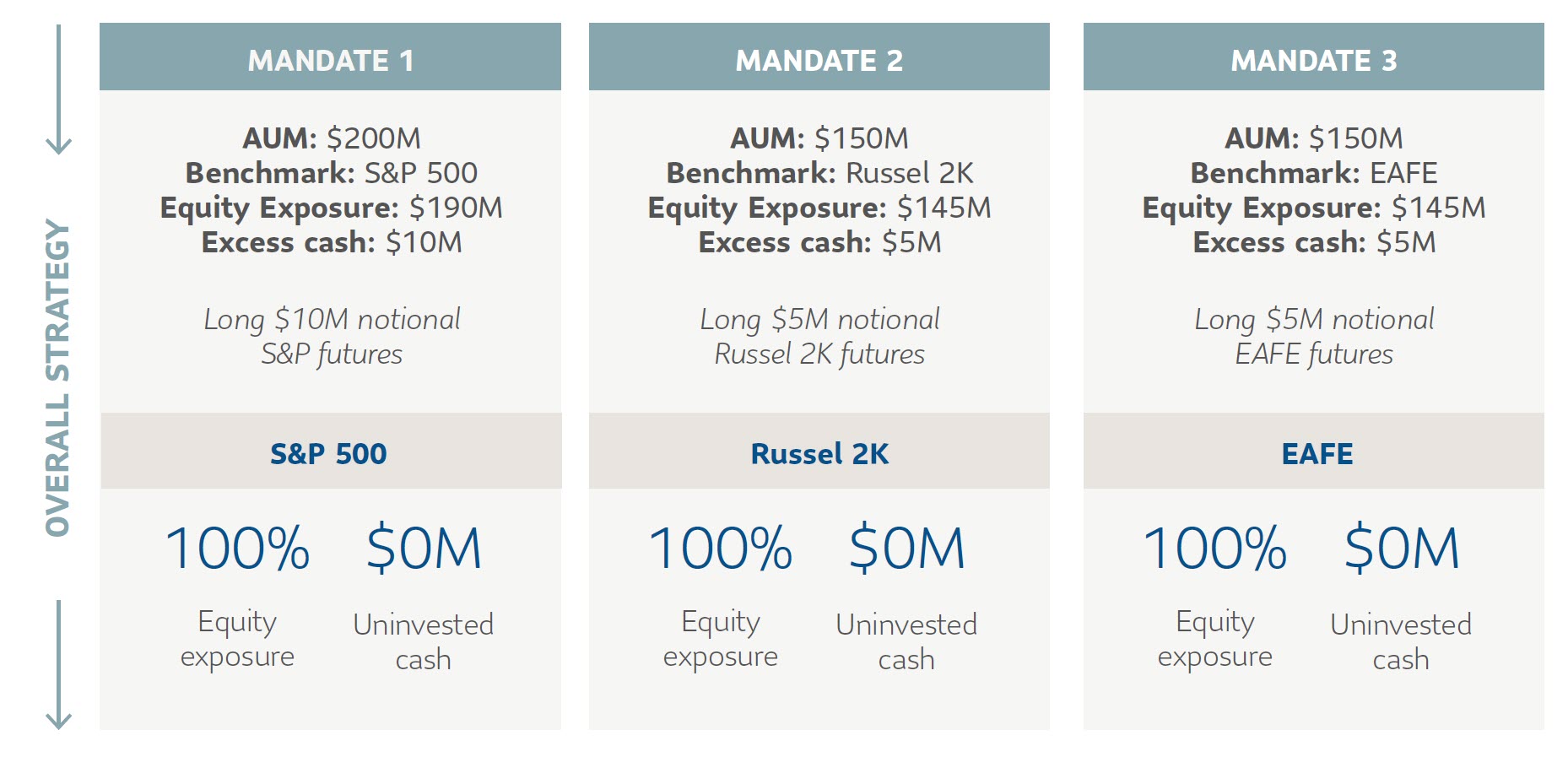

SLC Management works with clients to design a cash equitization overlay program that seeks to optimize the balance between the cost of implementation and tracking error. We use cash equitization to move portfolios closer to the policy objectives of the institution over time, while providing additional flexibility.

Cash equitization:

- Translates “excess” cash balances (balances that are positive on average over time due to operational frictions or liquidity needs) to the policy portfolio of the institution.

- Can provide flexibility to the institution in implementing a systematic and low cost rebalancing regime.

