The ESG imperative for insurers

Insurance companies are in a unique position amid the broad and growing interest globally in environmental, social and governance (ESG) issues: these companies must consider ESG factors—and the non-financial risks they present—in their roles as both insurer and investor. The need to successfully integrate ESG factors throughout a portfolio is even more critical as investors seek to sustainably achieve their risk-adjusted return and income objectives in today’s persistent low-rate environment.

SLC Management is committed to developing investment solutions for our insurance partners to address industry-specific challenges. We integrate ESG and other sustainability considerations into our investment processes.

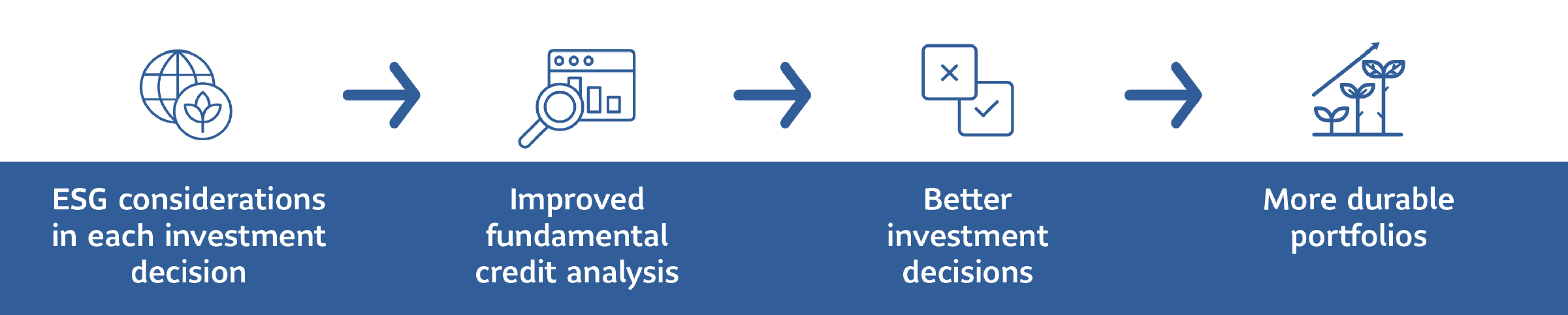

Our ESG-focused investment philosophy and process

We integrate ESG factors within our investment processes across our global investment platform. Through our deep analysis and a heightened awareness of non-financial risks, we seek to invest sustainably to preserve and enhance the long-term market value and income-generation capacity of the assets we manage.

We consider both short- and long-term risk impacts, primarily through portfolio management and specialized asset class research.

Our Sustainable Investing Policy

This policy aligns our approach to ESG investing with the Principles of Responsible Investments (PRI), which have always been an integral part of our initial and on-going investment analysis and decision-making.

Portfolio management capabilities:

- Portfolio managers and credit research analysts collaborate closely to “price” ESG risks in each investment decision.

- We focus on ensuring that we are adequately compensated for all material risks and identify ESG issues where we need to engage with management teams to improve their approach.

- Variables we consider include the objective of the underlying mandate, asset types, eligible investments, expected investment holding period and availability of information.

In-depth, asset class-specific research capabilities :

- Our approach to risk management is dynamic and accounts for both market- and company-specific ESG factors, plus material non-financial elements, such as policy implications.

- The nature and timing of our ESG analysis reflect the liquidity profile of the asset class and are adapted to the nuances of private fixed income investments and public bonds.

Our proprietary ESG ratings system

We evaluate credits’ ESG exposure through a framework that incorporates our fundamental, proprietary ratings system and third-party data. This framework allows us to form a comprehensive view of a credit and facilitates an ongoing dialogue about how ESG factors can affect our analysis and investment decisions. Our scoring matrix evaluates each credit issuer on its relative levels of E, S, G and non-financial risks, using a scale of 1 through 4. An overall ESG score is generated, taking into account the impact of any relevant non-financial factors, which are weighted differently based on sectors. Our team has developed ESG scores for over 80% of our public corporate names.

How are ratings calculated?

