Explore institutional insights

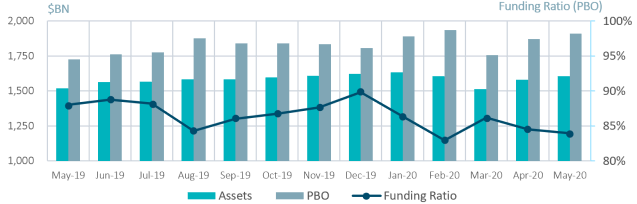

Funded status edged down as discount rates continued to fall

Despite another positive month of asset gains, lower discount rates decreased funded status in May

- Average funded status was down by 0.5% over the month - assets returned 1.9%, offset by a 2.5% increase in liabilities.

- Equities continued to rebound from March lows - the S&P 500 rose another 4.5% while the MSCI AW ex-U.S. increased 3.3%.

| Market Watch | Dec 2018 | Dec 2019 | April 2020 | May 2020 |

|---|---|---|---|---|

| Funded Status1 | 87% | 90% | 85% | 84% |

| CITI Discount Rate2 | 4.05% | 3.01% | 2.54% | 2.46% |

| Long Credit Yield2 | 4.89% | 3.63% | 3.41% | 3.31% |

| U.S. 30Y TSY Yield | 3.02% | 2.38% | 1.28% | 1.41% |

| S&P 500 | 2,507 | 3,231 | 2,912 | 3,044 |

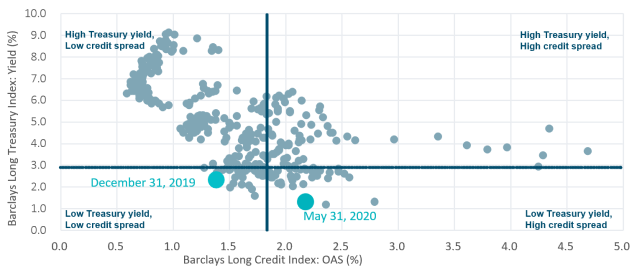

- The yield on the Bloomberg Barclays Long Credit Index declined by 10 basis points (bps) – an 18 bps tightening of long IG credit spreads was somewhat offset by rising Treasury yields. The U.S. 30-year Treasury yield rose by 13 bps over the month.

- Within IG credit, spreads continued to narrow - as credit markets continue to stabilize, IG spreads continued to rally, finishing May at 164 bps, a 27 bps decline month over month.

- Continued influx of U.S. corporate debt – issuance YTD exceeded $1TN, a figure not surpassed until November in 2019.

Long credit spreads vs. long Treasury yields

Spotlight: Evolving the LDI portfolio – 20 year bonds

- In May, the U.S. government issued 20-year maturity Treasuries for the first time since 1986. The initial auction was for $20BN, with an additional $34BN expected in June and July.

- In the IG corporate bond market, the amount outstanding in 20-year bonds (14% of IG market) is close to the total outstanding in 30-year bonds (18% of IG market).

- However, the lack of a benchmark 20-year Treasury has historically meant lower issuance and trading in 20-year corporate bonds compared to 30-year corporate bonds. Consequently, 20-year corporates trade with an illiquidity discount as investors demand additional relative spread as compensation.

- The illiquidity discount is expected to gradually disappear as the new benchmark 20-year Treasury attracts more new issuance and trading in 20-year corporates.

- Following the 20-year Treasury issuance we saw corporate issuers follow suit with Pfizer and other large corporations issuing 20-year maturity debt.

- For defined benefit pensions, these changes could have a number of impacts. We may see pricing movements in the 20-year space in the short term, which nimble active managers could look to exploit. Over the longer term, the new 20-year corporates could help improve curve matching for plan sponsors looking to fine tune their liability hedging portfolios.

Milliman Pension Funding Index

¹The April 2020 funded status figure reflects Milliman’s reconciliation from 84% to 85% provided in the May 2020 publication.

²The CITI discount rate corresponds to the FTSE short pension liability index. The Long Credit yield corresponds to the Bloomberg Barclays Long Credit Index.