- Provides flexibility to tactically rebalance in the course of extreme market events.

Liquidity: operational versus tactical cash

Liquidity held in a portfolio can be categorized as operational cash or tactical cash. Operational cash is generated by either frictional transferring of cashflows or holding of liquidity buffers. Tactical cash is generated by a portfolio manager holding cash as a deliberate strategy to deviate from a benchmark.

The primary objective of a cash equitization program is to minimize the impact of holding operational cash, as this reduction of beta risk creates a drag upon overall fund performance. Equitizing operational cash will add macro beta risk without deviating from the client’s policy objectives. Overlay managers need to work with clients to identify sources and patterns of operational cash. Fund level redemptions, transfers between portfolios and infusions all generate cash balances. An understanding of a manager’s ability to “put new cash to work” helps drive the overlay design.

At the individual fund manager level, the decision to equitize cash depends on the strategy of each portfolio manager. As cashflow patterns are understood, a general overlay rule for each underlying manager’s cash balances can be developed. The stability of cash balances will also influence the overlay strategy. For example, highly volatile cash positions can be managed on an average balance amount in lieu of trying to manage to unstable actual cash balances.

Tactical cash generally should not be included in a cash equitization program. Cash at the individual portfolio manager level can be considered an asset. The tactical allocation to cash can be a fundamental source of alpha. The equitization of this cash from managers who demonstrate a history of alpha generation would negatively impact overall performance. For example, a fixed income manager might use an active allocation to cash as part of the fund’s overall duration management strategy.

Mapping overlay risk

How to map the risk of the overlay strategy needs to be considered. Ideally the overlay would perfectly replicate the actual fund performance (both alpha and beta). The three options to consider are:

Mapping to actual holdings. This is not feasible, as alpha returns are idiosyncratic and don’t typically demonstrate a consistent replicable pattern, reducing the effectiveness of the equitization strategy.

Mapping to individual manager benchmarks. This option eliminates alpha distortion from the analysis. However, given the number of potential individual benchmarks, there is the possibility that each cannot be successfully mapped. Additionally, the number of individual benchmarks equitized can increase overlay program costs.

Mapping to a set of overall policy benchmarks. This option provides the best risk return profile for cash equitization and best aligns with the client’s objective from a holistic fund perspective. The returns of the policy benchmarks are regressed against a group of synthetic indices to determine the appropriate weights for each of the indices. Once the weights are determined, the appropriate mix of futures is determined in order to replicate the new synthetic portfolio. This method provides strong, stable mapping of risk while reducing the operational costs of equitization.

At the policy level some client mandates include a large proportion of non-macro risk benchmarks (e.g. absolute return, hedge fund, real estate etc). It is generally recommended to not include cash generated from these portfolios in cash equitization strategies. This may inadvertently impact the overall asset allocation and risk budgeting of the fund (adding beta to sources of cash that are not beta type risks).

Overlay Execution

Equitization strategies are designed to incorporate liquid and transparent instruments to minimize operational risk and total strategy cost. Instruments are screened on a number of risk factors. Exchange traded derivative futures contracts are primarily used in client cash equitization strategies. Futures contracts are inexpensive, liquid, and offered on a wide variety of asset classes, allowing for the asset allocation of the broader portfolio to be replicated.

A central liquidity pool is used to manage the margin requirements of the futures positions. Stress tests are designed to ensure that ample centralized cash liquidity is available for the daily posting of variation margin. Stress tests are also performed on the pool of US. Treasury bonds available to post for initial margin.

This strategy is designed to be passive and only replicate the market risk of the asset classes in the portfolio. Since the overlay is small relative to the overall portfolio, any incremental alpha generated from an active equitization strategy would not meaningfully contribute to the portfolio’s total return.

Mapping overlay risk to a set of overall policy benchmarks provides the best risk return profile for cash equitization from a holistic fund perspective.