Below is an example of how we scored a large financial services company within our ESG Plus framework. E, S, G and non-financial “plus” factors were each weighted based on their materiality to the sector:

- Environmental

- Score: High risk

- Weighted: 10%

- The firms outsized lending to energy companies supports organizations whose practices are harmful to the environment

- Social

- Score: Moderate to high risk

- Weighted: 20%

- The company has been flagged for controversies related to privacy and security, which put their customers’ personal data at risk

- Governance

- Score: High risk

- Weighted: 35%

- High profile scandals in the bank’s retail operations represented a failure in corporate oversight

- Plus

- Score: Moderate risk

- Weighted: 35%

- Large banks tend to invest more in technology, which can help to counter disruptive threats within the sector

Case study: Applying ESG to municipal bonds

ESG can be one of many factors that we consider when analyzing an investment, but at times it can tip the balance in the overall assessment and our decision to buy, hold or sell. Here are some recent examples of how this has affected portfolio decisions for municipal bonds.

- We opportunistically sold a state’s general obligation bonds based on poor governance of the state’s pension liabilities.

- We increased our position in a county’s water and sewer department bonds based on management’s proactive planning for environmental challenges such as the risk of rising sea levels and increased hurricane activity.

Our differentiated approach to ESG

- Unique dual perspective: Being an investment firm and an affiliate of Sun Life, a global financial services organization, affords us a unique vantage point from which to help institutional investors meet their ESG investing goals. Sun Life is one of our 220+ insurance company clients, totaling $148.9B+ (USD) in assets. We have a comprehensive understanding of the various policy measures and mandate constraints that are specific to insurance asset management.

- Focus on risk in all its forms: Across our investment platform, we bring heightened awareness of a wide array of risk factors, including non-financial, non-quantifiable ones, even if they do not fit neatly into the category of E, S or G. This “ESG Plus” view of risk is designed to identify any non-financial factors that could affect an issuer’s sustainability.

- Governance that upholds our commitment: Our focus on sustainable investing is reflected in our formally established committees.

Our Sustainability Governance Committee sets the overall priorities and approach on sustainability across SLC Management and our Sustainable Investment Council oversees how ESG is considered as part of the investment process.

As the non-financial risks insurance companies face—as both insurers and investors—continue to grow and change, it is essential that they adopt a holistic, evolving sustainable investing approach rather than using static guidelines. At SLC Management, we continuously strive to develop and improve our research capabilities, ESG and otherwise, as long-term stewards of our clients’ capital.

Disclaimers

The content of this document is intended for institutional investors only. It is not for retail use or distribution to individual investors. The information contained in this presentation is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this document.

Third party ESG data is an input into our proprietary evaluations of ESG risk. Absent common regulatory ESG standards and definitions, this data may be inconsistent among providers and is subject to change.

This material may contain examples of the firm’s internal ESG research program and is not intended to represent any particular product’s or strategy’s performance or how any particular product or strategy will be invested or allocated at any particular time. SLC Management’s ESG processes, rankings and factors may change over time. Information regarding a company’s ESG practices obtained through third-party reporting may not be accurate or complete, and is subject to change.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate.

Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association.

BentallGreenOak, InfraRed Capital Partners (InfraRed) are also part of SLC Management and Crescent Capital Group (Crescent) are also part of SLC Management.

BentallGreenOak is a global real estate investment management advisor and a provider of real estate services. In the U.S., real estate mandates are offered by BentallGreenOak (U.S.) Limited Partnership, who is registered with the SEC as an investment adviser, or Sun Life Institutional Distributors (U.S.) LLC, an SEC registered broker-dealer and a member of the Financial Industry Regulatory Authority (“FINRA”). In Canada, real estate mandates are offered by BentallGreenOak (Canada) Limited Partnership, BGO Capital (Canada) Inc. or Sun Life Capital Management (Canada) Inc. BGO Capital (Canada) Inc. is a Canadian registered portfolio manager and exempt market dealer and is registered as an investment fund manager in British Columbia, Ontario and Quebec.

InfraRed Capital Partners is an international investment manager focused on infrastructure. Operating worldwide, InfraRed manages equity capital in multiple private and listed funds, primarily for institutional investors across the globe. InfraRed Capital Partners Ltd. is authorized and regulated in the UK by the Financial Conduct Authority.

Crescent Capital Group is a global alternative credit investment manager registered with the U.S. Securities and Exchange Commission as an investment adviser. Crescent is a leading investor in mezzanine debt, middle market direct lending in the U.S. and Europe, high-yield bonds and broadly syndicated loans. Unless otherwise stated, all figures and estimates provided have been sourced internally and are as of March 31, 2021. Unless otherwise noted, all references to “$” are in Canadian dollars.

Unless otherwise stated, all figures and estimates provided have been sourced internally and are current as at the date of the paper unless separately stated. All data is subject to change.

This document may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

© SLC Management, 2021

SLC-20221102-2462392