Market Review

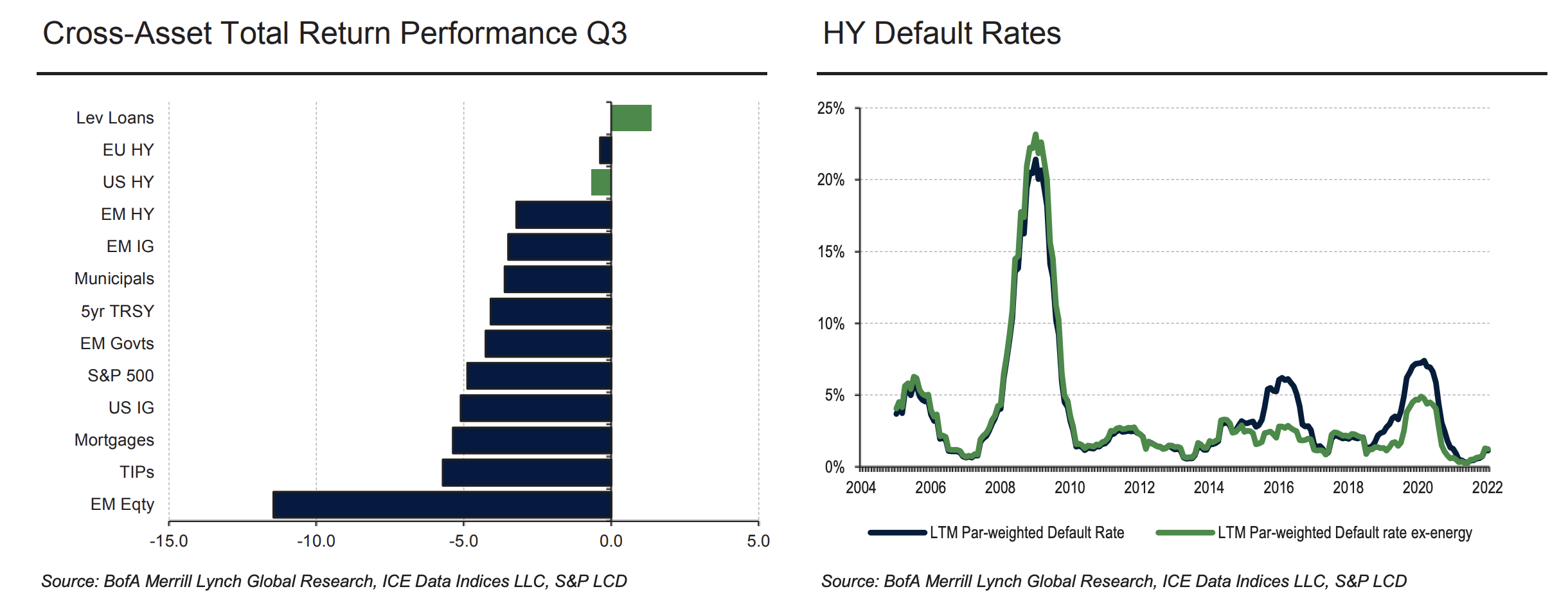

During the quarter, the US Fed raised rates twice, 75 basis points at the July and September FOMC meetings. As a result, US Treasury yields moved higher, with the 10-year ending the quarter at 3.83% and the 5-year at 4.09%. High yield bond yields widened to 9.58% but spreads tightened to 550 basis points; and in bank loans, yields widened to 8.47% in Q3. WTI oil prices ended Q3 at $79.49 / barrel, down 25% from last quarter. The S&P 500 returned - 4.89% in Q3 and -23.88% for the year.

Most major equity and fixed income asset classes suffered losses in Q3 including US high yield bonds which returned -0.68% as measured by the ICE BAML US High Yield index while leverage loans returned +1.37% as measured by the Morningstar LSTA Leveraged Loan index. Loans were the only asset class with a positive return for the quarter. Both asset classes managed to outperform all other markets including US Investment Grade, TIPs, Mortgages, Treasuries, Municipals, Emerging Market High Yield and the S&P 500 index for the quarter.

