Market

While the investment grade private credit (IG private credit) market did not end 2022 with a bang, it did not finish with a whimper either. Q4’s volume of $20.6 billion was an improvement over Q3’s volume of $14.2 billion, but was lower than for the same period in 2021, of $32.6 billion. Preliminary reported total volume for 2022 was $92.3 billion, well back of the $107.8 billion for 2021. While first half 2022 volume was 20% higher than the prior period, higher rates, inflation and market volatility dampened issuance for the remainder of the year, as reported volume every month from July through December 2022 was weaker than the prior period.

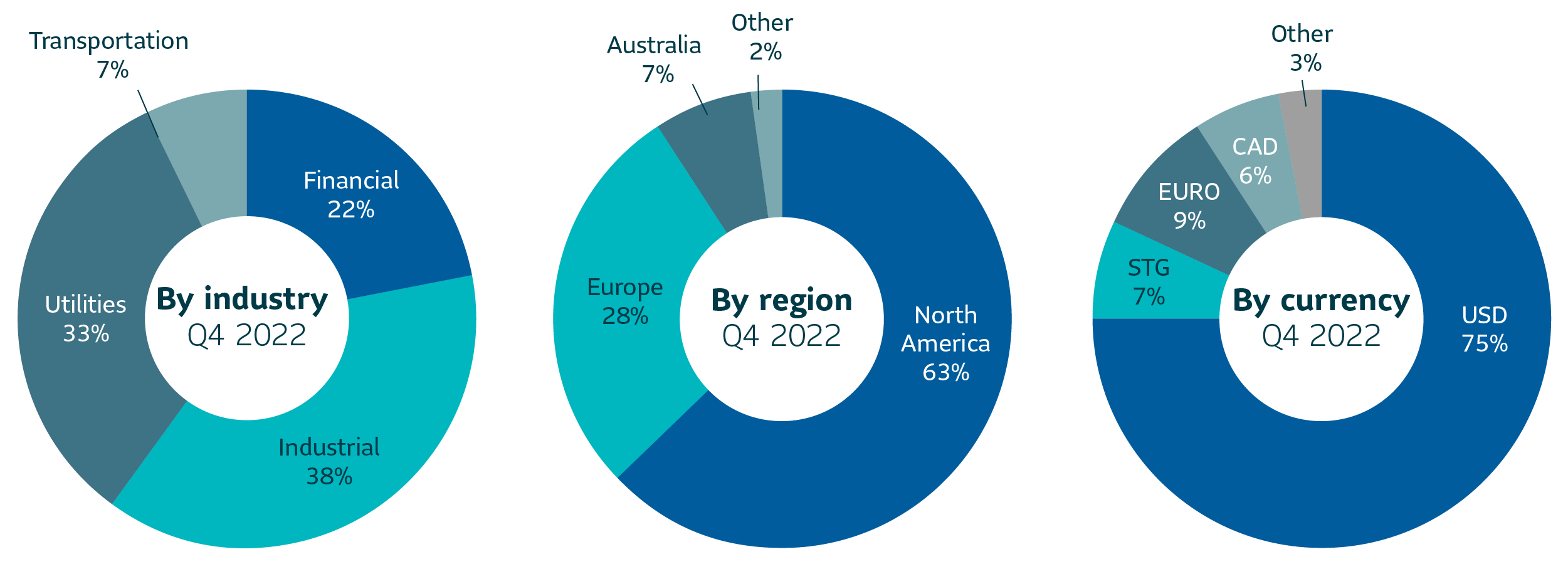

Robust utility and cross-border issuance drove increased volume in Q4 over Q3. Cross-border issuance was not only strong in Q4, but also returned to its historical share of the market (40%–50% of total volume) as issuers looked to the IG private credit market when the sterling and euro markets were not functioning well. Financial sector issuance accounted for over 40% of total issuance for 2022, but was well short of that in the year’s fourth quarter as the sector paused after a strong run that started at the beginning of the pandemic. The IG private credit market recorded only five $1 billion-plus deals in 2022, as opposed to the 19 completed in 2021. The increase in interest rates caused borrowers to take only what they needed in 2022, and reduced the number of issuers that came to market.

The ability of IG private credit to execute during market volatility, fund in different currencies and lock in rates with delayed takedowns all drove market volume throughout 2022. When the final volume figures are reported, 2022 will be either the second or third largest issuance year on record, albeit behind a record-setting 2021.

