Explore institutional insights

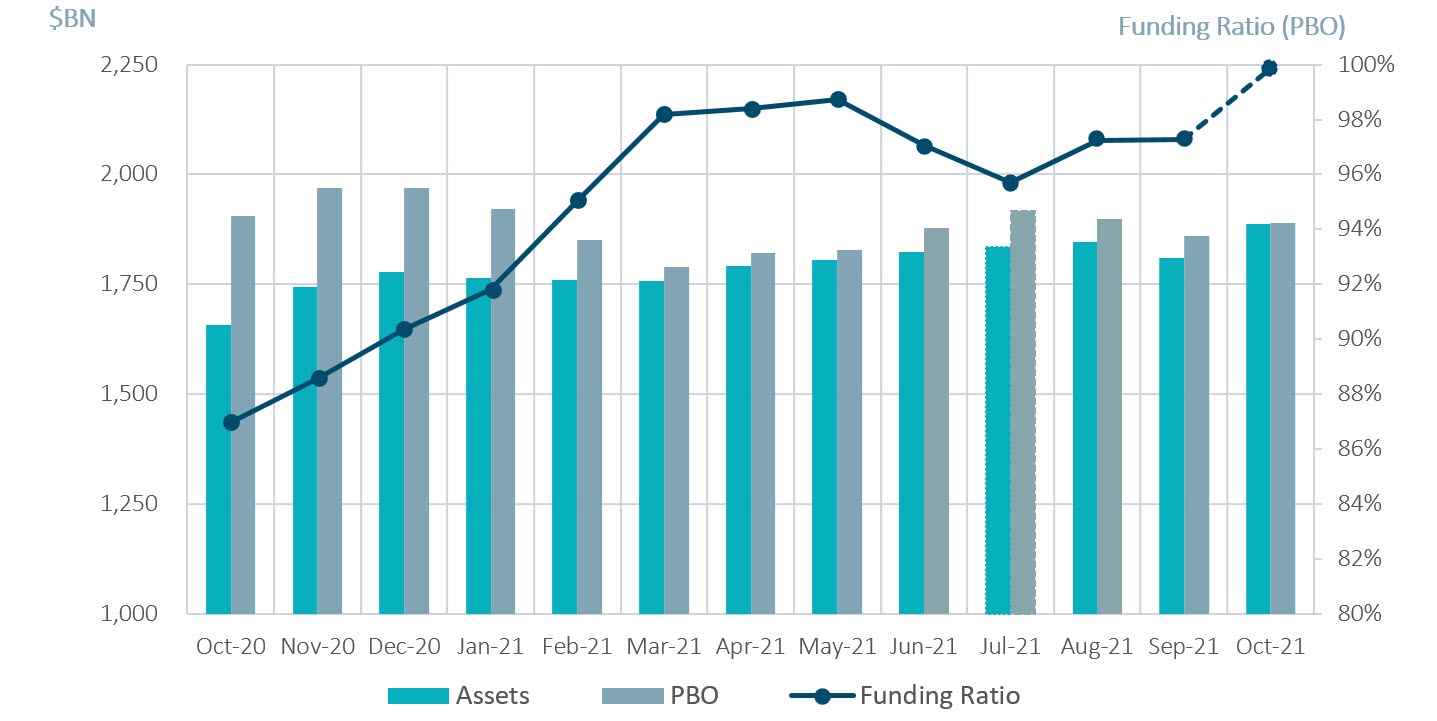

Strong investment performance pushes funded status near 100%

October Market Summary

- Average funded status increased by 2.6% to 99.9%: Assets returned 4.4% while a drop in discount rates increased liabilities by 1.6%. ¹

- U.S. equity markets rebounded in October: The S&P 500 rallied 6.9% during the month and is now up 22.6% since the start of the calendar year.

- The yield on the Bloomberg Barclays Long Credit Index decreased 7 basis points (bps): Long credit spreads widened 1 bps while the underlying Treasury basis decreased 8 bps. ¹

| Market Watch | Dec 2019 | Dec 2020 | Sept 2021 | Oct 2021 |

|---|---|---|---|---|

Funded status |

90% |

90% |

97% |

100% |

CITI discount rate² |

3.01% |

2.23% |

2.63% |

2.53% |

Long Credit yield² |

3.63% |

2.78% |

3.06% |

3.06% |

U.S. 30Y TSY yield |

2.39% |

1.64% |

2.04% |

1.93% |

S&P 500 |

3,231 |

3,756 |

4,308 |

4,605 |

Spotlight: Global rates markets remain uncertain as investors await central bank actions

- Over the last month, global short term rates markets began to show some volatility as investors debated central bank policies and inflation.

- In the U.S., the yield curve flattened dramatically as the 2s30s spread narrowed by 33 bps - The 2-year Treasury rose by more than 20 bps for the first time since 2018 while the 30-year Treasury fell by 11 bps.

- In Australia, 2-year rates moved from 12 to 78 bps in just 5 days as the Reserve Bank of Australia gave-up on its previously announced yield curve control policy.

- At the latest Fed meeting, chairman Jerome Powell announced that the Fed will begin tapering, e.g. decreasing its bond purchases, by $15 BN per month starting in late November.

- Global supply chains remain challenged, as shipping costs for a standard 40ft container from Shanghai to LA have increased from roughly $4k a year ago to $11k today.

- The port of LA is experiencing severe operational challenges, where on any day approximately 100 ships await to be docked and unloaded

- Energy prices continue to rise, WTI increased from $36 to $84 dollars per barrel year-over-year, while natural gas prices spiked across Europe as Russia squeezed supplies.

- The credit outlook for the energy sector improved, spreads have tightened 30 bps since the start of the year, largely due to higher prices combined with a new found financial discipline. For comparison, the broad US Corporate index has tightened 9 bps year-to-date.

- In our long credit portfolios we have been positioning for this challenging environment by focusing on staying up in quality. We remain underweight BBB’s and favor financial and utility sectors over higher beta industrials.

- Additionally, we don’t see an obvious catalyst for spreads to go tighter and continue to hold a ~4% sleeve in Treasuries as dry powder in the event that credit spreads widen.

Milliman Pension Funding Index (October Estimate)

¹ Funded Status for the month of October is estimated and subject to change as final numbers are released. Data from reference Bloomberg Indices.

² The CITI discount rate is estimated for the month of October based on the change in the Bloomberg Long AA corporate Index. The Long Credit yield corresponds to the Bloomberg Long Credit Index.