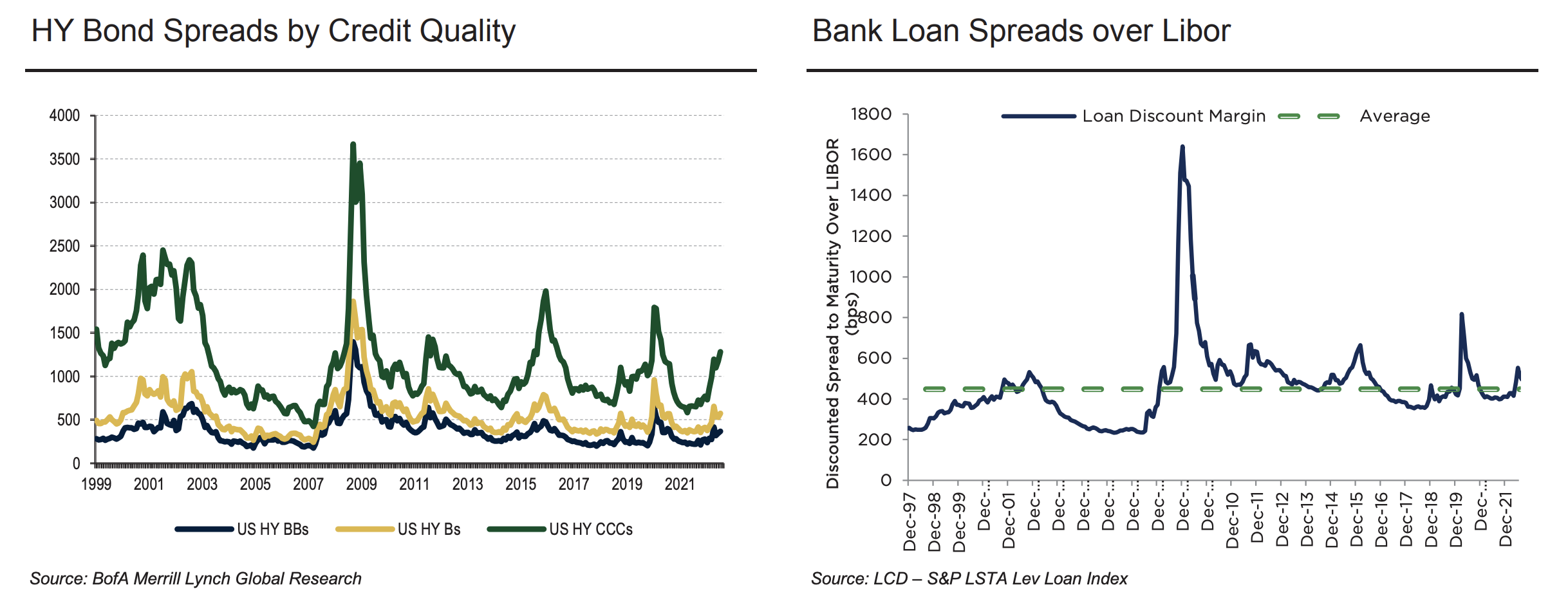

Most sectors were down in the high yield market; the best performing sectors were Transportation, Energy and Services and the worst performing sectors were Banking, Healthcare and Retail. For bank loans, the best performing sectors were Utilities, Real Estate and Energy and the worst performing sectors were Consumer Durables & Apparel, Health Care Equipment & Services and Software & Services. In terms of credit quality, BBs were the worst performers in high yield bonds given the move in rates. More specifically, BB bonds returned -0.88% underperforming B and CCC bonds by 31 and 67 basis points, respectively. Conversely, for loans, BBs returned +2.45% outperforming B and CCC loans by 127 and 417 basis points, respectively.