Interest rate volatility made pricing challenging at times in 2022, especially during the second and third quarters as IG private credit spreads lag public market rates. However, we were able to take advantage of opportunities in Q4 when there was a pricing lag that worked in our favor or for late-in-the year transactions when other investors were on the sidelines. We leveraged our expertise in the financial, energy efficiency and aviation sectors to underwrite solid credits with strong relative value, as well as in sourcing unique structured municipal credit and securitized transactions.

SLC Management

SLC Management’s U.S.-dollar fixed rate activity for Q4 was selective, with 19 transactions amounting to just over $1 billion. The investments reflected a healthy mix of well-priced broadly marketed transactions and higher value club/proprietary transactions. SLC Management transactions averaged a nine-year weighted average life, an average U.S. Treasury equivalent spread of 265 basis points. In terms of quality, the mix between A and BBB for the quarter was 66% and 34%, respectively.

Outlook

Our outlook for the pipeline is more uncertain than it was a year ago given the continued expectation for rising rates and a possible recession. Financial sector issuance should be solid, but current coupons have doubled from the lows of 2020 and the prospect of higher rates are a disincentive to issuers who don’t need capital in the near term. We expect several deals to transpire that were postponed due to volatility in 2022 (we have already seen such activity in the first week of 2023). We also expect increased competition from new alternative asset managers. Our focus will be to maintain our underwriting and pricing discipline and to creatively source unique or less competitively bid deals that yield strong relative value.

| Q4 2022 | Weighted average life | Average rating |

|---|---|---|

| Private Placement market | 11.6 years | 36%: A 64%: BBB |

| SLC Management1 | 10.0 years | 66%: A 34%: BBB |

1 SLC Management figures based on all commitments.

Investment grade credit ratings of our private placement portfolio are based on a proprietary, internal credit rating methodology that was developed using both externally purchased and internally developed models. This methodology is reviewed regularly. More details can be shared upon request. Although most U.S. dollar private placement investments have an external rating, for unrated deals there is no guarantee that the same rating(s) would be assigned to portfolio asset(s) if the assets were independently rated by a major credit ratings organization.

In focus: Operational considerations when investing in private credit

Looking forward to 2023, the growing private placement market is expected to continue to attract new entrants. Operational resources are an important consideration when it comes to such debt instruments. Investors should be aware of operational complexities when implementing a private credit strategy, as these investments diverge from public debt processes and are often more resource intensive.

There are two primary vehicles to access private placements, and this ownership structure dictates investor’s operational needs. In a fund, investor assets are pooled and held as a share interest. Conversely, in a separately managed account (SMA), assets are held directly by the investor in a segregated account. This structure often requires investors to take a greater role regarding operations.

Manual processes, bespoke terms require flexibility and specialized expertise

The following are some important operational factors investors need to consider:

The physical nature of assets often requires manual intervention for many functions you might expect to be automated in a public portfolio. Physical securities are not traded electronically, but rather delivered to the investor or their custodian’s vault for safekeeping.

In this new issue market where changes to funding schedules is commonplace, flexible cash management is crucial in private placement strategies. Cash reserves, short-term financing or sale of assets are utilized to adapt and meet unexpected funding requirements.

Bespoke terms in tandem with limited public data pose additional complexity. Terms and conditions that do not conform to standard accounting practices require additional expertise and resources. Private transaction data are not publicly listed and timing variances due to manual processing are common. Strong communication between the investor, investment manager and third-party servicers, including custodians and accounting providers, is key to implementing a successful strategy.

The manual nature of private credit highlights investors’ need for a solid understanding of operational implications and the necessary resources and expertise to effectively manage their portfolios.

For more information on these operational considerations, listen to our recent podcast.

Data presented in this article has been calculated internally based on external market data sourced from Private Placement Monitor.

Investment grade credit ratings of our private placement portfolio are based on a proprietary, internal credit rating methodology that was developed using both externally purchased and internally developed models. This methodology is reviewed regularly. More details can be shared upon request. Although most U.S. dollar private placement investments have an external rating, for unrated deals, there is no guarantee that the same rating(s)would be assigned to portfolio asset(s) if they were independently rated by a major credit ratings organization.

The information in this paper is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this paper.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc.(“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association. Registration as an investment adviser does not imply any level of skill or training. There is no assurance that the objective of any private placement strategy can be achieved. As with any strategy, the Advisor’s judgments about the relative value of securities selected for the portfolio can prove to be wrong.

Unless otherwise stated, all figures and estimates provided have been sourced internally and are as of December 31, 2022. Unless otherwise noted, all references to “$” are in U.S. dollars.

This document may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility. Unless otherwise stated, all figures and estimates provided have been sourced internally and are current as at the date of the paper unless separately stated. All data is subject to change.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

© 2023, SLC Management

SLC-20230127-2701648