yields still relatively low and spreads still relatively tight might make plan sponsors take pause. However, 2020 has shown us that volatility can be just around the corner – so what should plan sponsors do? We recommend continuing on the de-risking path, but doing so wisely and looking for ways to position based on this unique environment.

- Within a long credit portfolio, diversifying holdings can help reduce idiosyncratic risk while still staying fully invested to hedge the credit component of your liability. Increasing liquidity and keeping an eye on the quality of your portfolio can prepare you to take advantage of any volatility as we exit the pandemic (consider underweighting or reducing BBB’s relative to on–the-run benchmarks).

- For Alternative credit sources, consider other exposures that still maintain a correlation to plan liabilities such as investment grade private credit, which can help pick up yield and add diversification on an issuer and sector basis in both the long and intermediate parts of the curve.

- Increasing exposure to securitized bonds can provide an alternative source of alpha. For sponsors comfortable moving down the quality spectrum, issues in this sector can have stronger credit profiles than their corporate counterparts.

- If you are considering or approaching termination/hibernation:

- Sponsors that have benefited from the recent improvement in funded status and are now in reach of their long term funding goals may want to consider capital efficient overlay strategies. Utilizing synthetic equity can allow sponsors to allocate more physical assets to the hedging portfolio to maintain the desired hedge ratio with physical bonds.

- With a greater physical hedging portfolio, sponsors can build more customized cash flow focused portfolios that better align with duration, credit and curve risks relative to the liabilities.

Milliman Pension Funding Index

¹Data from reference Bloomberg Barclays Indices. Issuance data sourced from SIFMA.

²The CITI discount rate corresponds to the FTSE short pension liability index. The Long Credit yield corresponds to the Bloomberg Barclays Long Credit Index.