Explore institutional insights

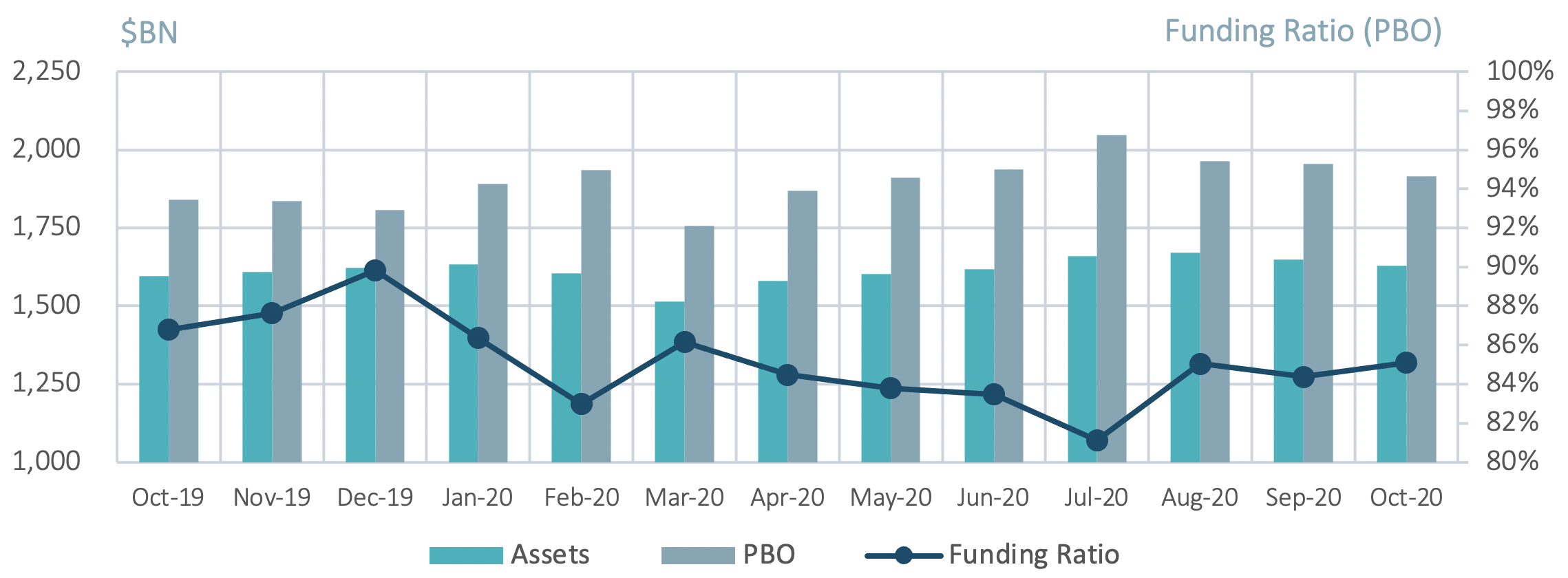

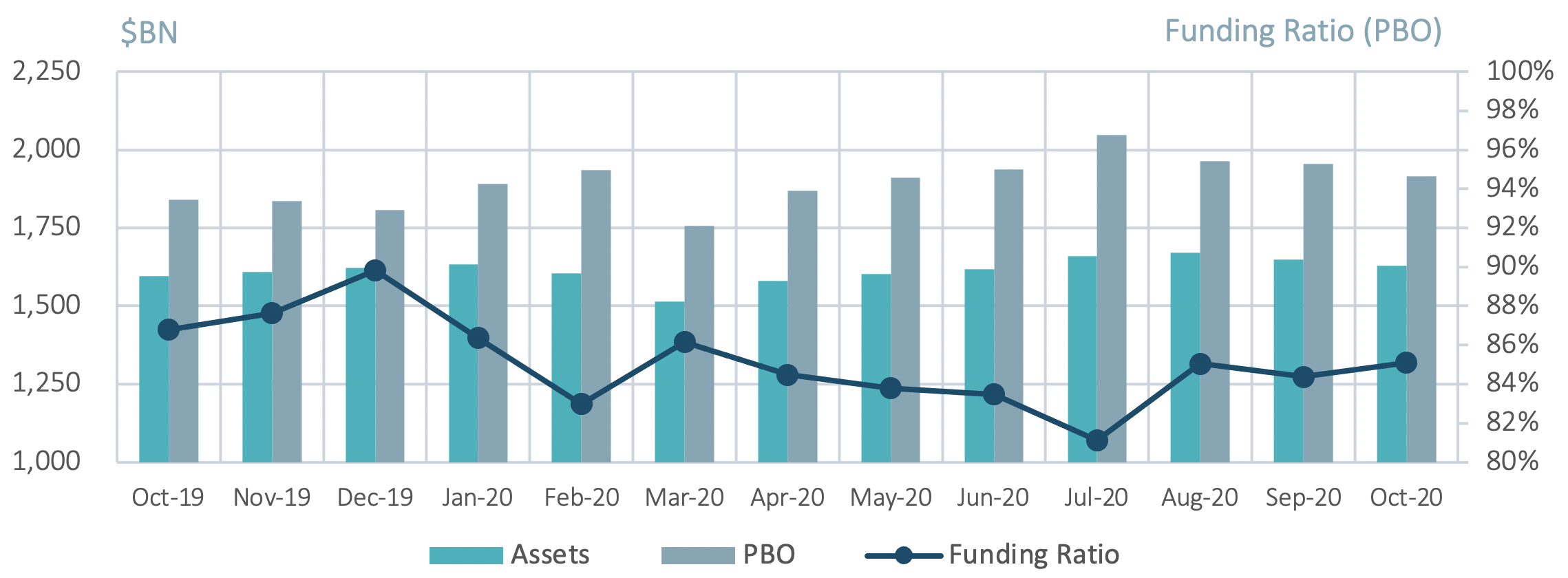

Rising discount rates drive funded status higher

October market summary

- Average funded status was up by 0.7% over the month: Assets returned -0.9%, while liabilities decreased by 1.8%.

- S&P 500: The S&P 500 posted a 2.8% loss in October, its second consecutive negative monthly return. Year-to-date the index remains positive at +1.2%.

| Market Watch | Dec 2018 | Dec 2019 | Sept 2020 | Oct 2020 |

|---|---|---|---|---|

| Funded status | 87% | 90% | 84% | 85% |

| CITI discount rate1 | 4.05% | 3.01% | 2.32% | 2.44% |

| Long Credit yield1 | 4.89% | 3.63% | 3.05% | 3.12% |

| U.S. 30Y TSY yield | 3.01% | 2.39% | 1.46% | 1.66% |

| S&P 500 | 2,507 | 3,231 | 3,363 | 3,270 |

- The yield on the Bloomberg Barclays Long Credit Index rose by 7 basis points (bps): Despite credit spreads (OAS) tightening 11 bps, an increase in interest rates pushed the index yield higher.

- Credit Spreads narrowed within broad Investment Grade (IG) credit: IG credit spreads finishing the month at 119 bps, a 9 bps tightening month over month.²

- IG Corporate Issuance slows down: U.S. IG corporate issuance posted its second lowest monthly figure of 2020 at $90B.

Long credit spreads vs. long Treasury yields

Spotlight: Market impacts from the 2020 U.S. presidential election

- President-elect Joe Biden will likely lead under a divided government where the GOP retains control of the Senate. Although Democrats have a potential path to Senate control, markets are assigning a low probability that they capture both seats in the Georgia runoff. GOP Sen. Majority Leader McConnell has openly stated that a stimulus deal is “job one,” but the package is likely to be smaller in scope and more reactive in nature.