The case for equitization

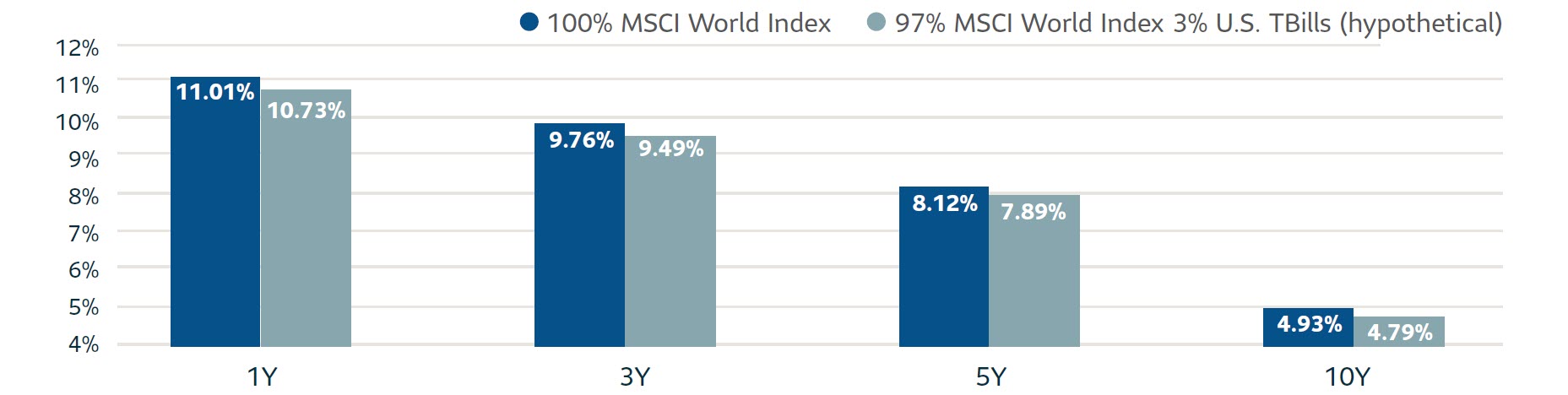

Any persistent allocation to cash can have a significant drag on performance over the long term, as seen in the hypothetical example below. A fund benchmarked to the MSCI World Index that holds an average cash allocation of 3% will significantly underperform on a 1, 3, 5, and 10 year annualized basis. A clear communication strategy to help manage significant portfolio flows between the overlay manager and the manager of underlying assets is required to minimize unintended leverage. Active monitoring of cash balances by the overlay manager is needed to identify any significant changes to underlying asset allocations.

A clear communication strategy to help manage significant portfolio flows between the overlay manager and the manager of underlying assets is required to minimize unintended leverage.

Annualized returns

Source: Bloomberg

For illustrative purposes only. An investor may not invest directly in an index.

Return enhancement: cash equitization

This document is intended for institutional investors only. The information in this document is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this presentation.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association.

The use of derivatives may expose the portfolio to risks that differ, and may be possibly greater than, the risks that would be generally associated with investing in fixed income assets. These risks include, but are not limited to: i) the lack of availability of a liquid market at the time that the portfolio may want to unwind a derivative contract; ii) the possibility that the portfolio may not be able to realize value from any derivatives contract if the contract counterparty cannot fulfill its obligations under the contract; and iii) the possibility that the portfolio could experience a loss of all or part of any margin, cash or securities, on deposit with that counterparty if that counterparty goes bankrupt. There is the possibility of deterioration in the functioning or liquidity of the market for derivative instruments which may decrease the value of the derivatives instruments, thereby decreasing the value of the portfolio. Under certain circumstances, the portfolio may be unable to close out derivative contracts in a timely manner or realize values that reflect the fair market values of those investments. The posting of derivative collateral and margin could result in liquidity demands for the portfolio. The portfolio will need to hold ample eligible collateral and margin to satisfy collateral requirements. Derivative contracts may include the use of leverage. Derivative collateral may not be sufficient to close out the portfolio’s obligations under its derivative contracts. There is no guarantee that these investment strategies will work under all market conditions or are suitable for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market.

Unless otherwise stated, all figures and estimates provided have been sourced internally and are as of June 30, 2020. Unless otherwise noted, all references to “$” are in U.S. dollars.

Nothing in this document should (i) be construed to cause any of the operations under SLC Management to be an investment advisory fiduciary under the U.S. Employee Retirement Income Security Act of 1974, as amended, the U.S. Internal Revenue Code of 1986, as amended, or similar law, (ii) be considered individualized investment advice to plan assets based on the particular needs of a plan or (iii) serve as a primary basis for investment decisions with respect to plan assets.

This document may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements.

As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility. Unless otherwise stated, all figures and estimates provided have been sourced internally and are current as at the date of the presentation unless separately stated. All data is subject to change.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

© 2021, SLC Management