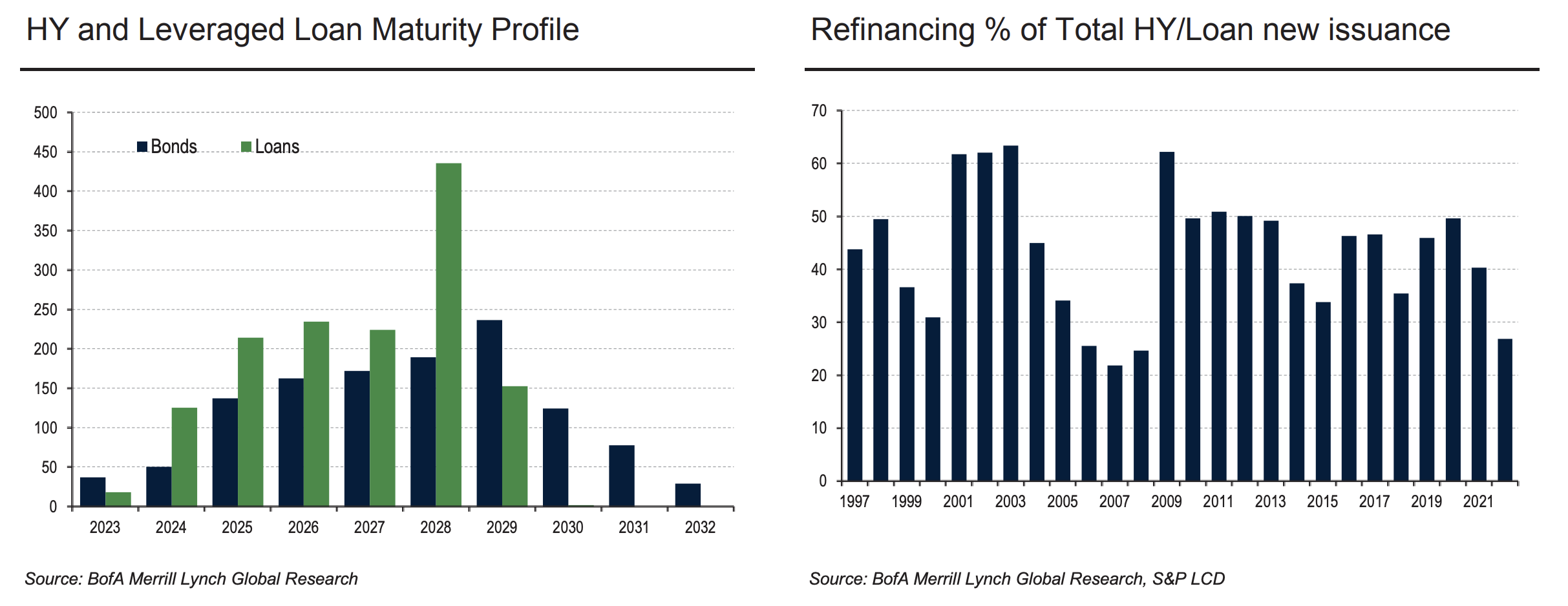

Quarterly fund flows were negative for both US high yield ($8.6 billion) and leveraged loans ($15.1 billion). For the year-to-date period, loans turned slightly negative at $32 million outflows and US high yield stood at $53.6 billion outflows. New issue volumes plummeted in Q3 amid a more hawkish Fed and a higher yielding environment with high yield bond issuance totaling only $18.9 billion gross in Q3, the lightest quarterly volume since Q1'09. Year to date, new issuance totaled $90 billion (gross) /$46 billion (net), which was down 78% and 69% year over year, respectively. Similarly, loan issuance totaled $24 billion gross which was the lightest quarterly volume since Q1'10. Year to date, leveraged loan issuance totaled $205 billion (gross) /$145.1 billion (net), which was down 69% and 50% year over year, respectively. Default rates moved slightly higher although they are still well below historical averages. The Moody's global LTM default rate for high yield bonds stood at 2.34% and for loans, it was 0.90% according to Morningstar LSTA at the end of Q3.

Market Outlook

Investors continue to face nothing but headwinds during 2022, triggering major losses across asset classes, with double-digit concurrent declines in equity and fixed income markets not seen in a generation. The good news is credit fundamentals were quite strong to start the year. Although moderating, we continue to expect most borrowers to exhibit revenue and cash flow growth in 2022, resulting in declining leverage ratios and a continuation of default rates near record lows. However, at the same time, we believe interest coverage ratios have likely peaked as benchmark rates (and floating coupons) begin to increase from historically low levels. We see heightened inflationary pressures and higher interest rates persisting into the second half of the year, leading to tightened financial conditions as the Fed has all but acknowledged they are behind the curve. Bond and loan coupons are likely to rise to multi-year highs by early 2023, potentially resulting in elevated refinancing risk for CCCrated, vulnerable borrowers.

Special Note: Fed Policy Insight

The data central banks are looking for has not materialized yet. The U.S. labor market remains tight. U.S. bond yields will likely continue to rise until the labor market cools. Inflation is still not showing material progress despite consistent rate hikes from the Fed. It looks like the Fed may be laying the groundwork for a slowdown in the pace of hikes after adding 75 bps at the November meeting. That is a pivot of sorts but not a full one, which would be the end of rate hikes following a declaration that inflation is under control. This could potentially be viewed as an extension to the rate hiking cycle. It is unclear how investors would react to slowing (hikes of 25 bps instead of 75 bps) instead of stopping. Until central banks see the data they want to see we don’t expect them to change their tune and turn dovish.