- Additionally, some of the more ambitious spending plans proposed by Democrats pre-election, such as the Green New Deal, may be off the table for now.

- The Fed will likely be forced to continue doing the heavy lifting in future market sell-offs, and they have already promised to keep rates low until at least 2023.

- Continued loose monetary policy should add more support to buoyant markets overall, although opportunities may be more sector specific.

- There remain potentially attractive opportunities in energy, while upside in consumer non-cyclicals could be more limited. Overall, Investment grade credit spreads are already approaching their pre-Covid tights.

- While Biden likely brings a different Covid-19 response, news from Europe (currently entering additional lockdowns) provides little evidence that the situation will improve drastically in the short run.

- On a more positive note, the growing pipeline of therapeutics and news of promising vaccine trials should help accelerate some return to economic normality as they become available.

- For DB plans, the “lower for longer” environment continues. However, with credit spreads making up the majority of corporate yields, it is important to assess the source of that spread exposure.

- We expect to see a continued shift to alternative asset classes such as private credit in LDI as sponsors look for ways to add yield and diversification without taking on additional credit risk.

- Within bond portfolios, the current tight spread levels make active management increasingly important in helping avoid the downside risk of overvalued securities.

Milliman Pension Funding Index

1The CITI discount rate corresponds to the FTSE short pension liability index. The Long Credit yield corresponds to the Bloomberg Barclays Long Credit Index.

2Data from reference Bloomberg Barclays Indices.